Sasol (SOL) Strategy Update: Investors Demand Answers

Table of Contents

Sasol (SOL), a global integrated energy and chemicals company, is facing intense scrutiny from investors regarding its long-term strategy. Recent financial performance and concerns about its energy transition plans have left many questioning the company's future direction. The fluctuating share price and pressure to demonstrate a clear path to sustainability are putting pressure on management to deliver convincing answers. This article delves into the key aspects of the recent Sasol strategy update and examines why investors are demanding clearer answers regarding their Sasol investment.

Weakening Financial Performance and Investor Concerns

Keywords: Sasol financial results, debt levels, profitability, earnings, cash flow, credit rating.

Sasol's recent financial reports have fueled investor anxieties. Declining profitability and increasing debt levels are key concerns. Let's examine the specifics:

- Analysis of Recent Financial Reports: The last few quarters have shown a consistent trend of decreased earnings and reduced cash flow. For example, [insert specific data point, e.g., Q3 2024 earnings were down X% compared to Q3 2023]. This negative trend raises serious questions about the company's ability to meet its financial obligations.

- Credit Rating Agency Assessments: Credit rating agencies have expressed concerns, with some potentially downgrading Sasol's credit rating. A lower credit rating increases borrowing costs and may make it harder for Sasol to secure future financing for crucial projects, impacting future Sasol stock performance.

- Impact of Fluctuating Energy Prices: Sasol's profitability is heavily reliant on volatile energy and raw material prices. Sharp increases in input costs, coupled with price pressures in the output markets, have significantly compressed margins.

- Significant Write-downs or Impairments: [Mention any specific write-downs or impairments and their impact on Sasol's valuation. Quantify the impact if possible]. This further erodes investor confidence in the company's ability to deliver sustainable returns.

The Energy Transition and Sasol's Response

Keywords: Sasol sustainability, ESG, decarbonization, renewable energy, green hydrogen, climate change, carbon emissions.

The energy transition is a pivotal challenge for Sasol, and its response is a major focus for investors. Concerns exist regarding the feasibility and speed of its decarbonization efforts:

- Sasol's Energy Transition Strategy: Sasol has outlined its plans to reduce its carbon footprint and transition towards more sustainable energy sources, notably focusing on green hydrogen. However, the specifics of this plan, including timelines and capital expenditure, require greater transparency.

- Feasibility and Timeline: The ambitious nature of Sasol's energy transition targets raises questions about the practical challenges and potential delays in implementation. Investors need reassurance that the transition will be both timely and effective.

- Investments in Renewable Energy: While Sasol has made some investments in renewable energy projects, the scale of these investments needs to be significantly expanded to meet its stated sustainability goals. A detailed breakdown of these investments and their expected ROI would alleviate investor concerns.

- Regulatory Risks and Opportunities: The evolving regulatory landscape surrounding climate change presents both risks and opportunities for Sasol. The company's ability to navigate this complex environment is crucial for its long-term success. Further clarity on how the company intends to address these potential challenges is necessary.

Operational Challenges and Strategic Initiatives

Keywords: Sasol operations, production efficiency, cost optimization, project delays, capital expenditure.

Operational efficiency and effective capital allocation are key to restoring investor confidence.

- Operational Disruptions: [Discuss any recent operational challenges faced by Sasol, such as production outages or safety incidents. Quantify the impact of these disruptions on production and profitability].

- Cost-Cutting Measures and Efficiency Improvements: Sasol has implemented various cost-cutting measures and efficiency improvement programs. The effectiveness of these programs needs to be demonstrably shown through quantifiable improvements in operational metrics.

- Major Capital Expenditure Projects: [Evaluate the progress and success of major capital expenditure projects. Highlight any delays and their impact on the overall strategy]. Transparency on project timelines and cost overruns is vital.

- Supply Chain Disruptions: Global supply chain disruptions have affected many industries, and Sasol is no exception. The company's ability to mitigate these risks and ensure the smooth flow of production is paramount.

Dividend Policy and Shareholder Returns

Keywords: Sasol dividend, shareholder value, share price performance, stock valuation, investment outlook.

Sasol's dividend policy is a crucial factor influencing investor sentiment and the Sasol share price.

- Sustainability of the Dividend: The sustainability of Sasol's current dividend policy is questionable given the recent financial performance. Investors need assurance that the dividend is sustainable in the long term without compromising the company's financial health.

- Investor Sentiment Regarding Dividends: Investor sentiment regarding the dividend payout ratio needs to be carefully assessed. A reduction in the dividend may be necessary to strengthen the balance sheet and invest in future growth, but this could negatively impact short-term share price performance.

- Factors Influencing Sasol's Share Price: Several factors influence Sasol's share price, including financial performance, energy transition progress, and overall market sentiment. A holistic view of these factors is needed for a comprehensive assessment.

- Attractiveness to Investors: The overall attractiveness of Sasol to investors hinges on its ability to deliver sustainable growth, improve its financial performance, and demonstrate a credible energy transition strategy. The company must showcase a clear path towards enhancing shareholder value.

Conclusion

This analysis of the recent Sasol (SOL) strategy update reveals significant investor concerns stemming from weakening financial performance, uncertainties surrounding its energy transition plans, and operational challenges. The company needs to provide clearer answers and demonstrate a credible path towards sustainable growth and improved shareholder returns to regain investor confidence. The future of Sasol stock depends on the company's ability to address these concerns effectively.

Call to Action: Stay informed about the evolving situation with Sasol (SOL) and its strategic direction. Continue to monitor the company's financial reports and announcements for further updates regarding its strategy and plans to address investor concerns. Understanding the Sasol (SOL) strategy is crucial for any investor considering its stock or already holding a Sasol investment.

Featured Posts

-

Unraveling The Mysteries A Deep Dive Into Agatha Christies Poirot Stories

May 20, 2025

Unraveling The Mysteries A Deep Dive Into Agatha Christies Poirot Stories

May 20, 2025 -

Amazon Warehouse Closures Quebec Union Takes Legal Action

May 20, 2025

Amazon Warehouse Closures Quebec Union Takes Legal Action

May 20, 2025 -

Ealm Ajatha Krysty Yewd Bfdl Aldhkae Alastnaey Nzrt Mstqblyt

May 20, 2025

Ealm Ajatha Krysty Yewd Bfdl Aldhkae Alastnaey Nzrt Mstqblyt

May 20, 2025 -

The Demise Of Anchor Brewing Company A Look Back And Ahead

May 20, 2025

The Demise Of Anchor Brewing Company A Look Back And Ahead

May 20, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Allegations And The Trump Connection

May 20, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Allegations And The Trump Connection

May 20, 2025

Latest Posts

-

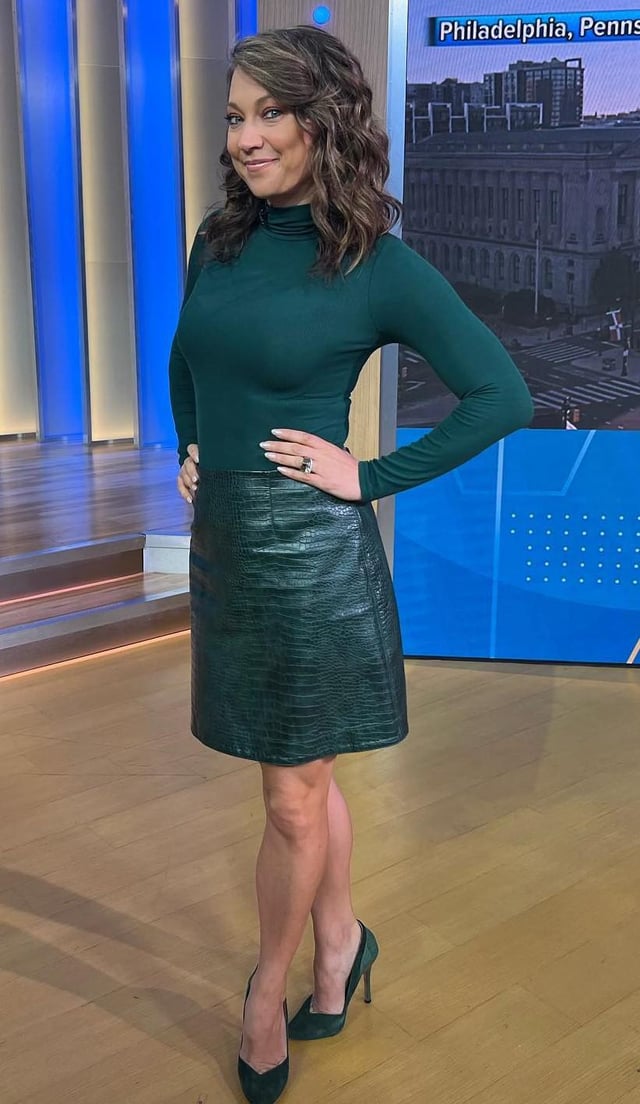

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025

Asheville Rising Helene Special Gmas Ginger Zee Visits Wlos

May 20, 2025 -

Michael Strahans Gma Departure The Real Reason He Left

May 20, 2025

Michael Strahans Gma Departure The Real Reason He Left

May 20, 2025 -

Ginger Zee Of Gma Visits Wlos To Promote Asheville Rising Helene Special

May 20, 2025

Ginger Zee Of Gma Visits Wlos To Promote Asheville Rising Helene Special

May 20, 2025 -

Good Morning Americas Ginger Zee Visits Wlos Ahead Of Asheville Rising Helene Special

May 20, 2025

Good Morning Americas Ginger Zee Visits Wlos Ahead Of Asheville Rising Helene Special

May 20, 2025 -

Behind The Scenes At Good Morning America Job Cuts And Staff Concerns

May 20, 2025

Behind The Scenes At Good Morning America Job Cuts And Staff Concerns

May 20, 2025