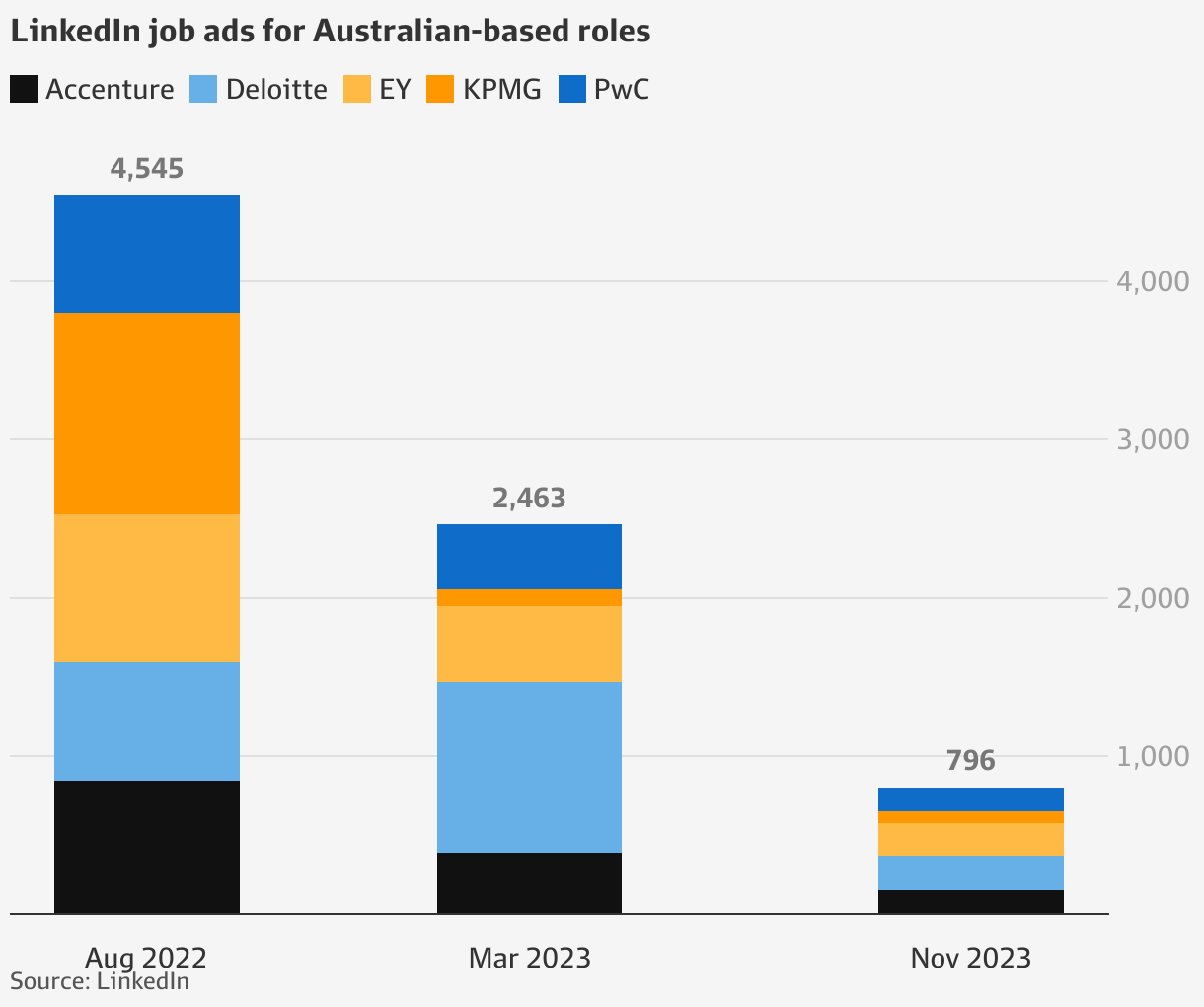

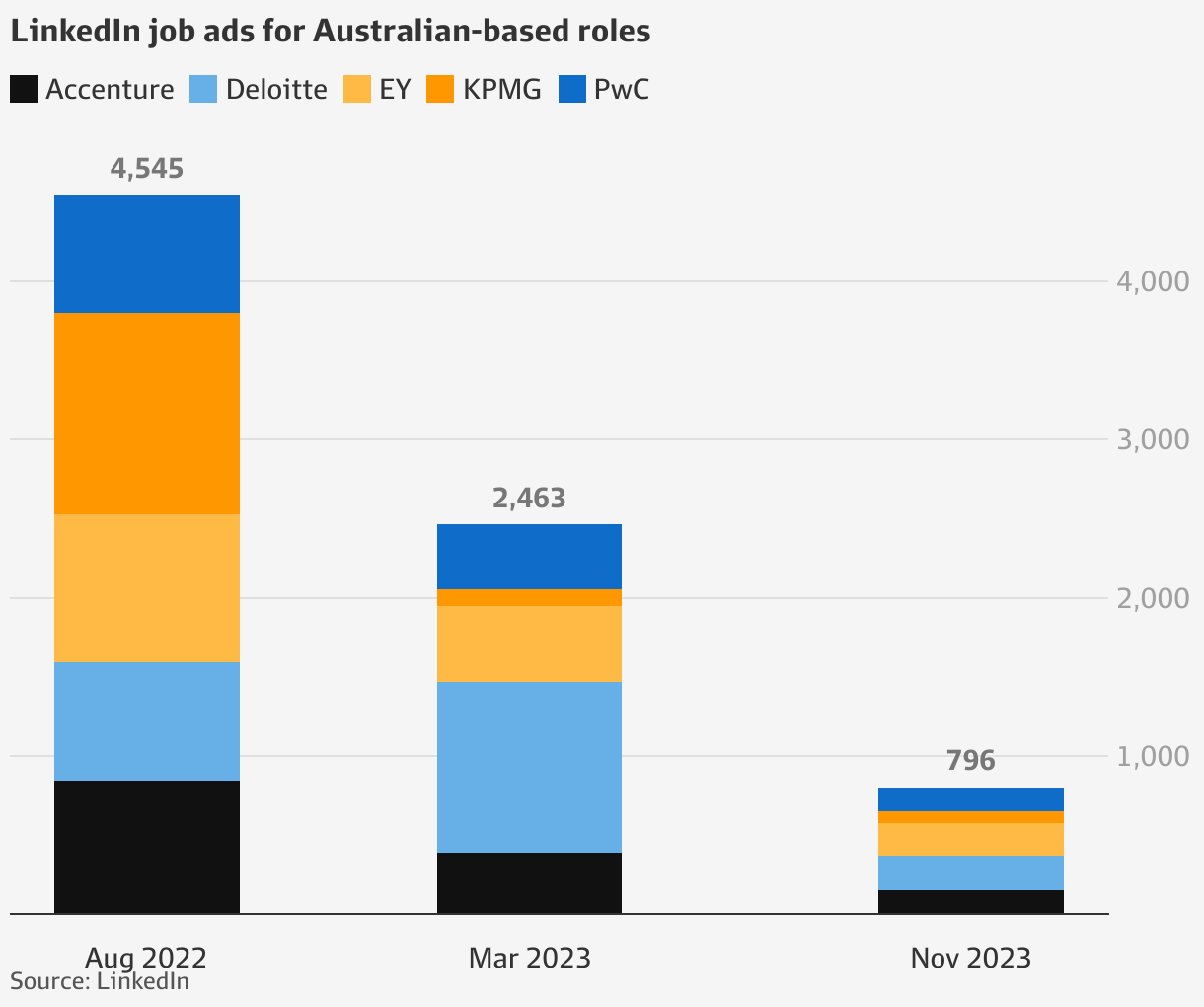

Scandal-Hit PwC Shrinks Global Footprint: Exits From More Than A Dozen Countries

Table of Contents

The Fallout from Recent Scandals

The decision to shrink PwC's global footprint is a direct consequence of several high-profile scandals that have severely damaged its reputation and client trust. These events have forced a strategic reassessment of its global network and operational model.

Data Leaks and Regulatory Scrutiny

A series of data breaches and regulatory investigations have significantly impacted PwC's credibility. These incidents highlight vulnerabilities in its internal security protocols and raise serious concerns about its ability to protect sensitive client information.

- Examples of specific scandals: The firm faced investigations related to data leaks impacting client confidentiality, including instances where sensitive financial data was compromised. Furthermore, regulatory bodies launched investigations into PwC's auditing practices, raising questions about the independence and objectivity of its audits.

- Impact on PwC's credibility and client trust: The scandals have eroded client trust, leading to a loss of confidence in PwC's ability to handle sensitive information and maintain ethical standards. This reputational damage has far-reaching consequences for the firm's future success.

Loss of Client Confidence and Market Share

The fallout from the scandals has directly translated into a loss of client confidence and a decline in market share. Major clients have switched to competing firms, and new client acquisition has slowed significantly.

- Mention loss of major clients, decrease in new client acquisition, and competitive pressures: Reports suggest a noticeable decrease in client retention rates, particularly among large multinational corporations. This loss of major clients has put significant pressure on PwC’s revenue streams. The heightened competitive pressure from other firms has further exacerbated the situation.

- Explain how client confidence is essential to the success of any auditing or consulting firm: In the auditing and consulting industry, trust is paramount. Clients need to have absolute confidence in the integrity and expertise of the firm they hire. The loss of this confidence translates directly into lost business.

Strategic Realignment of PwC's Global Network

In response to the scandals and their consequences, PwC is undertaking a significant strategic realignment of its global network. This involves a focused effort to consolidate operations and withdraw from less profitable markets.

Country Exits and Consolidation Efforts

PwC has announced its exit from, or plans to exit, numerous countries globally. This strategic retreat reflects a shift away from maintaining a broad global presence towards a more concentrated approach.

- List the countries PwC has left or is planning to leave: While the exact number and specific locations are subject to change and may not be publicly disclosed for competitive reasons, it's understood that PwC has reduced its footprint in over a dozen countries. These are primarily located in regions with lower profitability or higher regulatory risk.

- Explain the financial and strategic reasons for these exits (e.g., cost-cutting measures, market saturation, lack of profitability): The exits are driven by cost-cutting measures aimed at improving profitability. Some markets may be considered saturated, offering limited growth potential. Other locations may present significantly higher regulatory or operational challenges, impacting the cost-benefit analysis of maintaining a presence.

Focus on Core Markets and Key Services

PwC's revised global strategy focuses on strengthening its presence in core markets and key service areas where it holds a competitive advantage. This involves investing more resources in regions offering higher growth potential and focusing on profitable service lines.

- Identify the regions and service areas where PwC is investing more resources: The firm is concentrating its efforts on regions like North America, Europe, and parts of Asia where it enjoys greater market share and profitability. Services such as cybersecurity consulting and digital transformation are receiving significant investment.

- Discuss the firm's efforts to streamline operations and improve efficiency: The restructuring involves streamlining operational processes to improve efficiency and reduce costs. This includes consolidating offices, optimizing staffing levels, and investing in new technologies.

Impact on Employees and Clients

The shrinking of PwC's global footprint has significant implications for its employees and clients. These consequences necessitate careful management to mitigate potential negative effects.

Job Losses and Employee Morale

The downsizing inevitably leads to job losses and potential disruptions to employee morale. PwC is likely implementing various support programs to assist affected employees.

- Mention potential layoffs, relocation opportunities, and employee support programs: Layoffs are expected, though the exact numbers are not publicly available. PwC is likely offering relocation opportunities to some employees, and support programs such as outplacement services are being implemented to help those who lose their jobs transition to new opportunities.

- Analyze the ethical implications of layoffs and the importance of employee well-being: The ethical handling of layoffs is crucial. Transparency, fairness, and support for affected employees are essential to maintain morale and protect the firm's reputation.

Client Transition and Service Continuity

The exit from certain countries requires a smooth transition for clients whose services are affected. PwC needs to ensure seamless service continuity for clients, minimizing any disruption to their operations.

- Outline strategies PwC is using to support clients during this transition: PwC is likely working closely with affected clients to help them transition to alternative service providers or to consolidate their services within other PwC locations.

- Discuss the potential for disruption to client services and how PwC is mitigating this: The potential for disruption exists, and minimizing it requires careful planning and communication. PwC will likely focus on transferring client data and responsibilities to other offices, ensuring the ongoing delivery of essential services.

Conclusion

The shrinking of PwC's global footprint is a significant development driven by a confluence of factors: scandals that damaged its reputation, a strategic realignment focused on profitability, and the resultant impact on employees and clients. The decision to exit numerous countries reflects a significant shift in PwC's global strategy, prioritizing profitability and stability over extensive geographical reach.

The shrinking of PwC's global footprint raises crucial questions about the future of large accounting firms and their ability to maintain ethical standards. Staying informed about these developments is essential for businesses seeking reliable auditing and consulting services. Follow us for further updates on the evolving dynamics of the PwC global footprint and the broader accounting industry.

Featured Posts

-

Make February 20 2025 A Happy Day

Apr 29, 2025

Make February 20 2025 A Happy Day

Apr 29, 2025 -

Older Adults And You Tube A New Era Of Television Viewing

Apr 29, 2025

Older Adults And You Tube A New Era Of Television Viewing

Apr 29, 2025 -

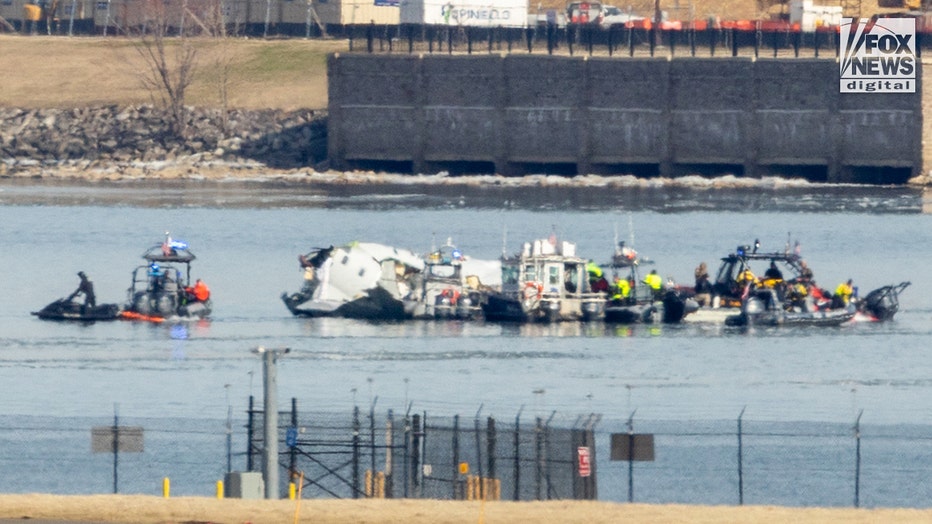

The Spread Of Misinformation The D C Plane Crash And Social Media

Apr 29, 2025

The Spread Of Misinformation The D C Plane Crash And Social Media

Apr 29, 2025 -

Understanding Adult Adhd 8 Subtle Symptoms And Their Impact

Apr 29, 2025

Understanding Adult Adhd 8 Subtle Symptoms And Their Impact

Apr 29, 2025 -

Gript I Toploto Vreme Mnenieto Na Prof Iva Khristova

Apr 29, 2025

Gript I Toploto Vreme Mnenieto Na Prof Iva Khristova

Apr 29, 2025