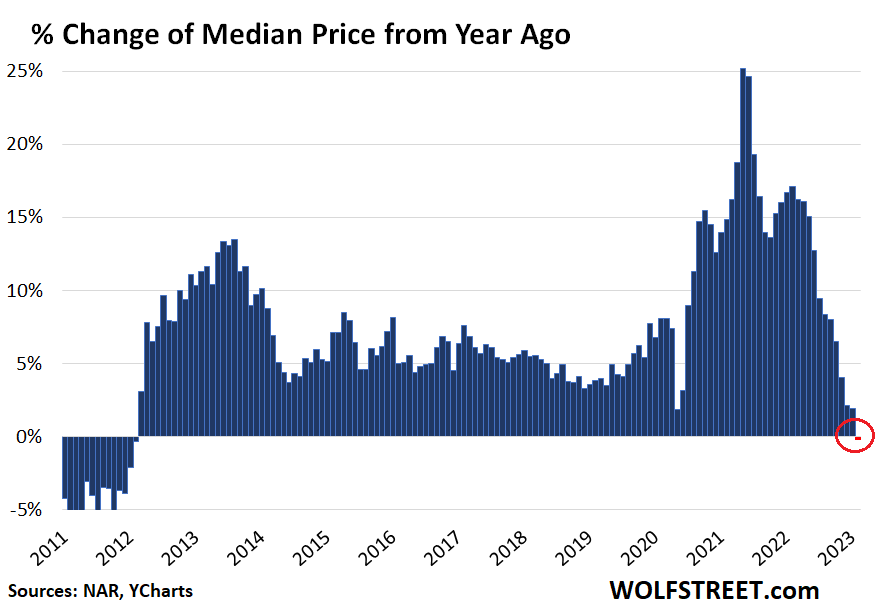

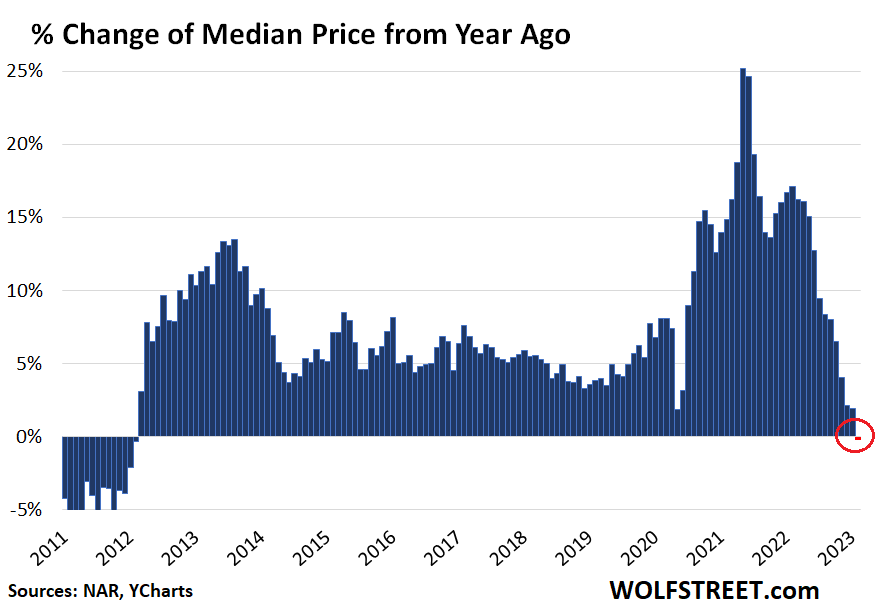

Sharp Decline In Toronto Home Sales: 23% Year-Over-Year Drop, 4% Price Decrease

Table of Contents

Factors Contributing to the Decline in Toronto Home Sales

Several intertwined factors have contributed to the sharp decline in Toronto home sales. Understanding these factors is crucial for navigating the current market landscape.

Rising Interest Rates and Mortgage Costs

The Bank of Canada's aggressive interest rate hikes have significantly impacted affordability in the Toronto housing market. Increases in the benchmark interest rate directly translate to higher mortgage rates, making it considerably more expensive for potential buyers to finance a home. This has led to a dramatic reduction in purchasing power for many, significantly impacting Toronto home sales.

- Higher borrowing costs deter potential buyers: Increased interest rates mean higher monthly mortgage payments, pushing homes out of reach for many prospective buyers.

- Increased monthly mortgage payments reduce affordability: Even with a similar down payment, the increased monthly payments can significantly strain household budgets.

- Fewer buyers qualify for mortgages: Stricter lending criteria and higher interest rates mean fewer buyers meet the requirements for mortgage approval, further reducing demand. This is acutely felt across the Toronto housing market, impacting both condo and detached home sales. Keywords like "mortgage rates," "interest rate hikes," "affordability crisis," and "Toronto housing market" are crucial for SEO.

Economic Uncertainty and Inflation

Beyond interest rates, economic uncertainty and persistent inflation are also dampening buyer confidence in the Toronto real estate market. Rising costs of living, coupled with concerns about potential recession and job security, are making many potential buyers hesitant to commit to large financial investments like purchasing a home.

- Inflation erodes purchasing power: The rising cost of everyday goods and services reduces the disposable income available for a down payment and mortgage payments.

- Economic uncertainty makes buyers hesitant: Concerns about job security and future economic prospects make buyers more cautious and less likely to enter the market.

- Concerns about job security reduce willingness to purchase: The fear of potential job loss significantly impacts the ability and willingness to take on a large financial commitment such as a mortgage in Toronto.

Reduced Inventory, but Still a Buyer's Market

While the inventory of homes for sale in Toronto remains relatively low compared to previous years, the significantly reduced demand has shifted the market dynamics in favour of buyers. This creates a buyer's market, even with the limited supply.

- Reduced competition among buyers: Fewer buyers translate to less competition for available properties.

- Increased negotiating power for buyers: Buyers now have greater leverage to negotiate lower prices and more favorable terms.

- Potential for better deals and price reductions: The current market conditions offer opportunities for buyers to secure better deals than during the peak seller's market. This applies to various property types across the Toronto real estate market.

Impact on Different Segments of the Toronto Real Estate Market

The decline in Toronto home sales is evident across various segments of the market.

Condominium Sales

The Toronto condo market has also experienced a significant downturn in sales, mirroring the broader trend. Rising interest rates and economic uncertainty have made condo purchases less attractive to potential buyers. The "Toronto condo market" keyword is important here for targeted SEO.

Detached Homes

Detached homes in Toronto have also seen a considerable decline in sales, though perhaps not as proportionally significant as condos in some areas. The higher cost of detached homes makes them even more susceptible to interest rate hikes and reduced buyer affordability. "Detached home sales Toronto" is a highly relevant keyword phrase.

Townhouses

The townhouse market in Toronto is experiencing a similar slowdown, impacted by the same factors affecting other segments – higher mortgage rates, economic uncertainty and reduced buyer confidence.

Conclusion: Navigating the Changing Landscape of Toronto Home Sales

The sharp decline in Toronto home sales, marked by a 23% year-over-year drop and a 4% price decrease, is largely attributable to rising interest rates, economic uncertainty, and a resulting shift towards a buyer's market. Understanding these factors is crucial for making informed decisions in this evolving market. Contact a real estate expert today to navigate this changing landscape and make the best choices for your individual circumstances in the Toronto home sales market.

Featured Posts

-

Pavle Grbovic Psg Kompromis U Prelaznoj Vladi

May 08, 2025

Pavle Grbovic Psg Kompromis U Prelaznoj Vladi

May 08, 2025 -

Wednesday April 16th 2025 Daily Lotto Numbers

May 08, 2025

Wednesday April 16th 2025 Daily Lotto Numbers

May 08, 2025 -

Ethereum Transaction Volume Spikes A Closer Look At The Recent 10 Increase

May 08, 2025

Ethereum Transaction Volume Spikes A Closer Look At The Recent 10 Increase

May 08, 2025 -

Ptt Is Basvurusu 2025 Tarihler Sartlar Ve Basvuru Kilavuzu

May 08, 2025

Ptt Is Basvurusu 2025 Tarihler Sartlar Ve Basvuru Kilavuzu

May 08, 2025 -

Andor Director Almost Reveals Rogue One Recut Details

May 08, 2025

Andor Director Almost Reveals Rogue One Recut Details

May 08, 2025