Saudi Arabia's PIF Imposes Year-Long Ban On PwC Advisory Work

Table of Contents

Reasons Behind the PIF's Decision to Ban PwC

The PIF's decision to suspend PwC's advisory services for a full year is shrouded in some mystery, but several potential factors contribute to the situation. While the PIF has not publicly disclosed the precise reasons, industry speculation points towards several possibilities:

-

Allegations of Misconduct: Reports suggest the ban may stem from allegations of professional misconduct or breaches of Saudi Arabian regulations within a previous PIF engagement. These potential breaches could involve ethical lapses, data security issues, or conflicts of interest. Keywords: investigation, misconduct, conflict of interest, professional standards, Saudi Arabian regulations.

-

Conflicts of Interest: The complexity of PIF's vast portfolio necessitates meticulous attention to potential conflicts of interest. Previous advisory engagements might have inadvertently created conflicts that compromised the impartiality required for objective advice. Keywords: conflict of interest, ethical concerns, impartiality, Saudi Arabian regulations.

-

Failure to Meet Expectations: PwC may have failed to meet the PIF's exacting standards regarding the quality of services delivered on past projects. This could involve missed deadlines, inaccurate analysis, or a lack of strategic insight aligned with the PIF's investment goals. Keywords: quality of service, performance standards, PIF expectations.

-

Internal Investigations and Findings: It's possible that internal investigations within the PIF uncovered issues requiring a strong response, leading to the suspension. This underscores the PIF's commitment to transparency and accountability in its investment practices. Keywords: internal investigation, transparency, accountability, Saudi Arabian governance.

Impact of the Ban on PwC's Operations in Saudi Arabia

The year-long ban will undoubtedly have a substantial impact on PwC's operations within Saudi Arabia. The consequences can be categorized into short-term and long-term effects:

-

Short-Term Impacts:

- Loss of Revenue: The immediate loss of PIF contracts will significantly impact PwC's revenue stream. This is especially true considering the PIF's substantial investment portfolio. Keywords: revenue loss, contract loss, financial impact.

- Reputational Damage: The ban will inevitably damage PwC's reputation and credibility within the Kingdom. This reputational damage could affect future business opportunities beyond the PIF's portfolio. Keywords: reputational damage, credibility, trust, Saudi Arabian market.

-

Long-Term Impacts:

- Job Losses and Restructuring: The loss of significant PIF-related projects could lead to job losses and restructuring within PwC's Saudi Arabian operations. Keywords: job losses, restructuring, workforce reduction.

- Effect on Future Business Acquisition: The ban could negatively affect PwC's ability to acquire new clients and expand its business in Saudi Arabia. It may also affect its ability to engage in mergers and acquisitions with Saudi Arabian businesses. Keywords: business acquisition, market share, competitive advantage.

Implications for Other Consulting Firms Operating in Saudi Arabia

The PIF's decision to ban PwC has far-reaching implications for the entire consulting industry operating in Saudi Arabia:

- Increased Scrutiny: Other consulting firms will likely face increased scrutiny regarding their ethical conduct, compliance with Saudi Arabian regulations, and the quality of their services. Keywords: increased scrutiny, regulatory compliance, ethical conduct.

- Potential Regulatory Changes: The ban may accelerate changes in regulatory frameworks governing the consulting industry in Saudi Arabia. This might lead to stricter licensing requirements and more stringent oversight. Keywords: regulatory changes, licensing, oversight, Saudi Arabian regulations.

- Increased Competition: The removal of PwC from PIF projects intensifies the competition among remaining consulting firms for these lucrative contracts. Keywords: competition, market share, PIF contracts.

- Heightened Focus on Ethical Conduct: The incident highlights the importance of maintaining the highest ethical standards and ensuring full compliance with Saudi Arabian laws and regulations in the Kingdom's growing business environment. Keywords: ethical conduct, compliance, corporate governance, Saudi Arabia.

PIF's Future Strategies and Selection of Advisory Services

The PIF's future approach to selecting advisory firms will likely undergo significant changes in the wake of this event:

- Stringent Selection Criteria: The PIF will likely implement even more stringent selection criteria and due diligence processes to mitigate future risks. Keywords: due diligence, risk assessment, selection criteria, PIF investment strategy.

- Emphasis on Ethical Conduct: Ethical conduct and compliance will become paramount considerations in the selection process, reflecting the PIF's commitment to transparency and responsible investment. Keywords: ethical considerations, compliance, responsible investment, Saudi Arabian investment.

- Potential Partnerships: The PIF may explore strategic partnerships with both local and international firms to diversify its advisory network and enhance its risk management capabilities. Keywords: strategic partnerships, risk management, diversification, Saudi Arabia investment.

- Changes in PIF's Investment Strategies: This event could also influence changes to the PIF's overall investment strategies, leading to a more cautious and selective approach. Keywords: investment strategy, risk management, investment diversification, Saudi Arabia's Vision 2030.

Conclusion: The Long-Term Effects of the PIF's Ban on PwC Advisory Services

The PIF's year-long ban on PwC advisory services marks a significant development in the Saudi Arabian business landscape. This decision underscores the PIF's commitment to stringent standards of ethical conduct and regulatory compliance. The consequences for PwC are substantial, encompassing immediate revenue loss, reputational damage, and potential long-term operational challenges. Meanwhile, other consulting firms operating in Saudi Arabia will face increased scrutiny and heightened competition. The ban signals a potential shift in the PIF's investment strategies and advisory selection process, with a stronger emphasis on due diligence and ethical considerations. To stay informed about the evolving implications of this ban and its broader effects on the Saudi Arabian business environment, follow reputable news sources and PIF publications for updates. The future implications for PIF advisory services and the broader Saudi Arabian economy warrant continued attention. Keywords: Saudi Arabia, PIF, PwC, advisory services, ban, future implications, Saudi Arabian business.

Featured Posts

-

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 29, 2025

Navigate The Private Credit Boom 5 Essential Dos And Don Ts

Apr 29, 2025 -

Adult Adhd From Suspicion To Effective Management

Apr 29, 2025

Adult Adhd From Suspicion To Effective Management

Apr 29, 2025 -

Is Kuxius Solid State Power Bank Worth The Higher Price A Detailed Review

Apr 29, 2025

Is Kuxius Solid State Power Bank Worth The Higher Price A Detailed Review

Apr 29, 2025 -

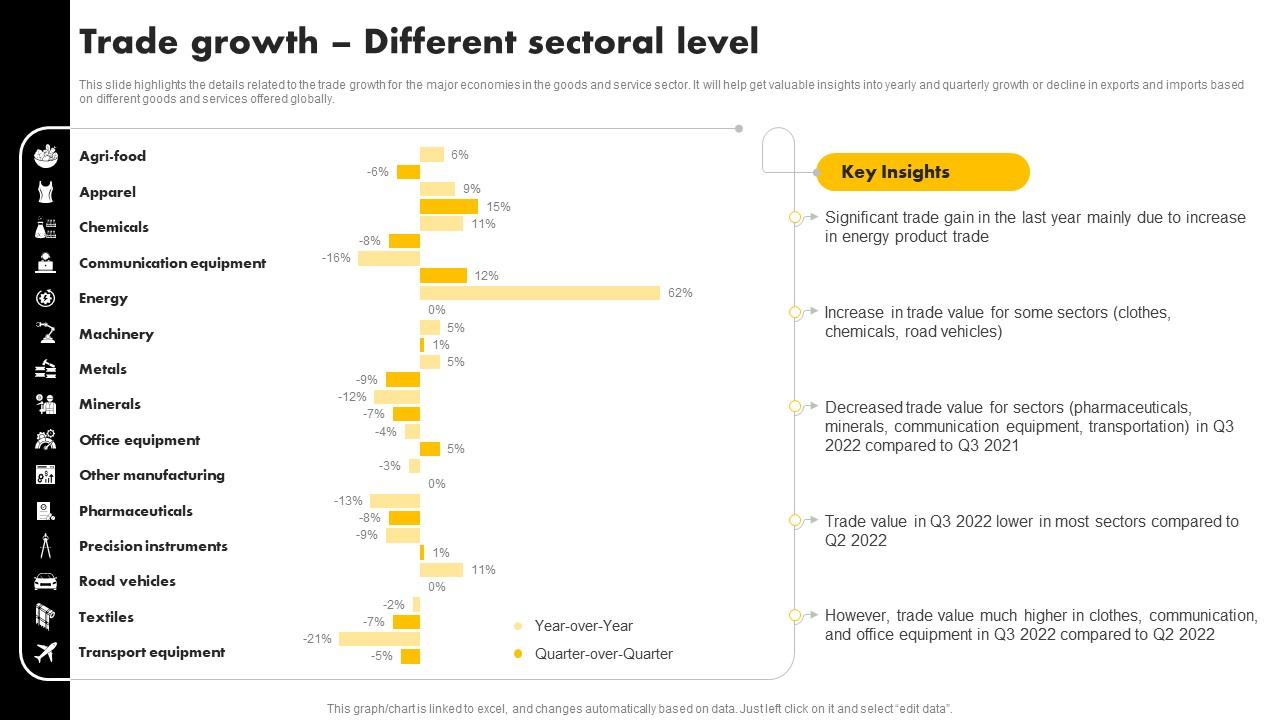

Identifying And Analyzing The Countrys Top Business Growth Areas

Apr 29, 2025

Identifying And Analyzing The Countrys Top Business Growth Areas

Apr 29, 2025 -

Ev Mandates Face Renewed Opposition From Car Dealers

Apr 29, 2025

Ev Mandates Face Renewed Opposition From Car Dealers

Apr 29, 2025