Should You Buy Palantir Stock Before May 5th? Wall Street's Surprising Consensus

Table of Contents

Analyzing Palantir's Recent Performance and Future Projections

Q1 2024 Earnings Expectations:

What can we expect from Palantir's Q1 2024 earnings report? Analysts are offering a range of predictions, making it crucial to understand the potential scenarios.

-

Expected Revenue Growth: Estimates vary, with some analysts predicting a substantial increase in revenue compared to the same period last year, while others are more conservative. Factors influencing revenue growth include the continued success of Palantir's Foundry platform and the expansion of its government and commercial contracts.

-

Profitability Forecasts: Profitability is a key metric for investors. Analysts will be keenly watching Palantir's progress towards consistent profitability. Any unexpected deviation from projected margins could significantly impact the Palantir stock price.

-

Key Performance Indicators (KPIs): Beyond revenue and profit, investors should monitor KPIs such as customer acquisition costs, customer churn, and average revenue per user (ARPU). These indicators offer insights into the health and sustainability of Palantir's business model.

-

Potential Surprises: The market is anticipating specific announcements. A positive surprise could involve exceeding revenue projections or demonstrating faster-than-expected growth in a key sector. Negative surprises might include lower-than-expected margins or slower-than-anticipated customer acquisition. Analyst predictions offer a range, but uncertainty always remains.

Long-Term Growth Potential of Palantir's AI and Data Analytics Businesses:

Palantir is well-positioned within the rapidly expanding AI and data analytics market. Their platform offers powerful capabilities for data integration, analysis, and visualization.

-

AI Market Disruption: Palantir's AI-powered solutions are transforming how organizations leverage data. Their focus on large language models and advanced analytics positions them for significant growth in various sectors.

-

Key Partnerships and Contracts: Strategic partnerships and substantial government and commercial contracts demonstrate strong market traction and validate Palantir's technology. Tracking new contract announcements leading up to May 5th will be important.

-

Competitive Advantages: Palantir's unique technology, strong security protocols, and experienced team provide significant competitive advantages in the complex world of data analytics and AI.

-

Government vs. Commercial Contracts: The stability of Palantir's government contracts contrasts with the potential volatility of commercial contracts. Understanding the balance between these sources of revenue is crucial for evaluating the company's overall financial health.

Evaluating the Risks Associated with Investing in Palantir Stock Before May 5th

Volatility Surrounding Earnings Reports:

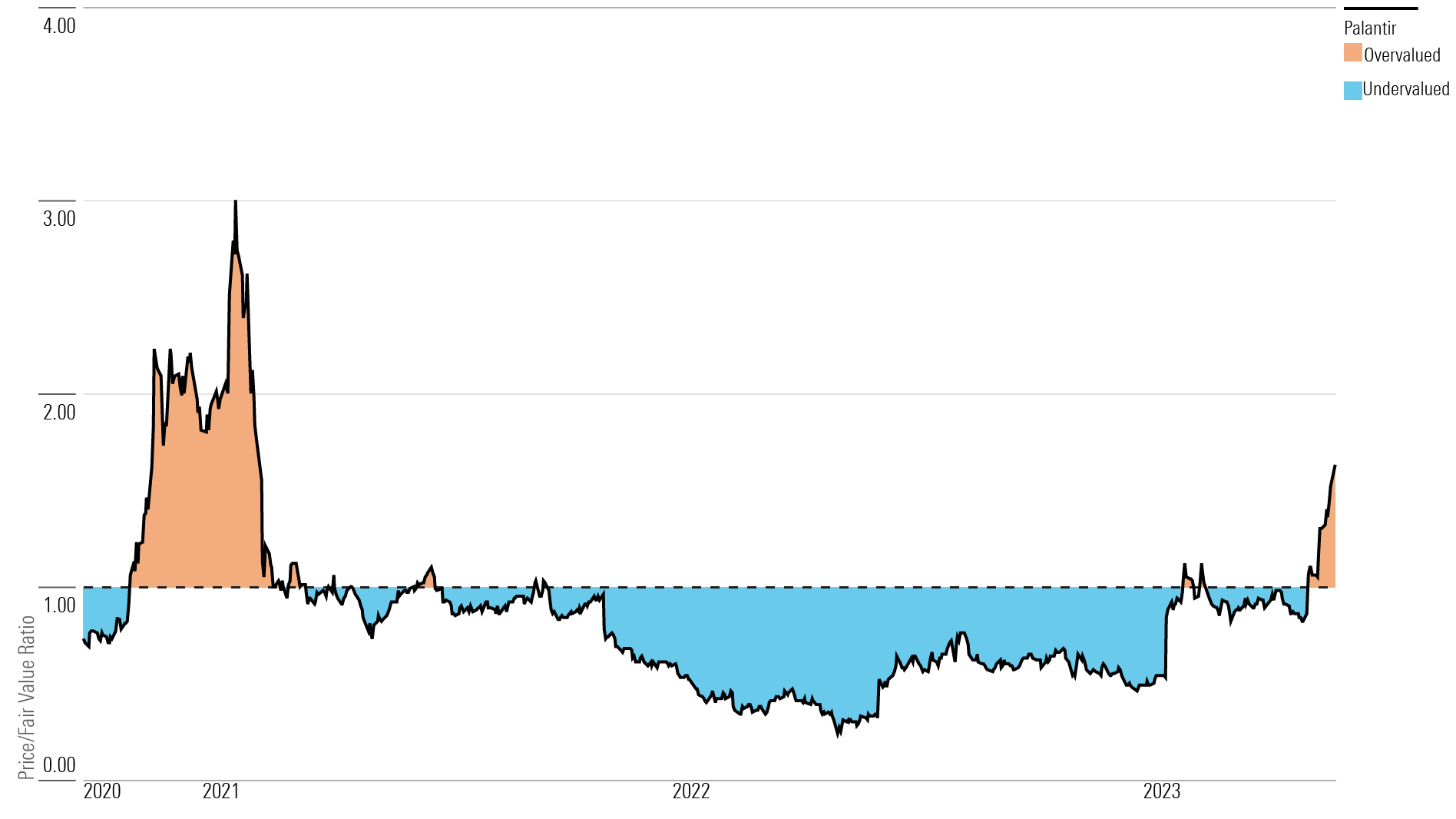

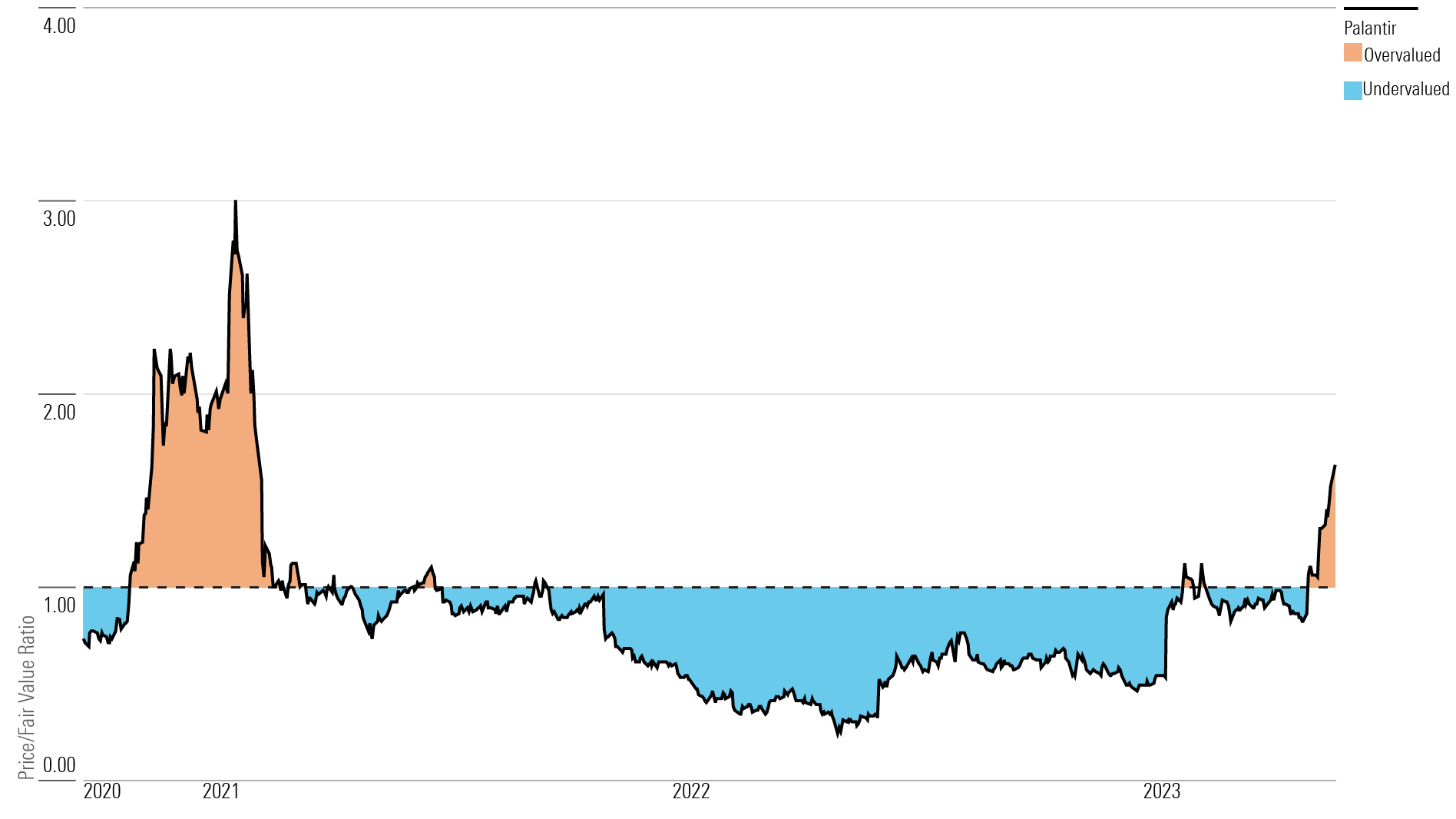

Earnings announcements are typically periods of increased stock price volatility. It's essential to understand and manage this risk.

-

Stock Price Fluctuations: Expect significant price swings around the May 5th announcement. The market will react strongly to both positive and negative surprises.

-

Downside Risks: If Palantir's Q1 2024 earnings fall short of expectations, the stock price could experience a significant drop. Investors need to be prepared for this possibility.

-

Historical Performance: Analyzing how Palantir's stock price has reacted to past earnings reports is valuable for gauging potential volatility.

Geopolitical and Economic Factors Impacting Palantir's Performance:

External factors can significantly impact Palantir's performance and stock price.

-

Government Spending: Changes in government spending, particularly in defense and intelligence sectors, directly affect Palantir's government contracts.

-

Global Economic Conditions: Recessionary pressures could impact both government and commercial spending on data analytics solutions, potentially affecting Palantir's revenue.

-

Market Sentiment: The overall market sentiment towards tech stocks and the broader economy plays a vital role in determining Palantir's stock price.

Considering Alternative Investment Strategies

Dollar-Cost Averaging (DCA) for Palantir Stock:

Dollar-cost averaging is a risk-mitigation strategy that involves investing a fixed amount of money at regular intervals.

-

Benefits of DCA: DCA helps smooth out the impact of market volatility and reduces the risk of buying high and selling low.

-

Implementing DCA for Palantir: Regularly investing in Palantir stock, regardless of short-term price fluctuations, can help mitigate risk.

Diversification within Your Portfolio:

Diversification is a fundamental principle of sound investment management.

-

Minimizing Portfolio Risk: Don't put all your eggs in one basket. Diversify your portfolio across different asset classes and companies to reduce overall risk.

-

Diversification Strategies: Consider investing in other sectors beyond technology, including bonds, real estate, and other stocks to create a well-rounded portfolio.

Conclusion:

The decision of whether to buy Palantir stock before May 5th depends on your risk tolerance, investment timeline, and assessment of the company's potential. While Palantir's future in AI and data analytics is promising, the inherent volatility surrounding earnings reports and external factors should be carefully considered. Remember to thoroughly research and diversify your investment portfolio.

Call to Action: Before making any investment decisions regarding Palantir stock, conduct your own thorough due diligence. Consider the potential rewards and risks associated with investing in Palantir PLTR before the May 5th earnings report, and make informed choices based on your financial goals. Learn more about Palantir's investment opportunities and make a strategic decision about buying Palantir stock today!

Featured Posts

-

More Than The Monkey What To Expect From Stephen Kings 2024 Film Releases

May 09, 2025

More Than The Monkey What To Expect From Stephen Kings 2024 Film Releases

May 09, 2025 -

Solve Nyt Strands Hints For Thursday February 20 Game 354

May 09, 2025

Solve Nyt Strands Hints For Thursday February 20 Game 354

May 09, 2025 -

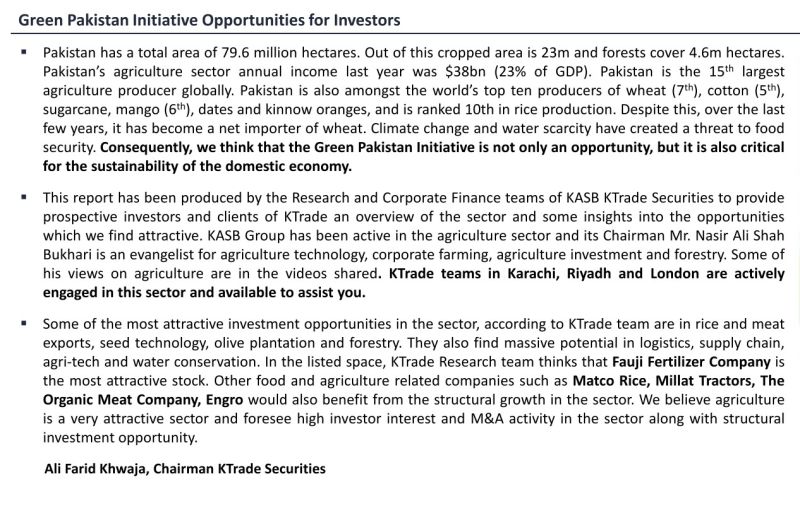

Partnering For Progress Jazz Cash And K Trades Impact On Stock Investment

May 09, 2025

Partnering For Progress Jazz Cash And K Trades Impact On Stock Investment

May 09, 2025 -

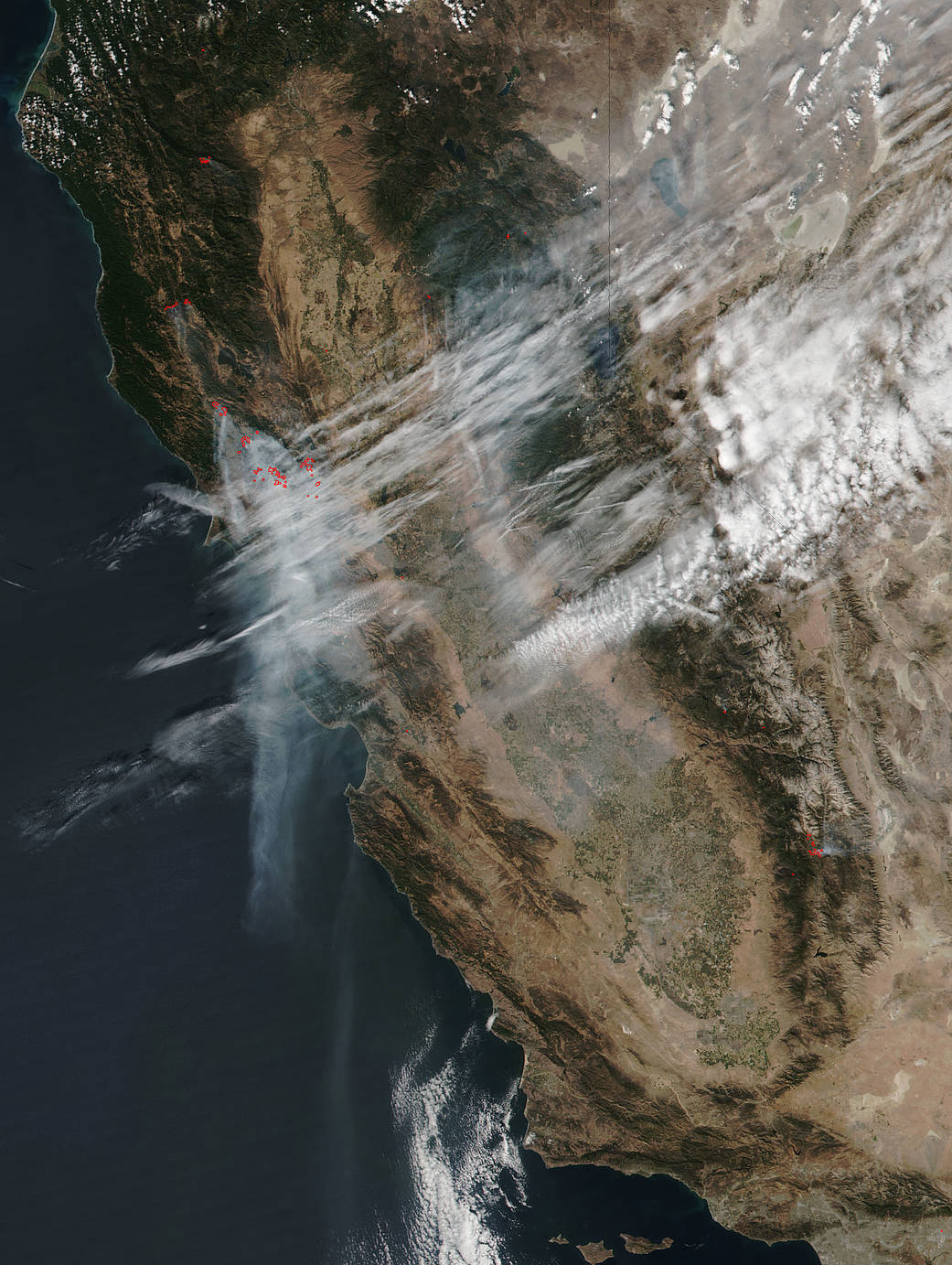

The Los Angeles Wildfires A Reflection Of Societal Trends In Disaster Gambling

May 09, 2025

The Los Angeles Wildfires A Reflection Of Societal Trends In Disaster Gambling

May 09, 2025 -

Sensex And Nifty Current Market Status And Intraday Movement

May 09, 2025

Sensex And Nifty Current Market Status And Intraday Movement

May 09, 2025