Shein's London IPO: Delayed Due To US Tariff Disputes

Table of Contents

The US Tariff Dispute: A Major Hurdle for Shein's IPO

The primary roadblock hindering Shein's London IPO is the ongoing dispute surrounding US tariffs. These tariffs represent a substantial challenge to Shein's business model and its projected financial performance, directly impacting its attractiveness to potential investors.

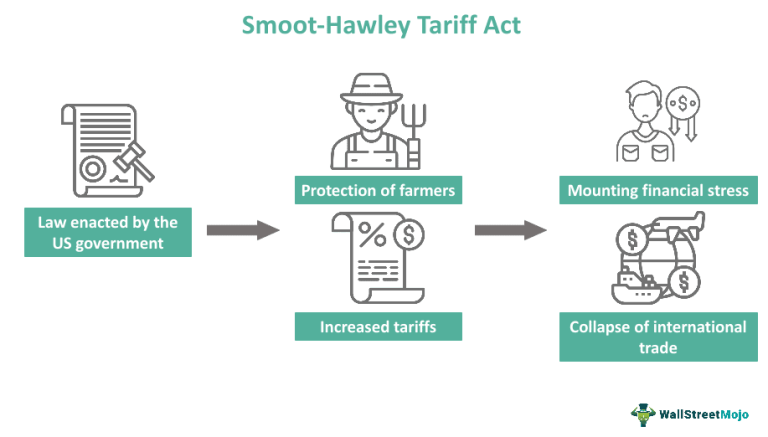

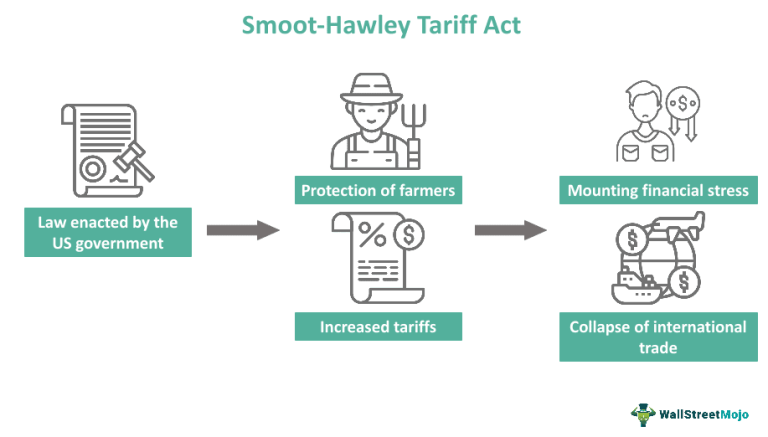

Understanding the Tariffs

The US has imposed significant tariffs on imported clothing and textiles from China, Shein's primary manufacturing source. These tariffs fall into several categories:

- Anti-dumping duties: These are levied when imported goods are sold at prices below their fair market value, allegedly undercutting domestic producers.

- Countervailing duties: These are imposed to offset government subsidies provided to foreign producers, giving them an unfair competitive advantage.

The financial impact of these tariffs on Shein is substantial. Reports suggest that these duties have added millions of dollars to Shein's operational costs, significantly reducing its profit margins and impacting its projected revenue growth. Precise figures are difficult to obtain, as Shein is a privately held company, but industry analysts have estimated a considerable negative impact on profitability.

Shein's Response to the Tariffs

Shein hasn't remained passive in the face of these tariffs. Its response strategies include:

- Diversification of sourcing: Shein is reportedly exploring alternative manufacturing locations beyond China to mitigate its reliance on a single source and reduce its exposure to US tariffs. The effectiveness of this strategy will depend on the ability to maintain quality and speed of production in new locations.

- Price adjustments: While unpopular, Shein may need to absorb some of the tariff costs or pass them onto consumers, potentially impacting its competitive pricing strategy.

- Lobbying efforts: Shein may be engaging in lobbying efforts to influence US trade policy and seek a more favorable tariff regime. However, the success of such efforts is uncertain.

Data on the effectiveness of these strategies remains limited due to the private nature of Shein's operations. However, shifts in its supply chain are expected as the company attempts to diversify its manufacturing base.

The Political Landscape

The political landscape surrounding US-China trade relations is highly volatile. The ongoing trade war between the two countries significantly influences the tariff disputes. The stances of key political figures on both sides will continue to affect the outcome and timeline of any potential resolution. Furthermore, broader implications exist for the entire global fashion industry, forcing companies to reassess their supply chain strategies and long-term growth plans.

Implications of the Delay for Shein's Future

The delay of the Shein London IPO has significant consequences for the company's future trajectory.

Investor Sentiment and Valuation

The delay has undoubtedly dampened investor sentiment. The uncertainty surrounding the US tariff dispute casts doubt on Shein's future profitability and growth potential, potentially impacting its valuation during a future IPO. Financial analysts have expressed mixed opinions, with some suggesting a potential downward revision of Shein's valuation while others remain optimistic about its long-term prospects. The delay might also make future fundraising efforts more challenging.

Competition and Market Share

The delay provides an opportunity for Shein's competitors in the fast fashion market to gain ground. Companies like Zara, H&M, and ASOS are actively vying for market share. A prolonged delay could lead to lost market share and a weaker competitive position for Shein.

Long-Term Strategic Adjustments

Shein will likely need to make significant long-term strategic adjustments to navigate the challenges posed by US tariffs. This may include:

- Restructuring its supply chain: Further diversifying manufacturing locations, potentially investing in facilities in countries with more favorable trade relationships with the US.

- Price adjustments: Finding a balance between maintaining competitive pricing and absorbing tariff costs.

- Product diversification: Exploring non-apparel product categories to reduce reliance on clothing, which is heavily impacted by tariffs.

- Brand building: Investing more in brand building activities to differentiate its offerings from competitors.

Alternative IPO Locations and Future Prospects

Given the challenges in London, Shein might consider alternative locations for its IPO.

Exploring Other Markets

Other potential IPO locations include Hong Kong and Singapore, both offering robust financial markets and potentially more favorable regulatory environments. However, each location presents its own set of advantages and disadvantages concerning regulatory hurdles, investor appetite, and overall market conditions.

- Hong Kong: Offers proximity to its existing supply chains in mainland China but carries potential political risks.

- Singapore: Offers a stable and transparent regulatory environment but may lack the same level of investor familiarity with the fast-fashion sector.

Timeline for a Rescheduled IPO

Predicting a timeframe for a rescheduled IPO is challenging. It hinges on the resolution of the US tariff disputes, Shein's success in mitigating the impact of these tariffs, and broader global economic conditions. Expert opinions vary, with some suggesting a possible timeline of 12-18 months, while others remain more cautious.

Conclusion: Shein's IPO Delay – Navigating the Turbulent Waters of Global Trade

Shein's delayed London IPO underscores the significant impact of US tariffs on global businesses. The ongoing trade dispute presents a considerable hurdle, affecting investor sentiment, competitive positioning, and strategic planning. While alternative IPO locations and mitigating strategies exist, the resolution of the tariff issues is crucial for Shein's future. Stay updated on further developments regarding Shein's London IPO and the resolution of the ongoing US tariff disputes by following relevant news sources and Shein's investor relations page (if available). Keywords: Shein IPO update, Shein stock, Shein investment.

Featured Posts

-

Secure Your Diana Ross Symphonic Celebration 2025 Uk Tickets

May 06, 2025

Secure Your Diana Ross Symphonic Celebration 2025 Uk Tickets

May 06, 2025 -

Affordable Finds That Dont Disappoint

May 06, 2025

Affordable Finds That Dont Disappoint

May 06, 2025 -

Kidnapped Father Of Crypto Entrepreneur Rescued Suffers Finger Amputation

May 06, 2025

Kidnapped Father Of Crypto Entrepreneur Rescued Suffers Finger Amputation

May 06, 2025 -

Ariana Grande And Jeff Goldblums I Dont Know Why Listen Now

May 06, 2025

Ariana Grande And Jeff Goldblums I Dont Know Why Listen Now

May 06, 2025 -

Watch The 2025 Met Gala Live Streaming Options For Latin America Mexico And The U S

May 06, 2025

Watch The 2025 Met Gala Live Streaming Options For Latin America Mexico And The U S

May 06, 2025

Latest Posts

-

Comparing Spielbergs Latest Ufo Film To His Previous Sci Fi Masterpieces

May 06, 2025

Comparing Spielbergs Latest Ufo Film To His Previous Sci Fi Masterpieces

May 06, 2025 -

Beyond Kang 10 Fitting Mcu Parts For Colman Domingo

May 06, 2025

Beyond Kang 10 Fitting Mcu Parts For Colman Domingo

May 06, 2025 -

Colman Domingos Next Mcu Role 10 Possibilities

May 06, 2025

Colman Domingos Next Mcu Role 10 Possibilities

May 06, 2025 -

Spielbergs New Ufo Movie A Comparison To His Classic Alien Sci Fi Films

May 06, 2025

Spielbergs New Ufo Movie A Comparison To His Classic Alien Sci Fi Films

May 06, 2025 -

10 Mcu Characters Colman Domingo Could Perfectly Play

May 06, 2025

10 Mcu Characters Colman Domingo Could Perfectly Play

May 06, 2025