Should You Buy XRP After Its 400% Price Jump? A Detailed Look

Table of Contents

Understanding the Recent XRP Price Surge

The meteoric rise in XRP's price wasn't a random event; several factors contributed to this significant jump. Let's break down the key influences.

The Ripple Lawsuit's Influence

The Ripple vs. SEC lawsuit ruling had a monumental impact on XRP's price. The partial victory for Ripple significantly shifted market sentiment.

- Summary of the court decision: The court ruled that XRP sales on exchanges did not constitute unregistered securities offerings.

- Positive market sentiment following the ruling: This decision removed a significant overhang of uncertainty, boosting investor confidence.

- Impact on investor confidence: The clarity provided by the ruling encouraged both institutional and retail investors to re-evaluate their XRP holdings and potentially increase their positions.

The ruling effectively removed a major regulatory hurdle, paving the way for increased adoption and potentially unlocking significant value for XRP holders. This positive news sparked a wave of buying pressure, propelling the price upwards.

Market Sentiment and Speculation

Beyond the legal victory, market sentiment and speculation played a crucial role in driving XRP's price increase.

- FOMO (fear of missing out): As the price climbed, many investors feared missing out on potential gains, leading to increased buying pressure.

- Social media hype: Social media platforms amplified the news, further fueling the price surge through discussions and influencer endorsements.

- General cryptocurrency market trends: The overall positive sentiment in the broader cryptocurrency market also contributed to XRP's price appreciation.

The confluence of positive news, social media hype, and broader market trends created a perfect storm, significantly boosting demand for XRP.

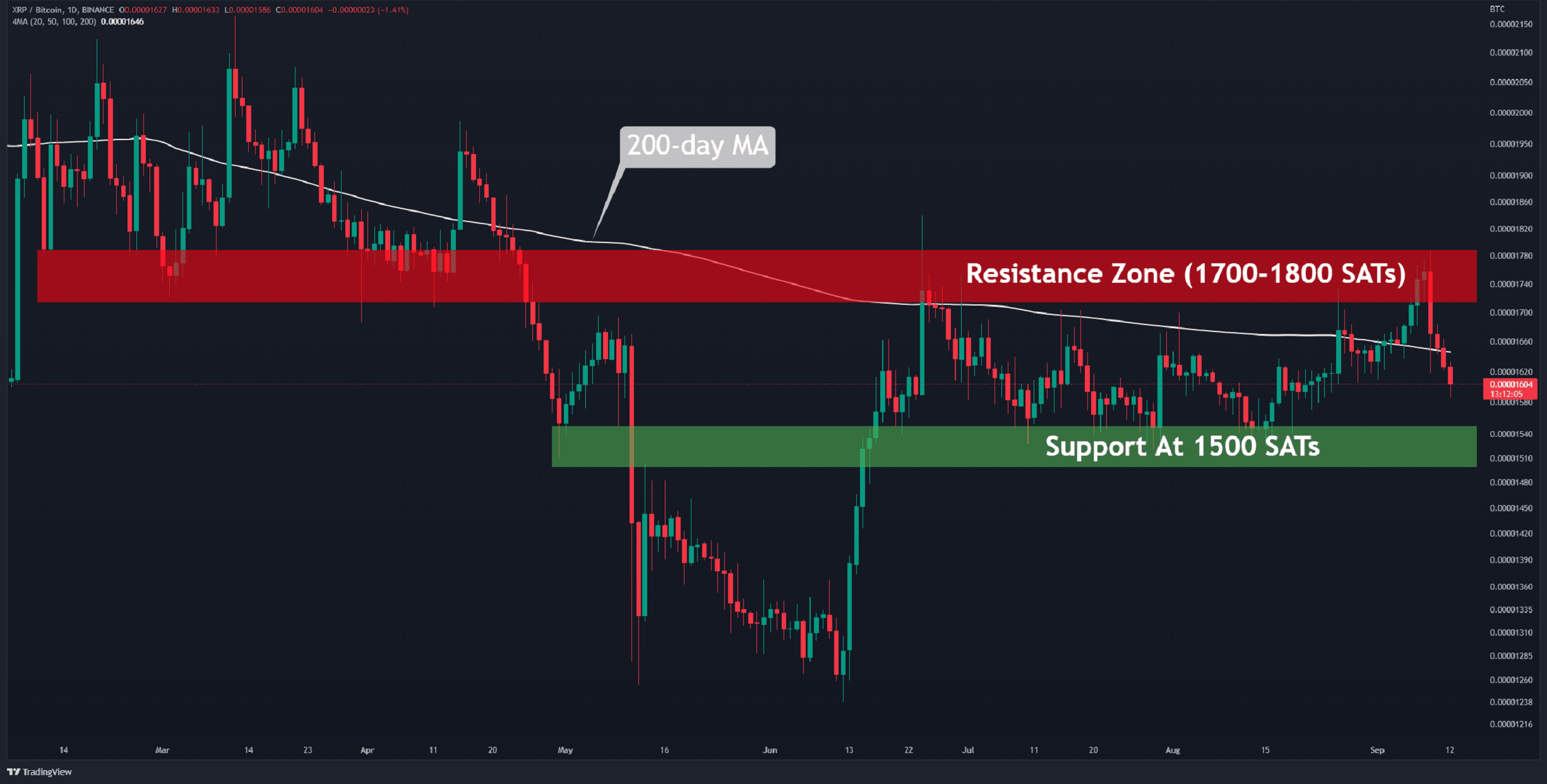

Technical Analysis of XRP's Chart

Technical analysis offers another perspective on XRP's price movement. While not a perfect predictor, examining chart patterns and key indicators can provide valuable insights.

- Key indicators used: Analysts may consider indicators like moving averages, relative strength index (RSI), and volume to gauge momentum and potential support/resistance levels.

- Important price levels to watch: Identifying key support and resistance levels helps to predict potential price reversals or continued upward momentum.

Technical analysis can help in understanding potential price trends but should be used in conjunction with fundamental analysis for a more comprehensive perspective. It's crucial to remember that technical analysis is not foolproof and should not be the sole basis for investment decisions.

Assessing the Risks of Investing in XRP Now

While the recent price surge is encouraging, it's crucial to acknowledge the inherent risks associated with investing in XRP, especially after such a dramatic price increase.

Volatility and Price Corrections

Cryptocurrencies are notoriously volatile, and XRP is no exception. The potential for significant price corrections remains a major risk.

- Risk of losing your investment: Investing in XRP involves the risk of losing a portion or all of your investment.

- Potential for sharp price corrections: The 400% increase could be followed by a significant pullback as the market consolidates.

Understanding and managing risk is crucial; only invest what you can afford to lose.

Regulatory Uncertainty (Lingering Concerns)

Although the Ripple lawsuit brought some clarity, regulatory uncertainty still persists.

- Remaining regulatory challenges: The legal landscape for cryptocurrencies remains complex and ever-evolving.

- Potential for future legal battles: Further regulatory actions or legal challenges could negatively impact XRP's price.

Investors need to remain aware of potential regulatory developments that could affect XRP's future.

Competition in the Cryptocurrency Market

XRP faces stiff competition in the ever-expanding cryptocurrency market.

- Competing cryptocurrencies: Numerous other cryptocurrencies offer similar functionalities or advantages.

- Technological advancements: Constant technological advancements in the blockchain space pose a challenge to existing projects.

The competitive landscape requires careful consideration, as newer, more innovative projects could potentially erode XRP's market share.

Strategies for Investing in XRP (If You Choose To)

If, after careful consideration of the risks, you decide to invest in XRP, employing sound investment strategies can help mitigate potential losses.

Dollar-Cost Averaging (DCA)

Dollar-cost averaging (DCA) is a strategy that involves investing a fixed amount of money at regular intervals, regardless of price fluctuations.

- Define DCA: It's a risk-mitigation technique that reduces the impact of volatility.

- Advantages in volatile markets: DCA helps to average out the purchase price, reducing the risk of buying at a market peak.

For example, investing $100 per week in XRP, regardless of price, reduces the impact of significant price swings.

Diversification

Diversification is a fundamental principle of sound investment. Don't put all your eggs in one basket.

- Benefits of diversification: Spreading your investments across different asset classes reduces overall portfolio risk.

- Examples of other crypto assets: Consider diversifying your portfolio with other cryptocurrencies, stocks, bonds, or other assets.

Diversification helps to cushion the blow of potential losses in any single asset.

Risk Tolerance and Investment Goals

Before investing in XRP, or any cryptocurrency, honestly assess your risk tolerance and investment goals.

- Assess your own risk appetite: Are you comfortable with potentially losing a significant portion of your investment?

- Define your investment goals: What are your financial objectives, and how does XRP fit into your overall investment strategy?

Matching your investment strategy to your risk tolerance and goals is crucial for long-term success.

Conclusion

The recent 400% price jump in XRP is undeniably exciting, driven by factors including the Ripple lawsuit outcome, positive market sentiment, and speculation. However, it's crucial to remember the inherent volatility and risks associated with cryptocurrency investments. Before considering whether to buy XRP, carefully weigh the potential rewards against the considerable risks, including price corrections, regulatory uncertainty, and competition. Employ strategies like dollar-cost averaging and diversification to mitigate your risk. Remember to assess your own risk tolerance and investment goals before making any investment decisions. This analysis is for informational purposes only and not financial advice. Do your own research before making any investment decisions related to XRP or any other cryptocurrency.

Featured Posts

-

Dhk Wrqs Wghnae Wyl Smyth Yhtfl Beyd Mylad Jaky Shan

May 07, 2025

Dhk Wrqs Wghnae Wyl Smyth Yhtfl Beyd Mylad Jaky Shan

May 07, 2025 -

Lewis Capaldis Album Extends Winning Streak Continued Success Story

May 07, 2025

Lewis Capaldis Album Extends Winning Streak Continued Success Story

May 07, 2025 -

Graduacion De Paises Menos Adelantados Lecciones Del Caso De Ca

May 07, 2025

Graduacion De Paises Menos Adelantados Lecciones Del Caso De Ca

May 07, 2025 -

Fotosessiya Rianny Rozovoe Kruzhevo I Soblazn

May 07, 2025

Fotosessiya Rianny Rozovoe Kruzhevo I Soblazn

May 07, 2025 -

The Karate Kids Influence On Popular Culture And Martial Arts

May 07, 2025

The Karate Kids Influence On Popular Culture And Martial Arts

May 07, 2025

Latest Posts

-

Oscars Historys Greatest Snubs Films And Actors Overlooked By The Academy

May 08, 2025

Oscars Historys Greatest Snubs Films And Actors Overlooked By The Academy

May 08, 2025 -

The Biggest Oscars Snubs Of All Time A Look Back At Hollywoods Biggest Misses

May 08, 2025

The Biggest Oscars Snubs Of All Time A Look Back At Hollywoods Biggest Misses

May 08, 2025 -

Analyzing Matt Damons Career Through Ben Afflecks Lens

May 08, 2025

Analyzing Matt Damons Career Through Ben Afflecks Lens

May 08, 2025 -

Matt Damons Role Selection Strategy Ben Afflecks Observation

May 08, 2025

Matt Damons Role Selection Strategy Ben Afflecks Observation

May 08, 2025 -

Ben Affleck Matt Damons Calculated Success In Film

May 08, 2025

Ben Affleck Matt Damons Calculated Success In Film

May 08, 2025