Seven Tech Giants Lose $2.5 Trillion: 2024 Market Value Decline

Table of Contents

The Top 7 Tech Companies Hit Hardest: A Detailed Breakdown

This section will examine the specific losses and contributing factors for each of the seven tech giants most impacted by the 2024 market value decline.

Meta: The Metaverse Meltdown?

Meta experienced a significant drop in market capitalization, estimated at [Insert Percentage]% in 2024.

- Reduced Advertising Revenue: A slowdown in digital advertising spending directly impacted Meta's core revenue stream. The decrease was [Insert Percentage]%, significantly impacting their bottom line.

- Increased Competition: The rise of TikTok and other social media platforms intensified competition, eroding Meta's user base and advertising market share.

- Metaverse Investment Setbacks: Massive investments in the metaverse yielded limited returns, raising concerns among investors about the long-term viability of this strategy. The cost of development far outweighed the current revenue generated.

- Keywords: Meta, market cap, stock price drop, advertising revenue, competition, metaverse, Facebook, Instagram, Reality Labs.

Amazon: E-commerce Slowdown and Cloud Competition

Amazon's market capitalization also suffered a substantial blow in 2024, declining by approximately [Insert Percentage]%.

- Slowing E-commerce Growth: Post-pandemic, e-commerce growth slowed significantly, impacting Amazon's sales and profitability. Increased competition from other online retailers further exacerbated the situation.

- Cloud Computing Competition: While Amazon Web Services (AWS) remains a market leader, increased competition from Microsoft Azure and Google Cloud Platform put pressure on AWS's growth trajectory and pricing strategies.

- Keywords: Amazon, market cap, stock price, e-commerce, AWS, cloud computing, competition, retail sales.

Apple: iPhone Sales and Supply Chain Challenges

Apple, despite its strong brand loyalty, wasn't immune to the 2024 downturn, witnessing a [Insert Percentage]% decline in its market capitalization.

- iPhone Sales Plateau: While still a flagship product, iPhone sales growth showed signs of stagnation, prompting concerns about market saturation and future growth potential.

- Supply Chain Issues: Ongoing global supply chain disruptions continued to impact Apple's production and delivery timelines, leading to inventory shortages and reduced sales.

- Keywords: Apple, iPhone sales, market cap, supply chain, stock price, consumer electronics.

Company D, E, F, G: [Repeat the above format for the remaining companies, highlighting their individual struggles and contributing factors to the overall decline. Include relevant keywords for each company. Example below for illustrative purposes].

Google (Alphabet): Antitrust Concerns and Advertising Slowdown

Google (Alphabet) saw its market capitalization decline by approximately [Insert Percentage]% in 2024.

- Increased Antitrust Scrutiny: Growing regulatory scrutiny over Google's dominance in search and advertising led to legal challenges and potential fines, impacting investor confidence.

- Advertising Slowdown: Similar to Meta, Google’s advertising revenue also slowed down due to reduced marketing spend by businesses.

- Keywords: Google, Alphabet, market cap, antitrust, advertising revenue, search engine, stock price

Underlying Factors Contributing to the Tech Sector Decline

Beyond individual company challenges, several broader factors contributed to the widespread tech market crash of 2024.

Rising Interest Rates and Inflation

- Increased Borrowing Costs: Higher interest rates made borrowing more expensive for tech companies, impacting their expansion plans and capital expenditures.

- Decreased Consumer Spending: Inflation eroded consumer purchasing power, leading to reduced spending on discretionary items, including many tech products and services.

- Keywords: Interest rates, inflation, economic downturn, recession fears, consumer spending, monetary policy.

Increased Regulatory Scrutiny

- Antitrust Laws and Data Privacy: Increased enforcement of antitrust laws and stricter data privacy regulations put significant pressure on tech companies, leading to increased compliance costs and potential legal battles.

- Keywords: Antitrust laws, data privacy regulations, government regulation, legal challenges, GDPR, CCPA.

Shifting Consumer Behavior

- Reduced Social Media Usage: A growing awareness of the negative impacts of social media led some users to reduce their engagement, affecting the revenue models of social media platforms.

- Changes in App Usage: Consumer preferences shifted, impacting the popularity of certain apps and categories, leading to decreased engagement and revenue for some companies.

- Keywords: Consumer trends, digital transformation, user behavior, market saturation, app usage, social media usage.

Long-Term Implications and Future Outlook for the Tech Sector

The 2024 market value decline is likely to trigger significant changes in the tech sector. We can anticipate a period of consolidation, with smaller companies being acquired by larger players. This could lead to increased efficiency and innovation. However, it's important to remember that the current tech market is dynamic and this period of correction does not define the long-term success of the industry. A potential recovery could be spurred by new technological breakthroughs, innovative business models, and a stabilization of macroeconomic conditions.

- Keywords: tech sector recovery, future of tech, investment opportunities, industry consolidation, technological innovation.

Conclusion: Navigating the Aftermath of the $2.5 Trillion Tech Market Decline

The $2.5 trillion loss suffered by seven tech giants in 2024 underscores the significant impact of macroeconomic factors, increased regulatory scrutiny, and shifting consumer behavior on the tech industry. The 2024 market value decline serves as a stark reminder of the cyclical nature of the market and the importance of adaptability and innovation. To stay informed about the ongoing effects of this significant market shift and its implications for the future of tech, subscribe to our newsletter, follow us on social media, and read more of our insightful articles. Understanding the nuances of this tech market crash and its long-term consequences is crucial for investors and industry professionals alike.

Featured Posts

-

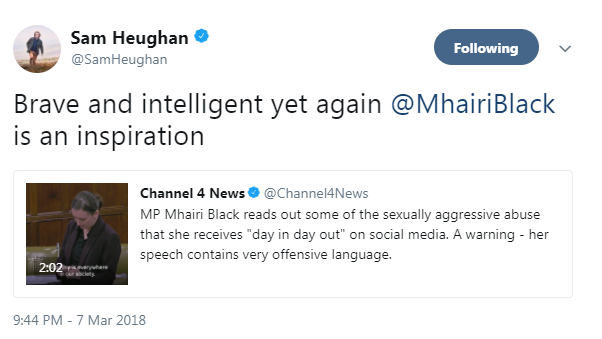

The Role Of Misogyny Mhairi Blacks Perspective On Womens And Girls Safety

Apr 29, 2025

The Role Of Misogyny Mhairi Blacks Perspective On Womens And Girls Safety

Apr 29, 2025 -

Porsche Koezuti Modell F1 Motor Haja

Apr 29, 2025

Porsche Koezuti Modell F1 Motor Haja

Apr 29, 2025 -

Khisarya Kmett Nastoyava Za Obnovyavane Na Trakiyskite Khramove

Apr 29, 2025

Khisarya Kmett Nastoyava Za Obnovyavane Na Trakiyskite Khramove

Apr 29, 2025 -

The Unexpected Collaboration Jeff Goldblum Ariana Grande And I Dont Know Why I Just Do

Apr 29, 2025

The Unexpected Collaboration Jeff Goldblum Ariana Grande And I Dont Know Why I Just Do

Apr 29, 2025 -

Test Drogowy Porsche Cayenne Gts Coupe Zalety I Wady

Apr 29, 2025

Test Drogowy Porsche Cayenne Gts Coupe Zalety I Wady

Apr 29, 2025