Sensex Soars 500 Points, Nifty Above 18400: Adani Ports & Other Key Market Movers

Table of Contents

Adani Ports' Stellar Performance: A Key Driver of the Rally

Adani Ports' exceptional performance played a pivotal role in propelling today's market rally. Its stock price witnessed a substantial increase, significantly impacting the overall market indices. This strong performance can be attributed to several factors:

-

Strong Q2 Results: Market analysts suggest that the company's recently released Q2 results likely exceeded market expectations, significantly boosting investor confidence and driving up demand for Adani Ports shares. This positive earnings surprise is a major factor in the stock's impressive gains.

-

Increased Trading Volume: The surge in Adani Ports' share price was accompanied by a significant increase in trading volume. This high volume indicates robust investor interest and participation, confirming the market's positive sentiment towards the company's prospects. High volume often signals strong buying pressure.

-

Positive Outlook: Analysts' positive outlook on Adani Ports' future growth prospects, fueled by expansion plans and continued strong performance in the logistics sector, further contributed to the bullish sentiment surrounding the stock. Future projections are viewed favorably by investors.

-

Impact on Indices: The significant gains in Adani Ports' share price directly and positively influenced the upward trajectory of both the Sensex and Nifty indices, highlighting its considerable weight in these key market indicators. Its performance acted as a significant catalyst for the broader market.

Global Market Influences: Positive Cues Boost Indian Sentiment

Positive global cues also contributed significantly to the buoyant Indian market sentiment. Several global factors played a part in this positive market trend:

-

Improved Global Economic Data: Positive economic indicators from major global economies, such as signs of easing inflation in the US and robust growth in certain Asian markets, boosted investor confidence worldwide, leading to increased risk appetite and investment in emerging markets like India.

-

Foreign Institutional Investor (FII) Investments: Increased Foreign Institutional Investor (FII) investments poured significant liquidity into the Indian market, further fueling the rally. This inflow of foreign capital is a major indicator of confidence in the Indian economy.

-

Stable Crude Oil Prices: Stable or slightly lower crude oil prices helped alleviate inflationary pressures, contributing to a more positive overall market sentiment. Lower oil prices benefit various sectors within the Indian economy.

-

Weakening US Dollar: A relatively weaker US dollar often makes Indian assets more attractive to international investors, leading to increased capital inflows and supporting the market's upward momentum. Currency fluctuations can significantly impact market performance.

Other Key Market Movers: Broad-Based Strength Across Sectors

Beyond Adani Ports' exceptional performance, other sectors and companies contributed to the market's positive momentum, indicating a broad-based rally:

-

IT Sector Gains: The IT sector witnessed significant gains, likely driven by positive global technology trends, strong quarterly results from some key players, and continued demand for IT services.

-

Banking Sector Strength: The banking sector also displayed strength, reflecting improving credit growth and increasing financial stability within the sector. This is a positive sign for the overall health of the Indian economy.

-

FMCG Sector Performance: The Fast-Moving Consumer Goods (FMCG) sector maintained its steady performance, signaling strong consumer demand and resilience within the sector. This indicates continued economic activity and consumer confidence.

-

Infrastructure Development: Positive news related to infrastructure projects and government initiatives likely contributed to the bullish sentiment, signaling continued investment and growth in this crucial sector.

Conclusion: Navigating the Bullish Trend in the Indian Stock Market

Today's market surge, with the Sensex climbing over 500 points and the Nifty surpassing 18400, represents a significant positive development for the Indian stock market. While Adani Ports' exceptional performance played a prominent role, this rally was also fueled by positive global influences and strong performances across various sectors. Investors should carefully monitor these key market movers, including Adani Ports and the broader global economic landscape, to understand ongoing trends and make informed investment decisions. Staying informed about Sensex and Nifty movements, analyzing key players, and understanding global market influences is crucial for successful navigation of the Indian stock market. Continue monitoring the Sensex and Nifty indices for further updates and potential investment opportunities.

Featured Posts

-

Black Rock Etf Billionaire Investment Poised For 110 Growth In 2025

May 09, 2025

Black Rock Etf Billionaire Investment Poised For 110 Growth In 2025

May 09, 2025 -

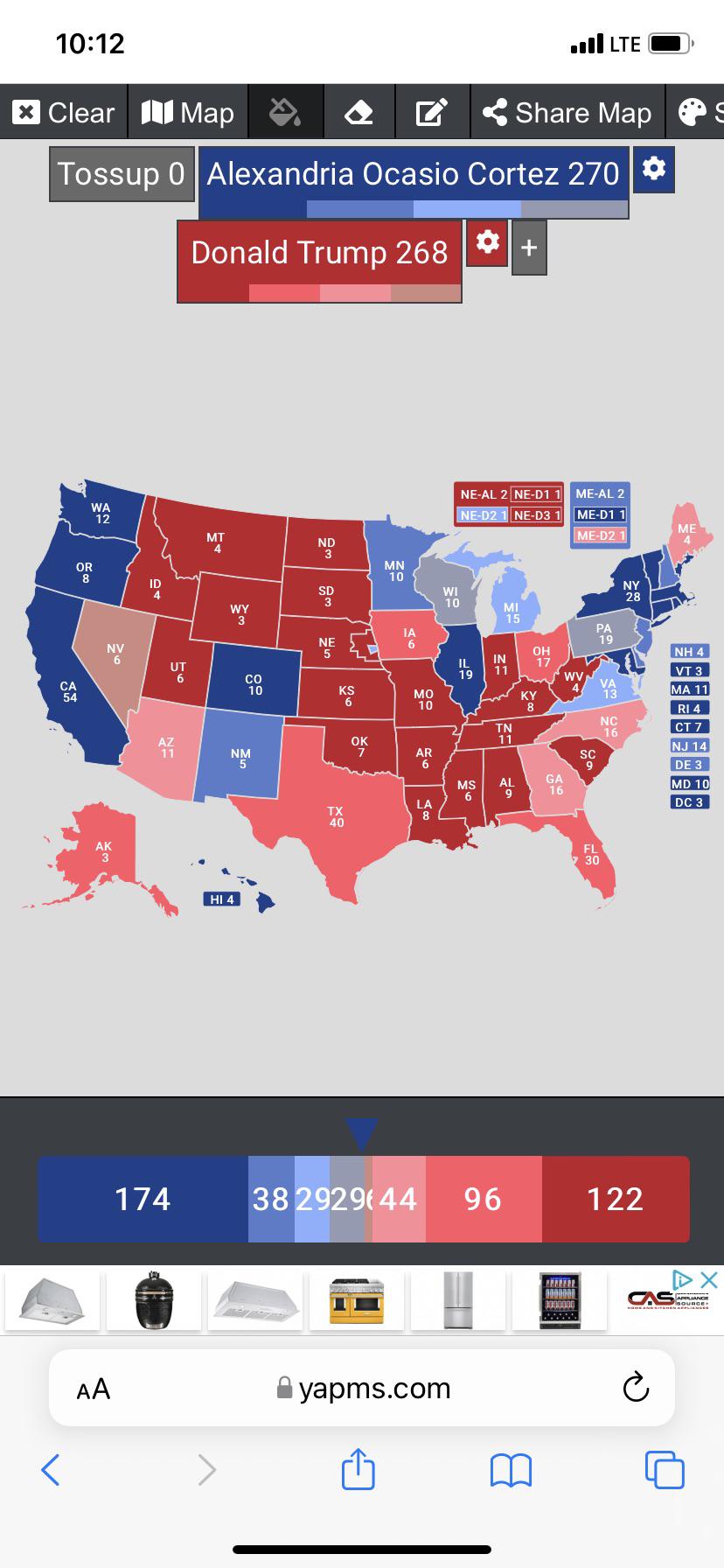

Aoc Vs Trump A Fox News Perspective

May 09, 2025

Aoc Vs Trump A Fox News Perspective

May 09, 2025 -

The Maha Movement And Trumps Surgeon General Nominee A Closer Look

May 09, 2025

The Maha Movement And Trumps Surgeon General Nominee A Closer Look

May 09, 2025 -

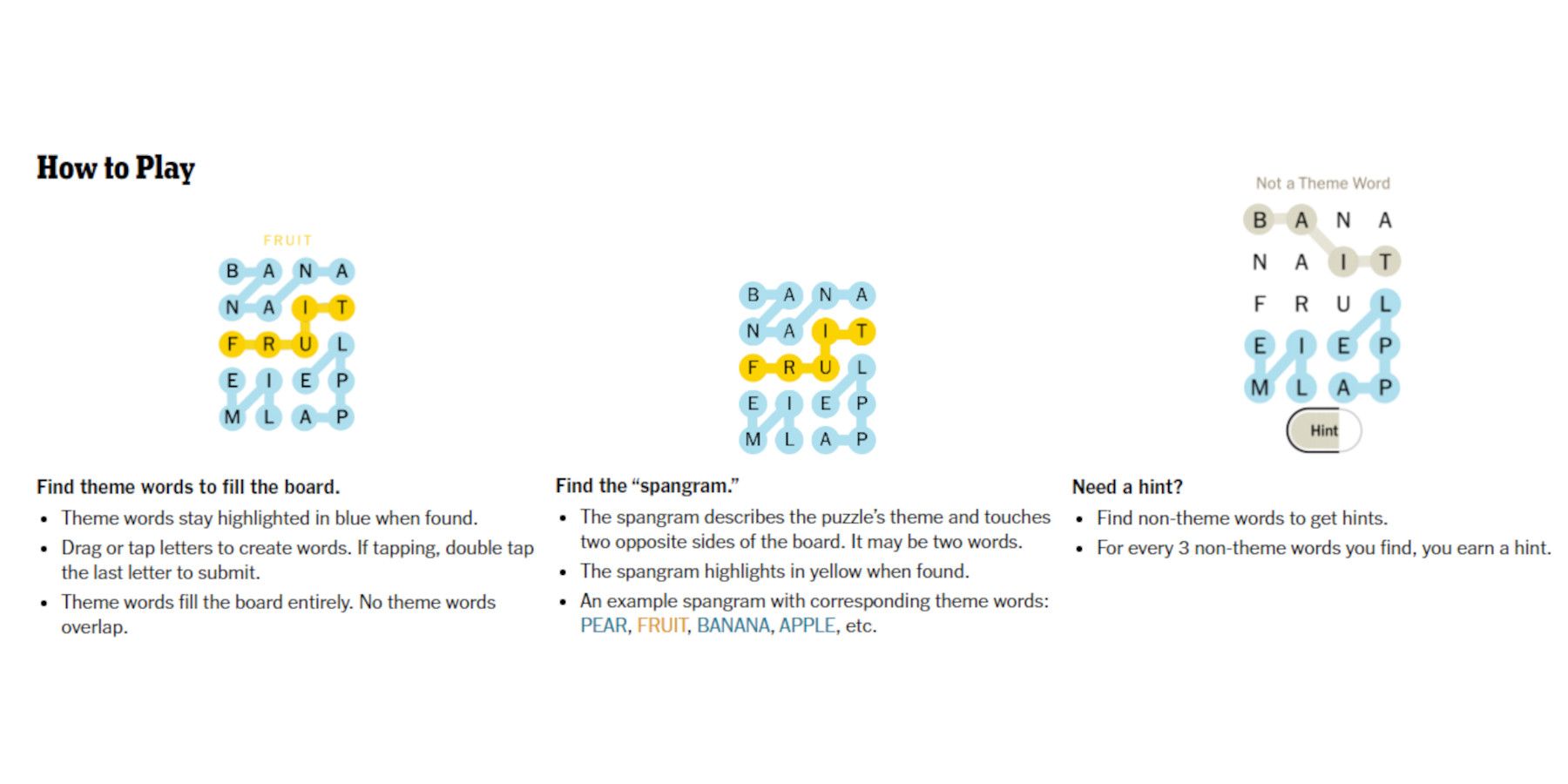

Nyt Strands Game 377 Hints And Solutions For March 15th

May 09, 2025

Nyt Strands Game 377 Hints And Solutions For March 15th

May 09, 2025 -

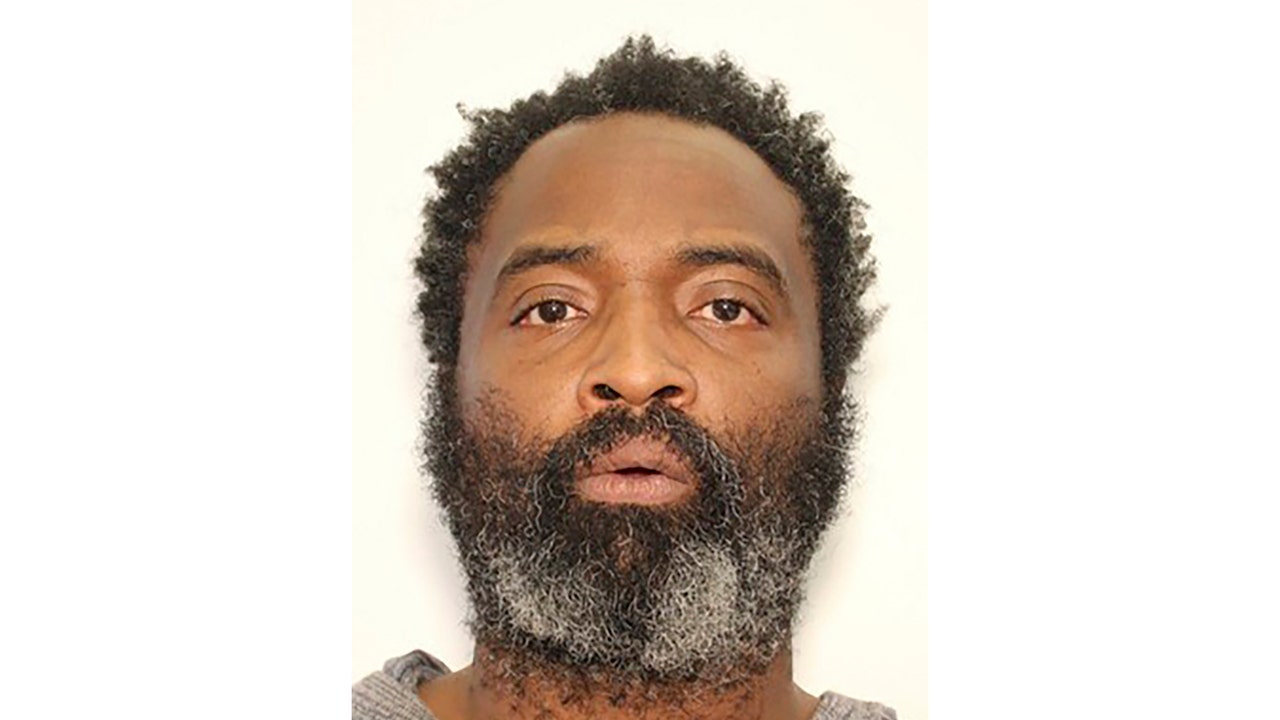

Arrest Made In Elizabeth City Weekend Shooting Suspect In Custody

May 09, 2025

Arrest Made In Elizabeth City Weekend Shooting Suspect In Custody

May 09, 2025