Securing Funding For A 270MWh Battery Energy Storage System (BESS) In Belgium

Table of Contents

Understanding the Belgian Regulatory Landscape for BESS Projects

Before diving into funding sources, understanding the Belgian regulatory framework is crucial. The Belgian government actively promotes renewable energy integration, creating a favorable environment for BESS projects, but navigating the regulations requires careful planning. This includes compliance with grid connection standards, safety regulations, and environmental impact assessments.

- Grid Connection: Engie Electrabel, Elia, and other distribution system operators (DSOs) have specific requirements for grid connection, including technical specifications and interconnection agreements. Understanding these requirements early in the project lifecycle is essential.

- Safety Standards: Stringent safety regulations govern the design, installation, and operation of BESS, requiring compliance with European and Belgian safety standards. Regular inspections and certifications are mandatory.

- Permitting Process: Obtaining the necessary permits and licenses can be time-consuming. This process involves various governmental agencies at both the federal and regional levels. Engaging experienced legal and regulatory consultants can streamline this process.

- Government Incentives: The Belgian government offers various incentives for renewable energy projects, including subsidies, tax breaks, and feed-in tariffs. The specific incentives available may vary depending on the project's location and characteristics. Thorough research of regional and federal programs is vital for maximizing funding opportunities. For example, the Flemish Region may offer different support compared to Wallonia.

Exploring Funding Sources for a 270MWh BESS Project

Securing funding for a 270MWh BESS project requires a diversified approach, combining various public and private funding sources.

Public Funding:

- European Union Funds: The Connecting Europe Facility (CEF) and other EU programs provide significant funding for energy infrastructure projects, including energy storage. These funds often require co-financing from other sources.

- Belgian Federal and Regional Grants: The Belgian federal government and regional governments (Flanders, Wallonia, Brussels) offer grants and subsidies for renewable energy projects. These grants are often competitive and require detailed applications.

- Public-Private Partnerships (PPPs): PPPs combine public funding with private investment, leveraging the expertise and resources of both sectors. This model can be particularly effective for large-scale projects like a 270MWh BESS.

Private Funding:

- Venture Capital & Private Equity: These investors are attracted to high-growth potential projects with strong returns. A compelling business plan and a strong management team are crucial for attracting this type of funding.

- Bank Loans: Traditional bank loans can provide a significant portion of the project financing. Securing a loan requires a robust financial model and demonstrable project viability.

- Corporate Bonds: Issuing corporate bonds can provide access to a wider pool of investors, but it requires meeting specific regulatory requirements.

- Project Finance: Project finance structures allocate risk and reward among various stakeholders, making it suitable for large-scale, capital-intensive projects.

Hybrid Funding Models:

Combining public and private funding sources is often the most effective strategy, maximizing leverage and minimizing risk. This blended approach allows for better risk sharing and increased project feasibility. For example, a combination of EU grants and private equity investment offers a strong foundation for a project of this scale.

Key Criteria for Securing Funding: Regardless of the funding source, investors will assess factors like project viability, strong financial projections, a comprehensive environmental impact assessment, and a highly competent development team.

Developing a Compelling Funding Proposal for Your 270MWh BESS Project

A well-structured funding proposal is critical for securing investment. It must clearly articulate the project's value proposition, financial viability, and potential for return on investment.

- Executive Summary: A concise overview of the project, its objectives, and its financial projections.

- Market Analysis: A thorough assessment of the Belgian energy market and the demand for energy storage.

- Technical Specifications: Detailed technical specifications of the 270MWh BESS system, including technology, location, and grid connection details.

- Financial Projections: A realistic and detailed financial model demonstrating the project's profitability and return on investment, including key performance indicators (KPIs) such as capacity factor, energy arbitrage revenue, and ancillary service revenue.

- Risk Assessment: A comprehensive assessment of potential risks and mitigation strategies.

- Environmental Impact Assessment: A thorough assessment of the project’s environmental impacts and adherence to all relevant environmental regulations.

- Team Expertise: Highlighting the experience and expertise of the project development team.

Navigating the Due Diligence Process and Contract Negotiations

Due diligence is essential to ensure transparency and mitigate risks. Investors will conduct thorough due diligence, scrutinizing the project's technical feasibility, financial projections, regulatory compliance, and environmental impact. Contract negotiations require careful attention to detail, focusing on risk allocation, payment terms, and dispute resolution mechanisms.

- Common Due Diligence Steps: Technical audits, financial reviews, legal reviews, environmental assessments.

- Key Clauses in Funding Agreements: Representations and warranties, payment schedules, termination clauses, dispute resolution mechanisms.

- Negotiation Strategies: Developing a clear understanding of investor expectations, preparing for potential challenges, and seeking professional legal and financial advice.

Conclusion: Securing Your BESS Project's Future in Belgium

Securing funding for a 270MWh BESS project in Belgium requires a strategic approach, combining a thorough understanding of the regulatory landscape with a compelling funding proposal. By carefully considering the various funding options, conducting thorough due diligence, and engaging in effective contract negotiations, developers can unlock the potential of this vital energy storage technology. Start planning your funding strategy for your Belgian BESS project today! Learn more about securing funding for your 270MWh Battery Energy Storage System (BESS) and unlock the potential of renewable energy in Belgium.

Featured Posts

-

Play Station Portal And Cloud Streaming Access To More Classic Games

May 03, 2025

Play Station Portal And Cloud Streaming Access To More Classic Games

May 03, 2025 -

Israil Meclisi Nde Yasanan Esir Aileleri Guevenlik Goerevlileri Catismasi Son Durum

May 03, 2025

Israil Meclisi Nde Yasanan Esir Aileleri Guevenlik Goerevlileri Catismasi Son Durum

May 03, 2025 -

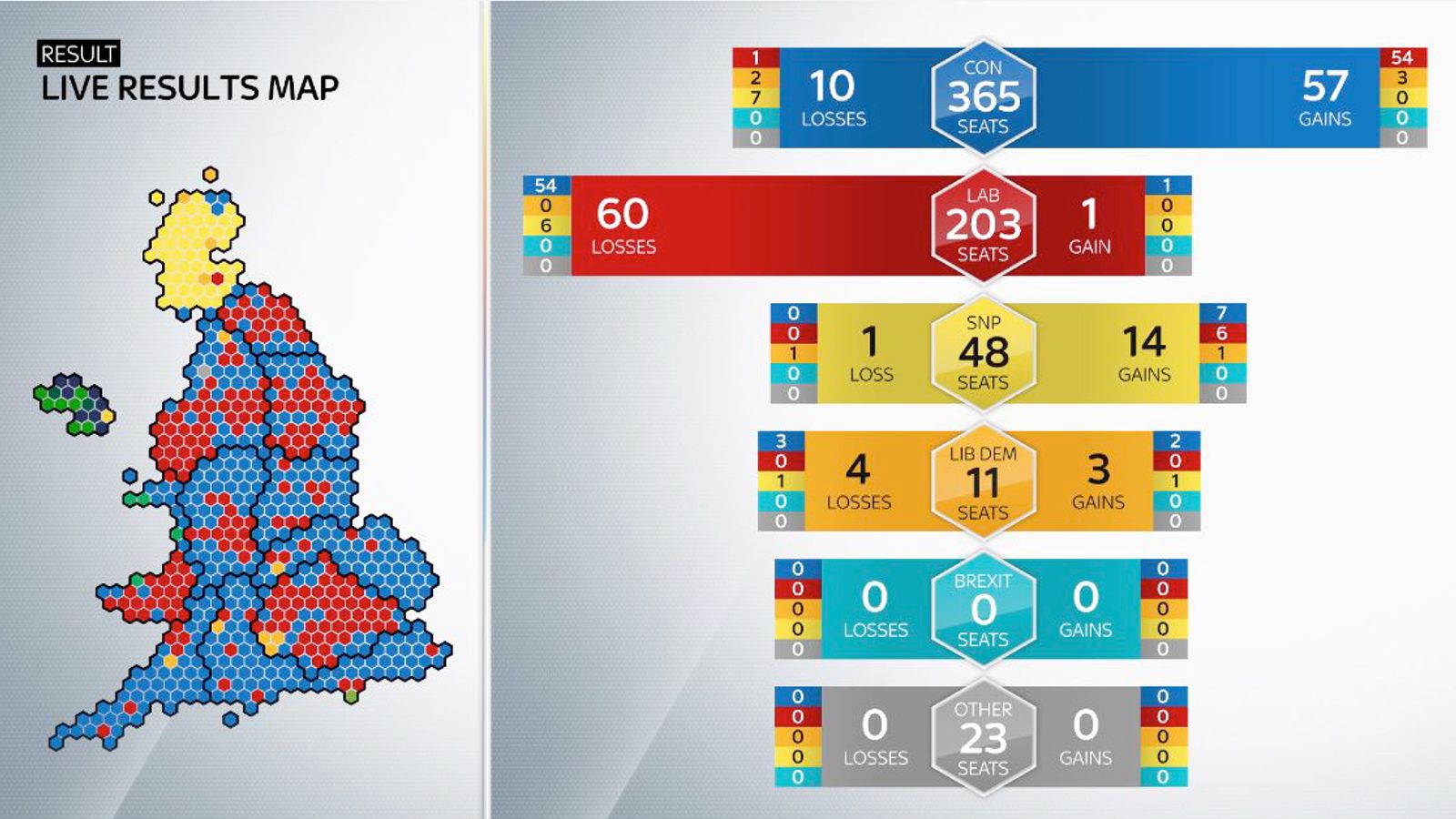

Conservative Partys Internal Struggle Chairmans Feud With Reform Uk

May 03, 2025

Conservative Partys Internal Struggle Chairmans Feud With Reform Uk

May 03, 2025 -

Local Elections 2024 The Reform Partys Electoral Challenge In The Uk

May 03, 2025

Local Elections 2024 The Reform Partys Electoral Challenge In The Uk

May 03, 2025 -

Is A Smart Ring The Future Of Relationship Transparency

May 03, 2025

Is A Smart Ring The Future Of Relationship Transparency

May 03, 2025

Latest Posts

-

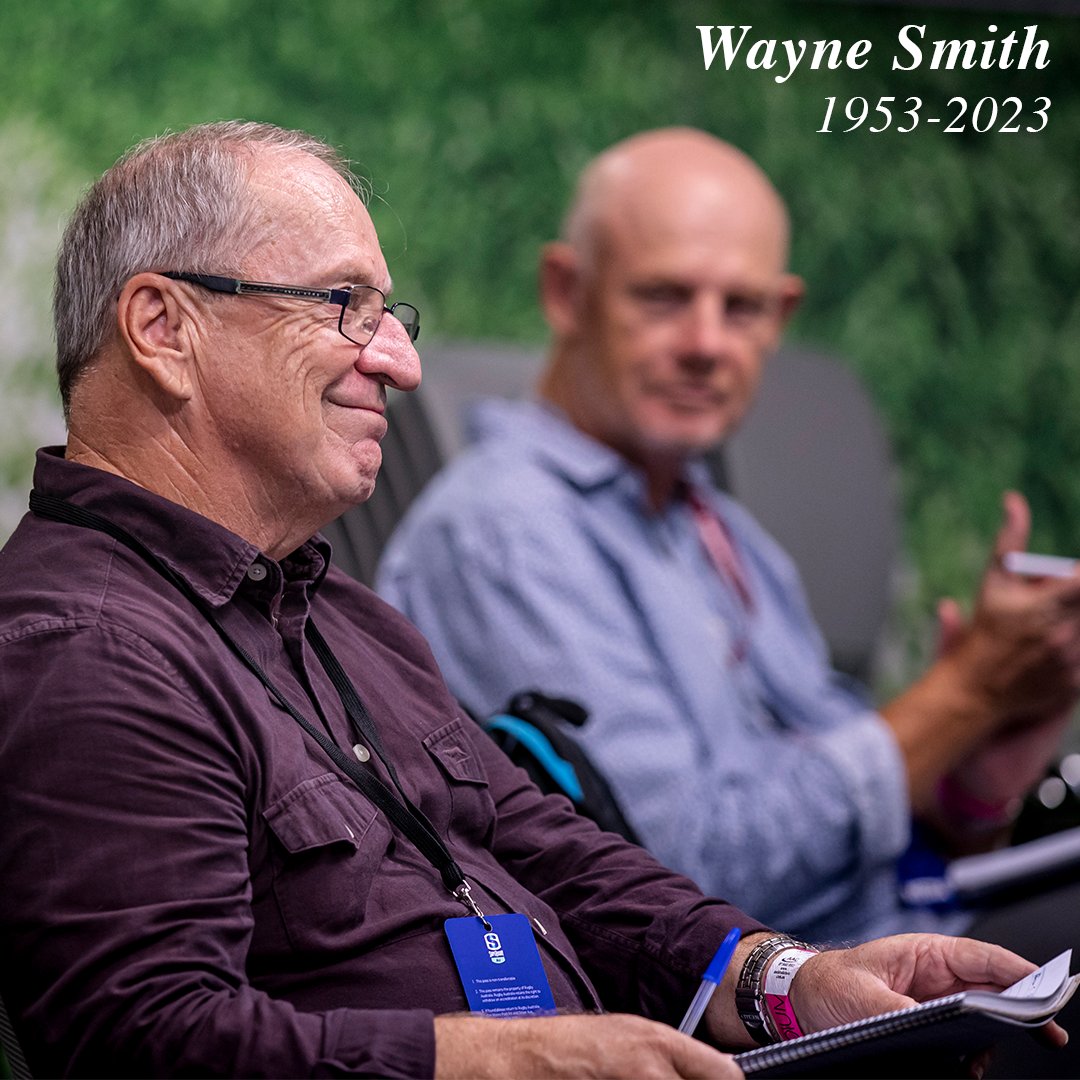

10 Year Old Girl Dies On Rugby Pitch A Community In Mourning

May 03, 2025

10 Year Old Girl Dies On Rugby Pitch A Community In Mourning

May 03, 2025 -

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 03, 2025

Remembering A Life Cut Short Tributes For 10 Year Old Rugby Player

May 03, 2025 -

Avrupa Is Birligi Ekonomik Ve Siyasi Boyutlar

May 03, 2025

Avrupa Is Birligi Ekonomik Ve Siyasi Boyutlar

May 03, 2025 -

Sulm Me Thike Ne Qender Tregtare Te Cekise Viktimat Dhe Hetimi

May 03, 2025

Sulm Me Thike Ne Qender Tregtare Te Cekise Viktimat Dhe Hetimi

May 03, 2025 -

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 03, 2025

A Tribute To Poppy Atkinson From Manchester United And Bayern Munich

May 03, 2025