Self-Defense Shooting: Do You Need Insurance Coverage?

Table of Contents

The Legal Landscape of Self-Defense Shooting

The legal complexities surrounding self-defense shooting are significant and vary considerably depending on your location. Even if you act in what you believe to be justifiable self-defense, the legal process can be long, arduous, and expensive. Successfully defending yourself against potential lawsuits requires navigating a minefield of legal intricacies and proving your actions were entirely justified under the law. This means understanding the nuances of your state's or country's self-defense laws, including the "duty to retreat" doctrine (where applicable), the use of deadly force, and the concept of reasonable force.

The potential for civil lawsuits following a self-defense shooting is very real, even if criminal charges are not filed. You could face:

- Wrongful death lawsuits: If someone is killed, their family may sue you for wrongful death, regardless of the circumstances.

- Claims of excessive force: Even if the shooting was justified, you could be sued for using excessive force if the actions taken were deemed unreasonable given the situation.

- Property damage claims: Damage to property during the self-defense incident can lead to separate civil lawsuits.

The financial burden of defending yourself in court is substantial. Expect to encounter significant costs, including:

- Attorney fees: Experienced legal representation specializing in self-defense cases is crucial, and their fees can be substantial.

- Court costs: Court filing fees, witness fees, and other administrative costs add up quickly.

- Expert witness fees: Expert witnesses, such as forensic specialists or self-defense instructors, are often necessary to strengthen your case, and their fees are considerable.

Types of Insurance Relevant to Self-Defense Shooting

Several types of insurance can offer varying degrees of protection in the aftermath of a self-defense shooting. Understanding your coverage is paramount.

Homeowner's/Renter's Insurance

Standard homeowner's or renter's insurance policies often include liability coverage. However, this coverage frequently has significant limitations regarding self-defense incidents. Many policies explicitly exclude coverage for intentional acts, and proving self-defense often falls into a grey area. It's absolutely vital to carefully review your policy details to understand the extent of your liability protection in such a scenario. The specific wording of your policy will determine whether or not your claim is covered.

Personal Liability Umbrella Insurance

A personal liability umbrella insurance policy provides broader coverage than your standard homeowner's or renter's insurance. These policies act as a supplement, extending your liability protection significantly. Their value lies primarily in covering high legal costs, exceeding the limits of your underlying home or renter's insurance. If faced with a costly lawsuit, an umbrella policy can provide crucial financial protection.

Self-Defense Insurance (Specialized Policies)

Specialized self-defense insurance policies are becoming increasingly available. These policies are specifically designed to cover the unique legal and financial risks associated with self-defense shootings. They typically provide coverage for:

- Legal fees: Comprehensive coverage of attorney fees, regardless of the outcome of the case.

- Bail bonds: If arrested, these policies can cover bail expenses.

- Other related expenses: This may include expert witness fees, court costs, and other incident-related expenses.

While these specialized policies can provide considerable peace of mind, it's important to compare costs and coverage levels carefully before committing.

Why You Should Consider Self-Defense Insurance Coverage

The financial risks associated with a self-defense shooting incident, regardless of the outcome, cannot be overstated. Even a justified shooting can lead to protracted and costly legal battles. The peace of mind that comprehensive insurance provides is invaluable.

Self-defense insurance helps protect your assets and financial stability, safeguarding your home, savings, and other valuable possessions. It can also significantly alleviate the emotional stress associated with such events. Navigating the legal system is difficult enough without the added burden of immense financial worry. Insurance can provide a vital buffer, allowing you to focus on your recovery and well-being.

Conclusion

Self-defense shooting, while potentially life-saving, carries significant legal and financial risks. Even if you are justified in your actions, the cost of legal battles, lawsuits, and related expenses can be devastating. Protecting yourself and your future requires careful consideration. Don't leave yourself vulnerable; explore your options for self-defense insurance coverage today. Research different policies and speak with an insurance professional to determine the best fit for your individual needs and circumstances. Secure your future with appropriate self-defense insurance. Don't wait until it's too late to protect yourself; consider your self-defense insurance options now.

Featured Posts

-

Scarlett Johansson Addresses Potential Black Widow Mcu Comeback

May 13, 2025

Scarlett Johansson Addresses Potential Black Widow Mcu Comeback

May 13, 2025 -

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

May 13, 2025

How Trumps Presidency Will Impact Mark Zuckerberg And Meta

May 13, 2025 -

Aktort Dzherard Btlr Negoviyat Lyubim Spomen Ot Blgariya

May 13, 2025

Aktort Dzherard Btlr Negoviyat Lyubim Spomen Ot Blgariya

May 13, 2025 -

Eva Longorias Dramatic Hair Transformation A Stunning New Look

May 13, 2025

Eva Longorias Dramatic Hair Transformation A Stunning New Look

May 13, 2025 -

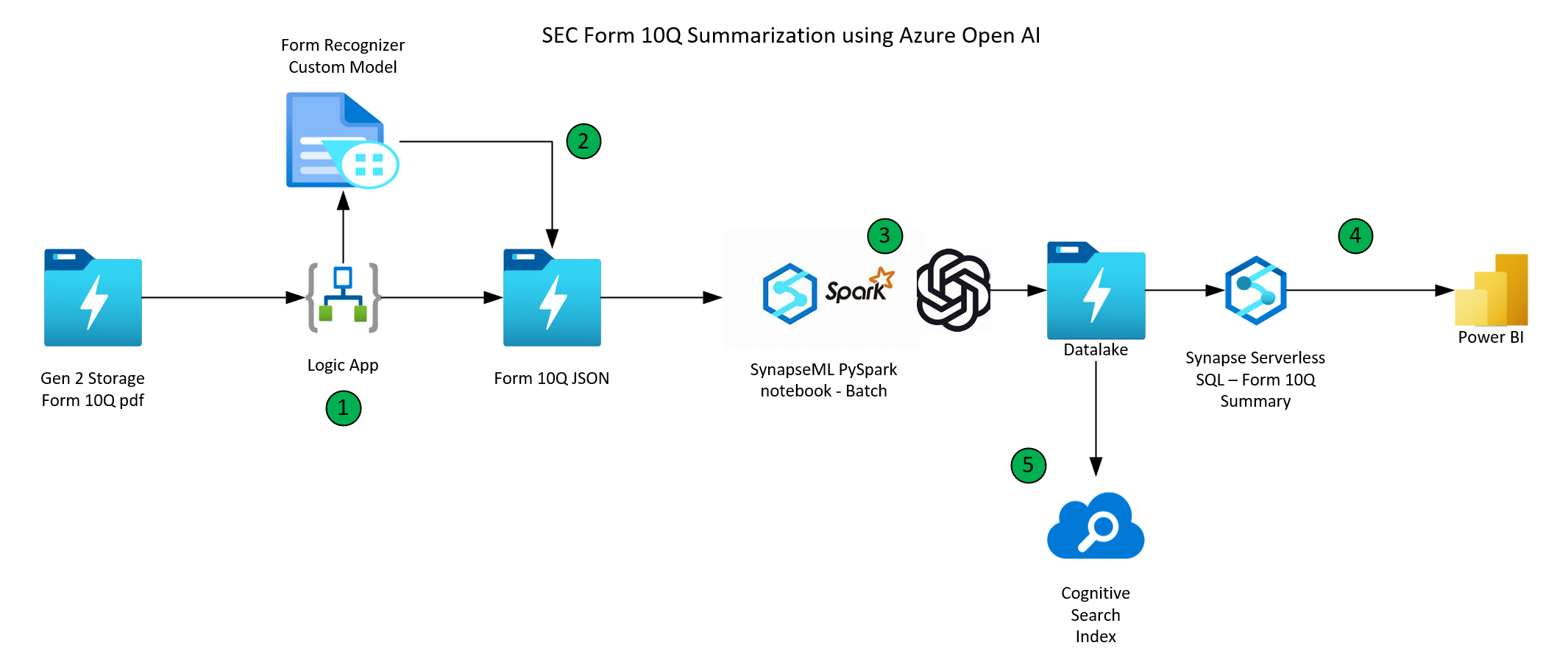

Building Voice Assistants Open Ais New Tools Unveiled

May 13, 2025

Building Voice Assistants Open Ais New Tools Unveiled

May 13, 2025

Latest Posts

-

Video Scotty Mc Creerys Son Pays Sweet Tribute To George Strait

May 14, 2025

Video Scotty Mc Creerys Son Pays Sweet Tribute To George Strait

May 14, 2025 -

Scotty Mc Creerys Son Honors George Strait A Must Watch Video

May 14, 2025

Scotty Mc Creerys Son Honors George Strait A Must Watch Video

May 14, 2025 -

Adorable Video Scotty Mc Creerys Son Pays Tribute To George Strait

May 14, 2025

Adorable Video Scotty Mc Creerys Son Pays Tribute To George Strait

May 14, 2025 -

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025

Watch Scotty Mc Creerys Sons Heartwarming George Strait Homage

May 14, 2025 -

Following In Dads Footsteps Scotty Mc Creerys Son Sings George Strait

May 14, 2025

Following In Dads Footsteps Scotty Mc Creerys Son Sings George Strait

May 14, 2025