Semiconductor ETF Sell-Off: A Case Study In Market Timing

Table of Contents

Understanding the Semiconductor Industry's Cyclicality

The semiconductor industry is notoriously cyclical, characterized by periods of rapid growth followed by significant corrections. Understanding this inherent volatility is crucial for successful investment.

Identifying Market Cycles and Trends

- Historical Patterns: The semiconductor industry has historically experienced boom-and-bust cycles, driven by technological advancements, economic fluctuations, and shifts in global demand. These cycles can span several years, making long-term planning essential.

- Key Indicators: Several key indicators help predict industry cycles. These include global chip demand (measured by sales figures and forecasts), inventory levels held by manufacturers and distributors, and capital expenditure (capex) by semiconductor companies, reflecting investment in new production capacity. High capex often precedes a period of increased supply, potentially leading to price corrections.

- Technological Advancements and Obsolescence: Rapid technological advancements lead to product obsolescence, impacting demand for older chips and creating opportunities for new technologies. This constant evolution contributes to the cyclical nature of the market. Understanding the life cycle of specific semiconductor technologies is crucial for effective investment strategies.

Analyzing the Impact of Geopolitical Factors

Geopolitical events significantly influence the semiconductor industry.

- US-China Relations: The complex relationship between the US and China, including trade wars and technological sanctions, significantly impacts semiconductor supply chains and prices. This ongoing tension introduces considerable uncertainty into the market.

- Regional Conflicts and Instability: Regional conflicts and political instability in key manufacturing regions can disrupt production and distribution, leading to supply shortages and price increases. Diversification across different geographical regions becomes essential to mitigate these risks.

- Government Policies and Subsidies: Government policies, including subsidies and export controls, play a major role in shaping the industry landscape. These policies can impact production capacity, pricing, and market access for various players.

Evaluating Risk Factors in Semiconductor ETFs

Semiconductor ETFs, while offering exposure to the growth potential of the sector, also carry significant risk.

Assessing Volatility and Market Sensitivity

- Inherent Volatility: Semiconductor ETFs are inherently more volatile than many other asset classes due to the cyclical nature of the industry and its sensitivity to macroeconomic factors. This high volatility presents both opportunities and risks.

- Macroeconomic Sensitivity: Semiconductor ETFs are highly sensitive to macroeconomic factors, including interest rates and inflation. Rising interest rates can curb investment and slow economic growth, negatively impacting demand for semiconductors. Inflation impacts input costs and can affect profitability.

- Correlation with Broader Market Trends: The performance of semiconductor ETFs is often correlated with broader market trends. During periods of overall market downturn, semiconductor ETFs tend to underperform.

Understanding Diversification and Portfolio Allocation

- Importance of Diversification: Diversification is crucial to mitigating risk when investing in semiconductor ETFs. This means spreading investments across different asset classes, geographical regions, and even different types of semiconductor ETFs.

- Asset Allocation: Appropriate asset allocation depends on individual risk tolerance and investment goals. Conservative investors may allocate a smaller portion of their portfolio to semiconductor ETFs, while more aggressive investors might allocate a larger percentage.

- Types of Semiconductor ETFs: Investors can choose from various semiconductor ETFs, including broad-market ETFs covering the entire sector and more specialized ETFs focusing on specific segments, like memory chips or processors. Careful consideration of the ETF's underlying holdings is essential.

Strategies for Navigating Semiconductor ETF Sell-Offs

Navigating sell-offs requires a well-defined strategy that considers both short-term and long-term goals.

Implementing a Long-Term Investment Strategy

- Benefits of Long-Term Investing: A long-term approach helps weather short-term market fluctuations and capitalize on the long-term growth potential of the semiconductor industry. Consistent investment over time reduces the impact of individual market dips.

- Ignoring Short-Term Fluctuations: Focusing on the long-term growth prospects rather than reacting to short-term market noise is critical. Emotional decision-making based on short-term price movements often leads to poor investment outcomes.

- Successful Long-Term Strategies: Successful long-term strategies often involve regular contributions to a diversified portfolio of semiconductor ETFs, allowing for averaging out purchase prices over time.

Employing Dollar-Cost Averaging and Value Investing

- Dollar-Cost Averaging: Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market price. This strategy reduces the risk of investing a large sum at a market peak.

- Value Investing: Value investing focuses on identifying undervalued assets. This involves analyzing financial statements, evaluating industry trends, and identifying semiconductor ETFs trading below their intrinsic value.

- Real-World Examples: Many investors have successfully navigated market downturns by employing dollar-cost averaging and focusing on value investing. Researching the strategies employed by successful investors can provide valuable insights.

Conclusion: Learning from the Semiconductor ETF Sell-Off

The semiconductor ETF sell-off serves as a valuable case study, highlighting the cyclical nature of the industry and the importance of strategic market timing. Understanding the risks associated with semiconductor ETFs, employing diversification, and adhering to long-term investment strategies are crucial for navigating future volatility. By understanding the nuances of the semiconductor market and employing sound investment strategies, you can navigate future semiconductor ETF sell-offs with greater confidence. Conduct thorough research, develop a well-defined investment plan, and carefully consider your risk tolerance before investing in semiconductor ETFs or similar volatile assets.

Featured Posts

-

The Unending Nightmare Gaza Hostages And Their Families

May 13, 2025

The Unending Nightmare Gaza Hostages And Their Families

May 13, 2025 -

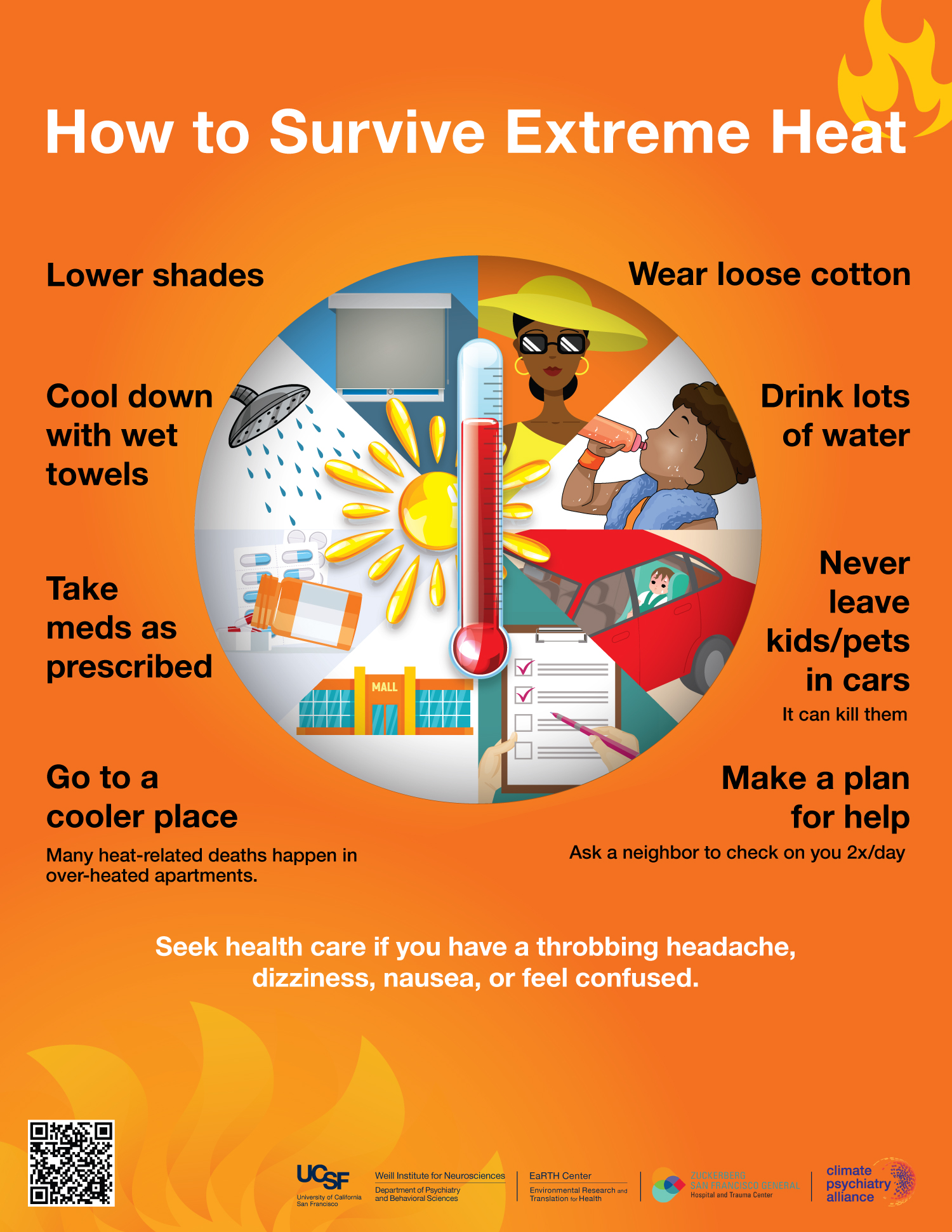

Health Advisory Issued Stay Safe During Extreme Heat

May 13, 2025

Health Advisory Issued Stay Safe During Extreme Heat

May 13, 2025 -

Chicago Cubs Kyle Tuckers Comments On Fans And The Team

May 13, 2025

Chicago Cubs Kyle Tuckers Comments On Fans And The Team

May 13, 2025 -

Pregnant Cassie Ventura And Husband Alex Fine Make First Public Appearance

May 13, 2025

Pregnant Cassie Ventura And Husband Alex Fine Make First Public Appearance

May 13, 2025 -

Tuckers Home Run Odds And Mlb Prop Bets For April 26th

May 13, 2025

Tuckers Home Run Odds And Mlb Prop Bets For April 26th

May 13, 2025

Latest Posts

-

Proyek Giant Sea Wall Menko Ahy Berikan Klarifikasi Terbaru

May 15, 2025

Proyek Giant Sea Wall Menko Ahy Berikan Klarifikasi Terbaru

May 15, 2025 -

Proyek Psn Giant Sea Wall Menko Ahy Rapat Jadwal Pembangunan Terbaru

May 15, 2025

Proyek Psn Giant Sea Wall Menko Ahy Rapat Jadwal Pembangunan Terbaru

May 15, 2025 -

Penjelasan Menko Ahy Mengenai Proyek Giant Sea Wall

May 15, 2025

Penjelasan Menko Ahy Mengenai Proyek Giant Sea Wall

May 15, 2025 -

Menko Ahy Bahas Psn Giant Sea Wall Kapan Dimulai Pembangunannya

May 15, 2025

Menko Ahy Bahas Psn Giant Sea Wall Kapan Dimulai Pembangunannya

May 15, 2025 -

Update Terkini Proyek Giant Sea Wall Penjelasan Menko Ahy

May 15, 2025

Update Terkini Proyek Giant Sea Wall Penjelasan Menko Ahy

May 15, 2025