Should You Invest In XRP (Ripple) Now For Future Wealth?

Table of Contents

The cryptocurrency market has exploded in recent years, with some digital assets achieving phenomenal growth. XRP, the native cryptocurrency of the Ripple network, has carved a significant niche for itself, but the question remains: should you invest in XRP (Ripple) now? This is a complex question with no easy answer. While XRP offers potential benefits like potentially high returns and fast transaction speeds, it also carries significant risks, including regulatory uncertainty and price volatility. This article will explore the crucial factors to consider before investing in XRP, analyzing its potential for future wealth creation by examining its technology, market position, regulatory landscape, and inherent investment risks.

2. Understanding XRP and Ripple's Technology

H2: What is XRP and How Does it Work?

XRP is a cryptocurrency designed to facilitate fast and low-cost international payments through RippleNet, Ripple's payment network. Unlike many cryptocurrencies that rely on energy-intensive proof-of-work consensus mechanisms, XRP uses a unique energy-efficient consensus mechanism, making it a more environmentally friendly option. Key features include:

- Speed: XRP transactions are significantly faster than many other cryptocurrencies, often completing in a matter of seconds.

- Low Transaction Fees: The cost of sending XRP is typically much lower than traditional banking fees or other cryptocurrencies' transaction fees.

- Scalability: The Ripple network is designed to handle a large volume of transactions, making it suitable for large-scale financial applications.

- RippleNet: This network connects banks and financial institutions globally, enabling seamless cross-border payments. Its use cases extend beyond simple transfers to include foreign exchange and other financial services.

These features, utilizing XRP technology, position Ripple as a strong contender in the global payments landscape.

H2: Ripple's Partnerships and Adoption:

Ripple has forged numerous strategic partnerships with major financial institutions worldwide. This institutional adoption is a critical factor in XRP's potential for long-term growth. Examples include:

- Banks: Several large banks utilize RippleNet for their international payments, enhancing efficiency and reducing costs.

- Payment Providers: Many payment processors are integrating XRP into their systems, expanding access to the cryptocurrency for a broader user base.

- Money Transfer Operators: These operators increasingly leverage Ripple's technology for faster and cheaper cross-border remittances.

This growing adoption signals increasing confidence in Ripple's technology and, consequently, in XRP itself.

3. XRP's Market Position and Price Volatility

H2: Analyzing XRP's Market Capitalization and Trading Volume:

(Note: Market cap and trading volume data should be updated with current figures at the time of publication. Include links to reputable sources such as CoinMarketCap or CoinGecko.) XRP consistently ranks among the top cryptocurrencies by market capitalization and trading volume, indicating significant market interest. However, this position is subject to change based on market fluctuations and overall cryptocurrency trends. Factors influencing XRP's price volatility include:

- Regulatory News: Any updates on the SEC lawsuit or global regulatory developments significantly impact XRP's price.

- Market Sentiment: Broader cryptocurrency market trends and investor confidence play a crucial role.

- Adoption Rate: Increased adoption by financial institutions and payment providers generally supports price growth.

H2: Future Price Predictions and Potential for Growth:

Predicting the future price of any cryptocurrency is inherently speculative. However, considering Ripple's partnerships, technological advancements, and potential regulatory clarity, there's potential for future growth. Factors driving potential future growth include:

- Wider Adoption: As more financial institutions embrace RippleNet, demand for XRP could increase.

- Regulatory Clarity: A positive resolution to the SEC lawsuit could significantly boost investor confidence.

- Technological Innovation: Further developments in Ripple's technology could lead to increased efficiency and broader adoption.

Conversely, risks include continued regulatory uncertainty and increased competition from other payment solutions.

4. Regulatory Landscape and Legal Challenges

H2: The SEC Lawsuit and Its Implications:

The ongoing SEC lawsuit against Ripple is a major factor impacting XRP's price and future. The lawsuit alleges that XRP is an unregistered security, which carries significant implications for the cryptocurrency's regulatory status. The outcome of the lawsuit remains uncertain, but it will undoubtedly shape XRP's future trajectory.

- Potential Outcomes: A favorable ruling could lead to increased investor confidence and price appreciation. An unfavorable ruling could severely impact XRP's value and adoption.

- Investor Sentiment: The lawsuit significantly influences investor sentiment, causing periods of price volatility.

H2: Global Regulatory Environment for Cryptocurrencies:

The regulatory landscape for cryptocurrencies is constantly evolving globally. Different jurisdictions are adopting varying approaches to regulating digital assets, creating uncertainty for investors. Understanding these regulations is crucial before investing in XRP or any cryptocurrency.

5. Investing in XRP: Risks and Rewards

H2: Assessing the Risks of Investing in XRP:

Investing in XRP carries substantial risks, primarily:

- Price Volatility: XRP's price is highly volatile, subject to significant fluctuations.

- Regulatory Uncertainty: The SEC lawsuit and the evolving global regulatory landscape create uncertainty.

- Market Risk: The cryptocurrency market is inherently risky, and XRP's price can be influenced by broader market trends. Diversifying your investment portfolio is crucial to mitigate risk.

H2: Developing a Sound Investment Strategy for XRP:

Investing in XRP requires careful consideration of your risk tolerance and a well-defined investment strategy. Before investing, ensure you:

- Conduct Thorough Research: Understand XRP's technology, market position, and regulatory challenges.

- Assess Your Risk Tolerance: Only invest an amount you can afford to lose.

- Diversify Your Portfolio: Don't put all your eggs in one basket. Diversification reduces overall investment risk.

6. Conclusion: Should You Invest in XRP?

Investing in XRP presents both significant potential rewards and substantial risks. The ongoing SEC lawsuit and the evolving regulatory landscape create uncertainty. While the technology behind XRP and its adoption by financial institutions are promising, the volatility of the cryptocurrency market necessitates caution. This article provides information for consideration, but it is not financial advice. Before making any investment decisions regarding XRP, conduct thorough research and assess your personal risk tolerance. Learn more about XRP investment strategies and research XRP's potential to make an informed decision about investing in XRP.

Featured Posts

-

Julius Randles Impact A Shift In Timberwolves Fans Perception

May 07, 2025

Julius Randles Impact A Shift In Timberwolves Fans Perception

May 07, 2025 -

Concert De Cloture Saison Onet Le Chateau Christophe Mali

May 07, 2025

Concert De Cloture Saison Onet Le Chateau Christophe Mali

May 07, 2025 -

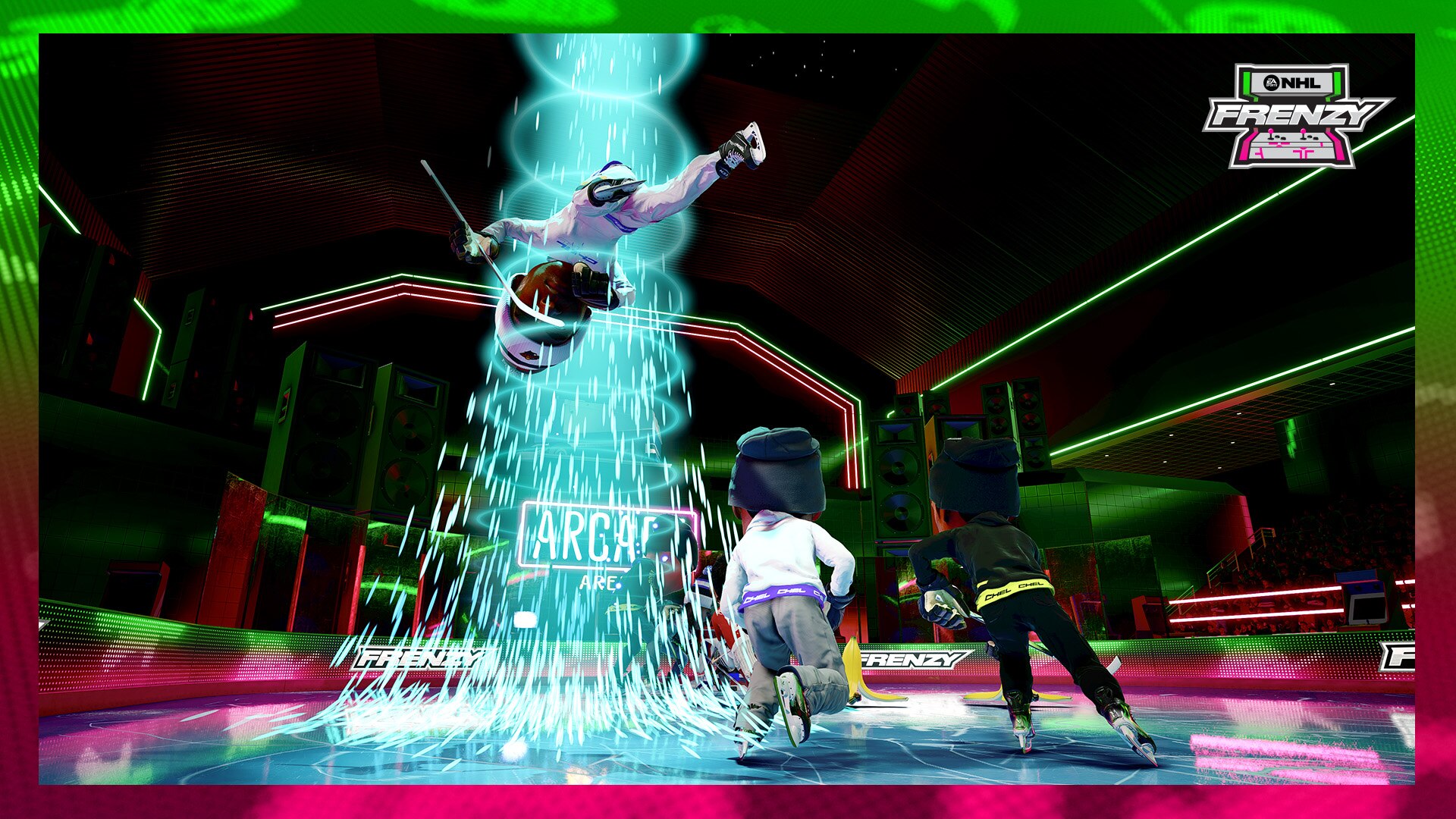

Nhl 25s Arcade Mode A Deep Dive Into This Weeks Release

May 07, 2025

Nhl 25s Arcade Mode A Deep Dive Into This Weeks Release

May 07, 2025 -

Minnesota Timberwolves Edwards Loses Significant Income Due To Suspension

May 07, 2025

Minnesota Timberwolves Edwards Loses Significant Income Due To Suspension

May 07, 2025 -

Are Bmw And Porsche Losing Ground In China A Look At The Current Landscape

May 07, 2025

Are Bmw And Porsche Losing Ground In China A Look At The Current Landscape

May 07, 2025

Latest Posts

-

How Saturday Night Live Launched Counting Crows To Fame

May 08, 2025

How Saturday Night Live Launched Counting Crows To Fame

May 08, 2025 -

The Night Counting Crows Changed Their Snl Performance And Its Aftermath

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Its Aftermath

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Defining Performance

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Performance

May 08, 2025 -

Counting Crows Snl Appearance A Career Defining Moment

May 08, 2025

Counting Crows Snl Appearance A Career Defining Moment

May 08, 2025 -

Counting Crows The Saturday Night Live Effect

May 08, 2025

Counting Crows The Saturday Night Live Effect

May 08, 2025