Should Investors Worry About Stretched Stock Market Valuations? BofA Weighs In

Table of Contents

BofA's Assessment of Current Stock Market Valuations

Bank of America, a leading financial institution, regularly publishes reports analyzing the stock market's health. Their assessments provide valuable insights into current valuations and potential future market performance. Understanding BofA's Stock Market Outlook is crucial for informed investment decisions. BofA's valuation reports typically incorporate various metrics, including the Price-to-Earnings ratio (P/E), Price-to-Sales ratio (P/S), and the Shiller PE ratio (CAPE), to gauge the market's overall valuation.

- Summary of BofA's overall assessment: BofA's stance on market valuations fluctuates depending on the economic climate. Their reports often express a degree of caution, highlighting the risks associated with elevated valuations while acknowledging the influence of factors like low interest rates and strong corporate earnings. Their precise assessment (bullish, bearish, or neutral) will change based on the time of publication and their most recent findings. Staying updated on their latest publications is essential.

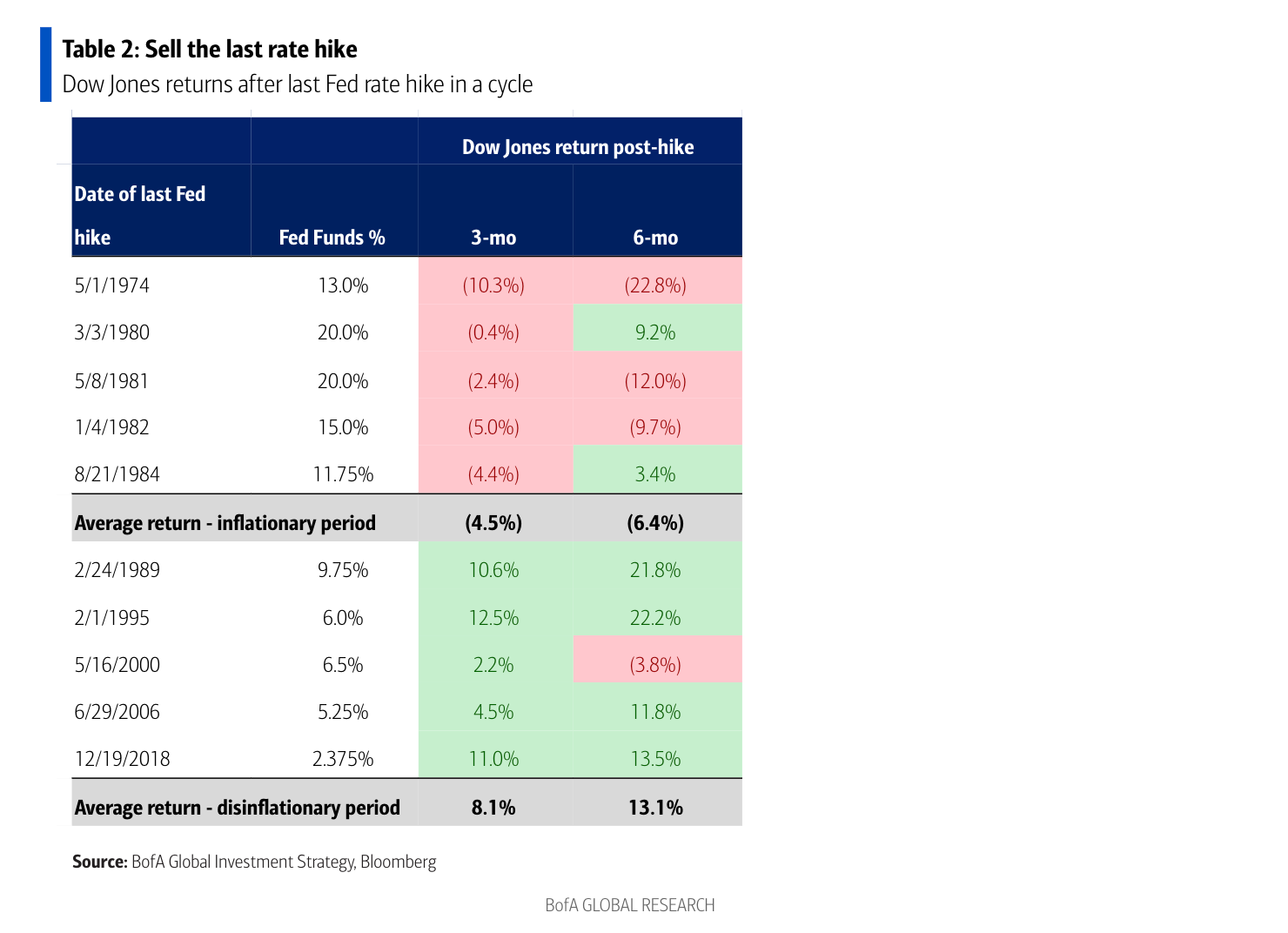

- Key metrics used by BofA to assess valuations: BofA uses a combination of traditional valuation metrics like P/E ratios, P/S ratios, and the CAPE ratio to analyze stocks and sectors. They also consider other factors like growth rates, interest rates, and overall economic conditions. They often use a comparative analysis looking at historical data, industry averages and competitor comparisons.

- Specific sectors or stocks identified as overvalued or undervalued by BofA: BofA's reports typically identify specific sectors or stocks that they deem to be overvalued or undervalued. These assessments are based on their proprietary models and analysis of financial performance, future prospects and the market sentiment surrounding particular companies and sectors. Look for specific mentions within their published reports.

- BofA's predictions regarding future market performance based on valuations: BofA's predictions regarding future market performance vary based on their valuation assessments and the overall economic environment. They generally provide a range of potential outcomes, considering various scenarios and risk factors. Their predictions are not guarantees, but rather informed projections based on their analysis.

Factors Contributing to Stretched Valuations

Several macroeconomic factors contribute to stretched stock market valuations. Understanding these factors is crucial for assessing the sustainability of current market levels and potential risks.

- Impact of low interest rates on investor behavior and stock prices: Low interest rates reduce the attractiveness of traditional fixed-income investments, driving investors towards higher-yielding assets like stocks, pushing valuations up. This is because the return from bonds becomes less competitive.

- Role of quantitative easing in inflating asset prices: Quantitative easing (QE) programs by central banks inject liquidity into the market, increasing the money supply and potentially inflating asset prices, including stocks. Increased money supply with limited supply of quality stocks can lead to price inflation.

- Effect of inflation on company earnings and valuations: Inflation can affect company earnings and valuations differently. While higher prices can boost revenue, it can also increase production costs, impacting profit margins. The impact of inflation on stock valuations depends on a company's ability to pass on increased costs to consumers, and it affects individual companies differently.

- Influence of robust economic growth on investor confidence: Strong economic growth fuels investor confidence, leading to higher demand for stocks and contributing to increased valuations. Confidence in future growth drives investment and speculation.

- Contribution of market speculation and FOMO (fear of missing out) to inflated prices: Market speculation and FOMO can significantly inflate stock prices beyond their fundamental value. This often leads to speculative bubbles which are prone to burst.

The Risk of a Market Correction

High valuations inherently increase the risk of a market correction or even a crash. Understanding this risk is critical for risk management.

- Historical examples of market corrections following periods of high valuations: History is replete with examples of market corrections following periods of elevated valuations. The dot-com bubble of the late 1990s and the 2008 financial crisis serve as stark reminders of the potential for significant market downturns.

- Potential triggers for a market correction: Several events could trigger a market correction, including rising interest rates, an economic slowdown, geopolitical instability, or a significant shift in investor sentiment. These can often be unexpected and unpredictable events.

- Strategies for mitigating risk during periods of high valuations: Several strategies can help mitigate risk during periods of high valuations. These include diversification across asset classes, hedging strategies, and a more defensive investment approach focusing on less volatile stocks with strong fundamentals. A well-diversified portfolio is essential for managing risk.

Investment Strategies in a High-Valuation Environment

Navigating a high-valuation environment requires a carefully crafted investment strategy. This requires evaluating risk tolerance and adjusting investment approach accordingly.

- Considerations for investors with different risk tolerances: Investors with different risk tolerances should adopt different strategies. Conservative investors might prioritize capital preservation and opt for a more defensive approach, while those with higher risk tolerance might consider growth-oriented investments.

- Advantages and disadvantages of different investment strategies in a high-valuation market: Value investing seeks undervalued stocks, while growth investing focuses on companies with high growth potential. Each strategy carries unique risks and rewards in a high-valuation market. Value investing can be safer but might offer less growth potential in a generally high market, while growth investing carries higher risk but could deliver significant returns.

- Importance of due diligence and thorough research before making investment decisions: Thorough research is critical to making informed decisions, regardless of market conditions. Investors should perform due diligence on companies before investing.

- The role of portfolio diversification in managing risk: Diversification remains a cornerstone of risk management. Spreading investments across different asset classes can reduce the impact of a potential market downturn on an individual portfolio.

Conclusion

BofA's analysis of stretched stock market valuations highlights the potential risks associated with current market conditions. While strong corporate earnings and low interest rates have fueled the recent surge, the possibility of a market correction remains a significant concern. Understanding factors contributing to these valuations, including low interest rates and quantitative easing, is critical. The advice provided emphasizes the need for a thoughtful investment strategy tailored to individual risk tolerance. This might involve considering value investing, growth investing, or a defensive approach. Remember, thorough research and portfolio diversification are vital tools for navigating this complex landscape.

While BofA's analysis provides valuable insights, understanding stretched stock market valuations requires ongoing monitoring and a carefully considered investment strategy. Stay informed about market trends and consult with a financial advisor to make informed decisions about your portfolio. Don't hesitate to research further on the topic of stock market valuations and BofA's perspectives.

Featured Posts

-

Significant Changes Announced For Britains Got Talent By Ant And Dec

May 05, 2025

Significant Changes Announced For Britains Got Talent By Ant And Dec

May 05, 2025 -

Fans Stunned By Anna Kendricks Actual Age

May 05, 2025

Fans Stunned By Anna Kendricks Actual Age

May 05, 2025 -

Kanye Wests Wife Bianca Censoris Latest Stunt A Solo Rollerblading Trip In Italy

May 05, 2025

Kanye Wests Wife Bianca Censoris Latest Stunt A Solo Rollerblading Trip In Italy

May 05, 2025 -

Deiveson Figueiredo Vs Cory Sandhagen Ufc Fight Night Predictions And Odds Breakdown

May 05, 2025

Deiveson Figueiredo Vs Cory Sandhagen Ufc Fight Night Predictions And Odds Breakdown

May 05, 2025 -

Christian Horners Prank Max Verstappens Fatherhood Quip

May 05, 2025

Christian Horners Prank Max Verstappens Fatherhood Quip

May 05, 2025

Latest Posts

-

Eksport Trotylu Z Polski Rekordowe Zamowienie I Perspektywy Rynkowe

May 06, 2025

Eksport Trotylu Z Polski Rekordowe Zamowienie I Perspektywy Rynkowe

May 06, 2025 -

Alcoas Halle Bailey Following Moms Softball Legacy In Tennessee

May 06, 2025

Alcoas Halle Bailey Following Moms Softball Legacy In Tennessee

May 06, 2025 -

Trotyl Z Polski Dla Armii Amerykanskiej Szczegoly Kontraktu

May 06, 2025

Trotyl Z Polski Dla Armii Amerykanskiej Szczegoly Kontraktu

May 06, 2025 -

Zamowienie Na Trotyl Z Polski Analiza Rynku I Potencjalnych Dostawcow

May 06, 2025

Zamowienie Na Trotyl Z Polski Analiza Rynku I Potencjalnych Dostawcow

May 06, 2025 -

Umowa Na Dostawe Trotylu Polska Firma I Armia Usa

May 06, 2025

Umowa Na Dostawe Trotylu Polska Firma I Armia Usa

May 06, 2025