Shein's London IPO Delay: The Impact Of US Tariffs

Table of Contents

Shein's Growth and Planned London IPO

Shein's Business Model and Market Domination

Shein's success is rooted in its disruptive ultra-fast fashion business model. Targeting a predominantly young, digitally native consumer base, Shein leverages data-driven design, agile manufacturing, and an efficient supply chain to offer trendy clothing at unbelievably low prices. This strategy has propelled Shein to become a dominant force in the online fashion retail market.

- Shein's revenue has reportedly exploded in recent years, reaching billions of dollars annually.

- The company boasts a massive user base, numbering in the hundreds of millions globally.

- Shein's market share in the fast fashion sector is substantial and continues to grow, surpassing many established brands.

- Shein's ultra-fast fashion approach, characterized by rapid design iterations and quick production cycles, is a key differentiator.

The Allure of a London IPO

Shein's choice of the London Stock Exchange for its initial public offering was strategic. London offers several key advantages for a global company like Shein:

- Access to significant capital: The London Stock Exchange provides access to a deep pool of international investors and significant capital for expansion.

- A strong investor base: London attracts investors from around the world, offering broader reach than some other exchanges.

- International reputation: Listing on the LSE enhances Shein's global brand image and credibility.

- Regulatory environment: While not without its complexities, the LSE's regulatory framework is generally considered robust and internationally recognized.

The Impact of US Tariffs on Shein's Operations

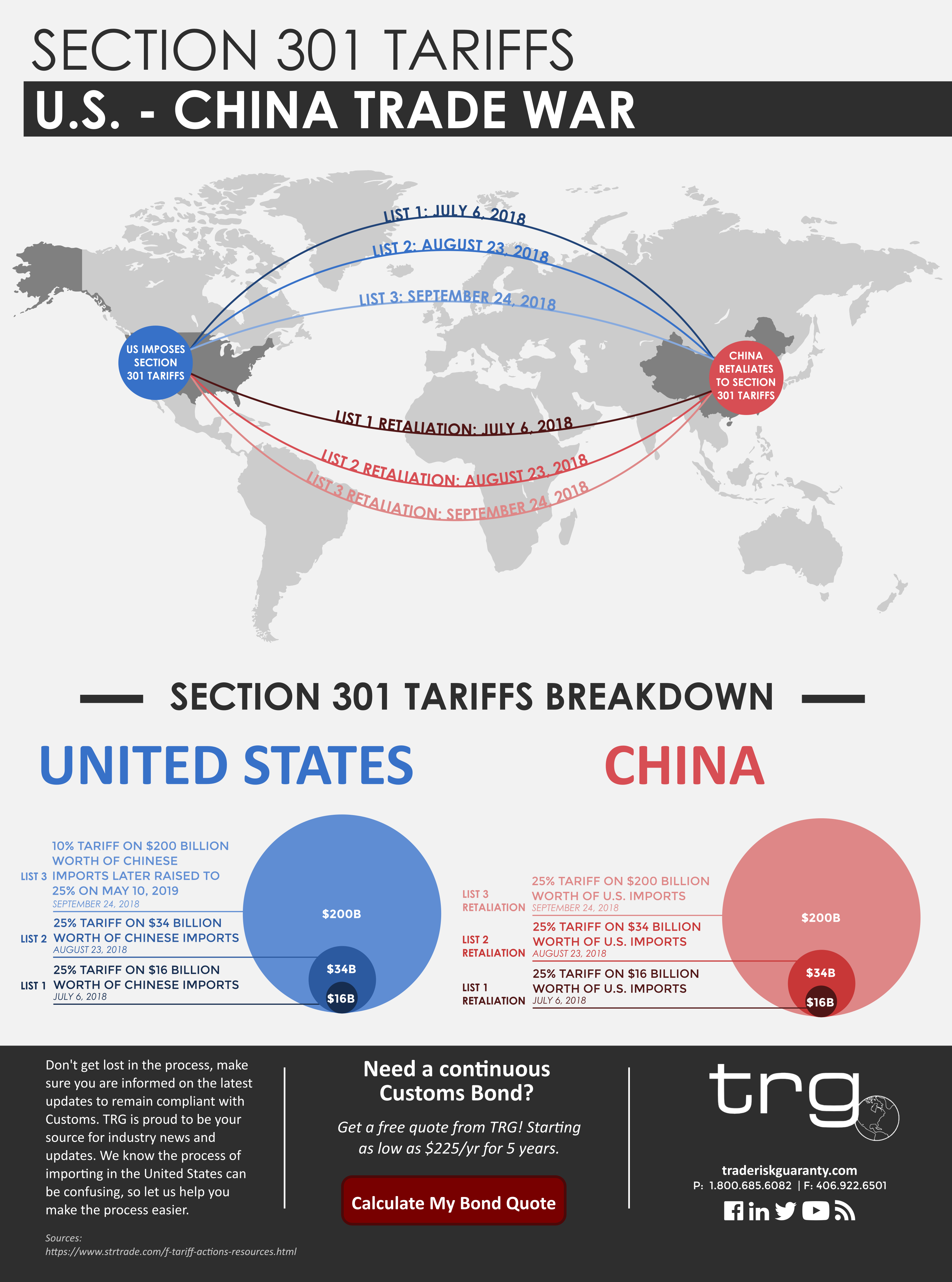

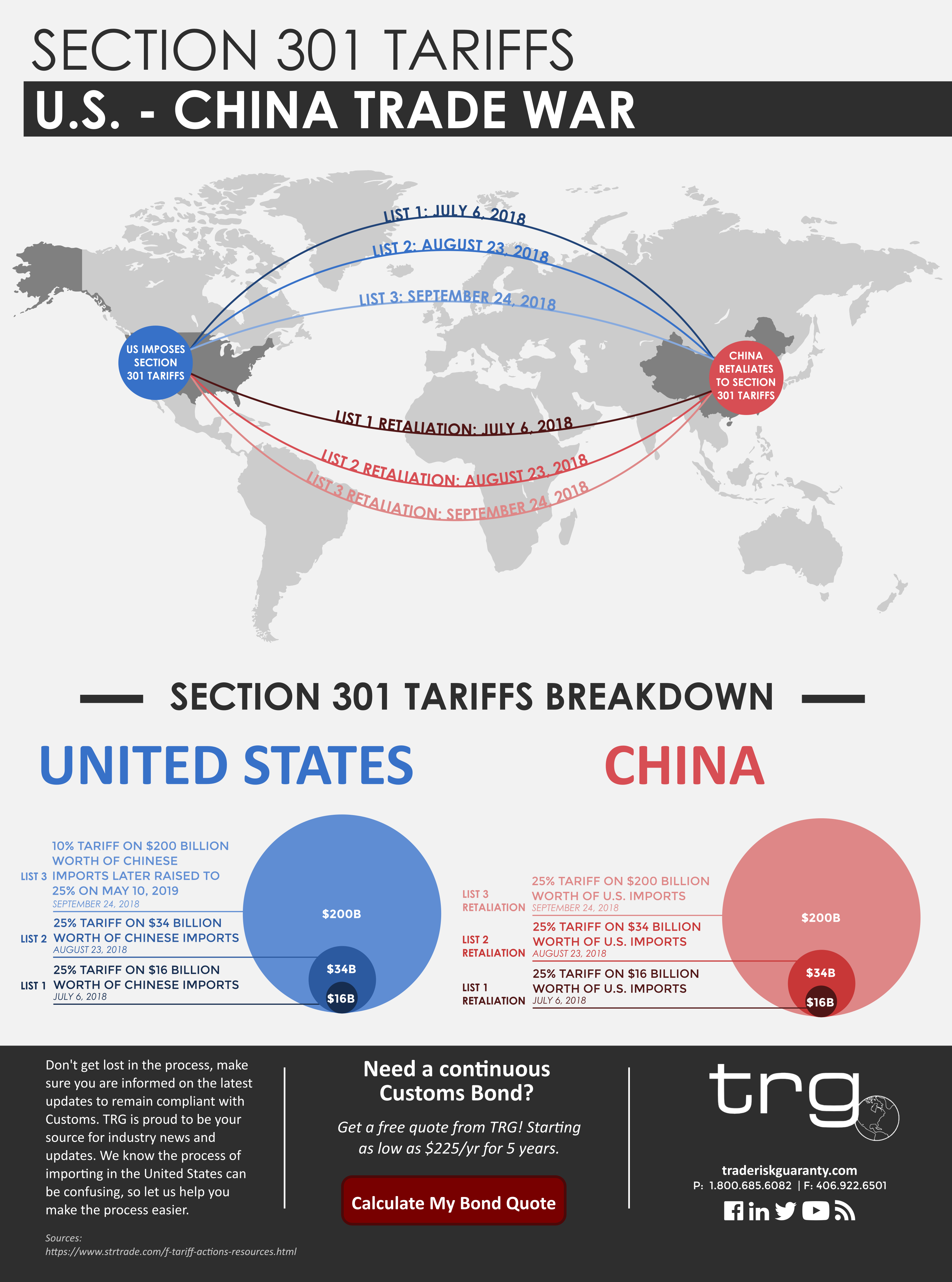

Understanding the US Tariffs

A significant hurdle for Shein's IPO plans is the imposition of US tariffs on clothing and textile imports from China, its primary manufacturing base. These tariffs significantly increase the cost of Shein's products entering the US market.

- Types of tariffs: Shein faces a range of tariffs on various clothing items and textiles.

- Tariff rates: These rates vary depending on the product category and can significantly impact production costs.

- Impact on production costs: The tariffs directly add to Shein's expenses, reducing profit margins and affecting competitiveness.

The Financial Strain of Increased Tariffs

The increased costs resulting from US tariffs pose a considerable challenge to Shein's profitability and its ability to attract investors.

- Reduced profit margins: Higher production costs inevitably squeeze profit margins.

- Increased production costs: These added expenses directly impact the already slim margins that Shein operates on.

- Supply chain disruption: The tariffs can lead to supply chain complexities and potential delays.

- Reduced competitiveness: Higher prices due to tariffs can make Shein less competitive against other fast fashion brands.

The Delay of the IPO and its Consequences

Official Statements and Explanations

While Shein hasn't explicitly stated that the US tariffs are the sole reason for the IPO delay, the increased costs and potential impact on investor confidence are undeniably significant factors. Official statements from Shein regarding the delay, when available, should be carefully analyzed for further insights. Any press releases or announcements from the company will be crucial in understanding the full extent of the situation.

Impact on Investors and the Market

The postponement of Shein's IPO has created uncertainty and impacted investor confidence.

- Potential impact on stock valuations: The delay could affect the potential valuation of the company at the time of the IPO.

- Investor sentiment: Uncertainty surrounding the IPO and the impact of tariffs have negatively impacted investor sentiment.

- Fast fashion competition: The delay gives competitors a window of opportunity to gain market share.

- Market volatility: The situation highlights the volatility of the fast fashion market and its susceptibility to geopolitical factors.

Conclusion: Shein's London IPO Delay and the Future of Fast Fashion

The delay of Shein's London IPO is intricately linked to the increased costs resulting from US tariffs on imports from China. These increased costs affect Shein's profitability and investor confidence, making it more difficult to secure the desired valuation. The future outlook for Shein's IPO remains uncertain. The company may need to adjust its pricing strategies, diversify its manufacturing locations, or explore alternative strategies to mitigate the impact of these tariffs. The situation highlights the intricate relationship between international trade policy and the global fast fashion industry. To stay informed on Shein's progress and the ongoing impact of US tariffs on the fast fashion industry, closely follow news and updates regarding Shein's IPO and the evolving landscape of international trade. The ongoing developments surrounding Shein's IPO and the effects of US tariffs will continue to shape the future of fast fashion.

Featured Posts

-

Stanley Cup Playoffs Understanding The Crucial First Round

May 04, 2025

Stanley Cup Playoffs Understanding The Crucial First Round

May 04, 2025 -

Understanding The Alleged Blake Lively And Anna Kendrick Conflict

May 04, 2025

Understanding The Alleged Blake Lively And Anna Kendrick Conflict

May 04, 2025 -

Analyzing The Connection Between Potent Cocaine And The Expansion Of Narco Sub Networks

May 04, 2025

Analyzing The Connection Between Potent Cocaine And The Expansion Of Narco Sub Networks

May 04, 2025 -

Newark Airport Flight Chaos United Airlines Cancellations After Faa Staffing Issue

May 04, 2025

Newark Airport Flight Chaos United Airlines Cancellations After Faa Staffing Issue

May 04, 2025 -

Ev Mandate Opposition Car Dealers Double Down

May 04, 2025

Ev Mandate Opposition Car Dealers Double Down

May 04, 2025

Latest Posts

-

Tensions Rise Bryce Mitchell And Jean Silva Clash Verbally Ahead Of Ufc 314 Bout

May 04, 2025

Tensions Rise Bryce Mitchell And Jean Silva Clash Verbally Ahead Of Ufc 314 Bout

May 04, 2025 -

Major Blow To Ufc 314 Neal Prates Bout Cancelled

May 04, 2025

Major Blow To Ufc 314 Neal Prates Bout Cancelled

May 04, 2025 -

Jean Silva Responds To Bryce Mitchells Claims Of Abusive Language At Ufc 314 Event

May 04, 2025

Jean Silva Responds To Bryce Mitchells Claims Of Abusive Language At Ufc 314 Event

May 04, 2025 -

Ufc 314 Mitchell Silva Press Conference Marked By Heated Exchange And Allegations Of Cursing

May 04, 2025

Ufc 314 Mitchell Silva Press Conference Marked By Heated Exchange And Allegations Of Cursing

May 04, 2025 -

Ufc 314 Star Studded Lineup Suffers Setback With Neal Prates Fight Cancellation

May 04, 2025

Ufc 314 Star Studded Lineup Suffers Setback With Neal Prates Fight Cancellation

May 04, 2025