Should You Buy Palantir Stock Now? A Pre-May 5th Analysis

Table of Contents

We will delve into Palantir's recent financial performance, analyze market sentiment and analyst ratings, assess potential risks, and briefly compare it to alternative investment opportunities. This comprehensive review aims to provide a clearer picture of Palantir's prospects, empowering you to make an informed decision.

Palantir's Recent Financial Performance and Future Projections

Q1 2024 Earnings Report Analysis (or relevant quarter)

Palantir's Q1 2024 earnings report (or substitute with the appropriate quarter) will be a key factor in determining its future trajectory. We need to analyze the following key metrics:

- Revenue Growth: A significant increase in revenue would signal strong demand for Palantir's data analytics and AI platforms. Look for year-over-year and quarter-over-quarter comparisons.

- Profitability: Examining profitability metrics like gross margin and operating income is crucial for assessing the company's financial health and sustainability. Are they moving in a positive direction?

- Cash Flow: Positive and growing cash flow demonstrates the company's ability to generate funds from its operations, a key indicator of financial strength.

- Key Performance Indicators (KPIs): Analyzing KPIs specific to Palantir's business model, such as customer acquisition costs and contract renewal rates, is vital to understanding its operational efficiency.

Comparison to analyst expectations and previous quarters will highlight the extent to which Palantir exceeded or underperformed. Any significant announcements regarding new contracts, partnerships, or product launches will also play a crucial role in shaping the investment outlook.

Long-Term Growth Potential

Palantir operates in the rapidly growing big data and artificial intelligence sectors, presenting significant long-term growth opportunities. Several factors contribute to its potential:

- Market Position: Palantir holds a strong position in government contracting and is increasingly expanding into the commercial sector. Analyzing its market share and competitive landscape is essential.

- Strategic Partnerships: Collaborations with other technology companies can significantly expand Palantir's reach and capabilities. Keep an eye on new partnerships and their potential impact.

- Future Revenue Streams: Identifying emerging revenue streams, such as new product offerings or expansion into new markets, is important for assessing its future growth potential.

- Technological Advancements: The impact of emerging technologies like generative AI on Palantir's products and services will play a crucial role in its long-term growth prospects.

Market Sentiment and Analyst Ratings

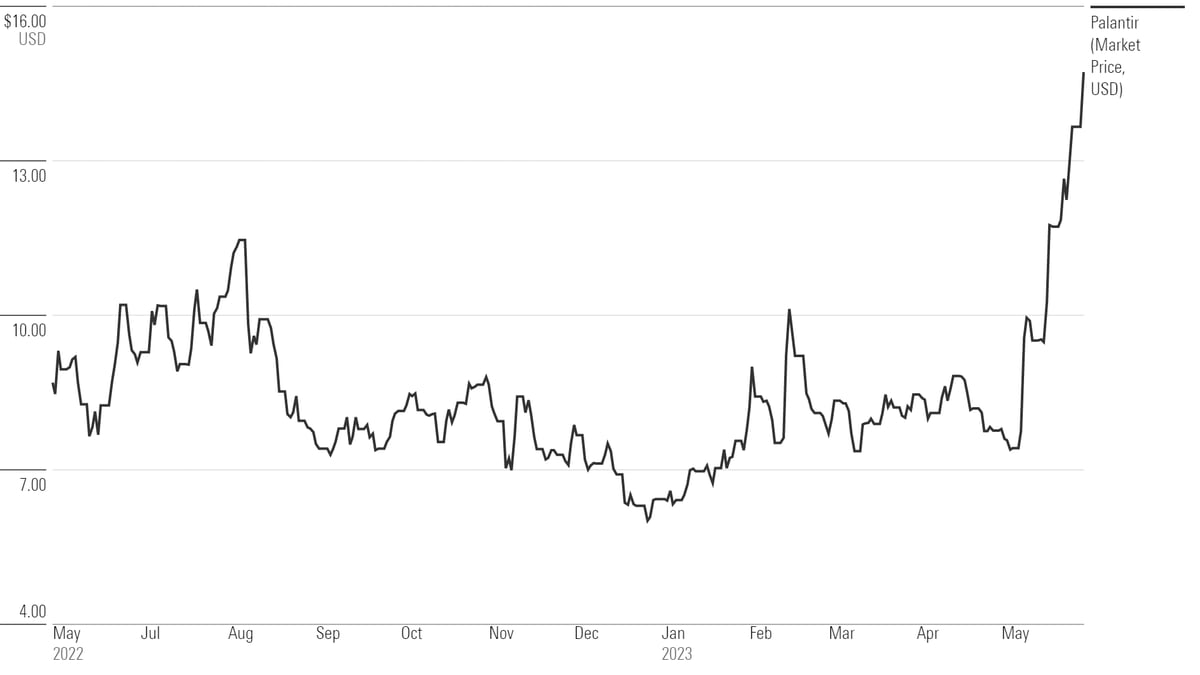

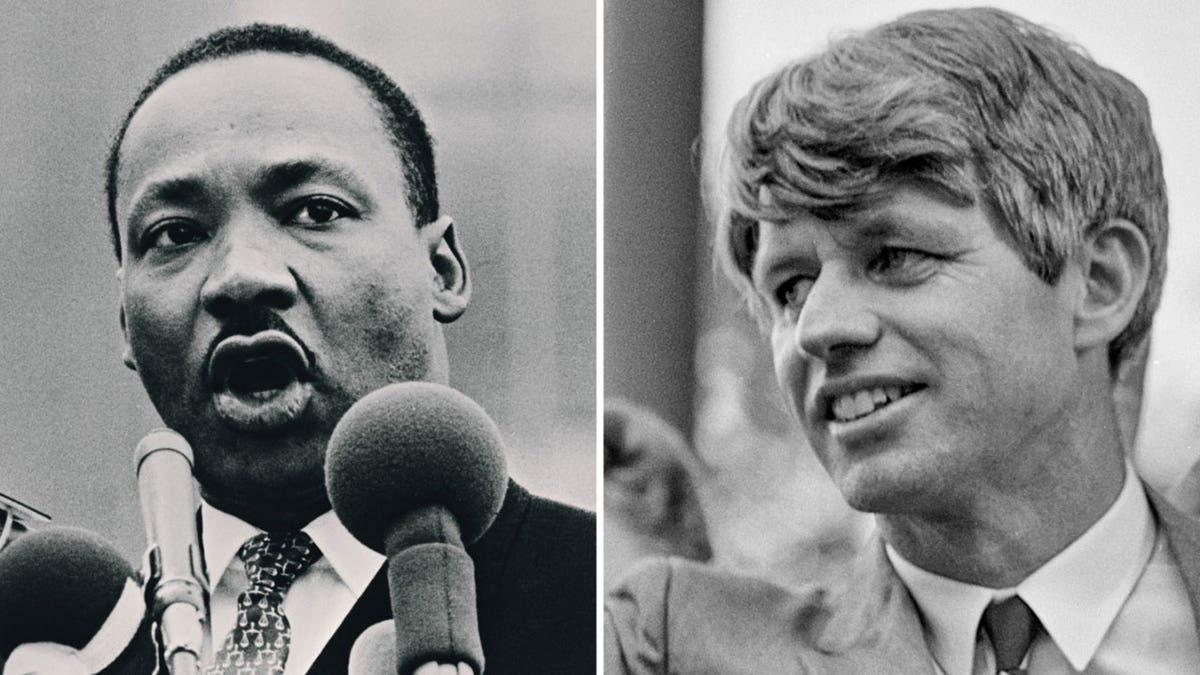

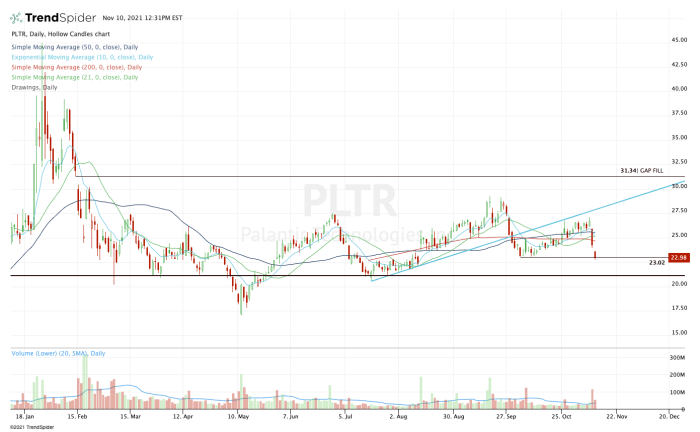

Current Stock Price and Trading Volume

Analyzing Palantir's recent stock price fluctuations and trading volume provides insights into current market sentiment.

- Price Fluctuations: Sharp increases or decreases in the stock price indicate significant market shifts in perception.

- Trading Volume: High trading volume might suggest strong investor interest, while low volume could indicate a lack of significant buying or selling pressure.

- Price Targets: Analysts' price targets offer a perspective on the potential future value of the stock, although it's crucial to remember these are just predictions.

Analyst Ratings and Recommendations

Analyst ratings (buy, hold, sell) offer a collective view of the market's perception of Palantir.

- Rating Summary: A summary of recent ratings provides a general sentiment, but it is important to critically examine individual analyst reports.

- Rationale: Understanding the reasoning behind these ratings—the factors influencing analysts' opinions—is crucial for informed decision-making.

- Overall Sentiment: The general market sentiment towards Palantir, positive or negative, significantly impacts its stock price.

Risks and Challenges Facing Palantir

Palantir faces several potential risks:

- Competition: The data analytics and AI market is highly competitive, with established players and new entrants constantly vying for market share.

- Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts, making it vulnerable to changes in government spending.

- Economic Downturn: Economic downturns can reduce demand for Palantir's services, particularly in the commercial sector.

- Technological Disruption: Rapid technological advancements can quickly render existing products obsolete, requiring constant innovation and adaptation.

Analyzing Palantir's strategies to mitigate these risks is crucial before investing.

Alternative Investment Opportunities

While this article focuses on Palantir, briefly comparing it to competitors like Databricks, Snowflake, or similar companies in the data analytics and AI sector provides context. This comparison should highlight Palantir's strengths and weaknesses relative to its peers, helping you assess its relative attractiveness as an investment. However, remember this is not a deep dive into these alternatives.

Conclusion: Should You Buy Palantir Stock Now? A Final Verdict (Pre-May 5th)

Our pre-May 5th analysis of Palantir reveals a mixed picture. While the company operates in a high-growth sector and possesses strong technology, it faces significant risks, including competition and dependence on government contracts. The Q1 2024 earnings report (or relevant quarter) and market sentiment surrounding the period leading up to May 5th will be critical in determining the future trajectory of the stock.

Based on the information analyzed, a final recommendation requires a careful weighing of the potential rewards against the inherent risks. Investors should consider their own risk tolerance and investment goals before making a decision. Remember, this is not financial advice, and independent research is crucial.

What are your thoughts on buying Palantir stock? Share your Palantir investment strategy! Is Palantir a good long-term stock investment for you? Let's discuss in the comments!

Featured Posts

-

Numerous Car Break Ins Reported At Elizabeth City Apartment Complexes

May 10, 2025

Numerous Car Break Ins Reported At Elizabeth City Apartment Complexes

May 10, 2025 -

Pam Bondis Upcoming Release Documents On Epstein Diddy Jfk And Mlk

May 10, 2025

Pam Bondis Upcoming Release Documents On Epstein Diddy Jfk And Mlk

May 10, 2025 -

Accessible Stock Investing The Impact Of The Jazz Cash And K Trade Collaboration

May 10, 2025

Accessible Stock Investing The Impact Of The Jazz Cash And K Trade Collaboration

May 10, 2025 -

Is Palantir Stock A Good Investment Before Its May 5th Earnings Release

May 10, 2025

Is Palantir Stock A Good Investment Before Its May 5th Earnings Release

May 10, 2025 -

The Jeanine Pirro Appointment Controversy Alcohol And The Us Attorney Role

May 10, 2025

The Jeanine Pirro Appointment Controversy Alcohol And The Us Attorney Role

May 10, 2025