Should You Buy Palantir Stock Before May 5? A Pre-Earnings Analysis

Table of Contents

Palantir's Recent Performance and Key Metrics

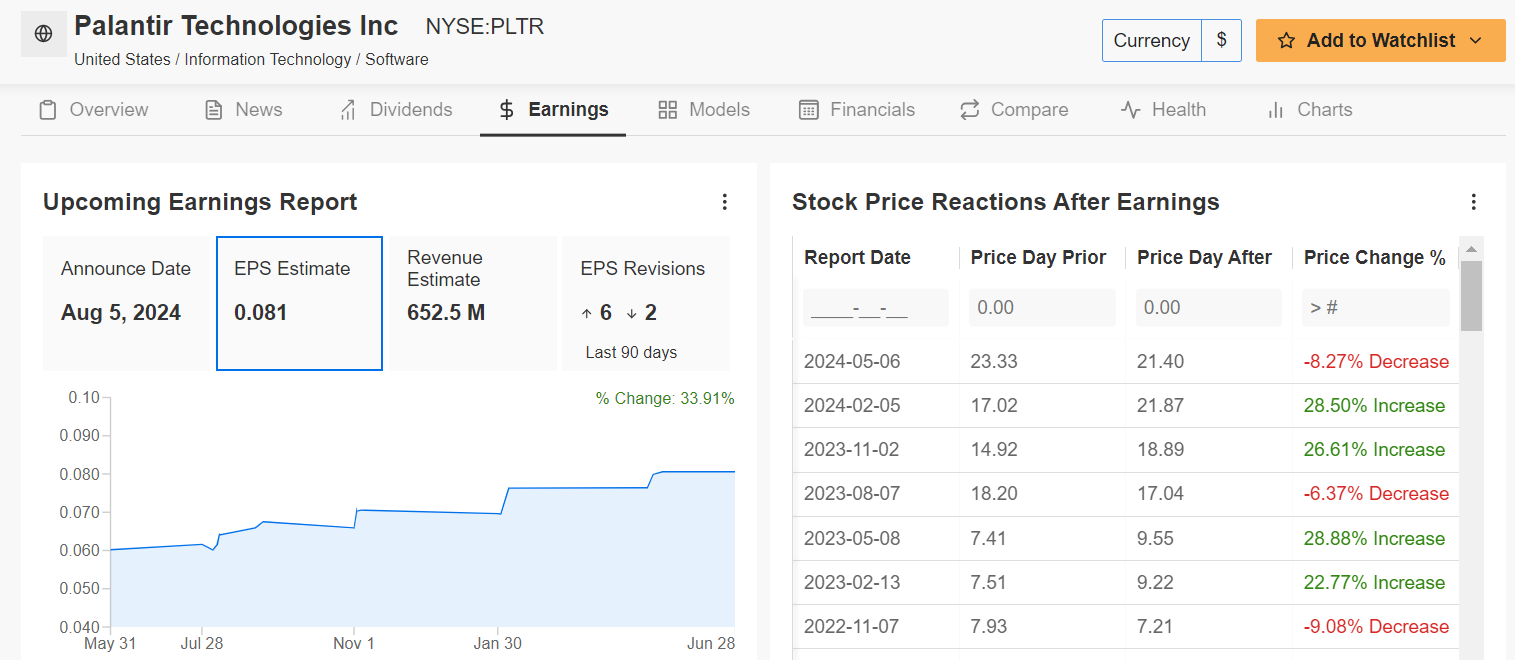

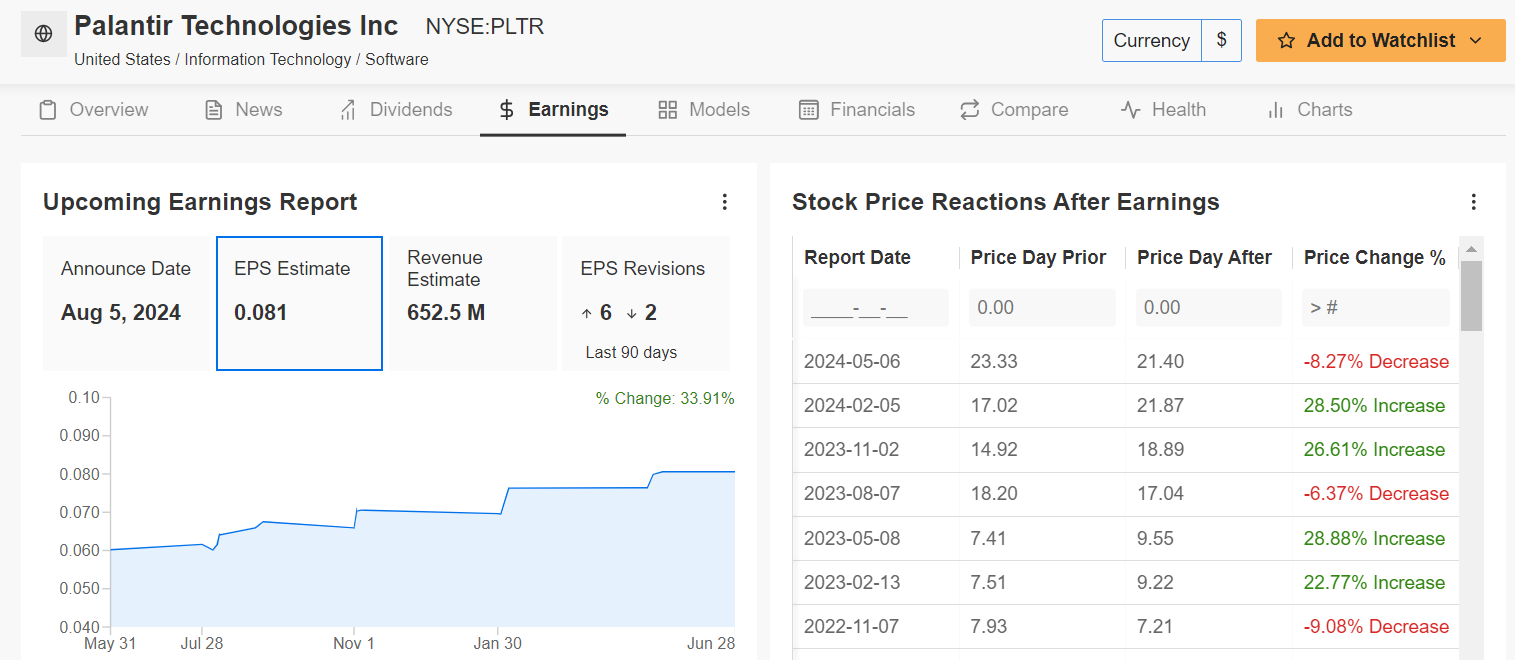

Before deciding whether to buy Palantir stock, it's crucial to analyze its recent performance. Examining key metrics provides valuable insight into the company's health and future prospects. Palantir's revenue growth, profitability, and customer acquisition rates are key indicators to watch. Let's delve into the numbers:

-

Revenue Growth: Analyzing the revenue growth in Q4 2023 compared to Q4 2022 reveals the trajectory of the company's top line. A strong increase suggests robust demand for Palantir's products and services. Conversely, a slowdown could signal potential challenges. (Note: Insert actual data and a chart here once available.)

-

Customer Acquisition and Retention: The number of new customers acquired and the retention rate of existing clients are critical for sustainable growth. A high customer acquisition rate and strong retention indicate a healthy and expanding customer base. (Note: Insert actual data and a chart here once available.)

-

Profitability and Margins: Investors closely examine operating margins and profitability to assess the efficiency and sustainability of Palantir's business model. Improving profit margins indicate better cost management and increased profitability. (Note: Insert actual data and a chart here once available.)

Analyzing Market Sentiment and Analyst Predictions

Understanding the market sentiment surrounding Palantir stock is crucial. Are investors generally bullish or bearish? News articles, social media discussions, and analyst reports provide valuable clues.

-

Market Sentiment: Currently, the market sentiment for Palantir appears to be (insert current sentiment – bullish, bearish, or neutral). This sentiment is likely influenced by factors such as (list key factors, e.g., recent contract wins, competitive landscape, macroeconomic conditions).

-

Analyst Ratings and Price Targets: Analyst ratings and price targets offer a professional perspective on Palantir's future price. The average price target is currently (insert data), which represents (a percentage above or below) the current price. (Insert a table summarizing analyst ratings – buy, hold, sell).

-

Recent News and Events: Any recent news, such as the signing of significant contracts, new partnerships, or regulatory changes, can significantly influence Palantir stock. Keeping abreast of such developments is essential for informed investment decisions.

Potential Risks and Rewards of Investing in Palantir Stock Before Earnings

Investing in Palantir stock, like any investment, carries both risks and rewards. It's crucial to weigh these carefully.

Potential Risks:

- High Stock Volatility: Palantir stock is known for its volatility, meaning the price can fluctuate significantly in short periods.

- Earnings Disappointment: If Palantir's earnings fail to meet market expectations, the stock price could experience a sharp decline.

- Competition: Palantir faces competition from other companies in the big data and AI markets.

- Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts, which can be subject to changes in government policy.

Potential Rewards:

- High Growth Potential: Palantir operates in a rapidly growing market with substantial long-term growth potential.

- Strong Government Contracts: Palantir boasts a strong pipeline of government contracts, providing a stable revenue stream.

- Leading AI Technology: Palantir is a leader in the development and application of artificial intelligence technology.

Alternative Investment Strategies

Considering alternative investment strategies broadens your perspective. Waiting for the earnings report, diversifying your portfolio, or exploring other tech stocks are all viable options.

- Waiting for Earnings: Postponing your investment until after the May 5th earnings announcement minimizes the risk of immediate losses due to negative surprises.

- Portfolio Diversification: Diversifying your investment portfolio reduces risk by spreading your investments across different assets and sectors.

- Other Tech Stocks: Exploring alternative tech stocks with similar growth potential but perhaps lower risk profiles can be a suitable strategy.

Conclusion: Should You Buy Palantir Stock Before May 5th?

Based on this pre-earnings analysis, the decision of whether to buy Palantir stock before May 5th is complex. The potential for high growth is balanced by the considerable risk associated with market volatility and the possibility of earnings disappointment. Weigh the pros and cons carefully. While Palantir’s technology and government contracts present strong arguments, the inherent volatility of the stock demands cautious consideration.

Remember, this is not financial advice. Thorough due diligence is essential before making any investment decisions. After careful consideration of this pre-earnings analysis, make your informed decision about your Palantir investment strategy. Further research into Palantir shares and understanding the broader market context will be critical to your Palantir investment success.

Featured Posts

-

Get Elizabeth Arden Skincare For Less At Walmart

May 09, 2025

Get Elizabeth Arden Skincare For Less At Walmart

May 09, 2025 -

Federal Electoral Boundaries Understanding The Shift In Greater Edmonton

May 09, 2025

Federal Electoral Boundaries Understanding The Shift In Greater Edmonton

May 09, 2025 -

This Weeks Bitcoin Mining Surge Factors Contributing To The Growth

May 09, 2025

This Weeks Bitcoin Mining Surge Factors Contributing To The Growth

May 09, 2025 -

Che Tai Nghiem Khac Doi Voi Hanh Vi Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025

Che Tai Nghiem Khac Doi Voi Hanh Vi Bao Hanh Tre Em Tai Co So Giu Tre

May 09, 2025 -

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 09, 2025

Mariah The Scientists Burning Blue A Highly Anticipated Return

May 09, 2025