Should You Invest In Ripple (XRP) While It's Trading Below $3?

Table of Contents

The cryptocurrency market is notoriously volatile, and Ripple (XRP), currently trading below $3, is no exception. This article tackles the crucial question: should you invest in Ripple (XRP) while it sits at this price point? We'll delve into Ripple's technology, its ongoing legal battle, market conditions, and the potential risks and rewards to help you make an informed decision. We'll present a balanced perspective, weighing the pros and cons to help you navigate this complex investment landscape.

Understanding Ripple (XRP) and its Potential:

Ripple's Technology and Functionality:

The XRP Ledger is a distributed, open-source, permissionless blockchain designed for fast and efficient transactions. Its unique features include:

- Speed: XRP transactions are significantly faster than many other cryptocurrencies, often settling in a matter of seconds.

- Low Cost: Transaction fees on the XRP Ledger are incredibly low, making it a cost-effective solution for cross-border payments.

- Scalability: The XRP Ledger can handle a high volume of transactions, making it suitable for large-scale applications.

- DeFi Integration: XRP is increasingly integrated into decentralized finance (DeFi) applications, broadening its use cases beyond traditional payments.

Ripple's technology positions it as a strong competitor in the remittance market, offering a faster and cheaper alternative to traditional banking systems. Keywords: XRP Ledger, cross-border payments, scalability, DeFi, remittance.

Ripple's Partnerships and Adoption:

RippleNet, Ripple's payment network, boasts a growing list of partnerships with major financial institutions globally. This widespread adoption significantly impacts XRP's value and potential for future growth. Examples include:

- Several major banks utilize RippleNet for cross-border transactions, streamlining processes and reducing costs.

- Payment providers are increasingly integrating XRP into their platforms to offer faster and more efficient payment services.

- Geographical expansion of RippleNet continues, bringing its services to new markets and expanding its user base.

The increasing number of partnerships and global adoption are key indicators of Ripple's potential for long-term growth. Keywords: RippleNet, financial institutions, global adoption, partnerships.

The SEC Lawsuit and its Impact:

The ongoing legal battle between Ripple and the Securities and Exchange Commission (SEC) significantly impacts investor sentiment and XRP's price. The SEC alleges that XRP is an unregistered security, while Ripple argues that it's a currency.

- The outcome of the lawsuit remains uncertain, creating regulatory uncertainty around XRP.

- A favorable ruling could lead to a significant price surge, while an unfavorable outcome could result in further price decline.

- The legal battle highlights the risks associated with investing in cryptocurrencies, especially those facing regulatory scrutiny.

Understanding the complexities of this lawsuit is crucial for any investor considering XRP. Keywords: SEC lawsuit, Ripple vs SEC, regulatory uncertainty, legal battle.

Analyzing the Current Market Conditions for XRP:

Technical Analysis of XRP's Price:

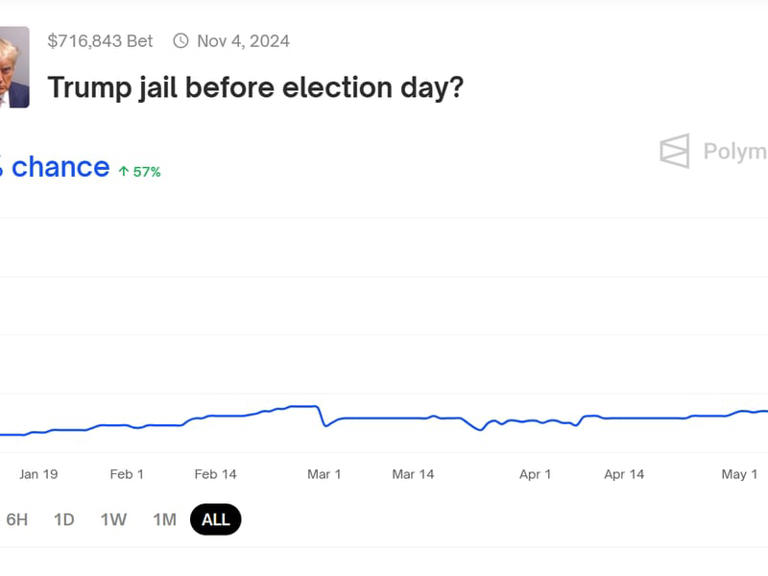

Analyzing XRP's price charts reveals key support and resistance levels, providing insights into potential future price movements. [Insert chart or graph illustrating recent XRP price trends].

- Identifying key support and resistance levels is crucial for predicting potential price reversals or breakouts.

- Monitoring relevant technical indicators (e.g., RSI, MACD) can provide additional insights into market sentiment and momentum.

- However, technical analysis alone shouldn't be the sole basis for investment decisions.

Keywords: XRP price prediction, technical analysis, support levels, resistance levels, price chart.

Fundamental Analysis of Ripple's Value:

A fundamental analysis of Ripple considers factors beyond its price, examining its market capitalization, circulating supply, and overall growth potential.

- Comparing XRP's market capitalization and circulating supply to other cryptocurrencies provides context for its valuation.

- Factors driving future growth include increased adoption by financial institutions, technological advancements, and a positive resolution to the SEC lawsuit.

- A holistic fundamental analysis is essential for assessing the long-term value proposition of XRP.

Keywords: market capitalization, circulating supply, fundamental analysis, XRP valuation.

Assessing the Risks and Rewards of Investing in XRP Below $3:

Potential Rewards:

Investing in XRP at its current price below $3 offers the potential for significant returns if the price appreciates.

- Various price appreciation scenarios can be modeled based on different assumptions about adoption, regulation, and market conditions.

- Calculating potential ROI (Return on Investment) helps quantify the potential gains.

- However, it's crucial to remember that these are just potential scenarios, and actual returns may vary significantly.

Keywords: XRP investment, ROI, return on investment.

Potential Risks:

Investing in XRP involves substantial risks, including:

- Volatility: Cryptocurrency markets are inherently volatile, and XRP's price can fluctuate significantly in short periods.

- Regulatory Uncertainty: The ongoing SEC lawsuit creates uncertainty about XRP's regulatory status and future prospects.

- Loss of Investment: There's a significant risk of losing your entire investment if the price of XRP declines.

- Security Risks: Holding cryptocurrencies involves security risks, such as hacking and theft.

Diversification and responsible risk management are crucial when investing in XRP. Keywords: XRP risk, cryptocurrency volatility, investment risk, diversification.

Conclusion: Should You Invest in Ripple (XRP) Now?

Investing in Ripple (XRP) at its current price presents both significant potential rewards and substantial risks. The ongoing SEC lawsuit introduces significant regulatory uncertainty, while the potential for widespread adoption and technological advancements offers a counterpoint. Ultimately, whether or not you invest depends on your risk tolerance, investment goals, and thorough due diligence.

We reiterate that this article provides a balanced perspective, but it is not financial advice. Conduct your own extensive research, considering both the technical and fundamental aspects, and consult with a financial advisor before making any investment decisions. Make an informed decision about your Ripple (XRP) investment today! Learn more about investing in Ripple (XRP) below $3 and other cryptocurrencies by researching reputable sources and understanding your personal risk tolerance. Remember, responsible investment practices are key to mitigating potential losses.

Featured Posts

-

Elon Musk To Remain Tesla Ceo Board Addresses Replacement Rumors

May 02, 2025

Elon Musk To Remain Tesla Ceo Board Addresses Replacement Rumors

May 02, 2025 -

Nrc Suspends Warri Itakpe Rail Operations Due To Train Engine Failure

May 02, 2025

Nrc Suspends Warri Itakpe Rail Operations Due To Train Engine Failure

May 02, 2025 -

Class Action Lawsuit Alleges Deceptive Practices By Fortnite Maker Epic Games

May 02, 2025

Class Action Lawsuit Alleges Deceptive Practices By Fortnite Maker Epic Games

May 02, 2025 -

Mones Desperate Attempt To Reclaim Tbs Championship From Watanabe

May 02, 2025

Mones Desperate Attempt To Reclaim Tbs Championship From Watanabe

May 02, 2025 -

Ahm Ma Jae En Blay Styshn 6 Tsrybat Wtwqeat

May 02, 2025

Ahm Ma Jae En Blay Styshn 6 Tsrybat Wtwqeat

May 02, 2025

Latest Posts

-

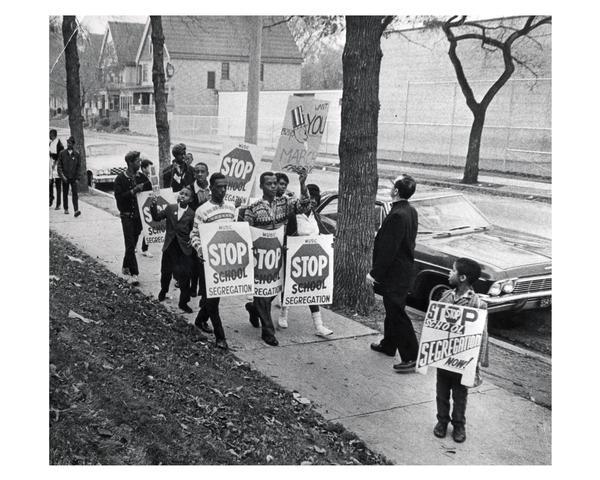

The Fallout From The Justice Departments School Desegregation Decision

May 02, 2025

The Fallout From The Justice Departments School Desegregation Decision

May 02, 2025 -

School Desegregation Order Ended Analysis And Future Outlook

May 02, 2025

School Desegregation Order Ended Analysis And Future Outlook

May 02, 2025 -

Justice Departments Decision A Turning Point In School Desegregation

May 02, 2025

Justice Departments Decision A Turning Point In School Desegregation

May 02, 2025 -

School Desegregation Order Rescinded Analysis And Future Outlook

May 02, 2025

School Desegregation Order Rescinded Analysis And Future Outlook

May 02, 2025 -

The Justice Department And School Desegregation A Shifting Landscape

May 02, 2025

The Justice Department And School Desegregation A Shifting Landscape

May 02, 2025