S&P 500 Volatility: Strategies For Managing Downside Risk

Table of Contents

Understanding S&P 500 Volatility and its Causes

Historical Volatility Analysis

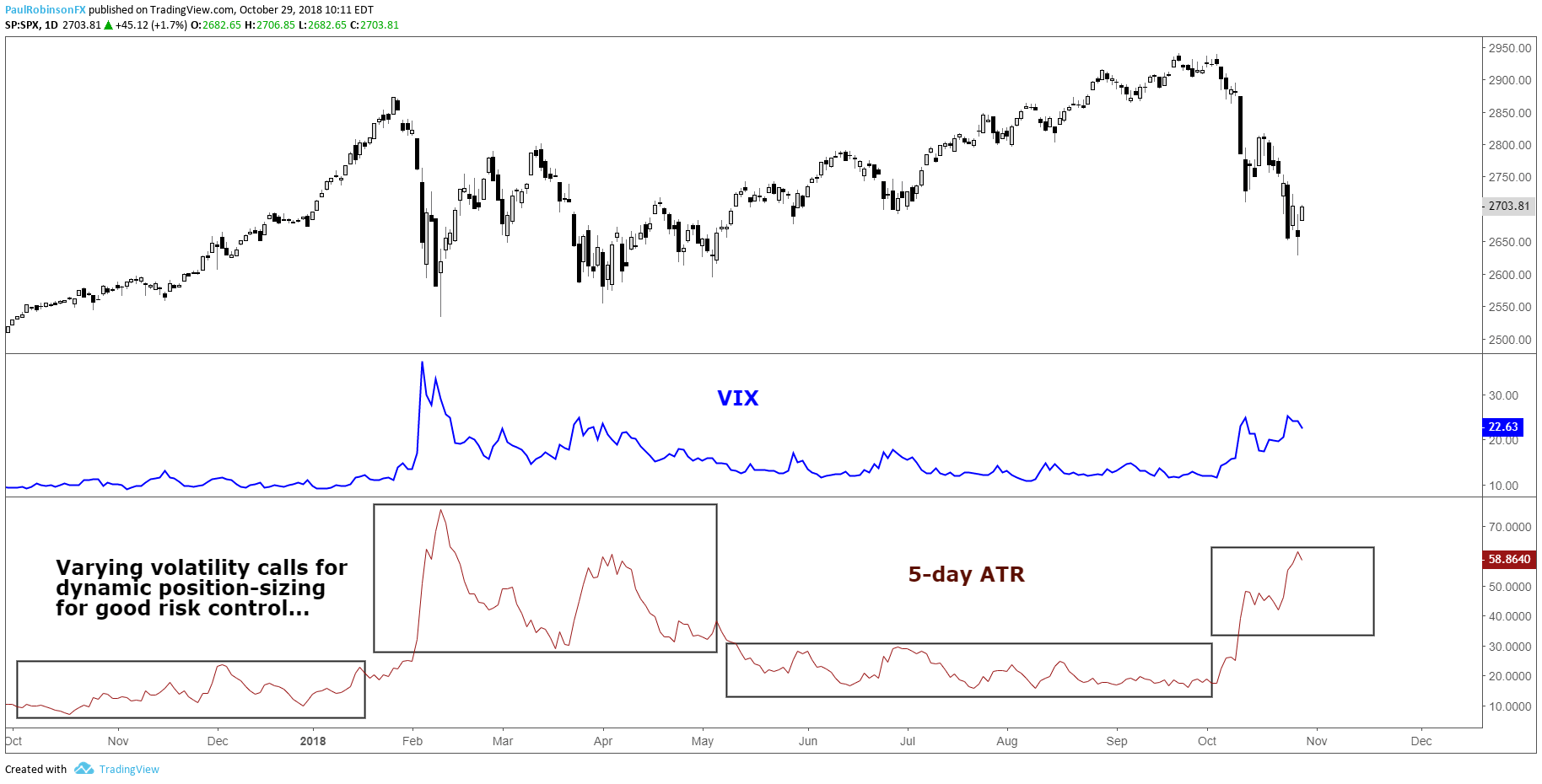

Analyzing the S&P 500's historical volatility reveals recurring periods of significant market fluctuations. Examining historical data illuminates the impact of various factors on market behavior. Charts clearly demonstrate the dramatic swings, showcasing both bull and bear markets. For instance, the dot-com bubble burst of 2000 and the 2008 financial crisis represent periods of extreme S&P 500 historical volatility, causing significant market corrections.

- 2000 Dot-com Bubble Burst: Triggered by the collapse of inflated tech valuations, leading to a significant decline in the S&P 500.

- 2008 Financial Crisis: The subprime mortgage crisis and subsequent global financial meltdown caused a dramatic plunge in the S&P 500, highlighting systemic risk.

- COVID-19 Pandemic (2020): The sudden economic shutdown and uncertainty led to a sharp initial drop, followed by a rapid recovery, demonstrating the impact of unforeseen events on market fluctuations.

Understanding these periods of high S&P 500 historical volatility is essential for developing effective risk mitigation strategies. Analyzing the interplay of economic indicators and market sentiment during these events provides valuable insights into potential future volatility.

Identifying Volatility Drivers

Several factors contribute to S&P 500 volatility. Understanding these drivers enables investors to better anticipate and manage risk:

- Interest Rate Changes: Federal Reserve interest rate adjustments significantly impact borrowing costs and investor sentiment, influencing market direction and volatility. Higher rates can cool down inflation, but can also slow economic growth.

- Inflation: High and unpredictable inflation erodes purchasing power and impacts corporate earnings, often leading to market uncertainty and increased volatility. Inflation risk is a key concern for investors.

- Geopolitical Risks: Global events, such as wars, political instability, and trade disputes, can create significant uncertainty, resulting in market volatility. Geopolitical risk is often unpredictable and can severely impact the S&P 500.

- Economic Growth: Slowdowns or recessions trigger investor fear, leading to market sell-offs and increased volatility. Economic uncertainty is a primary driver of market fluctuations.

By monitoring these factors and understanding their potential impact, investors can improve their ability to navigate periods of increased S&P 500 volatility.

Diversification Strategies to Reduce S&P 500 Risk

Diversification is a cornerstone of effective risk management. Spreading investments across various asset classes and geographies reduces reliance on any single market and thus mitigates potential losses.

Asset Class Diversification

Diversifying beyond equities is vital for reducing overall portfolio volatility. Different asset classes tend to react differently to market forces, providing a buffer during market downturns.

- Bonds: Generally considered less volatile than stocks, bonds can provide stability during market corrections. Their inverse correlation with stocks can help offset losses.

- Real Estate: Real estate investments can offer diversification benefits, particularly during periods of inflation. However, real estate is considered illiquid in comparison to other asset classes.

- Commodities: Commodities like gold and oil can act as inflation hedges and provide portfolio diversification. Gold, in particular, is often viewed as a safe haven asset.

Strategic asset allocation is crucial for building a diversified portfolio. The optimal allocation depends on individual risk tolerance and investment goals.

Geographic Diversification

Investing in international markets reduces dependence on the US economy and mitigates the impact of US-specific events on the S&P 500.

- Developed Markets: Markets such as Europe and Japan offer diversification while maintaining a relatively stable investment environment.

- Emerging Markets: Emerging markets offer higher growth potential but also higher risk and volatility. Careful consideration of market-specific risk is necessary.

International diversification helps to reduce overall portfolio volatility, creating a more resilient investment strategy. It is important to thoroughly research any international investments.

Active Risk Management Techniques for the S&P 500

Active risk management strategies involve employing specific techniques to limit losses during periods of increased S&P 500 volatility.

Hedging Strategies

Hedging involves using financial instruments to offset potential losses in your S&P 500 investments.

- Options Trading: Buying put options provides downside protection, allowing you to sell your shares at a predetermined price, even if the market falls.

- Futures Contracts: Futures contracts allow investors to lock in prices for future purchases or sales, mitigating price fluctuations.

- Inverse ETFs: Inverse ETFs aim to profit from market declines, offering a hedge against S&P 500 losses. However, these products are high-risk.

Hedging strategies add a layer of protection but require understanding of derivatives markets and associated risks.

Stop-Loss Orders and Protective Puts

These tools help automatically limit potential losses:

- Stop-Loss Orders: These orders automatically sell your assets when the price falls below a predetermined level, limiting potential losses.

- Protective Puts: Buying put options alongside your S&P 500 holdings creates a floor for your investment, limiting potential downside risk.

Implementing these tools requires careful consideration of their limitations and potential costs.

Dollar-Cost Averaging (DCA)

DCA mitigates the risk of investing a lump sum at a market peak. By investing smaller amounts at regular intervals, you reduce the average cost per share and lessen the impact of market volatility.

- Consistent Investment: Regular investments help smooth out the impact of market fluctuations, potentially leading to lower average costs over time.

- Reduced Emotional Decision-Making: DCA reduces the temptation to time the market, avoiding potentially costly emotional decisions.

DCA is a long-term strategy that can be especially beneficial during volatile periods.

Conclusion

Mastering S&P 500 volatility requires a proactive approach. Effective downside risk management involves a combination of diversification across asset classes and geographies, coupled with active risk management techniques like hedging, stop-loss orders, and dollar-cost averaging. Understanding the historical volatility of the S&P 500 and the factors that drive market fluctuations is paramount. By carefully considering these strategies and tailoring them to your individual risk tolerance and investment goals, you can significantly improve your ability to navigate market downturns and protect your portfolio. Implement these strategies today and take control of your downside risk! For further resources on S&P 500 volatility and risk management, [link to relevant resources].

Featured Posts

-

Understanding Pasifika Sipoti April 4th In Short

May 01, 2025

Understanding Pasifika Sipoti April 4th In Short

May 01, 2025 -

Kshmyr Ky Apyl Brtanwy Wzyr Aezm Kw Pysh Ky Gyy Dstawyz

May 01, 2025

Kshmyr Ky Apyl Brtanwy Wzyr Aezm Kw Pysh Ky Gyy Dstawyz

May 01, 2025 -

Levenslang Voor Fouad L Waarom Geen Tbs Bij De Erasmusschutter

May 01, 2025

Levenslang Voor Fouad L Waarom Geen Tbs Bij De Erasmusschutter

May 01, 2025 -

Xrp Cryptocurrency A Beginners Guide

May 01, 2025

Xrp Cryptocurrency A Beginners Guide

May 01, 2025 -

Is Xrps 400 3 Month Rally A Sustainable Investment

May 01, 2025

Is Xrps 400 3 Month Rally A Sustainable Investment

May 01, 2025

Latest Posts

-

Top New Cruise Lines Sailing South In 2025

May 01, 2025

Top New Cruise Lines Sailing South In 2025

May 01, 2025 -

The 5 Best Family Cruise Lines A Tpg Guide

May 01, 2025

The 5 Best Family Cruise Lines A Tpg Guide

May 01, 2025 -

Southern Cruises 2025 New Ships And Itineraries

May 01, 2025

Southern Cruises 2025 New Ships And Itineraries

May 01, 2025 -

Cau Chuyen Phia Sau Du An 500k V Mach 3 Goc Nhin Tu Cong Nhan Dien Luc Mien Nam

May 01, 2025

Cau Chuyen Phia Sau Du An 500k V Mach 3 Goc Nhin Tu Cong Nhan Dien Luc Mien Nam

May 01, 2025 -

Du An 500k V Mach 3 Ghi Dau Hanh Trinh Cua Cong Nhan Dien Luc Mien Nam

May 01, 2025

Du An 500k V Mach 3 Ghi Dau Hanh Trinh Cua Cong Nhan Dien Luc Mien Nam

May 01, 2025