Should You Buy The Dip? Entertainment Stock Analysis

Table of Contents

Understanding the Current Entertainment Market Landscape

The entertainment industry, encompassing film, television, gaming, music, and more, is a dynamic landscape constantly evolving. Current trends significantly impact the performance of entertainment stocks. The "streaming wars" continue to reshape the television and film industries, with established players and new entrants vying for market share. This competition affects profitability and stock prices. Box office performance remains a key indicator of success for film studios, but the impact of streaming releases and changing consumer habits is undeniable.

Meanwhile, the gaming and esports markets exhibit robust growth, attracting significant investment and creating new opportunities for investors. Global events, from economic downturns to geopolitical instability, also significantly influence entertainment consumption patterns. For example, a global pandemic can boost demand for streaming services while simultaneously hurting box office revenues. Let's examine some key aspects:

- Impact of streaming services on traditional media: The rise of Netflix, Disney+, HBO Max, and other streaming platforms has disrupted traditional television and film distribution models. This has led to both opportunities and challenges for established media companies.

- Growth of the gaming and esports markets: The gaming industry is booming, driven by the increasing popularity of esports and mobile gaming. This presents exciting investment opportunities, but also increased competition and rapid technological changes.

- The influence of global events on entertainment consumption: Economic conditions, political instability, and global crises can dramatically impact consumer spending on entertainment.

- Analysis of recent box office successes and failures: Examining recent box office numbers reveals trends in audience preferences and the financial success of different film genres and studios.

- Emerging technologies (VR, AR) and their effect on the industry: Virtual Reality (VR) and Augmented Reality (AR) technologies are poised to revolutionize the entertainment experience, creating new investment possibilities and challenges.

Identifying Potential "Dips" in Entertainment Stocks

A "dip" in the context of stock market analysis refers to a temporary decline in a stock's price, often caused by short-term market fluctuations or company-specific news. Identifying undervalued entertainment stocks requires a thorough understanding of both fundamental and technical analysis.

- Analyzing stock price charts and historical data: Studying stock price charts helps to identify trends and potential support levels, offering clues to when a stock might be undervalued.

- Understanding fundamental analysis (revenue, earnings, debt): Fundamental analysis involves examining a company's financial health, evaluating revenue streams, profitability, and debt levels. A strong financial foundation can indicate resilience during a dip.

- Using technical analysis indicators (moving averages, RSI): Technical indicators like moving averages and the Relative Strength Index (RSI) can provide signals of potential buying opportunities during price corrections.

- Comparing stock performance to industry benchmarks: Comparing a stock's performance against its industry peers helps determine if the dip is company-specific or a broader market trend.

- Recognizing temporary setbacks versus long-term trends: It's crucial to differentiate between temporary market fluctuations and long-term negative trends affecting a company's prospects.

Assessing the Risks of Buying the Dip in Entertainment Stocks

Entertainment stocks are inherently volatile due to the cyclical nature of the industry and the influence of consumer preferences. Several risks should be carefully considered before buying the dip:

- Risk of further price declines: Even after a dip, a stock's price can continue to fall, leading to potential losses.

- Impact of changing consumer preferences: Shifts in entertainment consumption patterns (e.g., a decline in movie-going) can severely impact a company's performance.

- Competition within the entertainment industry: The entertainment industry is highly competitive, and a company's failure to adapt can result in significant financial setbacks.

- Economic factors (recessions, inflation): Economic downturns can lead to decreased consumer spending on entertainment, negatively affecting stock prices.

- Geopolitical risks and their influence: Global events can create uncertainty and volatility in the entertainment stock market.

Strategies for Investing in Entertainment Stocks During a Dip

Managing the risk associated with buying the dip requires a well-defined investment strategy. Diversification and strategic approaches can mitigate potential losses.

- Diversifying across different entertainment sectors: Spreading investments across various entertainment sectors (film, television, gaming, music) reduces reliance on the performance of a single sector.

- Investing in established companies versus high-growth startups: Established companies often exhibit greater stability during market downturns, although they might offer lower growth potential than high-growth startups.

- Employing a dollar-cost averaging strategy: This involves investing a fixed amount of money at regular intervals, regardless of the stock price, reducing the impact of market volatility.

- Setting stop-loss orders to limit potential losses: A stop-loss order automatically sells a stock when it reaches a predetermined price, limiting potential losses.

- Long-term investment horizon versus short-term trading: A long-term investment approach can help weather short-term market fluctuations and benefit from the long-term growth potential of the entertainment industry.

Conclusion

Deciding whether to buy the dip in entertainment stocks requires careful consideration of the current market landscape, potential risks, and your personal investment goals. Thorough research, including both fundamental and technical analysis, is crucial. Understanding the inherent volatility of the entertainment industry is paramount.

Before making any investment decisions regarding an entertainment stock dip, conduct thorough due diligence. Understand the inherent risks and potential rewards. Carefully consider your investment strategy and risk tolerance when analyzing opportunities in the entertainment stock market. Remember, timing the market is difficult, and professional advice should be sought if needed. Continue your research into entertainment stock dips to make the best choices for your portfolio.

Featured Posts

-

Your Guide To The Air Jordan Sneakers Releasing In June 2025

May 29, 2025

Your Guide To The Air Jordan Sneakers Releasing In June 2025

May 29, 2025 -

Male Escorts Apology To Cassie Following Diddy Sex Party Allegations

May 29, 2025

Male Escorts Apology To Cassie Following Diddy Sex Party Allegations

May 29, 2025 -

The Wealth Of Bryan Cranston Projections For 2025

May 29, 2025

The Wealth Of Bryan Cranston Projections For 2025

May 29, 2025 -

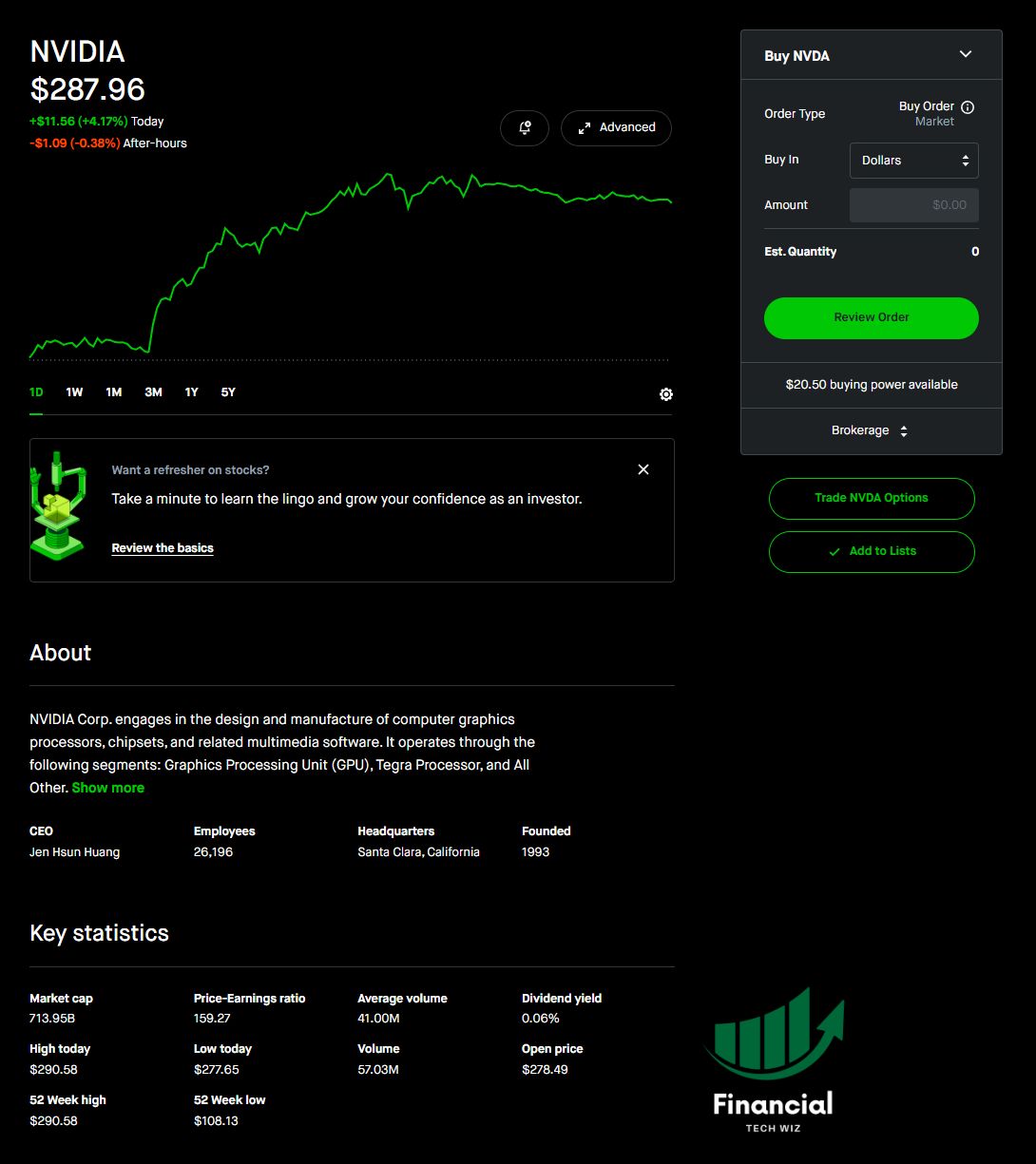

Uk Traders Now Have Access To Robinhoods Desktop Platform

May 29, 2025

Uk Traders Now Have Access To Robinhoods Desktop Platform

May 29, 2025 -

New Malware Threat Arcane Infostealer Infects You Tube And Discord Users

May 29, 2025

New Malware Threat Arcane Infostealer Infects You Tube And Discord Users

May 29, 2025

Latest Posts

-

Taylor Swift Fans Ticketmaster Reveals Your Place In The Queue

May 30, 2025

Taylor Swift Fans Ticketmaster Reveals Your Place In The Queue

May 30, 2025 -

Axe Ceremonia 2025 Cancelado Reclama Tu Reembolso En Ticketmaster

May 30, 2025

Axe Ceremonia 2025 Cancelado Reclama Tu Reembolso En Ticketmaster

May 30, 2025 -

Kee Summer Concert Series Lineup And Schedule For Victoria Day Weekend In Bala

May 30, 2025

Kee Summer Concert Series Lineup And Schedule For Victoria Day Weekend In Bala

May 30, 2025 -

Donald Trump Busca Frenar Ticketmaster Orden Ejecutiva Contra La Reventa De Boletos

May 30, 2025

Donald Trump Busca Frenar Ticketmaster Orden Ejecutiva Contra La Reventa De Boletos

May 30, 2025 -

Taylor Swift Ticketmaster Update Find Your Spot In Line

May 30, 2025

Taylor Swift Ticketmaster Update Find Your Spot In Line

May 30, 2025