Sharp Rise In Ethereum Address Activity: A 10% Jump In Two Days

Table of Contents

Analyzing the Surge in Ethereum Network Activity

The 10% increase in Ethereum address activity isn't just a minor fluctuation; it's a substantial shift indicating heightened engagement within the Ethereum ecosystem. To understand the magnitude of this change, we need to examine the underlying data. "Address activity" encompasses various on-chain metrics, including the creation of new Ethereum addresses, the volume of transactions processed, and the level of interaction with smart contracts.

- Specific Numbers: Data from [Source - e.g., Etherscan, Glassnode] shows a jump from an average of [previous average] daily active addresses to [new average] in the past two days. This represents a [percentage]% increase.

- Comparison to Previous Levels: This recent surge surpasses previous peaks observed in [mention specific time periods], indicating a significant and potentially sustained increase in network engagement.

- Spikes and Patterns: Preliminary analysis reveals a notable spike coinciding with [mention a specific event, if applicable, e.g., a major DeFi protocol launch or significant NFT sale]. Further investigation is required to determine if this correlation is causal.

- Gas Fees and Network Congestion: The increased activity has naturally led to a rise in gas fees, reflecting the increased demand for network resources. While not crippling, this congestion underscores the growing popularity and utilization of the Ethereum network.

Potential Factors Contributing to Increased Ethereum Address Activity

Several key factors likely contributed to this remarkable increase in Ethereum address activity. The convergence of these elements points towards a potentially bullish outlook for the Ethereum ecosystem.

- The Rise of Decentralized Finance (DeFi): The explosive growth of DeFi applications continues to drive substantial activity on the Ethereum network. Users are interacting with lending platforms, decentralized exchanges (DEXs), and yield farming protocols, contributing to a high transaction volume.

- The Booming NFT Market: The Non-Fungible Token (NFT) market remains incredibly vibrant. The creation, trading, and minting of NFTs require Ethereum transactions, significantly contributing to the overall network activity. Recent high-profile NFT sales have likely fueled this aspect of the surge.

- Ethereum 2.0 Progress: While not fully launched, the ongoing development and implementation of Ethereum 2.0 contribute to positive sentiment and increased engagement. Anticipation of improved scalability and efficiency is attracting new users and developers.

- Increased Smart Contract Deployments: The ongoing development and deployment of innovative smart contracts across various sectors further contributes to the increased transaction volume and Ethereum address activity.

- Growing Institutional Adoption: There's increasing evidence of institutional investors entering the Ethereum market. Their involvement, even on a relatively small scale, significantly impacts transaction volume and overall network activity.

Implications of the Increased Ethereum Address Activity for the Market

This surge in Ethereum address activity holds significant implications for the cryptocurrency market, both in the short term and the long term.

- Ethereum Price Prediction: The increased network activity often correlates with price increases. While not a guaranteed predictor, this surge suggests a potential bullish trend for Ethereum's price.

- Market Sentiment: The heightened activity positively impacts investor confidence and overall market sentiment, creating a more optimistic outlook.

- Ripple Effects on Altcoins: Positive developments in Ethereum often impact other cryptocurrencies (altcoins), potentially leading to increased interest and investment in the broader crypto market.

- Sustainability of the Increase: The critical question remains whether this increase is sustainable. Sustained growth hinges on continued development, adoption, and the successful implementation of scalability solutions.

Conclusion

The 10% jump in Ethereum address activity within 48 hours represents a remarkable surge in network engagement, driven by a confluence of factors, including DeFi growth, NFT market activity, Ethereum 2.0 development, and increased institutional adoption. This significant increase has positive implications for Ethereum's price, market sentiment, and the broader cryptocurrency ecosystem. Stay tuned for updates on Ethereum address activity and keep an eye on Ethereum network activity for further insights into the evolving market trends. Learn more about the factors driving Ethereum's growth and its future potential.

Featured Posts

-

Tonights Game Jayson Tatum Injury Status Celtics Vs Nets

May 08, 2025

Tonights Game Jayson Tatum Injury Status Celtics Vs Nets

May 08, 2025 -

Boston Celtics Head Coach On Jayson Tatums Wrist

May 08, 2025

Boston Celtics Head Coach On Jayson Tatums Wrist

May 08, 2025 -

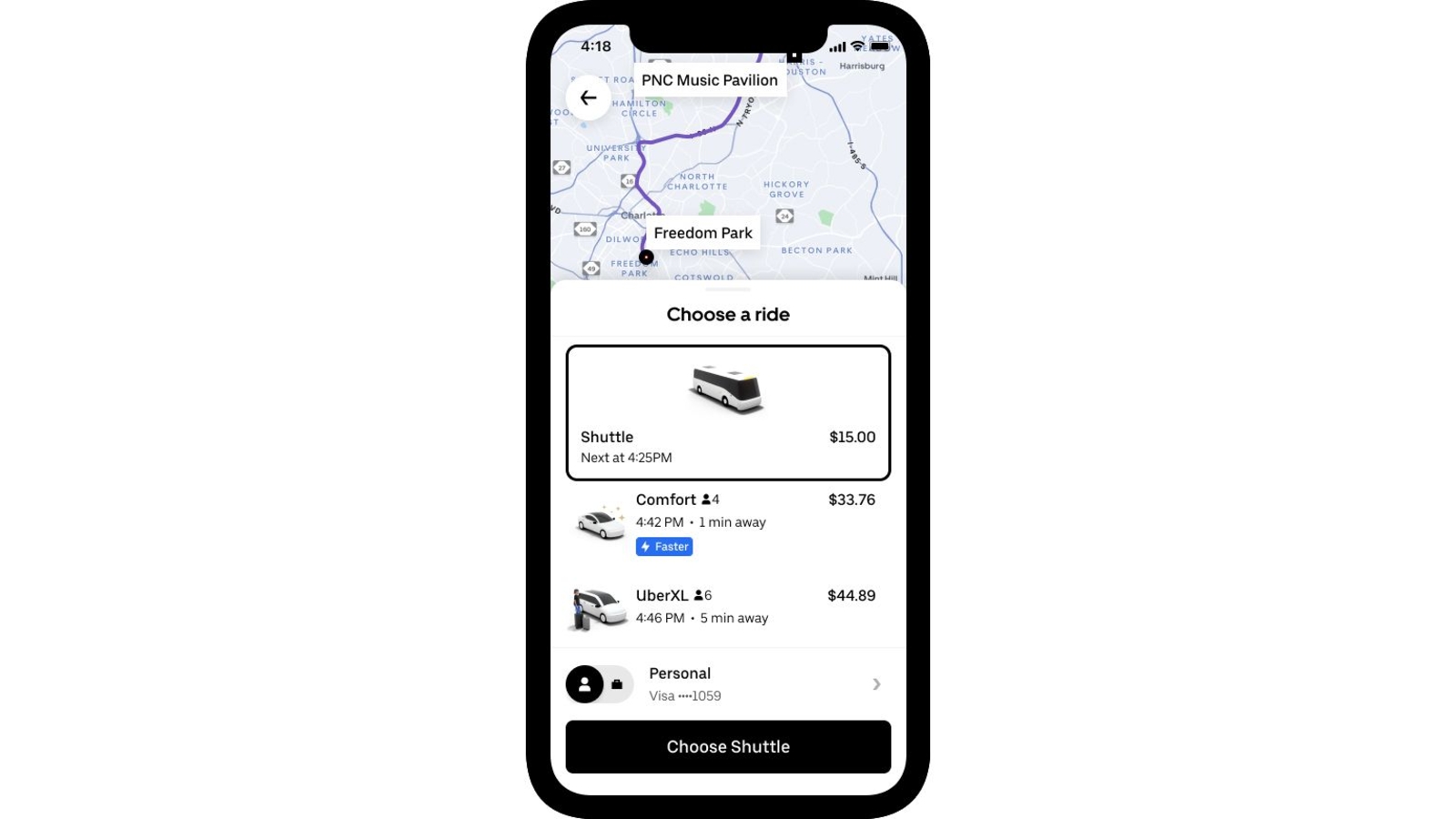

United Center Fans Get 5 Rides With New Uber Shuttle Service

May 08, 2025

United Center Fans Get 5 Rides With New Uber Shuttle Service

May 08, 2025 -

Lyon Psg Maci Canli Izle Hangi Kanalda Ne Zaman

May 08, 2025

Lyon Psg Maci Canli Izle Hangi Kanalda Ne Zaman

May 08, 2025 -

Lahwr Ke Bazarwn Myn Gwsht Ky Qymtwn Myn Adafe Ky Wjwhat Awr Mstqbl Ke Amkanat

May 08, 2025

Lahwr Ke Bazarwn Myn Gwsht Ky Qymtwn Myn Adafe Ky Wjwhat Awr Mstqbl Ke Amkanat

May 08, 2025