Schroders Reports Asset Drop Amidst First Quarter Stock Sell-Off

Table of Contents

Schroders, a global asset manager with a long history and substantial assets under management (AUM), provides investment solutions to institutions and individuals worldwide. Its performance serves as a key indicator of broader market trends and investor sentiment. The first-quarter sell-off resulted in a considerable reduction in Schroders' AUM, prompting a closer examination of the underlying causes and implications. Key factors contributing to this decline included global economic uncertainty, rapidly rising interest rates implemented by central banks to combat inflation, and escalating geopolitical tensions.

Detailed Analysis of Schroders' First Quarter Performance

Asset Under Management (AUM) Decline

Schroders experienced a significant drop in AUM during the first quarter. Preliminary figures indicate a decrease of approximately X% (or a monetary value of Y), representing a substantial decline compared to the previous quarter and the same period last year. This overall AUM decline was influenced by the underperformance of various asset classes. For example, the equity market downturn significantly impacted the value of equity-based investments within Schroders' portfolio, contributing a larger percentage to the overall loss than, say, the more stable bond holdings.

- Quantitative Data: Include a precise percentage decrease in AUM and the monetary value of the loss.

- Comparative Analysis: Compare Q1 2024 AUM to Q4 2023 AUM and Q1 2023 AUM.

- Asset Class Breakdown: Show the percentage decline in AUM for different asset classes (equities, bonds, alternatives). Use a bar chart to visualize this breakdown.

Impact of Market Volatility on Investment Strategies

The heightened market volatility during Q1 forced Schroders to adapt its investment strategies. The firm's risk management team closely monitored market conditions and made adjustments to portfolio allocations to mitigate potential losses. This involved a shift towards more defensive positions in some instances, though the specific strategies would depend on the individual fund mandates. For example, certain funds might have reduced their exposure to high-growth tech stocks, which were particularly hard hit.

- Portfolio Adjustments: Detail specific examples of portfolio re-allocations, such as shifting from equities to bonds or reducing exposure to specific sectors.

- Investment Decision Examples: Highlight specific investment decisions that were influenced by the sell-off and their outcomes.

- Fund Performance Analysis: Provide a brief overview of the performance of Schroders' different investment funds and strategies during Q1.

Client Outflows and Investor Sentiment

The market downturn also led to some client outflows during the first quarter, although the extent was not as dramatic as the AUM decline itself, suggesting a measure of client confidence in Schroders' long-term strategy. Negative market sentiment understandably impacted investor confidence, leading to some degree of caution. However, Schroders' strong track record and reputation helped mitigate the severity of this impact.

- Client Outflow Quantification: State the approximate percentage or monetary value of client outflows.

- Investor Sentiment Analysis: Discuss surveys or other indicators of investor sentiment towards Schroders.

- Impact on Business: Assess the financial and reputational impacts of client outflows and negative sentiment.

Broader Market Context and Contributing Factors

Global Macroeconomic Factors

The first-quarter market sell-off was largely driven by several intertwined macroeconomic factors. High inflation, fuelled by supply chain disruptions and robust consumer demand, prompted aggressive interest rate hikes by central banks worldwide. This increased borrowing costs, dampening economic growth and impacting investor confidence. Geopolitical risks, including the ongoing war in Ukraine and heightened tensions between China and the US, further exacerbated market uncertainty.

- Inflationary Pressures: Discuss the impact of high inflation on investor sentiment and market valuations.

- Interest Rate Hikes: Explain the role of rising interest rates in slowing economic growth and impacting asset prices.

- Geopolitical Risks: Analyze the influence of geopolitical events on market volatility and investor confidence. Link to credible sources like the IMF or World Bank.

Sector-Specific Performance and Market Trends

Certain sectors were hit harder than others during the first-quarter sell-off. The technology sector, for instance, experienced a significant downturn due to rising interest rates, which disproportionately impacted high-growth, often unprofitable companies. The energy sector, conversely, showed relative strength due to ongoing geopolitical uncertainty and high energy prices.

- Sector Performance Breakdown: Illustrate the performance of various sectors using a chart or table.

- Industry-Specific Factors: Explain the specific factors affecting the performance of key sectors.

- Correlation Analysis: Demonstrate the correlation between Schroders' asset drop and broader market trends.

Schroders' Response and Future Outlook

Management Commentary and Strategies

Schroders' management has acknowledged the challenges posed by the first-quarter market downturn but has expressed confidence in the long-term resilience of their investment strategies. They emphasize their focus on active management, fundamental research, and long-term value creation. Schroders is actively reviewing its investment approach and may implement further adjustments to adapt to the evolving market conditions.

- Management Quotes: Include direct quotes from Schroders' management's statements on Q1 performance and future plans.

- Risk Mitigation Strategies: Outline the steps Schroders is taking to mitigate future risks and enhance performance.

- Restructuring Plans: Mention any plans for restructuring or changes in investment approaches.

Predictions and Expectations for the Remainder of the Year

Predicting future market performance is inherently uncertain. However, based on current macroeconomic trends and market forecasts, Schroders anticipates a gradual recovery in AUM, contingent on a stabilization of global economic conditions and a decrease in geopolitical tensions. The firm remains cautious, acknowledging that unforeseen events could significantly impact its performance in the coming quarters.

- AUM Projections: Provide a cautious outlook on Schroders' expected AUM for the remainder of the year.

- Recovery Scenarios: Discuss potential scenarios for market recovery and their impact on Schroders' performance.

- Uncertainties: Highlight the uncertainties involved in predicting future market conditions.

Understanding the Schroders Asset Drop and its Implications

In summary, Schroders' first-quarter performance reflects the broader impact of a challenging market environment characterized by high inflation, rising interest rates, and geopolitical uncertainty. The significant drop in AUM highlights the importance of robust risk management and adaptive investment strategies in navigating market fluctuations. The company's response underscores its commitment to long-term value creation and its ability to adapt to evolving market conditions. Stay updated on Schroders' ongoing performance and navigate the complexities of market fluctuations by regularly checking their official reports and analyses, understanding the implications of Schroders' asset drops and other market indicators.

Featured Posts

-

Rumeurs De Manipulation Macron Et L Election Du Prochain Pape A Rome

May 03, 2025

Rumeurs De Manipulation Macron Et L Election Du Prochain Pape A Rome

May 03, 2025 -

Australian Government Responds To Increased Chinese Naval Activity Near Sydney

May 03, 2025

Australian Government Responds To Increased Chinese Naval Activity Near Sydney

May 03, 2025 -

Judges Cant Review Trumps Tariffs He Argues

May 03, 2025

Judges Cant Review Trumps Tariffs He Argues

May 03, 2025 -

Macron Prepare De Nouvelles Sanctions Contre La Russie

May 03, 2025

Macron Prepare De Nouvelles Sanctions Contre La Russie

May 03, 2025 -

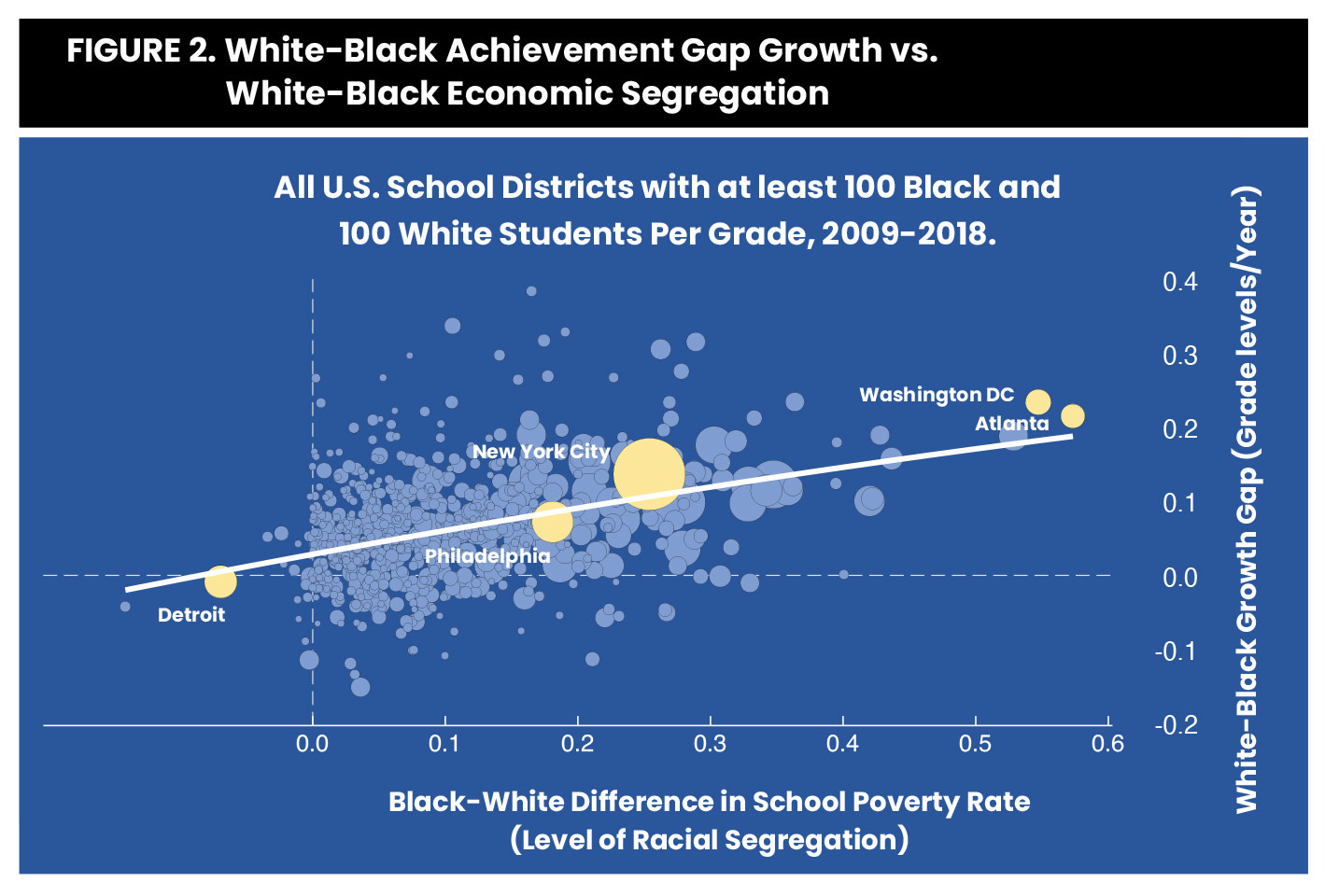

The Future Of School Desegregation In The Wake Of Doj Decision

May 03, 2025

The Future Of School Desegregation In The Wake Of Doj Decision

May 03, 2025

Latest Posts

-

Bryce Mitchell Calls Out Jean Silva For Profanity At Ufc 314 Press Conference

May 04, 2025

Bryce Mitchell Calls Out Jean Silva For Profanity At Ufc 314 Press Conference

May 04, 2025 -

Ufc 314 Neal Vs Prates Cancellation Shakes Up Star Studded Card

May 04, 2025

Ufc 314 Neal Vs Prates Cancellation Shakes Up Star Studded Card

May 04, 2025 -

The Paddy Pimblett Dustin Poirier Retirement Debate

May 04, 2025

The Paddy Pimblett Dustin Poirier Retirement Debate

May 04, 2025 -

Poirier Retires Paddy Pimbletts Reaction Sparks Debate

May 04, 2025

Poirier Retires Paddy Pimbletts Reaction Sparks Debate

May 04, 2025 -

Ufc 314 In Depth Look At Chandler Vs Pimblett Odds And Predictions

May 04, 2025

Ufc 314 In Depth Look At Chandler Vs Pimblett Odds And Predictions

May 04, 2025