Should You Invest In XRP (Ripple) While It's Trading Below $3?

Table of Contents

XRP's Current Market Position and Price Analysis

To determine whether investing in XRP below $3 is wise, we need to analyze its current market standing from both technical and fundamental perspectives.

Technical Analysis of XRP's Chart

Technical analysis offers insights into potential future price movements based on past performance. Let's examine some key indicators:

- Moving Averages: A look at the 50-day and 200-day moving averages can reveal whether XRP is currently in an uptrend or downtrend. A bullish crossover (50-day moving above the 200-day) could signal positive momentum.

- RSI (Relative Strength Index): This indicator measures the magnitude of recent price changes to evaluate overbought or oversold conditions. A low RSI might suggest the price is nearing a bottom.

- MACD (Moving Average Convergence Divergence): The MACD identifies changes in the strength, direction, momentum, and duration of a trend. A bullish divergence (price making lower lows while the MACD makes higher lows) could be a positive sign.

Analyzing these indicators alongside recent price action, including support and resistance levels, can offer clues about potential future price movements. (Note: Charts and graphs would be included here in a published article). Significant price patterns or breakouts, such as head-and-shoulders patterns or flag formations, should also be carefully considered.

Fundamental Analysis of Ripple and XRP

Beyond technical analysis, understanding Ripple's fundamentals is crucial. Ripple's ongoing legal battle with the SEC casts a shadow over XRP's future. However, positive developments could significantly impact the price.

- Ripple's Partnerships: Ripple continues to forge partnerships with financial institutions globally, driving XRP adoption for cross-border payments. The expansion of these partnerships is a key factor influencing XRP's long-term prospects.

- Technological Advancements: Ripple's ongoing development and improvements to its technology, including enhancements to its speed and efficiency, could attract further institutional interest.

- SEC Lawsuit: The ongoing SEC lawsuit against Ripple remains a significant risk. A favorable outcome could significantly boost XRP's price, while an unfavorable outcome could result in further declines. Staying informed about the lawsuit's progress is vital.

Risks Associated with Investing in XRP Below $3

Investing in XRP, even at its current price, carries inherent risks.

Volatility and Price Fluctuations

Cryptocurrencies are notoriously volatile. XRP is no exception, experiencing significant price swings.

- Historical Volatility: Examine XRP's historical price charts to appreciate the extent of these fluctuations. Past performance is not indicative of future results, but it highlights the inherent risk.

- Market Sentiment: Broad market sentiment towards cryptocurrencies, as well as news events affecting Ripple specifically, can trigger dramatic price changes.

Regulatory Uncertainty

Regulatory uncertainty poses a significant risk. The SEC lawsuit and the evolving regulatory landscape in different jurisdictions create uncertainty about XRP's legal status and future.

- Varying Regulations: Regulations concerning cryptocurrencies differ widely across jurisdictions. This creates uncertainty for investors.

- Potential for Bans or Restrictions: The possibility of outright bans or severe restrictions on XRP in certain markets remains a risk.

Competition in the Cryptocurrency Market

XRP faces competition from other cryptocurrencies in the payments and blockchain space.

- Established Competitors: Established competitors, such as Bitcoin and Ethereum, hold considerable market share.

- Emerging Competitors: New and emerging cryptocurrencies continuously enter the market, potentially challenging XRP's position.

Potential Rewards of Investing in XRP Below $3

Despite the risks, investing in XRP below $3 might offer several potential rewards.

Long-Term Growth Potential

Some analysts believe XRP possesses significant long-term growth potential.

- Technological Advantages: Ripple's technology offers potential advantages in cross-border payments, potentially leading to broader adoption.

- Increased Institutional Adoption: Growing adoption by financial institutions could drive increased demand and price appreciation.

Investment Opportunities at Discounted Prices

The current price might present a buying opportunity for long-term investors.

- Price Comparison: Compare the current price to historical highs and lows to gauge its potential for recovery.

- Potential for High Returns: If the price recovers, significant returns are possible.

Diversification Benefits

Adding XRP to a diversified investment portfolio can help reduce overall risk. However, remember that diversification does not eliminate risk. Proper risk management is crucial in cryptocurrency investment.

Conclusion

Should you invest in XRP (Ripple) while it's trading below $3? The answer depends on your risk tolerance, investment goals, and thorough research. While the current price presents a potential buying opportunity for long-term investors, the significant risks associated with XRP—particularly its volatility and regulatory uncertainty—cannot be ignored. Remember to carefully weigh the potential rewards against the substantial risks before making any investment decisions. Conduct your own thorough research and consider seeking advice from a qualified financial advisor before investing in XRP (Ripple) or any other cryptocurrency.

Featured Posts

-

This Shocking Food Is Worse Than Smoking Says Doctor A Leading Cause Of Premature Death

May 01, 2025

This Shocking Food Is Worse Than Smoking Says Doctor A Leading Cause Of Premature Death

May 01, 2025 -

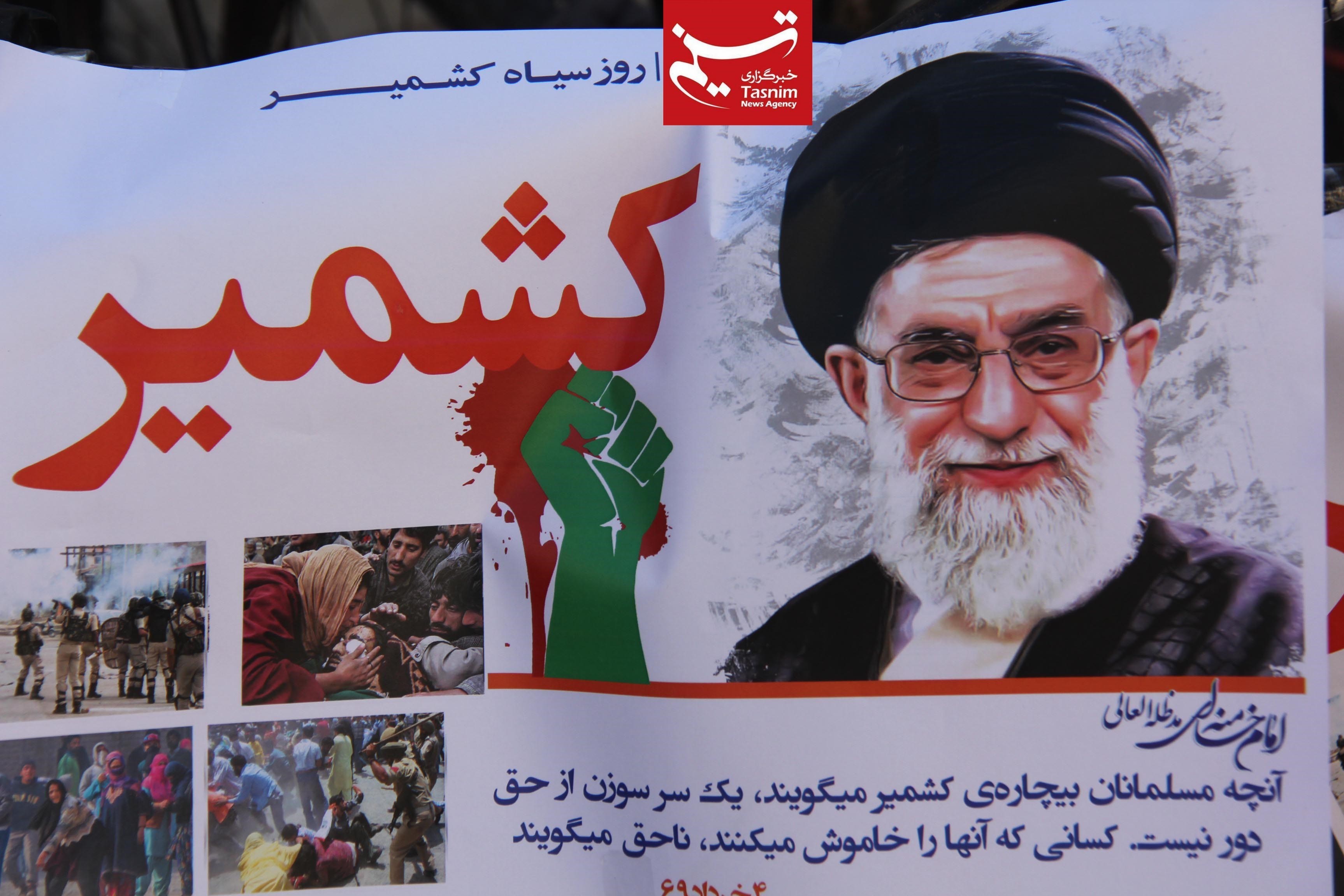

Kshmyr Brtanwy Parlymnt Ky Khly Hmayt Awr Sdr Azad Kshmyr Ka Byan

May 01, 2025

Kshmyr Brtanwy Parlymnt Ky Khly Hmayt Awr Sdr Azad Kshmyr Ka Byan

May 01, 2025 -

Limburgse Ondernemers Geconfronteerd Met Lange Wachttijden Enexis

May 01, 2025

Limburgse Ondernemers Geconfronteerd Met Lange Wachttijden Enexis

May 01, 2025 -

Xrp Price Prediction Could Xrp Hit 10 Ripples Dubai License And Resistance Break

May 01, 2025

Xrp Price Prediction Could Xrp Hit 10 Ripples Dubai License And Resistance Break

May 01, 2025 -

Dragons Den A Guide To Success For Entrepreneurs

May 01, 2025

Dragons Den A Guide To Success For Entrepreneurs

May 01, 2025

Latest Posts

-

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

May 01, 2025

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

May 01, 2025 -

Pierre Poilievres Election Loss What Went Wrong

May 01, 2025

Pierre Poilievres Election Loss What Went Wrong

May 01, 2025 -

Black Sea Oil Spill 62 Miles Of Beaches Closed In Russia

May 01, 2025

Black Sea Oil Spill 62 Miles Of Beaches Closed In Russia

May 01, 2025 -

Major Oil Spill Prompts Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025

Major Oil Spill Prompts Closure Of 62 Miles Of Black Sea Beaches In Russia

May 01, 2025 -

Russias Black Sea Oil Spill Leads To Widespread Beach Closures

May 01, 2025

Russias Black Sea Oil Spill Leads To Widespread Beach Closures

May 01, 2025