Shein's London IPO: Fallout From US Tariffs

Table of Contents

The Impact of US Tariffs on Shein's Business Model

Shein's meteoric rise is intrinsically linked to its low-cost, fast-fashion business model. However, the ongoing China-US trade war and the resulting US import tariffs on clothing and textiles have significantly impacted its profitability. The increased Shein tariffs represent a considerable challenge to its core strategy.

- Increased production costs: Tariffs levied on goods imported from China directly increase Shein's production costs. This affects every stage of its supply chain, from raw materials to finished garments.

- Competitive pricing under pressure: Shein's competitive advantage lies in its incredibly low prices. The added costs from tariffs put pressure on this strategy, potentially forcing price increases or reduced profit margins.

- Shifting sourcing strategies: To mitigate tariff impacts, Shein is likely exploring diversification of its production locations. This involves setting up manufacturing facilities or forging partnerships in countries with more favorable trade agreements with the US. This diversification adds complexity and costs to the Shein supply chain.

- Impact on financial health: The increased costs associated with tariffs directly influence Shein's profit margins and overall financial health. Analysts are closely watching how the company absorbs these costs and maintains its profitability.

- Passing costs to consumers: The question of whether Shein will pass increased costs onto consumers remains crucial. While this is a common practice, it could impact sales if consumers are unwilling to accept higher prices.

Why a London IPO? Assessing the Alternatives

Shein's reported consideration of a London IPO, rather than a listing on the New York Stock Exchange or in Hong Kong, suggests a carefully considered strategic decision.

- Advantages of the London Stock Exchange: The London Stock Exchange offers access to a large pool of European and global investors, providing a potentially lucrative funding opportunity. Furthermore, the regulatory environment in London might be perceived as more favorable than in other jurisdictions.

- Comparison with other venues: A New York listing would have exposed Shein more directly to the impact of US tariffs and regulatory scrutiny. Hong Kong, while closer geographically to its production base, might present different regulatory challenges.

- Investor sentiment and valuation: Investor sentiment towards Shein will significantly impact its IPO valuation. Concerns about labor practices, environmental sustainability, and intellectual property rights could affect investor confidence and ultimately the price of the Shein stock.

- Risks associated with a London IPO: Brexit uncertainties and broader global economic factors present potential risks. Fluctuations in the pound sterling could impact the valuation of Shein stock, and a downturn in the global economy could negatively affect investor appetite.

Regulatory Scrutiny and its Influence on the IPO Decision

Shein faces increasing regulatory scrutiny concerning its business practices. This scrutiny has significantly influenced its IPO decision.

- Labor practices, environmental concerns, and intellectual property: Shein has faced criticism regarding its labor practices, environmental sustainability, and intellectual property rights. These concerns could impact investor interest and the IPO's success.

- Impact on IPO timing and location: The negative publicity surrounding these issues has likely influenced the timing and location of the IPO. A London listing might offer a less scrutinizing environment compared to the US.

- Investor confidence: Negative publicity can significantly damage investor confidence, impacting the IPO's valuation and the overall success of the Shein Stock offering.

- Mitigation strategies: Shein is actively trying to address these concerns, implementing measures to improve labor practices, reduce its environmental impact, and strengthen its intellectual property protection. The effectiveness of these strategies will significantly impact investor confidence.

Implications for the Fast Fashion Industry

Shein's IPO decision will set a precedent for other fast-fashion brands, impacting the global fashion market significantly.

- Setting a precedent: Shein's strategic moves regarding tariffs and its IPO location will influence the decisions of its competitors.

- Impact on the competitive landscape: The success or failure of the Shein IPO will significantly reshape the competitive landscape of the fast-fashion industry.

- Sustainable and ethical practices: The increasing demand for sustainable and ethical fashion will continue to influence industry standards and consumer preferences. Shein's response to these concerns will be crucial for its long-term success.

- Influence on consumer preferences: Shein's choices regarding ethical sourcing and supply chain transparency will influence consumer preferences and drive industry-wide changes.

Conclusion

Shein's decision to explore a London IPO, driven in part by the fallout from US tariffs and increased regulatory scrutiny, marks a significant turning point for the fast-fashion giant. The move reflects the challenges of operating in a globally interconnected yet increasingly complex market environment. The success of the Shein IPO will depend on several factors, including navigating regulatory hurdles, addressing sustainability concerns, and maintaining investor confidence. The Shein London Stock Exchange listing will be a closely watched event for the entire industry.

Call to Action: Stay informed about the developments surrounding Shein's London IPO and the ongoing impact of US tariffs on the fast-fashion industry. Keep an eye on our future articles for further analysis and insights into the Shein IPO and its implications for the global retail landscape.

Featured Posts

-

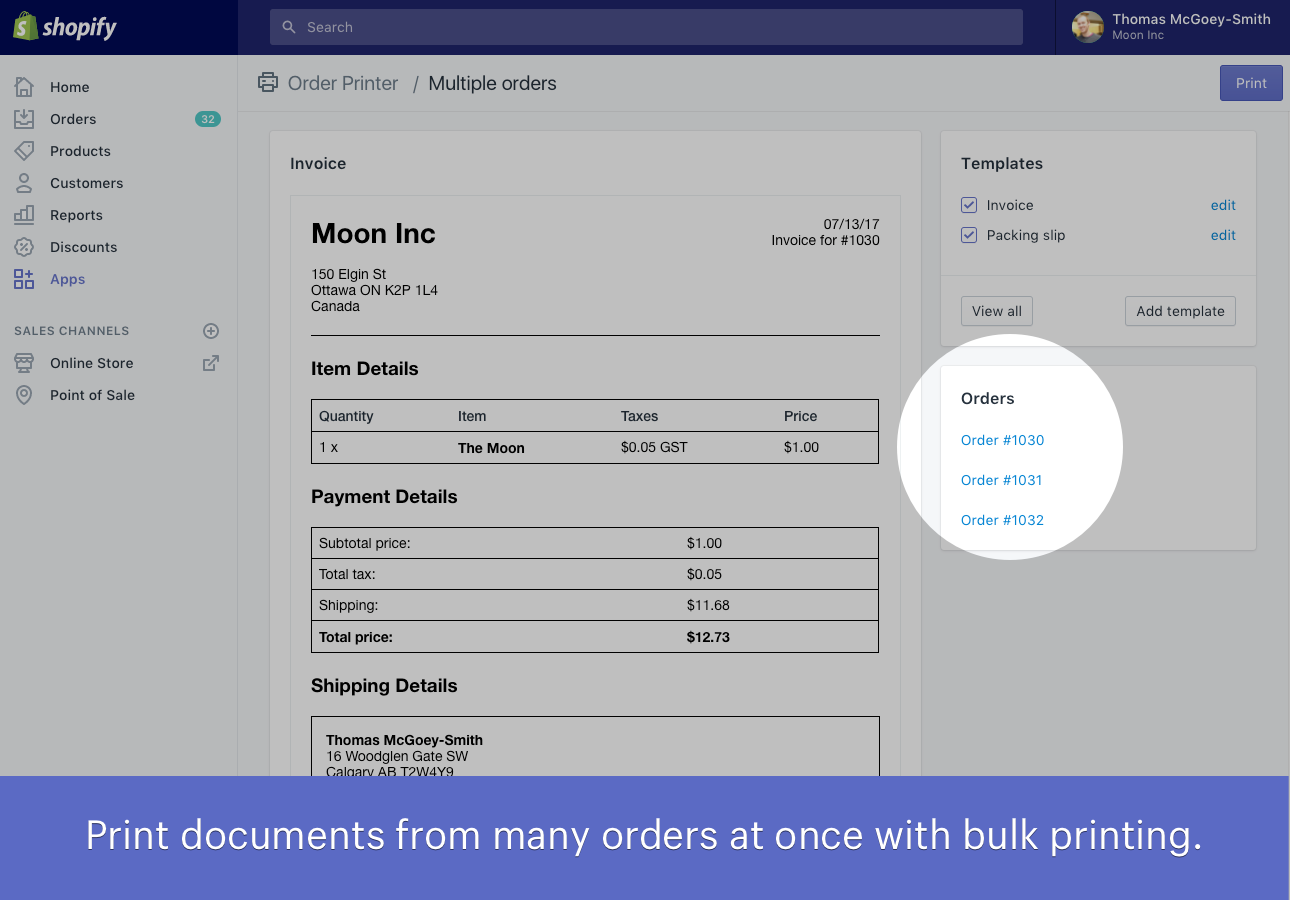

Shopify Developer Program Changes A Revenue Share Analysis

May 05, 2025

Shopify Developer Program Changes A Revenue Share Analysis

May 05, 2025 -

1 050 Price Surge At And T Details Broadcoms Impact On V Mware Costs

May 05, 2025

1 050 Price Surge At And T Details Broadcoms Impact On V Mware Costs

May 05, 2025 -

Nhl News Johnston And Rantanen Power Victories Panthers Thrilling Comeback

May 05, 2025

Nhl News Johnston And Rantanen Power Victories Panthers Thrilling Comeback

May 05, 2025 -

First Round Nhl Playoffs Matchups Predictions And Analysis

May 05, 2025

First Round Nhl Playoffs Matchups Predictions And Analysis

May 05, 2025 -

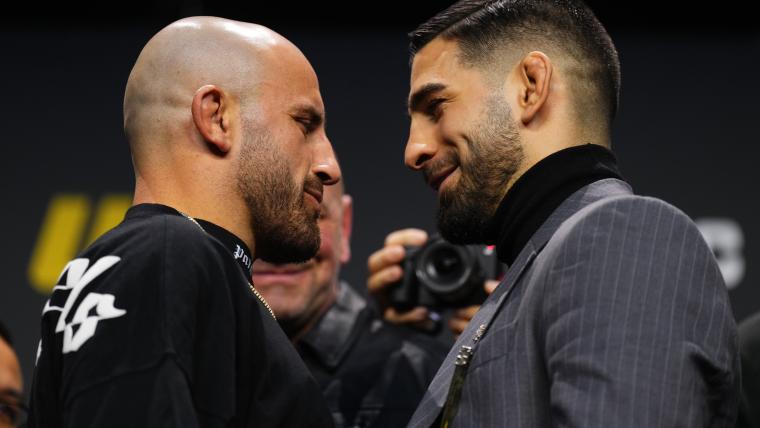

Ufc 314 Main Event Early Odds Comparison For Volkanovski Vs Lopes

May 05, 2025

Ufc 314 Main Event Early Odds Comparison For Volkanovski Vs Lopes

May 05, 2025

Latest Posts

-

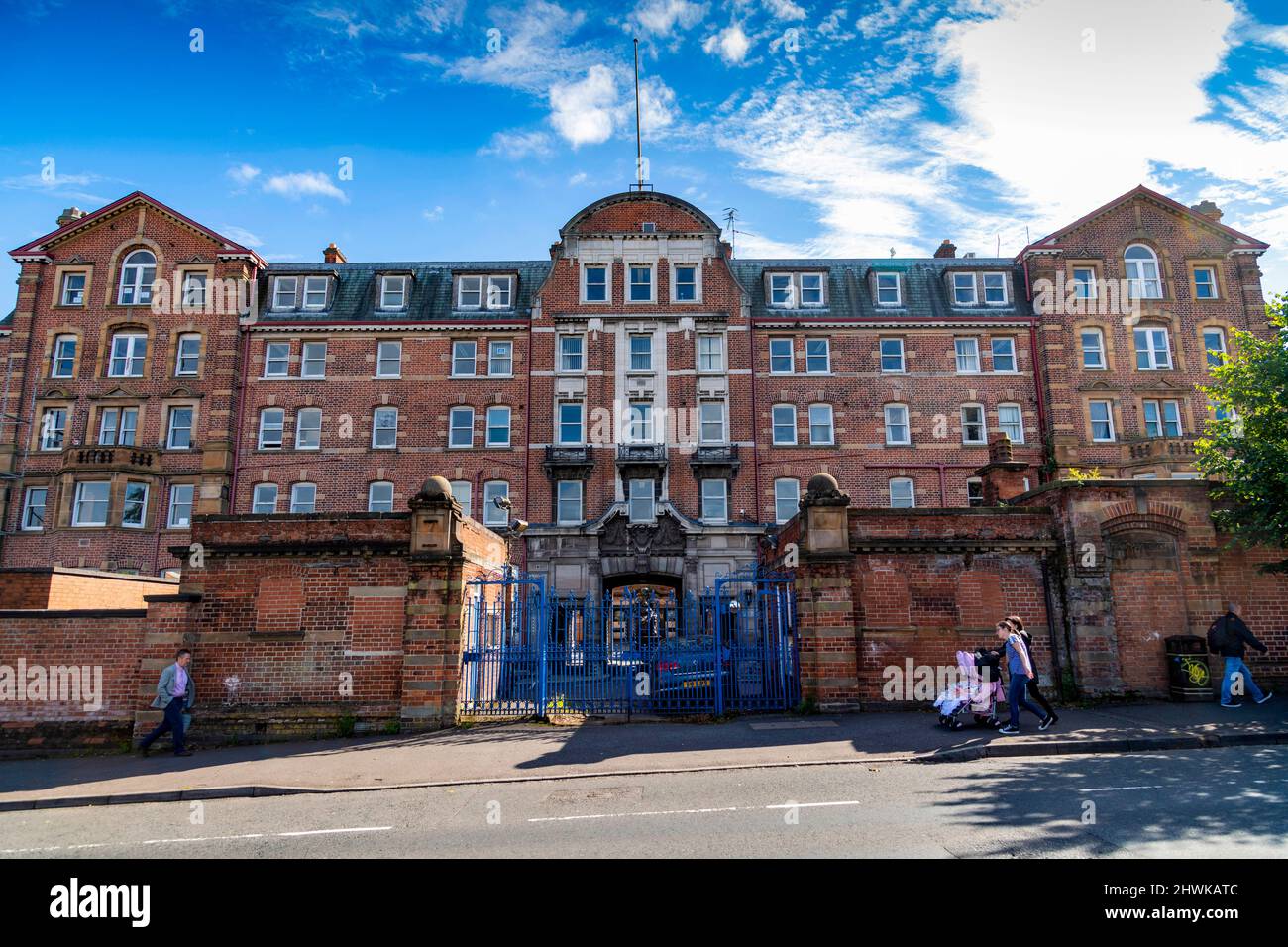

James Burns Analysis Of A Belfast Hospital Incident Involving A Hammer

May 05, 2025

James Burns Analysis Of A Belfast Hospital Incident Involving A Hammer

May 05, 2025 -

Hospital Hammer Incident Investigating James Burnss Motives

May 05, 2025

Hospital Hammer Incident Investigating James Burnss Motives

May 05, 2025 -

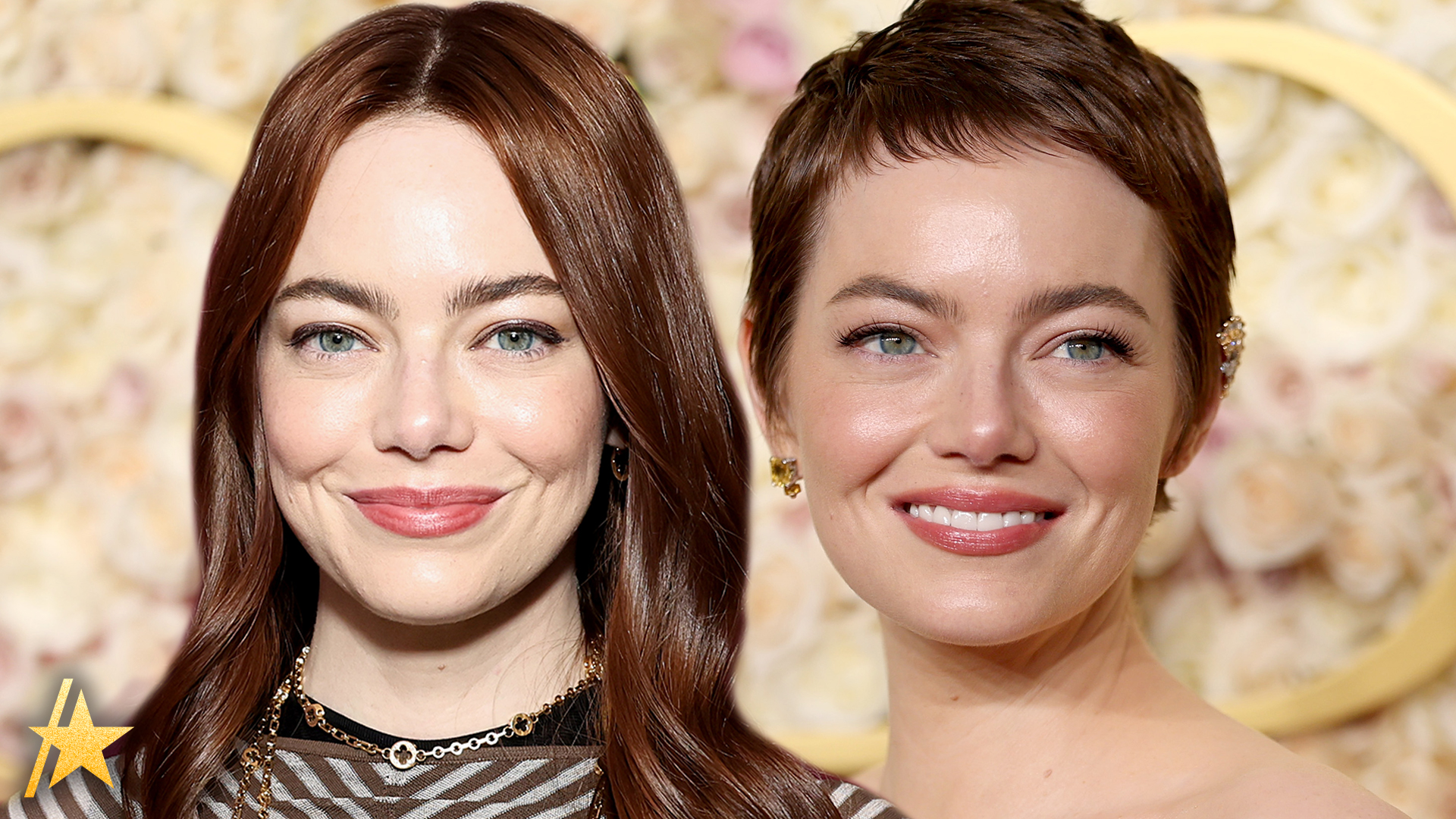

Emma Stones Oscars 2025 Red Carpet Look A Louis Vuitton Masterpiece

May 05, 2025

Emma Stones Oscars 2025 Red Carpet Look A Louis Vuitton Masterpiece

May 05, 2025 -

Belfast Hospital Hammer Incident Ex Soldier James Burnss Actions

May 05, 2025

Belfast Hospital Hammer Incident Ex Soldier James Burnss Actions

May 05, 2025 -

Oscars 2025 Emma Stones Bold Sequin Louis Vuitton Gown And Retro Hairstyle

May 05, 2025

Oscars 2025 Emma Stones Bold Sequin Louis Vuitton Gown And Retro Hairstyle

May 05, 2025