Sensex Soars 500 Points, Nifty Above 18400: Adani Ports, Eternal Industries Lead Market Movers

Table of Contents

Sensex and Nifty's Record-Breaking Day

Today's trading session witnessed a phenomenal performance by both the Sensex and Nifty indices. The Sensex closed at a record high, gaining a staggering 500 points, a significant percentage increase representing robust investor confidence. The Nifty, similarly, surged past the 18400 mark, reflecting a positive market sentiment. This surge follows a period of relative market stability, making today's gains all the more impressive. The historical context is significant, surpassing previous highs and indicating a potential bullish trend. The increased trading volume further reinforces the intensity of today's market activity.

- Sensex Closing Value: [Insert Closing Value]

- Nifty Closing Value: [Insert Closing Value]

- Sensex Percentage Change: [Insert Percentage Change]

- Nifty Percentage Change: [Insert Percentage Change]

- Trading Volume: [Insert Trading Volume Data]

- Market Capitalization Change: [Insert Market Cap Change Data]

Adani Ports and Eternal Industries – Top Market Movers

Adani Ports and Eternal Industries were the undisputed stars of today's market rally. Both companies experienced exceptional growth, significantly contributing to the overall market surge. Adani Ports, in particular, saw a substantial increase in its stock price, driven by [Insert Specific Reason, e.g., positive Q2 earnings, new infrastructure project announcement]. Similarly, Eternal Industries' impressive performance can be attributed to [Insert Specific Reason, e.g., successful product launch, strong sales figures]. Their exceptional performance underscores the potential for growth within their respective sectors.

-

Adani Ports:

- Opening Stock Price: [Insert Opening Price]

- Closing Stock Price: [Insert Closing Price]

- Percentage Gain: [Insert Percentage Gain]

- Trading Volume: [Insert Trading Volume]

- Reasons for Strong Performance: [Expand on reasons, referencing news or financial reports]

-

Eternal Industries:

- Opening Stock Price: [Insert Opening Price]

- Closing Stock Price: [Insert Closing Price]

- Percentage Gain: [Insert Percentage Gain]

- Trading Volume: [Insert Trading Volume]

- Reasons for Strong Performance: [Expand on reasons, referencing news or financial reports]

Sectoral Performance and Market Trends

While Adani Ports and Eternal Industries led the charge, the broader market also showcased significant gains across several sectors. The Banking and IT sectors performed particularly well, reflecting positive investor sentiment towards these key economic drivers. The FMCG sector also saw considerable growth, suggesting strong consumer confidence. Global market trends, particularly positive indicators from international markets, likely contributed to the overall bullish sentiment. Increased investor confidence, fueled by recent economic data and government policies, may also have played a significant role.

- Top-Performing Sectors: Banking, IT, FMCG, [Add others]

- Underperforming Sectors: [List underperforming sectors if any]

- Reasons for Sector-Specific Trends: [Elaborate on reasons for performance of different sectors]

Expert Opinions and Market Outlook

Market experts are cautiously optimistic about the continued positive trend, although they advise against reading too much into a single day's performance. [Quote from a market expert]. The short-term outlook remains positive, with many analysts predicting sustained growth in the coming weeks. However, the long-term outlook will depend on various factors, including global economic conditions and domestic policy decisions. It's crucial to monitor key economic indicators and global market trends for a clearer picture.

- Short-term Outlook for Sensex and Nifty: Positive, with potential for further gains.

- Long-term Market Predictions: Cautiously optimistic, contingent upon various factors.

- Key Factors to Watch For: Global economic conditions, domestic policy, and key economic indicators.

Understanding the Sensex and Nifty's Impressive Gains

Today's market rally, highlighted by the "Sensex Soars 500 Points, Nifty Above 18400" surge, represents a significant milestone for the Indian stock market. The outstanding performance of Adani Ports and Eternal Industries, coupled with broad-based sector gains, reflects a positive market sentiment. Positive global trends, investor confidence, and strong sectoral performance all contributed to this impressive day. Experts offer a cautiously optimistic outlook, urging investors to monitor key factors for a clearer picture of the long-term trajectory.

Stay informed about future market movements by subscribing to our newsletter for daily updates on the Sensex, Nifty, and other key Indian stock market indicators. Understanding the nuances of the Sensex and Nifty is crucial for informed investment decisions.

Featured Posts

-

Infineons Ifx Disappointing Sales Guidance Impact Of Trump Tariffs

May 10, 2025

Infineons Ifx Disappointing Sales Guidance Impact Of Trump Tariffs

May 10, 2025 -

La France Et Son Bouclier Nucleaire Une Strategie Europeenne

May 10, 2025

La France Et Son Bouclier Nucleaire Une Strategie Europeenne

May 10, 2025 -

Intriguing Theory Could David Expose Morgans Biggest Weakness

May 10, 2025

Intriguing Theory Could David Expose Morgans Biggest Weakness

May 10, 2025 -

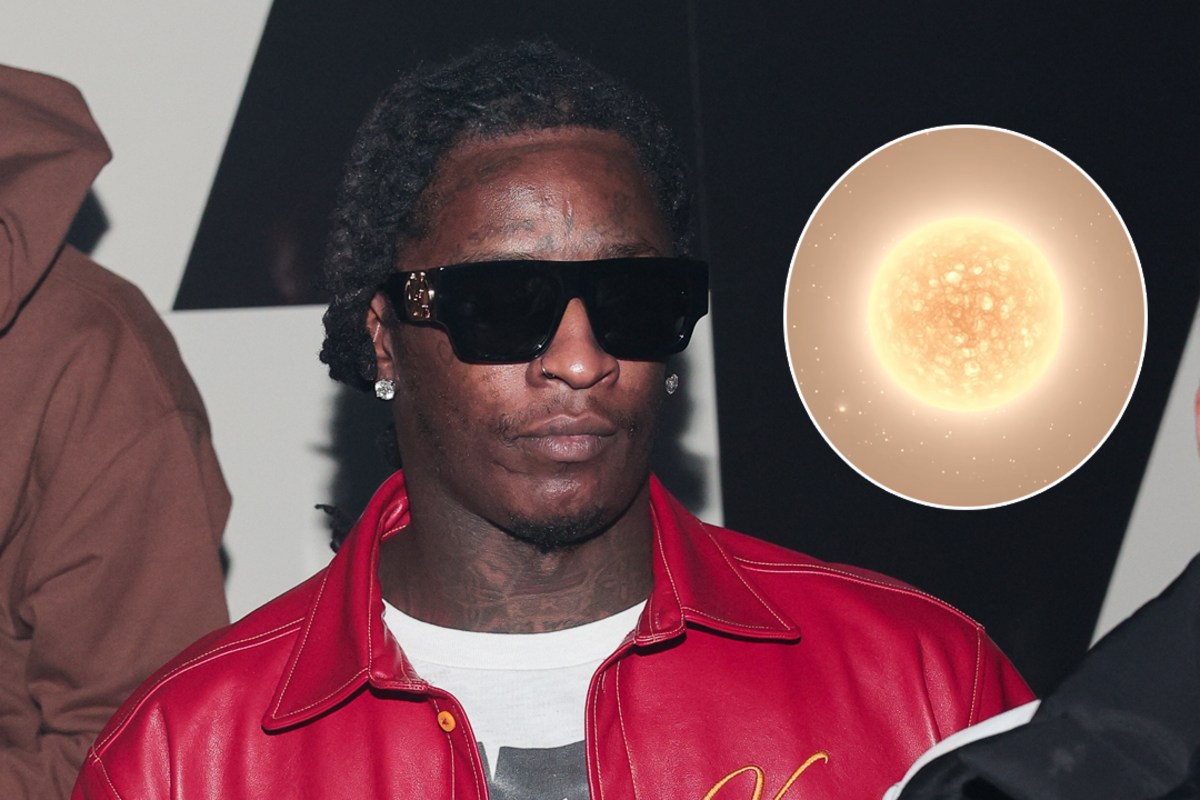

Uy Scuti Young Thug Teases Album Release

May 10, 2025

Uy Scuti Young Thug Teases Album Release

May 10, 2025 -

Living Legends Of Aviation Recognizes Bravery Firefighters And Beyond

May 10, 2025

Living Legends Of Aviation Recognizes Bravery Firefighters And Beyond

May 10, 2025