Saudi Arabia Investment Push: Deutsche Bank's Global Strategy

Table of Contents

Deutsche Bank's Positioning in the Saudi Arabian Market

Deutsche Bank is actively cultivating a strong presence in the Saudi Arabian market, leveraging its global expertise to support the Kingdom's economic transformation.

Existing Partnerships and Collaborations

Deutsche Bank has established several key partnerships with prominent Saudi Arabian entities. These collaborations are crucial for understanding the intricacies of the local market and providing tailored financial solutions.

- Partnership with the Public Investment Fund (PIF): Deutsche Bank has worked with the PIF on several significant transactions, advising on investments and providing access to global capital markets.

- Collaborations with leading Saudi conglomerates: The bank has established relationships with major Saudi businesses across diverse sectors, providing them with investment banking, financing, and asset management services.

- Engagement with government agencies: Deutsche Bank actively collaborates with various government agencies to support the implementation of Vision 2030 initiatives.

These Saudi Arabian partnerships demonstrate Deutsche Bank's commitment to fostering long-term relationships and contributing to the Kingdom's economic growth. The bank's deep understanding of the Saudi Arabia financial sector positions it advantageously for future opportunities.

Strategic Investments and Acquisitions

While specific details of acquisitions might be confidential for competitive reasons, Deutsche Bank's strategic investment approach in Saudi Arabia is evident through its participation in significant projects and its commitment to funding initiatives aligned with Vision 2030. This reflects a long-term commitment to the Saudi Arabia investment opportunities.

- Investments in renewable energy projects: Deutsche Bank has been involved in financing renewable energy projects, contributing to Saudi Arabia's goals for sustainable development.

- Participation in infrastructure development: The bank has supported infrastructure projects, playing a vital role in the modernization of the Kingdom's transportation and logistics networks.

- Supporting technology sector growth: Deutsche Bank is actively involved in supporting the growth of the Saudi technology sector through various investment channels.

This FDI in Saudi Arabia reflects Deutsche Bank's confidence in the Kingdom's long-term economic prospects and its commitment to supporting its strategic development goals.

Specialized Financial Services Offered

Deutsche Bank offers a comprehensive suite of financial services tailored to the unique needs of the Saudi Arabian market.

- Investment Banking: Providing advisory services on mergers and acquisitions, equity capital markets, and debt financing.

- Asset Management: Offering a range of investment products and strategies designed for Saudi Arabian investors.

- Wealth Management: Catering to high-net-worth individuals and families in the Kingdom, providing bespoke wealth planning and investment solutions.

- Trade Finance: Supporting international trade and commerce within and outside Saudi Arabia.

These services position Deutsche Bank as a key player in providing the necessary financial tools for the growth of the Saudi Arabian economy. This expertise in investment banking in Saudi Arabia, wealth management Saudi Arabia, and asset management Saudi Arabia sets it apart.

Alignment with Saudi Vision 2030

Deutsche Bank's activities in Saudi Arabia are closely aligned with the goals and objectives of Vision 2030.

Supporting Key Sectors

Deutsche Bank's strategic focus supports several key sectors identified in Vision 2030:

- Tourism: Facilitating investments in tourism infrastructure and hospitality projects.

- Renewable Energy: Providing financing and advisory services for renewable energy projects, contributing to the Kingdom's sustainability goals.

- Technology: Supporting the growth of the technology sector through investments and financial solutions.

- Diversification of the economy: Supporting businesses in non-oil sectors to reduce reliance on hydrocarbons.

These contributions highlight Deutsche Bank's commitment to supporting the Saudi Arabia economic diversification strategy as outlined in Vision 2030. Their involvement promotes sustainable investment Saudi Arabia and renewable energy investments Saudi Arabia.

Commitment to Sustainable Development

Deutsche Bank demonstrates a strong commitment to ESG (Environmental, Social, and Governance) factors in its Saudi Arabian investments.

- Promoting sustainable finance initiatives: Actively supporting projects with strong ESG credentials.

- Implementing responsible investment policies: Adhering to strict environmental and social guidelines in its investment decisions.

- Transparency and accountability: Maintaining high standards of transparency and accountability in its operations.

These initiatives demonstrate Deutsche Bank’s commitment to sustainable finance Saudi Arabia and responsible investment Saudi Arabia. The bank is actively shaping a more sustainable future for the Kingdom.

Competitive Landscape and Challenges

Despite the significant opportunities, Deutsche Bank faces a competitive landscape and certain challenges in the Saudi Arabian market.

Major Competitors

Deutsche Bank competes with several major international and regional banks in the Saudi Arabian investment market.

- Other global investment banks: These institutions offer similar services and compete for the same investment opportunities.

- Local Saudi banks: These banks possess strong local market knowledge and established relationships.

Regulatory Environment and Risks

Operating in the Saudi Arabian market presents certain regulatory challenges and risks.

- Regulatory compliance: Adhering to the evolving regulatory framework in Saudi Arabia.

- Geopolitical risks: Navigating the complex geopolitical landscape of the region.

- Currency fluctuations: Managing risks associated with currency exchange rate volatility.

Understanding and managing these risks is crucial for success in the Saudi Arabia investment push. Navigating the Saudi Arabian regulatory environment requires expertise and careful planning.

Conclusion: Saudi Arabia Investment Push: Deutsche Bank's Global Strategy

Deutsche Bank's strategic approach to the Saudi Arabian investment market demonstrates a clear understanding of Vision 2030's objectives. By actively engaging in partnerships, making strategic investments, and offering specialized financial services, the bank is well-positioned to capitalize on the significant opportunities presented by the Kingdom's economic transformation. The bank’s commitment to sustainable development and navigating the competitive landscape, including the Saudi Arabian regulatory environment, is paramount. Understanding the challenges and risks associated with investment risk Saudi Arabia is crucial for long-term success.

Key takeaways include Deutsche Bank's strong partnerships, alignment with Vision 2030, and comprehensive suite of financial services. Their contribution to the Saudi Arabia investment push is significant and reflects a long-term commitment to the Kingdom's economic growth.

For investors interested in the Saudi Arabia Investment Push, Deutsche Bank offers a wealth of expertise and resources. Contact us today to discuss your investment strategy and learn more about how we are capitalizing on this significant opportunity.

Featured Posts

-

Prison Isere Critiques Apres Les Attaques Et La Visite Ministerielle

May 30, 2025

Prison Isere Critiques Apres Les Attaques Et La Visite Ministerielle

May 30, 2025 -

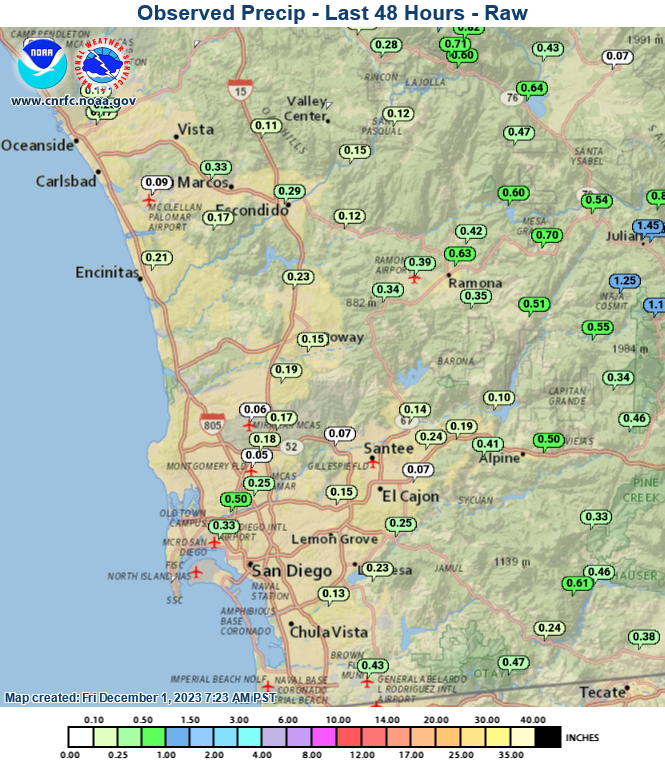

San Diego Rain Totals Cbs 8 Coms Latest Updates

May 30, 2025

San Diego Rain Totals Cbs 8 Coms Latest Updates

May 30, 2025 -

Apples Os Rebranding Fact Or Fiction

May 30, 2025

Apples Os Rebranding Fact Or Fiction

May 30, 2025 -

Measles Outbreak In Kansas A Growing Concern

May 30, 2025

Measles Outbreak In Kansas A Growing Concern

May 30, 2025 -

Metallicas Glasgow Hampden Park Concert World Tour Date Announced

May 30, 2025

Metallicas Glasgow Hampden Park Concert World Tour Date Announced

May 30, 2025