Secure A Personal Loan With Bad Credit: Up To $5000

Table of Contents

Understanding Your Credit Score and Its Impact

Your credit score is a crucial factor in determining your eligibility for a personal loan, and understanding it is the first step to success. Lenders use your credit score – a three-digit number – to assess your creditworthiness and predict the likelihood of you repaying the loan. A higher credit score generally translates to better loan terms, including lower interest rates and more favorable repayment plans. Conversely, a low credit score can result in loan rejection or significantly higher interest rates.

Your credit score is calculated based on several key factors:

- Payment History (35%): This is the most significant factor. Consistent on-time payments demonstrate your reliability as a borrower.

- Amounts Owed (30%): This refers to your credit utilization ratio – the amount of credit you're using compared to your total available credit. Keeping this ratio low (ideally below 30%) is crucial.

- Length of Credit History (15%): A longer credit history, showing consistent responsible credit use over time, generally results in a better score.

- New Credit (10%): Opening numerous new credit accounts in a short period can negatively impact your score.

- Credit Mix (10%): Having a mix of different credit accounts (credit cards, installment loans) can positively influence your credit score.

Before applying for a loan, it's wise to check your credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) for any errors. Understanding your credit report and score allows you to address any issues and potentially improve your chances of loan approval. Remember the difference between hard and soft inquiries; hard inquiries (when a lender checks your credit) can slightly lower your score, while soft inquiries (like you checking your own credit) don't.

Finding Lenders Who Offer Bad Credit Personal Loans

Finding the right lender is crucial when you have bad credit. Several options exist, each with its advantages and disadvantages:

- Online Lenders: Many online lenders specialize in bad credit personal loans. They often offer a streamlined application process and quicker approval times. However, it's essential to research thoroughly and compare interest rates and fees carefully.

- Banks and Credit Unions: While banks are more stringent with their lending criteria, some may offer loans to borrowers with bad credit, especially if you have a long-standing relationship with the institution. Credit unions often have more lenient requirements and may offer more competitive rates than banks.

- Beware of Predatory Lenders: Avoid lenders who offer extremely high interest rates, hidden fees, or aggressive collection practices. Payday loans, in particular, should be avoided due to their extremely high interest rates and potential for creating a cycle of debt. Installment loans are a better option for bad credit, although it is important to still compare interest rates carefully.

Remember to always compare interest rates, fees, and repayment terms from multiple lenders before making a decision. Read reviews and look for lenders with a reputation for fair and transparent practices.

Strategies to Improve Your Chances of Loan Approval

While securing a loan with bad credit can be challenging, you can improve your odds of approval by employing several strategies:

- Secure a Co-signer: Having a co-signer with good credit can significantly increase your chances of approval. The co-signer agrees to repay the loan if you default.

- Consider a Secured Loan: If possible, consider applying for a secured loan. This type of loan requires collateral, such as a savings account or car, which reduces the lender's risk.

- Improve Your Credit Score: Before applying, work on improving your credit score. Even small improvements can make a big difference. Pay down existing debt, pay bills on time, and avoid opening new credit accounts.

- Provide a Strong Loan Application: Complete your loan application accurately and thoroughly. Provide detailed information about your income, employment history, and expenses. Demonstrate a stable income and responsible financial behavior.

Reading the Fine Print: Understanding Loan Terms and Fees

Before signing any loan agreement, carefully review all the terms and conditions. Pay close attention to:

- APR (Annual Percentage Rate): This represents the total cost of borrowing, including interest and fees. Compare APRs from different lenders to find the best deal.

- Interest Rate: The interest rate determines the cost of borrowing. A higher interest rate means higher total repayment costs.

- Fees: Be aware of any associated fees, including origination fees, late payment fees, and prepayment penalties.

- Repayment Plan: Ensure the repayment plan aligns with your budget and financial capabilities. Avoid loans with repayment terms that could put you at risk of default.

Asking questions if anything is unclear is crucial. Don't hesitate to contact the lender to clarify any aspects of the loan agreement before committing.

Conclusion

Securing a personal loan with bad credit requires careful planning and research. By understanding your credit score, finding reputable lenders, employing strategies to improve your chances of approval, and meticulously reviewing loan terms, you can significantly increase your likelihood of success. Remember, obtaining a loan of up to $5000 is achievable even with bad credit. Start your journey towards securing a personal loan with bad credit today! Use the strategies outlined above to increase your chances of approval and find the best loan option for your needs. Don't let bad credit hold you back – find the right $5000 loan for you!

Featured Posts

-

Marlins Defeat Nationals Stowers And Conine Lead The Charge

May 28, 2025

Marlins Defeat Nationals Stowers And Conine Lead The Charge

May 28, 2025 -

El Equipo Espanol De Atletismo Para El Mundial Indoor De Nanjing Convocatoria Completa

May 28, 2025

El Equipo Espanol De Atletismo Para El Mundial Indoor De Nanjing Convocatoria Completa

May 28, 2025 -

Eu Tariffs Trump Pushes Back Deadline To July 9th

May 28, 2025

Eu Tariffs Trump Pushes Back Deadline To July 9th

May 28, 2025 -

Euro Millions Results Tuesday 15th April 34 Million Jackpot

May 28, 2025

Euro Millions Results Tuesday 15th April 34 Million Jackpot

May 28, 2025 -

M 5 15

May 28, 2025

M 5 15

May 28, 2025

Latest Posts

-

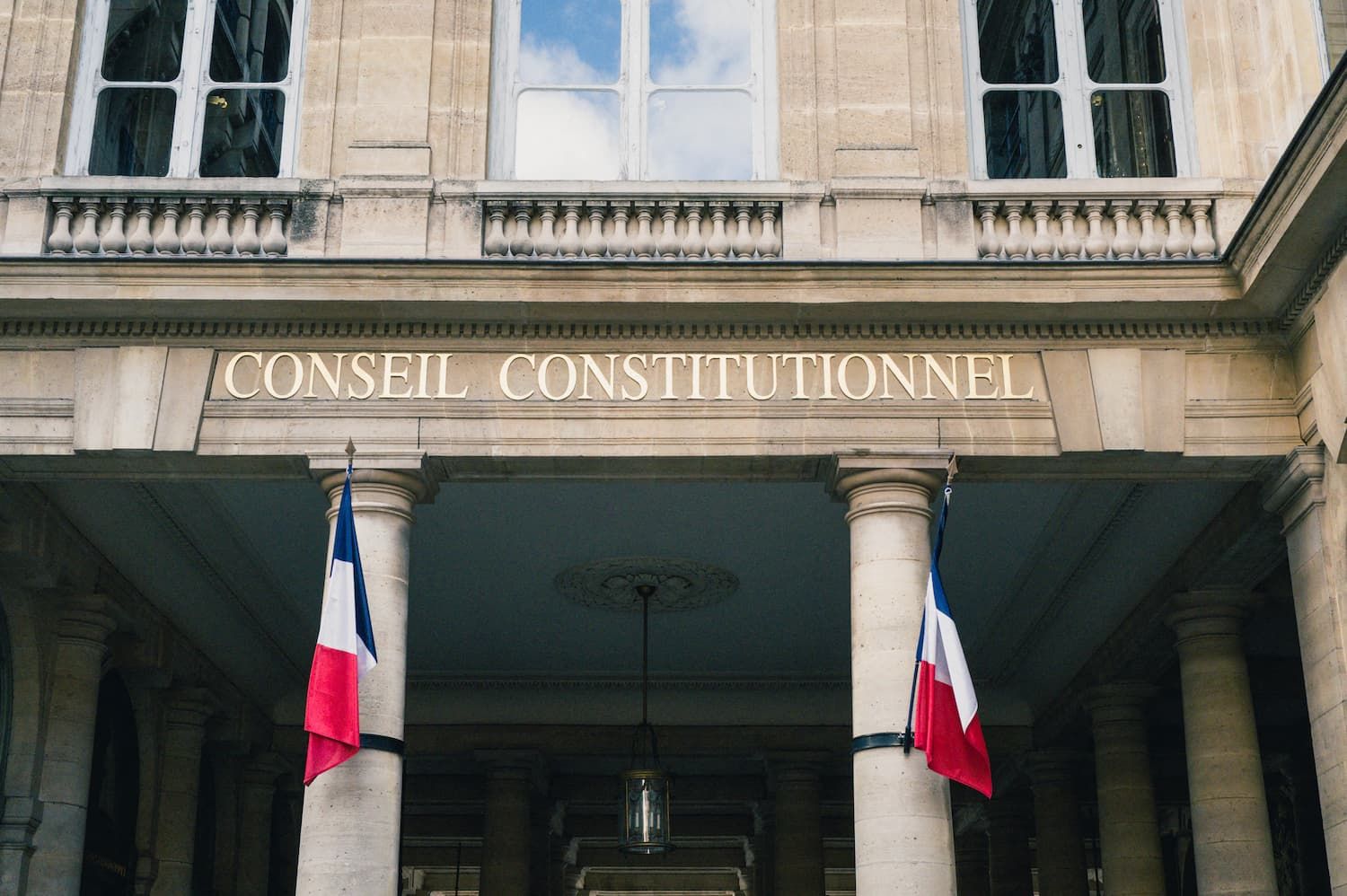

Marine Le Pen Et La Justice Jacobelli Defend L Immunite D Une Deputee Rn

May 30, 2025

Marine Le Pen Et La Justice Jacobelli Defend L Immunite D Une Deputee Rn

May 30, 2025 -

Concert De Medine Subventionne En Grand Est Reactions Et Controverses

May 30, 2025

Concert De Medine Subventionne En Grand Est Reactions Et Controverses

May 30, 2025 -

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025

Grand Est Polemique Autour Des Subventions Pour Un Concert De Medine

May 30, 2025 -

Le Jugement De Marine Le Pen Divisions Et Consequences De La Sentence

May 30, 2025

Le Jugement De Marine Le Pen Divisions Et Consequences De La Sentence

May 30, 2025 -

Ineligibilite De Marine Le Pen L Impact De La Decision Sur La Politique Francaise

May 30, 2025

Ineligibilite De Marine Le Pen L Impact De La Decision Sur La Politique Francaise

May 30, 2025