Should You Refinance Federal Student Loans Privately? Key Considerations

Table of Contents

Potential Benefits of Private Refinancing

Refinancing federal student loans with a private lender can offer several advantages, but it's crucial to weigh them carefully against potential drawbacks.

Lower Interest Rates

One of the primary motivations for private refinancing is the potential for lower interest rates. A borrower with $50,000 in loans at 7% could save thousands of dollars by refinancing to a 4% rate over the life of the loan. This translates to significant savings, making repayment more manageable.

- Illustrative Example: A $50,000 loan at 7% over 10 years would cost approximately $7,700 in interest. At 4%, the interest cost would drop to around $4,400, a savings of over $3,300.

- Rate Comparison is Key: It's crucial to compare interest rates from multiple private lenders to secure the best possible deal. Don't settle for the first offer you receive.

Simplified Repayment

Many borrowers juggle multiple federal student loans with varying interest rates and repayment schedules. Private refinancing allows for consolidation, simplifying repayment into a single, streamlined monthly payment.

- Improved Budgeting: A single payment simplifies budgeting and financial organization, reducing the risk of missed payments and late fees.

- Shorter Loan Terms (Potential): Some private lenders offer shorter loan terms, potentially allowing you to pay off your debt faster. However, remember that shorter terms mean higher monthly payments.

Flexible Repayment Options

While federal student loans offer certain repayment plans, private lenders may provide additional flexibility.

- Variable Interest Rates: Some private loans offer variable interest rates, which can be advantageous if interest rates fall. However, they also carry the risk of increasing rates.

- Income-Based Repayment (Potentially): While less common than with federal loans, some private lenders may offer income-based repayment options, adjusting payments based on your income. This is not guaranteed.

Potential Drawbacks of Private Refinancing

While the benefits of private refinancing are enticing, it's critical to understand the potential drawbacks.

Loss of Federal Protections

This is perhaps the most significant disadvantage. Refinancing federal student loans privately means losing crucial borrower protections offered by federal programs.

- Income-Driven Repayment Plans (IDR): Federal loans often offer IDR plans, adjusting payments based on income. These are lost upon refinancing.

- Deferment and Forbearance: Federal loans allow for temporary pauses in payments under certain circumstances (e.g., unemployment). These options disappear with private refinancing.

- Loan Forgiveness Programs: Certain professions (e.g., public service) may qualify for federal loan forgiveness programs. These are forfeited upon private refinancing. This loss is permanent.

Higher Risk in Economic Downturns

Private student loans lack the government safety nets that federal loans provide.

- Vulnerability During Recessions: During economic downturns, private lenders may not offer the same flexibility as the federal government in terms of repayment options.

- No Government Backstop: Unlike federal loans, private loans don't have the backing of the U.S. government.

Potential for Higher Fees and Penalties

Private lenders may charge various fees associated with refinancing.

- Origination Fees: These fees are charged upfront to process the loan application.

- Prepayment Penalties: Some lenders charge penalties if you pay off the loan early.

Factors to Consider Before Refinancing

Before making a decision, carefully consider these critical factors:

Credit Score and Financial Health

A good credit score and stable financial situation are essential for securing favorable terms.

- Credit Score Impact: A lower credit score may result in higher interest rates or loan denial.

- Check Your Credit Report: Review your credit report to identify and address any errors before applying.

Current Interest Rates and Loan Terms

Compare your current federal loan interest rates to those offered by private lenders.

- Significant Interest Rate Reduction Required: Only refinance if you can secure a significantly lower interest rate. A small reduction might not be worth the loss of federal protections.

- Loan Term Impact: Consider the impact of the loan term on your total interest paid. A shorter term means higher monthly payments but lower overall interest.

Long-Term Financial Goals

Align your refinancing decision with your long-term financial plans.

- Career Aspirations: Consider your future career path and potential income growth.

- Future Financial Goals: Factor in other financial goals, such as buying a home or starting a family.

Conclusion

Refinancing federal student loans privately can offer lower interest rates and simplified repayment, but it comes with the significant drawback of losing federal protections. Carefully weigh the potential benefits against the risks involved. Consider your credit score, current interest rates, and long-term financial goals. Only refinance if a substantial interest rate reduction justifies the loss of federal safety nets. Thoroughly research your options and consult with a financial advisor if necessary before deciding whether to refinance federal student loans privately.

Featured Posts

-

La Lakers News Scores And Highlights Vavel United States

May 17, 2025

La Lakers News Scores And Highlights Vavel United States

May 17, 2025 -

Knicks Josh Hart Sets New Franchise Record For Triple Doubles

May 17, 2025

Knicks Josh Hart Sets New Franchise Record For Triple Doubles

May 17, 2025 -

Memahami Laporan Keuangan Panduan Lengkap Untuk Bisnis Yang Berkembang

May 17, 2025

Memahami Laporan Keuangan Panduan Lengkap Untuk Bisnis Yang Berkembang

May 17, 2025 -

Nominalizari Premiile Gopo 2025 Anul Nou Care N A Fost Si Morometii 3 In Frunte

May 17, 2025

Nominalizari Premiile Gopo 2025 Anul Nou Care N A Fost Si Morometii 3 In Frunte

May 17, 2025 -

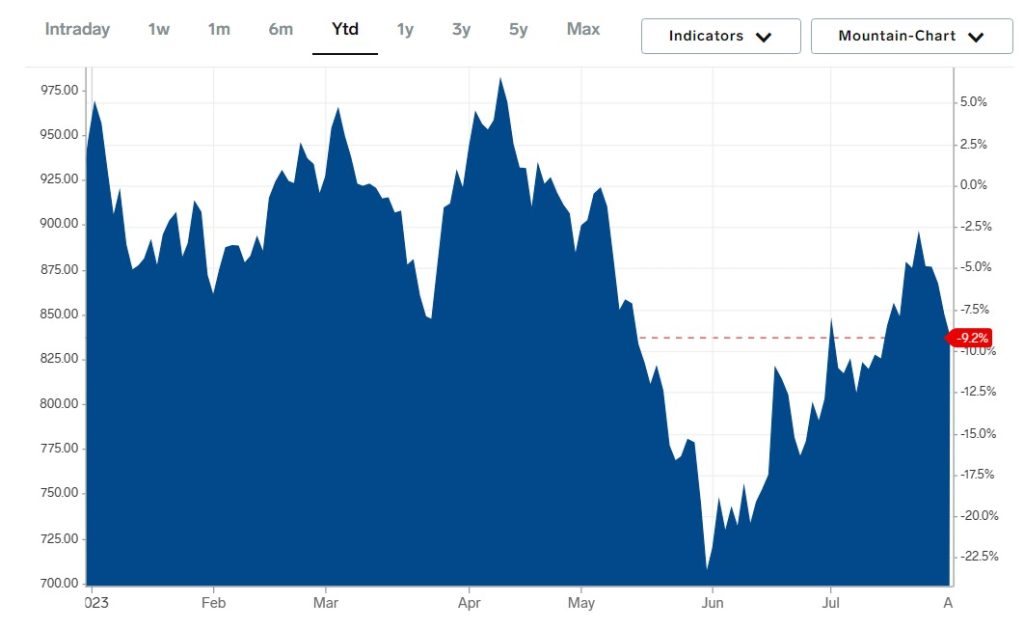

Oil Price Analysis And News Your May 16 Market Overview

May 17, 2025

Oil Price Analysis And News Your May 16 Market Overview

May 17, 2025