Should Investors Buy Palantir Stock Ahead Of May 5th Earnings Report?

Table of Contents

Palantir Technologies (PLTR) is set to release its earnings report on May 5th, leaving investors wondering whether now is the right time to buy. This article will delve into the key factors influencing Palantir stock, helping you make an informed decision before the earnings announcement. We'll examine recent performance, future prospects, and potential risks associated with investing in Palantir stock.

Palantir's Recent Performance and Market Sentiment

Analyzing Palantir's recent performance is crucial for determining whether to buy before the May 5th earnings report. The stock price has experienced considerable volatility in recent months, influenced by several factors. News surrounding new contracts, particularly government contracts which are a significant part of Palantir's revenue, has often driven short-term price movements. Analyst ratings and overall market sentiment toward the tech sector also play a significant role.

- Stock price trend in the last quarter: [Insert recent stock price trend data here. Source the data from a reputable financial website]. Note any significant upward or downward swings and their likely causes.

- Key financial metrics (revenue, earnings per share, etc.) from previous reports: [Insert relevant financial data from previous quarters. Source the data and include links]. Highlight any significant changes in revenue growth, profitability, and operating expenses.

- Analyst ratings and price targets: [Summarize current analyst ratings and price targets. Mention the range of predictions and the reasoning behind them]. Include details about whether the consensus is bullish, bearish, or neutral.

- Overall market sentiment towards Palantir: [Describe the overall market feeling towards Palantir. Is it positive, negative, or uncertain? Back this up with references to news articles or analyst reports]. Gauge if there’s widespread optimism or skepticism.

Key Factors to Consider Before Buying Palantir Stock

Before investing in Palantir stock, you need to weigh several crucial factors that influence its long-term potential and short-term risks. Palantir's growth strategy relies heavily on expanding its government and commercial customer bases, leveraging its powerful data analytics platform. However, competition in the big data analytics market is fierce, with established players and innovative startups vying for market share.

- Government contracts and their impact on revenue: [Discuss the importance of government contracts to Palantir's revenue stream. Analyze the potential for securing new contracts and the risks associated with relying on government funding]. Consider the potential impact of changes in government policy.

- Competition in the big data analytics market: [Identify key competitors and assess Palantir's competitive advantages and disadvantages. Consider factors like technology, pricing, and market reach]. Discuss how Palantir differentiates itself.

- Palantir's long-term growth potential: [Analyze Palantir's potential for expansion into new markets and its ability to innovate and adapt to changing technological landscapes]. Consider the potential for international expansion.

- Potential risks and challenges facing the company: [Identify potential risks, such as financial uncertainty, intense competition, and dependence on a small number of large clients]. Consider the impact of macroeconomic factors.

Analyzing Palantir's Upcoming Earnings Report

The May 5th earnings report will be crucial for determining the future trajectory of Palantir's stock price. Investors should carefully scrutinize several key metrics to gauge the company's financial health and future prospects.

- Revenue growth expectations: [Discuss the anticipated revenue growth based on previous performance and analyst estimates]. Compare expectations to actual results from previous reports.

- Profitability (or lack thereof): [Analyze Palantir's profitability and its path towards achieving sustained profitability]. Note any changes in profit margins or operating expenses.

- Guidance for future quarters: [Analyze the company's guidance for future quarters and assess its realism]. Compare this guidance to previous guidance and actual results.

- New contracts or partnerships announced: [Consider the potential impact of any new contracts or partnerships announced in the earnings report]. Evaluate the strategic significance and financial implications.

Conclusion

This article examined the factors influencing Palantir stock ahead of its May 5th earnings report. We've looked at recent performance, future prospects, and potential risks involved in buying PLTR stock. The decision to buy Palantir stock remains complex and depends on individual investor risk tolerance and investment goals. The upcoming earnings report will provide crucial insights, but remember that even with thorough analysis, investing in Palantir, or any stock, involves risk.

Call to Action: Before making any investment decisions regarding Palantir stock, conduct thorough due diligence and consider seeking advice from a qualified financial advisor. Carefully analyze the May 5th earnings report and its implications before deciding whether to buy Palantir stock. Remember, investing in Palantir involves risk.

Featured Posts

-

How Trumps Executive Orders Affected The Transgender Community A Personal Account

May 10, 2025

How Trumps Executive Orders Affected The Transgender Community A Personal Account

May 10, 2025 -

Harry Styles Debuts Retro Mustache In London

May 10, 2025

Harry Styles Debuts Retro Mustache In London

May 10, 2025 -

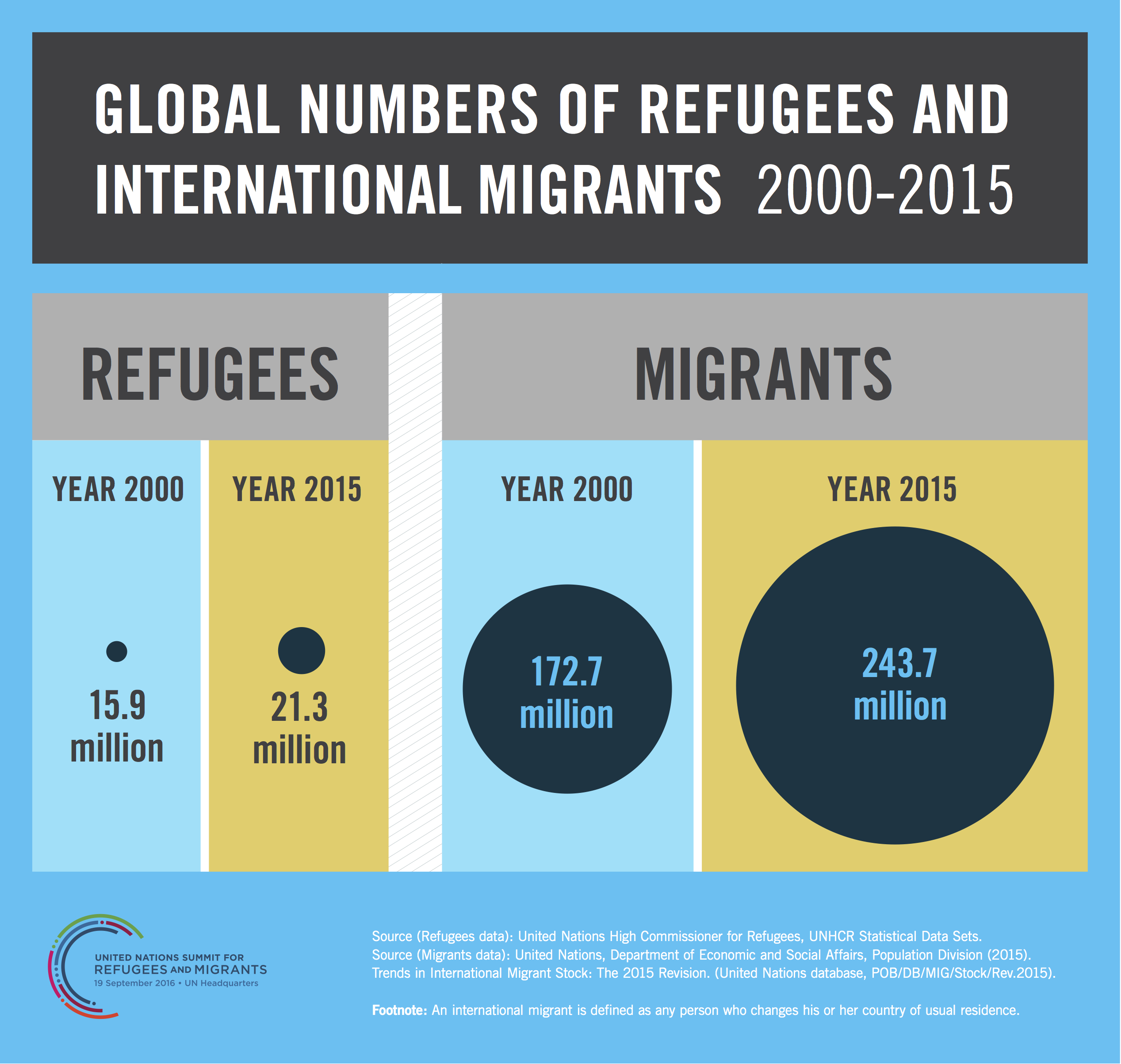

Uk Asylum Crackdown Home Office Targets Migrants From Three Countries

May 10, 2025

Uk Asylum Crackdown Home Office Targets Migrants From Three Countries

May 10, 2025 -

Todays Sensex And Nifty Significant Gains Across Sectors

May 10, 2025

Todays Sensex And Nifty Significant Gains Across Sectors

May 10, 2025 -

Sensex Live Market Rebounds Up 100 Points Nifty At 17 950

May 10, 2025

Sensex Live Market Rebounds Up 100 Points Nifty At 17 950

May 10, 2025