SEC's Crypto Broker Regulations: Chairman Atkins Hints At Significant Revisions

Table of Contents

Chairman Atkins's Statements and Their Implications

Chairman Atkins's pronouncements haven't been explicitly detailed in a single, public statement, but a pattern of comments and actions suggests a move away from the rigidly defined approach of the past. While specific quotes may be limited due to the evolving nature of the situation, the general sentiment points towards a reevaluation of the current regulatory framework. This shift is likely driven by several factors, including the inherent volatility of the crypto markets, the need to enhance investor protection in this relatively nascent space, and the rapid pace of technological advancements within the crypto ecosystem.

- Specific concerns raised by Atkins: While not explicitly stated, concerns likely include the lack of clarity surrounding definitions of crypto assets and the challenges of applying existing securities laws to decentralized technologies.

- Potential areas for regulatory improvements: This may encompass more transparent guidelines for registering as a crypto broker-dealer, potentially including tiered registration based on asset type or trading volume, along with better-defined compliance measures.

- The impact of these statements on cryptocurrency prices: The ambiguity surrounding the potential changes has led to price volatility, with some tokens experiencing significant price swings based on market interpretation of Atkins's inferred position.

Potential Revisions to Existing Regulations

The anticipated revisions to SEC's crypto broker regulations could profoundly reshape the crypto industry. Key areas for potential changes include:

-

Redefining "broker-dealer": The current definition may need to adapt to the unique characteristics of decentralized finance (DeFi) protocols and other innovative crypto platforms that don't fit neatly into the traditional broker-dealer model. A more nuanced definition, potentially with carve-outs for certain activities, could be implemented.

-

Modifications to registration requirements: This could involve streamlining the registration process for smaller exchanges, while imposing stricter requirements for larger platforms handling significant trading volumes and offering a wider range of crypto assets. This would need to balance investor protection with encouraging innovation.

-

Impact on market access and competition: Regulatory changes could impact market access for smaller players, potentially favoring larger, established exchanges better equipped to meet stringent compliance standards. However, clearer regulations might also level the playing field and promote fair competition.

-

Specific regulatory changes: These could include clearer guidelines on custody of digital assets, anti-money laundering (AML) and know-your-customer (KYC) protocols, and cybersecurity standards.

-

Impact on stakeholders: Exchanges might face increased compliance costs, while investors could benefit from enhanced protection. Developers of decentralized platforms might see their innovations either encouraged or hampered depending on the specifics of the revised regulations.

-

Benefits and drawbacks: Potential benefits include greater investor confidence and market stability, while potential drawbacks include stifling innovation and limiting market access for smaller businesses.

The Broader Regulatory Landscape and International Comparisons

The SEC's approach to crypto regulation is not isolated. The European Union's Markets in Crypto-Assets (MiCA) regulation, for example, offers a contrasting framework. Comparing these approaches highlights the global challenges of regulating a decentralized technology. Harmonization of global regulations is a significant long-term goal, although the diverse regulatory approaches across nations present considerable obstacles.

- Key differences in regulatory approaches: MiCA focuses on licensing and market abuse prevention, while the SEC's focus has been on securities laws. Other jurisdictions have adopted varied approaches, from outright bans to more laissez-faire policies.

- Implications of regulatory divergence: International crypto businesses must navigate a patchwork of regulations, leading to compliance complexities and potential jurisdictional arbitrage.

- International cooperation: Increased cooperation among regulators is essential for efficient and effective global crypto regulation, reducing regulatory fragmentation and creating a more predictable environment for crypto businesses.

Impact on Crypto Innovation and Investment

The proposed revisions to SEC's crypto broker regulations will undeniably impact both crypto innovation and investment. The nature of this impact – stimulative or restrictive – will depend heavily on the specifics of the changes.

-

Impact on innovation: Overly stringent regulations could stifle innovation in areas like DeFi and NFTs, while a balanced approach could foster responsible growth.

-

Impact on investor confidence: Clearer regulations could boost investor confidence, leading to increased capital flows into the crypto market. However, overly burdensome regulations could have the opposite effect.

-

Specific examples: Regulations affecting staking rewards or decentralized autonomous organizations (DAOs) could significantly impact DeFi innovation. NFT marketplaces may face increased scrutiny regarding their operations.

-

Investor participation: A well-designed regulatory framework that prioritizes transparency and investor protection would likely attract institutional investors and increase market participation.

Conclusion

Chairman Atkins's implied willingness to revise SEC's crypto broker regulations signals a potential turning point in the US crypto regulatory landscape. The implications are far-reaching, affecting exchanges, investors, developers, and the broader crypto ecosystem. While revisions could enhance investor protection and market stability, they also risk stifling innovation if not carefully designed. Staying informed about upcoming changes in SEC crypto regulations update is crucial for all stakeholders. Engage in the ongoing discussion on the future of SEC crypto regulation and advocate for a balanced approach that fosters responsible innovation while safeguarding investors. The path forward requires careful consideration of the potential benefits and challenges associated with these crucial crypto broker regulatory changes.

Featured Posts

-

Sir Ian Mc Kellens Early Coronation Street Appearance A Stepping Stone To Success

May 13, 2025

Sir Ian Mc Kellens Early Coronation Street Appearance A Stepping Stone To Success

May 13, 2025 -

The Big Issues Childrens Competition And The Winner Is

May 13, 2025

The Big Issues Childrens Competition And The Winner Is

May 13, 2025 -

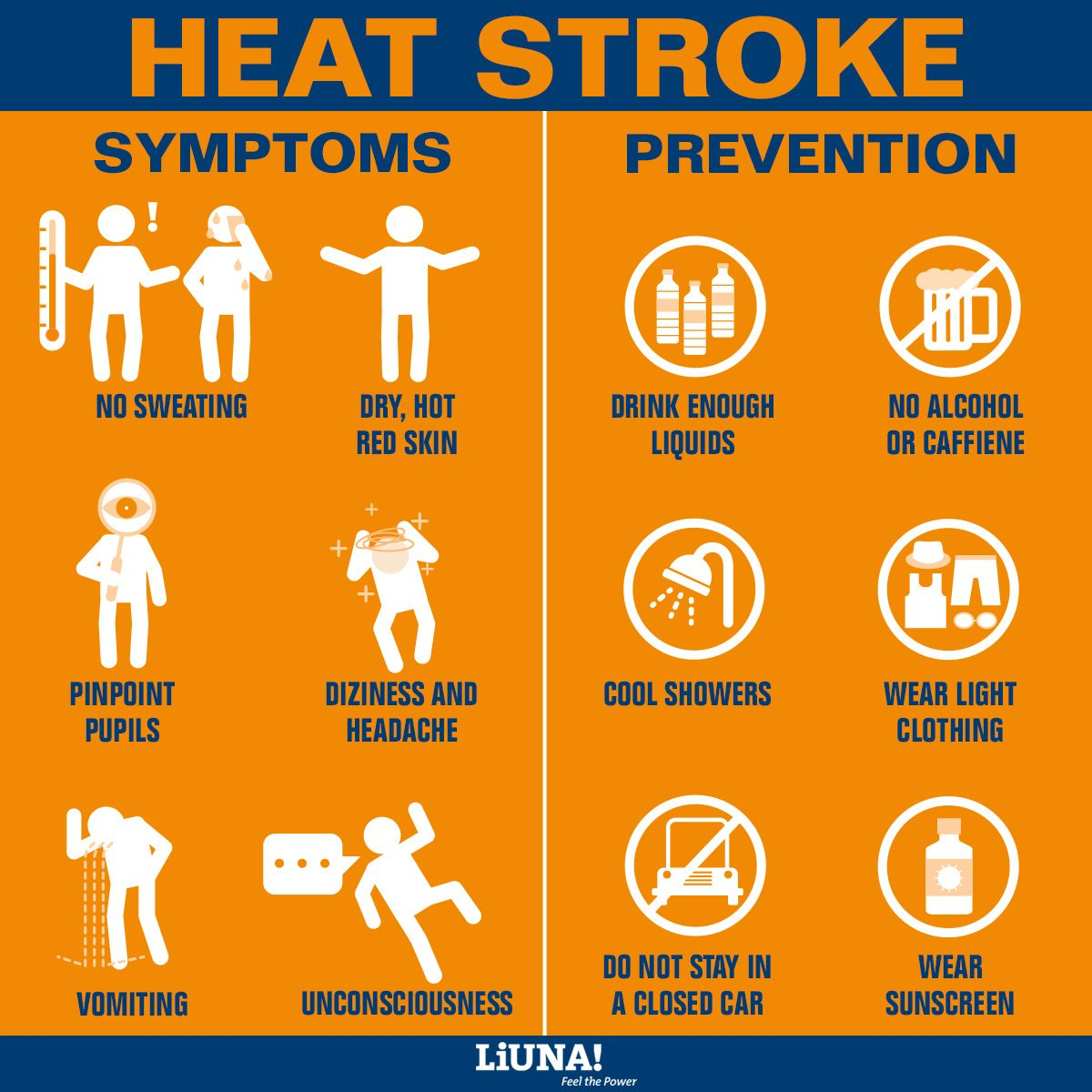

La And Orange Counties Sizzle Under Record Breaking Heat Safety Tips And Resources

May 13, 2025

La And Orange Counties Sizzle Under Record Breaking Heat Safety Tips And Resources

May 13, 2025 -

Pregnant Cassie And Alex Fines Red Carpet Debut At Mob Land Premiere

May 13, 2025

Pregnant Cassie And Alex Fines Red Carpet Debut At Mob Land Premiere

May 13, 2025 -

Revisiting The Classics Dooms Enduring Influence On Modern Game Design

May 13, 2025

Revisiting The Classics Dooms Enduring Influence On Modern Game Design

May 13, 2025

Latest Posts

-

Did Political Correctness Sink Snow White Analyzing The Box Office Disaster

May 14, 2025

Did Political Correctness Sink Snow White Analyzing The Box Office Disaster

May 14, 2025 -

Disneys Snow White Flop Signals The End Of Live Action Remakes

May 14, 2025

Disneys Snow White Flop Signals The End Of Live Action Remakes

May 14, 2025 -

Snow White Box Office Bomb A Case Study In Divisive Marketing

May 14, 2025

Snow White Box Office Bomb A Case Study In Divisive Marketing

May 14, 2025 -

Disneys Woke Snow White Critical And Commercial Failure

May 14, 2025

Disneys Woke Snow White Critical And Commercial Failure

May 14, 2025 -

The Snow White Disaster A Box Office Crash And Burn

May 14, 2025

The Snow White Disaster A Box Office Crash And Burn

May 14, 2025