Singapore's DBS Grants Polluting Industries Reprieve For Reform

Table of Contents

DBS's Green Financing Initiatives: A Closer Look

DBS's commitment to sustainable finance is evident in its various green financing programs. These initiatives aim to help polluting industries transition to cleaner practices by providing financial support for environmental upgrades and technological improvements. The bank's approach to green financing incorporates Environmental, Social, and Governance (ESG) investing principles, a crucial element in modern sustainable finance.

- Examples of specific programs: DBS offers tailored loan packages for renewable energy projects, waste management improvements, and energy efficiency upgrades within various industries. These packages often include preferential interest rates and flexible repayment schedules.

- Loan details: Loan amounts vary significantly depending on the project's scale and environmental impact. Interest rates are generally competitive, often reflecting the lower risk associated with sustainable investments. Repayment terms are structured to align with the project's timeline and the industry's expected transition period.

- Environmental criteria: To qualify for financing, industries must meet stringent environmental standards, including demonstrable reductions in carbon emissions, waste management improvements, and adherence to Singapore's environmental regulations. Third-party audits and verification processes are often incorporated.

- Incentives and support: Beyond financial assistance, DBS offers technical expertise and advisory services to guide industries through the transition process. This includes support with project feasibility studies, environmental impact assessments, and the implementation of best practices.

The Arguments For: Supporting a Just Transition

Proponents of DBS's decision argue that it supports a just transition – a phased approach that prioritizes both environmental protection and economic stability. An abrupt shutdown of polluting industries could have devastating economic consequences, leading to job losses and social unrest.

- Economic consequences of immediate closures: The sudden closure of polluting industries could trigger significant economic disruption, impacting supply chains, reducing GDP growth, and potentially destabilizing related sectors.

- Impact on employment and worker livelihoods: Thousands of workers could lose their jobs, leading to financial hardship and social instability. A phased transition allows for retraining programs and alternative employment opportunities.

- Importance of retraining and support programs: Government and industry collaboration on retraining initiatives, coupled with DBS's financial support, is crucial for ensuring a smooth transition for affected workers and mitigating the negative social impact.

- Fostering innovation: A gradual transition allows for investment in research and development, fostering innovation in cleaner technologies and creating new economic opportunities in the green sector.

The Arguments Against: Concerns About Greenwashing and Effectiveness

Critics express concerns about potential greenwashing, where companies make superficial environmental improvements to appear more sustainable without genuinely reducing their environmental impact. The effectiveness of the reforms being financed also remains a key point of contention.

- Potential greenwashing tactics: Industries might focus on minor improvements while continuing unsustainable practices elsewhere. Lack of transparency in reporting could allow companies to exaggerate their progress.

- Lack of transparency and accountability: Robust monitoring and reporting mechanisms are needed to ensure that financed projects deliver their promised environmental benefits. Independent audits and public disclosure are essential to maintaining accountability.

- Inadequate environmental standards: If the environmental standards set by DBS are too lenient, the impact on emissions and overall environmental sustainability could be minimal. Stronger regulations and enforcement are crucial.

- Need for stronger regulatory frameworks: Government regulations and policies need to complement DBS's initiatives, setting clear targets and penalties for non-compliance. This includes stricter enforcement of existing environmental laws.

Alternative Approaches: Stricter Regulations vs. Incentivized Transition

The debate highlights the tension between stricter environmental regulations (like carbon taxes or emissions trading schemes) and incentivized transitions through green financing. Stricter regulations could force faster change but risk immediate economic disruption. Incentivized transitions, as employed by DBS, offer a more gradual approach but run the risk of greenwashing and insufficient impact. A balanced approach incorporating both strategies, guided by clear policy frameworks and strong government oversight, may be most effective. The successful implementation of the UN's Sustainable Development Goals (SDGs) requires such a balanced strategy.

Conclusion

DBS's decision to grant a reprieve to polluting industries, offering financing for environmental reforms, presents a complex dilemma. While a just transition is crucial to avoid severe economic repercussions, concerns about greenwashing and the effectiveness of the reforms remain valid. The success of this approach hinges on transparency, strong regulatory oversight, and robust mechanisms to ensure genuine environmental improvements. The future of Singapore's environmental sustainability hinges on effective implementation of green financing initiatives like those offered by DBS and a commitment to transitioning towards a cleaner, more sustainable future. We must continue to scrutinize DBS's initiatives and engage in a broader societal conversation about responsible environmental reform and sustainable financing in Singapore. Learn more about DBS's green financing initiatives and hold corporations accountable for their environmental impact.

Featured Posts

-

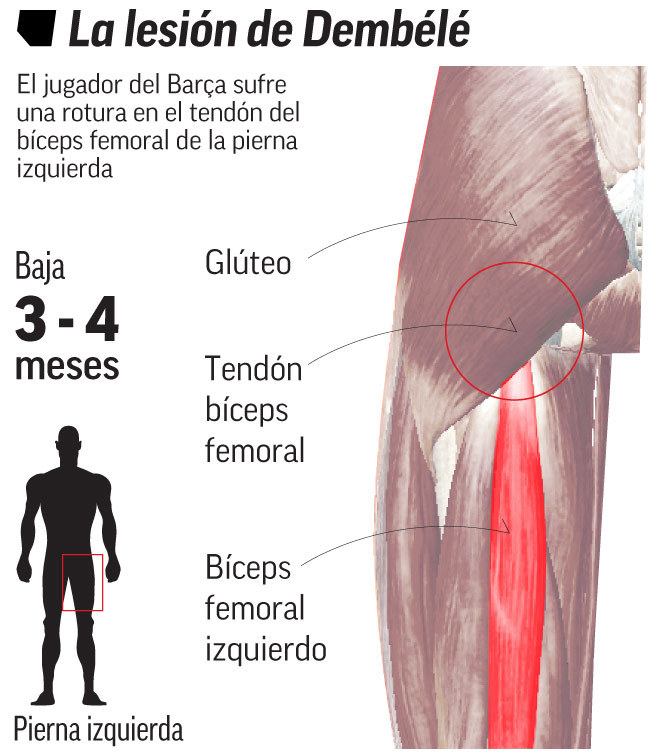

Arsenal News Dembele Injury Blow Throws Artetas Plans Into Disarray

May 08, 2025

Arsenal News Dembele Injury Blow Throws Artetas Plans Into Disarray

May 08, 2025 -

Grave Incidente Entre Flamengo Y Botafogo Batalla Campal En El Partido

May 08, 2025

Grave Incidente Entre Flamengo Y Botafogo Batalla Campal En El Partido

May 08, 2025 -

The Vaticans Financial Mess Assessing Pope Franciss Reform Efforts

May 08, 2025

The Vaticans Financial Mess Assessing Pope Franciss Reform Efforts

May 08, 2025 -

Colin Cowherd And Jayson Tatum A Continuing Point Of Contention

May 08, 2025

Colin Cowherd And Jayson Tatum A Continuing Point Of Contention

May 08, 2025 -

Bitcoin Guencel Fiyati Son Dakika Degerlendirme

May 08, 2025

Bitcoin Guencel Fiyati Son Dakika Degerlendirme

May 08, 2025