SEC Vs. Ripple: XRP's Future As A Commodity Hangs In The Balance

Table of Contents

The SEC's Case Against Ripple

Allegations of Unregistered Securities Offerings

The SEC alleges that Ripple conducted unregistered securities offerings of XRP, violating federal securities laws. This claim is based on the Howey Test, a legal framework used to determine whether an investment contract exists.

- The SEC argues XRP sales constituted investment contracts because investors reasonably expected profits based on Ripple's efforts to develop and promote the cryptocurrency.

- The SEC cites Ripple's various sales and marketing strategies as evidence of a deliberate effort to offer XRP as an investment opportunity. This includes institutional sales, programmatic sales, and other marketing activities.

- The SEC’s case hinges on demonstrating a reasonable expectation of profit derived from Ripple’s efforts, rather than from the inherent value or utility of XRP itself. This is a key point of contention in the case.

Ripple's Defense

Ripple counters that XRP is a decentralized digital asset, functioning more like a currency or a commodity than a security. They argue the Howey Test is inapplicable in this context.

- Ripple emphasizes XRP's use in cross-border payments and its widespread adoption on numerous cryptocurrency exchanges globally, highlighting its utility beyond mere investment.

- They argue the Howey Test doesn't apply to XRP due to its decentralized nature and the lack of direct control by Ripple over its price or market activity.

- Ripple highlights the significant number of XRP holders who are not affiliated with the company, further emphasizing its decentralized nature and challenging the SEC's assertion of a centralized investment scheme.

Potential Outcomes and Their Implications for XRP

SEC Victory

If the SEC prevails, XRP could be classified as a security, significantly impacting its trading and potentially leading to delisting from major cryptocurrency exchanges.

- This could result in significant price drops and reduced liquidity for XRP, making it difficult for investors to buy or sell.

- Investors holding XRP might face legal repercussions, depending on the specifics of the ruling and their involvement in XRP transactions.

- It could set a precedent for how other cryptocurrencies are regulated, potentially leading to stricter regulatory scrutiny across the crypto market.

Ripple Victory

A victory for Ripple would establish a precedent supporting the classification of certain cryptocurrencies as commodities, boosting investor confidence and potentially driving XRP's price upward.

- This would likely increase XRP's trading volume and accessibility, making it easier for investors to participate in the market.

- It could lead to clearer regulatory guidelines for the crypto industry, providing much-needed certainty for investors and businesses operating in the space.

- It might encourage other cryptocurrency projects to challenge the SEC's classification of digital assets, potentially leading to a more nuanced and technology-friendly regulatory approach.

Settlement

A settlement between the SEC and Ripple is also a possibility, potentially leading to a negotiated outcome with implications for XRP's future. This could involve various conditions, including limitations on sales and marketing, or concessions regarding regulatory compliance. The terms of any settlement would significantly influence the future trajectory of XRP.

The Broader Implications for the Cryptocurrency Market

The SEC vs. Ripple case has far-reaching consequences for the entire cryptocurrency market. The outcome will influence how regulatory bodies worldwide approach the classification of other cryptocurrencies, impacting investment decisions and overall market stability. This uncertainty affects not only XRP but the entire crypto space, creating a climate of cautious anticipation. The ruling could set a precedent for future regulatory actions concerning other digital assets.

Conclusion

The SEC vs. Ripple case is a pivotal moment for the cryptocurrency market. The classification of XRP as a security or a commodity will have profound implications for investors, exchanges, and the broader crypto ecosystem. The uncertainty surrounding the outcome highlights the need for clear regulatory frameworks in the digital asset space. Staying informed about the developments in this landmark case is crucial for anyone invested in or interested in the future of XRP and the cryptocurrency market. Understanding the potential outcomes and their impact on your investment portfolio is essential. Keep monitoring the unfolding events in the SEC vs. Ripple case to make informed decisions regarding your XRP holdings and other cryptocurrency investments. The future of XRP, and potentially the entire crypto landscape, hangs in the balance.

Featured Posts

-

Confirmation Obscure 2008 Disney Game Now On Ps Plus Premium

May 02, 2025

Confirmation Obscure 2008 Disney Game Now On Ps Plus Premium

May 02, 2025 -

A Cheating Prevention Ring Would You Use It

May 02, 2025

A Cheating Prevention Ring Would You Use It

May 02, 2025 -

59 56 Loss Lady Raiders Fall Short Against Cincinnati At Home

May 02, 2025

59 56 Loss Lady Raiders Fall Short Against Cincinnati At Home

May 02, 2025 -

Remembering Priscilla Pointer A Tribute To The Dallas And Carrie Star

May 02, 2025

Remembering Priscilla Pointer A Tribute To The Dallas And Carrie Star

May 02, 2025 -

Merrie Monarch Festival On Hawai I Island A Showcase Of Pacific Island Dance And Music

May 02, 2025

Merrie Monarch Festival On Hawai I Island A Showcase Of Pacific Island Dance And Music

May 02, 2025

Latest Posts

-

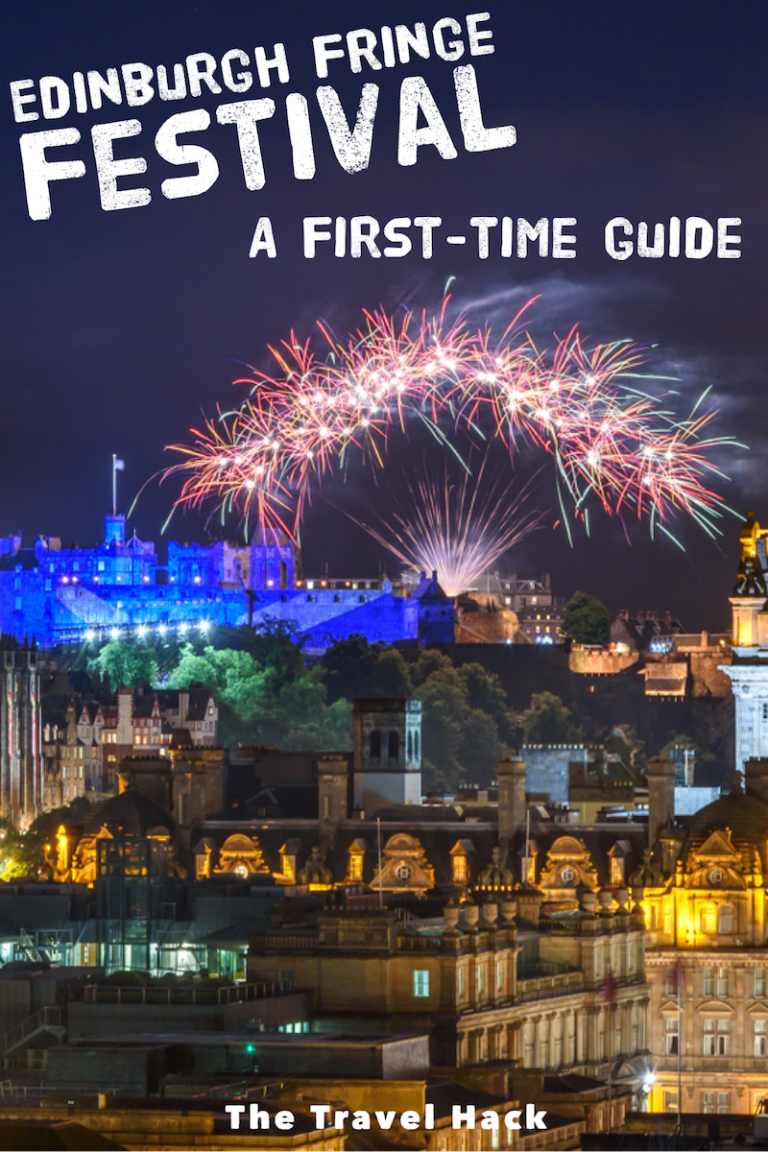

Pussy Riots Alyokhina New Play At Edinburgh Fringe Festival 2025

May 02, 2025

Pussy Riots Alyokhina New Play At Edinburgh Fringe Festival 2025

May 02, 2025 -

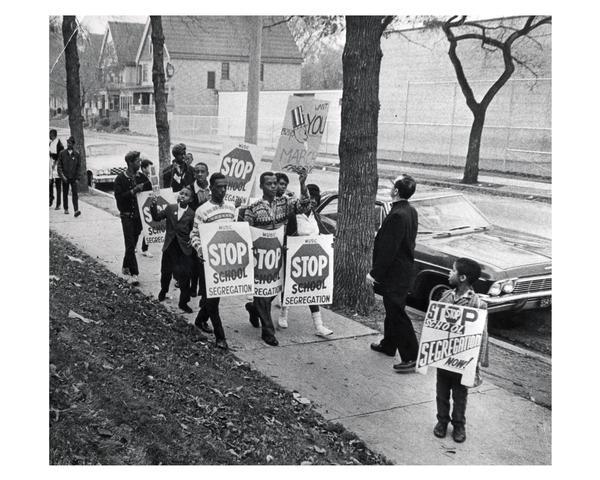

The End Of A Desegregation Order A Turning Point In School Integration

May 02, 2025

The End Of A Desegregation Order A Turning Point In School Integration

May 02, 2025 -

Edinburgh Fringe 2025 Pussy Riots Maria Alyokhina Stages New Play

May 02, 2025

Edinburgh Fringe 2025 Pussy Riots Maria Alyokhina Stages New Play

May 02, 2025 -

Maria Alyokhinas Riot Day Play Edinburgh Fringe 2025 Debut

May 02, 2025

Maria Alyokhinas Riot Day Play Edinburgh Fringe 2025 Debut

May 02, 2025 -

The Fallout From The Justice Departments School Desegregation Decision

May 02, 2025

The Fallout From The Justice Departments School Desegregation Decision

May 02, 2025