Should Investors Worry About Elevated Stock Market Valuations? BofA's View

Table of Contents

BofA's Current Stance on Stock Market Valuations

BofA's official stance on current stock market valuations has fluctuated, reflecting the dynamic nature of the market. While they haven't declared a blanket "bubble" scenario, their recent reports indicate a cautious outlook. Analysts have expressed concerns about certain sectors being overvalued, suggesting a potential for market correction. This isn't a call for immediate panic selling, but rather a warning to proceed with prudence and diversify portfolios.

-

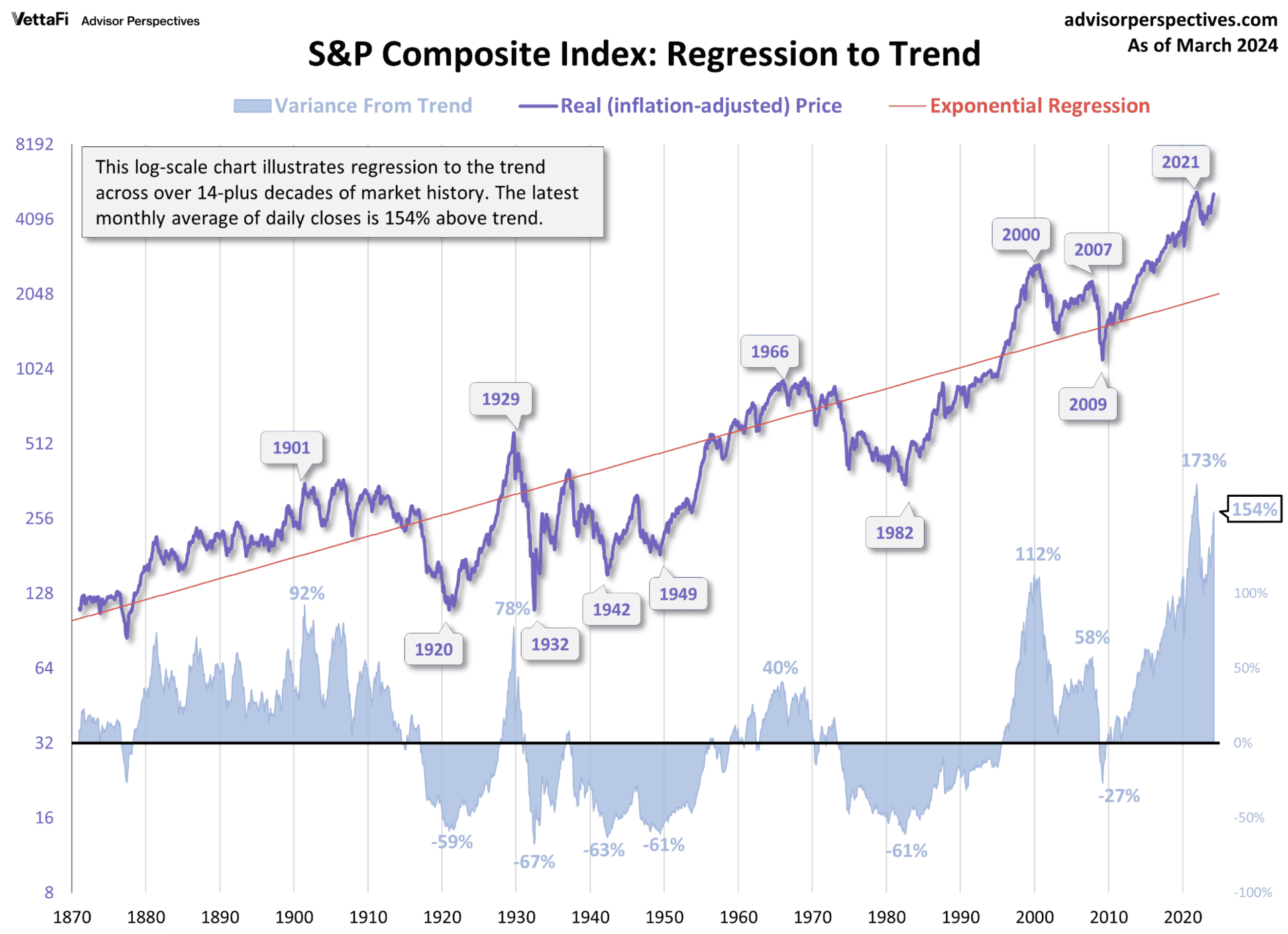

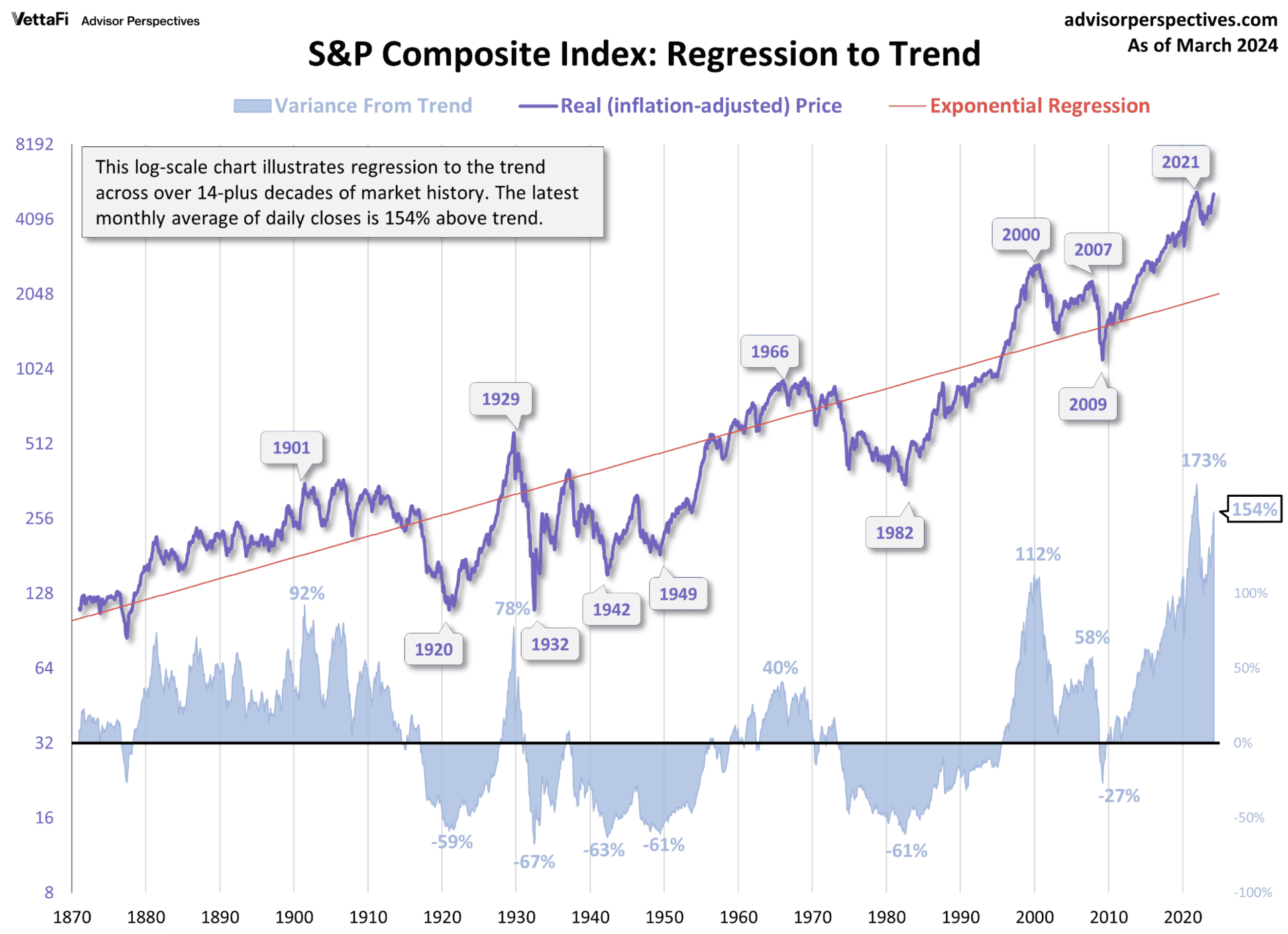

Data Points: BofA analysts frequently cite metrics like Price-to-Earnings (P/E) ratios and market capitalization to GDP ratios to gauge valuations. Recent reports might highlight elevated P/E ratios in specific sectors, indicating potentially high valuations relative to earnings. Similarly, a high market capitalization to GDP ratio could signal an overall overvalued market.

-

Overvalued and Undervalued Sectors: BofA's research may identify technology and certain consumer discretionary sectors as potentially overvalued, while others, such as energy or certain financials, might be deemed relatively undervalued. These assessments are subject to change and depend heavily on various economic factors.

-

Market Predictions: BofA's predictions for future market performance often hinge on their valuation analysis. They might forecast moderate growth with potential volatility, emphasizing the importance of risk management. Their outlook is not a definitive prediction, but rather a probabilistic assessment based on their analysis of current stock market valuations and related economic indicators.

Factors Contributing to Elevated Stock Market Valuations

Several interconnected economic and market factors contribute to the current elevated stock market valuations. Understanding these factors is critical for assessing the sustainability of current prices.

-

Low Interest Rates: Historically low interest rates have encouraged investors to seek higher returns in the stock market, driving up demand and consequently, valuations. This is because bonds and other fixed-income investments offer comparatively lower yields.

-

Quantitative Easing and Monetary Policy: Central banks' quantitative easing programs, designed to stimulate economic growth, have injected significant liquidity into the market, further fueling asset price inflation, including stock market valuations.

-

Corporate Earnings Growth: Strong corporate earnings growth can justify higher stock valuations. However, if earnings growth falters while valuations remain high, it could signal an overvalued market and increase the risk of a correction.

-

Geopolitical Events: Global uncertainties, such as trade wars, political instability, or geopolitical tensions, can impact market sentiment. While sometimes leading to short-term dips, these events can also influence long-term investor behavior and valuations.

-

Technological Advancements and Disruptive Innovation: Rapid technological advancements and disruptive innovation often attract significant investment, leading to higher valuations for companies in these sectors. However, this rapid growth can also lead to overvaluation if not carefully analyzed.

Risks Associated with High Stock Market Valuations

While higher stock prices are generally positive, elevated stock market valuations also present considerable risks for investors. Understanding these risks is crucial for making informed investment decisions.

-

Market Corrections and Crashes: Unsustainable valuations increase the vulnerability of the market to corrections or even crashes. A sudden shift in investor sentiment or an unexpected economic downturn could trigger a sharp decline in prices.

-

Significant Capital Loss: High valuations mean a greater potential for capital loss if the market corrects. Investors who bought at peak valuations could face substantial losses if prices fall.

-

Rising Interest Rates: Rising interest rates generally lead to lower stock valuations as investors shift their investments to higher-yielding bonds. This can impact valuations across the market.

-

Inflation Eroding Returns: High inflation erodes the purchasing power of returns, negating the benefits of higher stock prices. Real returns (adjusted for inflation) become much lower, especially in a high-valuation environment.

-

Increased Competition: In high-growth sectors, increased competition can lead to reduced profit margins and lower future growth, potentially impacting stock valuations.

BofA's Recommendations for Investors

Navigating a market with potentially elevated stock market valuations requires a strategic approach. BofA's recommendations generally emphasize caution and diversification.

-

Diversification Strategies: Diversifying across different asset classes (stocks, bonds, real estate) and sectors is crucial to mitigate risk. Don't put all your eggs in one basket.

-

Sector-Specific Recommendations: BofA's analysts might recommend focusing on undervalued sectors or companies with strong fundamentals and growth potential.

-

Asset Allocation: Adjusting asset allocation based on risk tolerance and investment goals is paramount. A conservative investor might reduce their equity exposure, while a more aggressive investor might maintain a higher allocation.

-

Holding Periods and Risk Tolerance: BofA might advise investors to consider their time horizon and risk tolerance when making investment decisions. Long-term investors might be better positioned to weather market corrections.

-

Active vs. Passive Investing: The choice between active and passive investing depends on individual circumstances and expertise. BofA's recommendations might vary based on investor profiles.

Alternative Investment Strategies to Consider

Given the potential risks associated with high stock market valuations, BofA might suggest exploring alternative investment strategies to diversify portfolios and manage risk.

-

Bonds: Bonds generally offer lower returns but also lower risk compared to stocks. They can provide stability and downside protection in a volatile market.

-

Real Estate: Real estate can provide diversification and inflation hedge, but liquidity can be limited.

-

Commodities: Commodities like gold or oil can act as inflation hedges and diversify portfolios, but their prices can be volatile.

Conclusion

BofA's view on elevated stock market valuations is one of cautious optimism. While they haven't declared a market crash imminent, they emphasize the importance of prudent risk management and diversification. Factors like low interest rates and strong corporate earnings have contributed to high valuations, but rising interest rates, inflation, and geopolitical risks present challenges. BofA’s recommendations generally include diversifying investments across asset classes, carefully evaluating sector-specific risks, and adjusting asset allocation based on risk tolerance and investment horizon. Understanding current stock market valuations is key to making informed investment decisions. While BofA's perspective on stock market valuations provides valuable insight, remember that conducting your own research and seeking professional financial advice is crucial. Stay informed about changes in stock market valuations and adjust your investment strategy accordingly. Understanding current stock market valuations is key to making informed investment decisions.

Featured Posts

-

Meurtre D Federico Aramburu Deux Suspects D Extreme Droite Toujours Recherches

May 20, 2025

Meurtre D Federico Aramburu Deux Suspects D Extreme Droite Toujours Recherches

May 20, 2025 -

Gunners Eye Premier League Star 17 Million Transfer Battle With Liverpool

May 20, 2025

Gunners Eye Premier League Star 17 Million Transfer Battle With Liverpool

May 20, 2025 -

Novost O Vnuke Mikhaelya Shumakhera

May 20, 2025

Novost O Vnuke Mikhaelya Shumakhera

May 20, 2025 -

El Regreso Fallido De Schumacher Un Amigo Revela Una Conversacion Impactante

May 20, 2025

El Regreso Fallido De Schumacher Un Amigo Revela Una Conversacion Impactante

May 20, 2025 -

Solo Travel On A Budget Affordable Adventures Around The World

May 20, 2025

Solo Travel On A Budget Affordable Adventures Around The World

May 20, 2025

Latest Posts

-

Bribery Scandal Retired 4 Star Admiral Found Guilty On Four Counts

May 20, 2025

Bribery Scandal Retired 4 Star Admiral Found Guilty On Four Counts

May 20, 2025 -

Four Bribery Charges Against Retired 4 Star Admiral Result In Guilty Verdict

May 20, 2025

Four Bribery Charges Against Retired 4 Star Admiral Result In Guilty Verdict

May 20, 2025 -

Admirals Bribery Conviction Implications For Navy Culture And Reform

May 20, 2025

Admirals Bribery Conviction Implications For Navy Culture And Reform

May 20, 2025 -

Us Four Star Admiral Found Guilty The Full Story Of Corruption Charges

May 20, 2025

Us Four Star Admiral Found Guilty The Full Story Of Corruption Charges

May 20, 2025 -

Corruption Charges Lead To Conviction Of Retired Four Star Us Admiral

May 20, 2025

Corruption Charges Lead To Conviction Of Retired Four Star Us Admiral

May 20, 2025