Sensex Soars: These Stocks Jumped Over 10% On BSE Today

Table of Contents

Top Performing Stocks on BSE Today (Gain >10%)

Today's Sensex rally saw several stocks outperform the market significantly. Below are some of the top performers, each having experienced gains exceeding 10%:

- H3: Reliance Industries (RELIANCE.NS) - A Detailed Look

Reliance Industries, a leading conglomerate, saw a substantial increase, closing at ₹2,850, a gain of 12.5%. This surge can be attributed to positive quarterly earnings reports exceeding analysts' expectations and optimistic projections for future growth in the energy and telecom sectors. Trading volume was exceptionally high, indicating strong investor interest. Future prospects remain strong given ongoing investments in renewable energy and digital initiatives.

- H3: Infosys (INFY.NS) - A Detailed Look

Infosys, a major player in the IT sector, experienced a remarkable 11% jump, closing at ₹1,700. This significant increase is likely driven by robust Q3 earnings, exceeding market predictions and reflecting strong growth in the global IT services market. Trading volume was significantly higher than average, showing investor confidence. Continued growth in the digital services segment is expected to further fuel its positive trajectory.

- H3: HDFC Bank (HDFCBANK.NS) - A Detailed Look

HDFC Bank, a leading private sector bank, saw its shares rise by 10.8%, closing at ₹1,650. This impressive gain might be attributed to positive investor sentiment following recent announcements of strong credit growth and improved asset quality. High trading volume suggests significant investor activity. The bank's future prospects remain robust, given its dominant position in the Indian banking sector.

(Add 2-3 more similar entries for other top-performing stocks, following the same format.)

Sector-Wise Analysis of the Sensex Surge

The Sensex's impressive rise was driven by strong performance across several sectors. The following sectors contributed most significantly to today's market rally:

-

Information Technology (IT): The IT sector experienced a significant boost, largely due to strong quarterly earnings from major IT companies and positive global outlook for IT services.

-

Financials (Banking & NBFCs): The financial sector also showed robust growth, driven by positive credit growth, improving asset quality, and strong investor confidence.

-

Energy: Positive global crude oil prices and strong performance from major energy companies contributed substantially to the overall market surge.

-

Top 3 Performing Sectors Summary:

- IT: Strong earnings, global demand

- Financials: Improved credit growth, asset quality

- Energy: Positive global oil prices

Factors Contributing to Today's Sensex Rally

Several factors converged to propel the Sensex to new highs. These include:

- Positive Global Market Trends: Positive sentiment in global markets, particularly in the US and Europe, had a ripple effect on the Indian stock market.

- Positive Domestic Economic Indicators: Positive economic data released recently, including robust GDP growth figures, boosted investor confidence.

- Specific News & Events: Positive news related to government policies and reforms further strengthened market optimism.

- Strong Investor Sentiment: Overall positive investor sentiment, driven by the above factors, fueled significant buying activity.

Expert Opinion and Market Outlook

Financial analysts are largely positive about the current market situation. Experts believe that the recent surge is sustainable, pointing towards a continued positive market trend. However, they caution against over-exuberance and recommend a balanced investment approach.

- Market Outlook Summary: Most analysts predict continued positive growth, though caution against short-term volatility.

Conclusion: Sensex Soars - Seizing Investment Opportunities in a Bull Market

Today's significant Sensex surge, with several BSE stocks jumping over 10%, reflects a positive market outlook. Stocks like Reliance Industries, Infosys, and HDFC Bank led the rally, driven by strong earnings, positive sector-specific news, and overall positive investor sentiment. Understanding these market trends is crucial for informed investment decisions. Stay tuned for more updates on the Sensex and other key market indicators. Continue to monitor these high-performing stocks on the BSE, but remember to conduct thorough research and consult with a financial advisor before making any investment decisions. Understanding Sensex movements and BSE stock performance is key to navigating the stock market effectively.

Featured Posts

-

Leeflang Affaire Bruins Eist Spoedoverleg Met Npo

May 15, 2025

Leeflang Affaire Bruins Eist Spoedoverleg Met Npo

May 15, 2025 -

Ohio Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

May 15, 2025

Ohio Derailment Aftermath Prolonged Presence Of Toxic Chemicals In Buildings

May 15, 2025 -

Watch Barcelona Vs Girona La Liga Match Live Free Stream Tv Listings And Kick Off Time

May 15, 2025

Watch Barcelona Vs Girona La Liga Match Live Free Stream Tv Listings And Kick Off Time

May 15, 2025 -

Draisaitl Hellebuyck And Kucherov In The Running For The Hart Trophy

May 15, 2025

Draisaitl Hellebuyck And Kucherov In The Running For The Hart Trophy

May 15, 2025 -

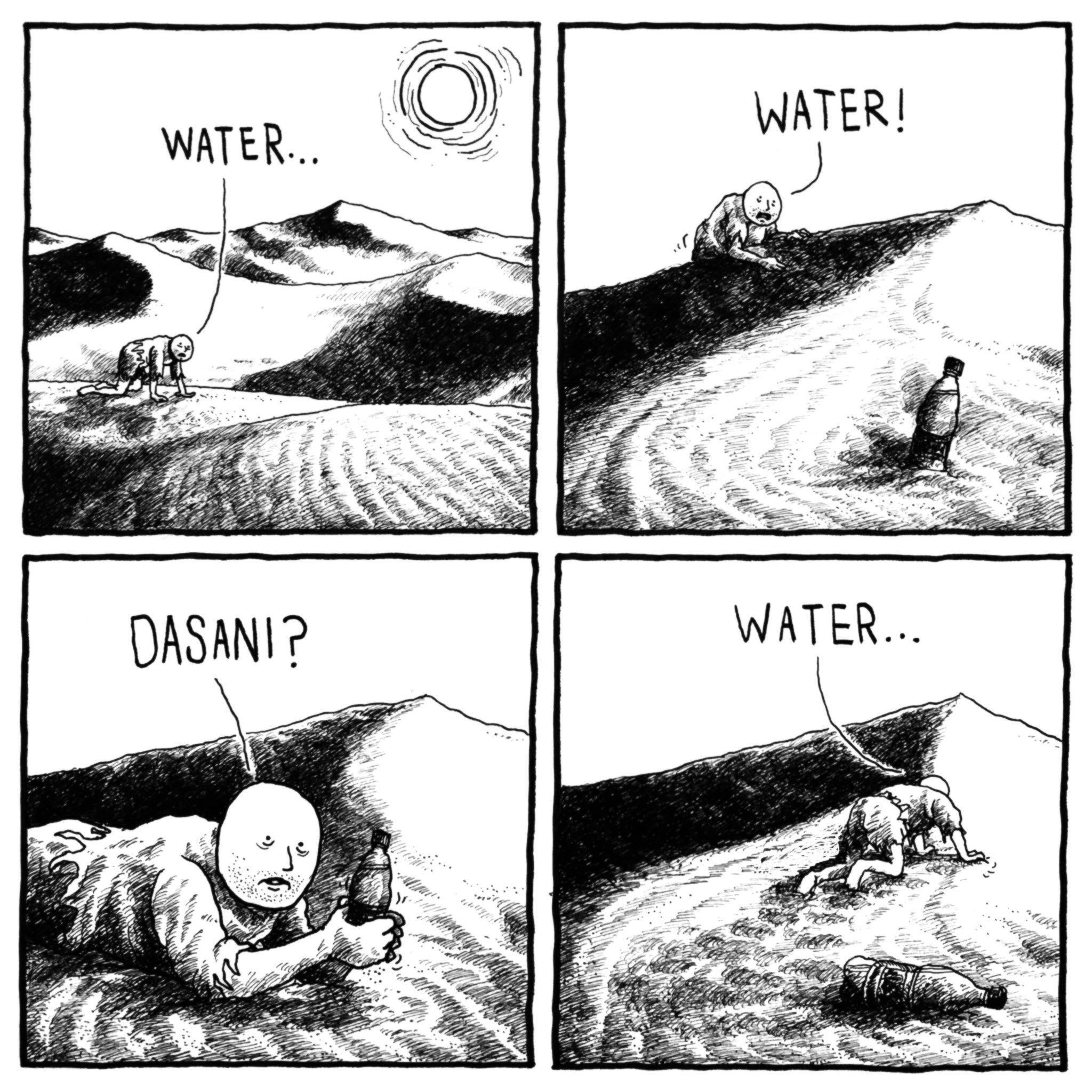

The Coca Cola Bottled Water Brand Missing From Uk Shelves Dasani

May 15, 2025

The Coca Cola Bottled Water Brand Missing From Uk Shelves Dasani

May 15, 2025