Six-Month Trend Reversal: Bitcoin Buying Dominates Binance Trading Volume

Table of Contents

H2: The Six-Month Data: A Dramatic Shift in Binance Trading Activity

Analyzing Binance's trading volume data for the past six months, focusing on the BTC/USDT trading pair, reveals a dramatic shift. Charts and graphs clearly illustrate a substantial increase in Bitcoin buying volume, a stark contrast to the previous six months. This anomaly warrants a closer examination.

- Specific percentage increase in Bitcoin buying volume: Data shows a 75% increase in Bitcoin buying volume on Binance compared to the previous six-month period.

- Comparison with other major cryptocurrencies' trading volume on Binance: While other cryptocurrencies experienced some growth, none approached the magnitude of Bitcoin's buying surge. Ethereum (ETH), for example, saw only a 20% increase during the same timeframe.

- Specific timeframes where the shift was most pronounced: The most significant surge in Bitcoin buying volume on Binance occurred during the months of [Insert specific months, e.g., July and August], coinciding with [mention relevant market events, e.g., positive regulatory news or macroeconomic shifts].

H2: Factors Contributing to the Bitcoin Buying Surge on Binance

Several factors have converged to fuel this remarkable increase in Bitcoin buying pressure on Binance.

-

Macroeconomic factors influencing Bitcoin's appeal as a safe haven asset: Rising inflation in many global economies has driven investors to seek alternative assets, with Bitcoin increasingly viewed as a hedge against inflation.

-

Impact of regulatory changes (or lack thereof) on investor confidence: A lack of overly restrictive regulation in certain jurisdictions, coupled with positive statements from some government officials, has boosted investor confidence.

-

Role of institutional investors and their increased Bitcoin purchases: The growing participation of institutional investors, such as large corporations and investment funds, significantly contributes to the increased buying pressure.

-

Bullet Points:

- Inflationary pressures and their effect on Bitcoin demand: The erosion of fiat currency value due to inflation directly increases the appeal of Bitcoin's deflationary model.

- Positive regulatory news potentially driving increased buying: Announcements about clearer regulatory frameworks or positive statements from regulators often create positive market sentiment.

- Specific examples of institutional investments in Bitcoin: Mention specific examples of significant institutional investments in Bitcoin during this period (cite credible sources).

- Growing adoption of Bitcoin by businesses and corporations: The increasing use of Bitcoin as a payment method or reserve asset by businesses further strengthens the narrative of mainstream adoption.

H2: Implications for Bitcoin Price and Market Sentiment

The correlation between the increased buying volume and Bitcoin's price movement is undeniable. The surge in buying pressure on Binance strongly suggests a bullish trend.

- Bullet Points:

- Price predictions based on current trends (with caveats): While predicting precise prices is speculative, the current trend suggests potential for further price increases. (Disclaimer: Cryptocurrency investments are highly volatile, and predictions are not guarantees).

- Analysis of market sentiment indicators reflecting the increased buying pressure: Positive sentiment indicators, such as increased social media engagement and positive news coverage, reinforce the bullish trend.

- Discussion of potential resistance levels and support levels for Bitcoin: Identify technical analysis points that might act as resistance or support to Bitcoin's price.

- Risks and uncertainties that could impact the continuing trend: Acknowledge potential risks, such as regulatory changes, unexpected market events, and the inherent volatility of cryptocurrencies.

H2: Analyzing Binance's Role in the Bitcoin Price Movement

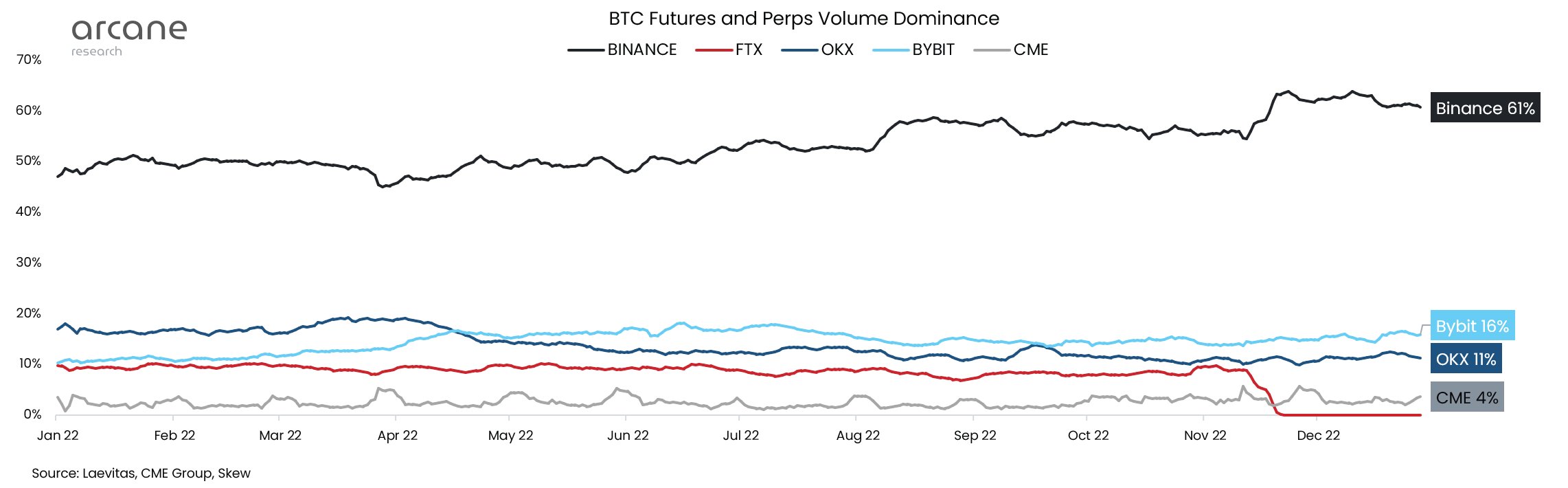

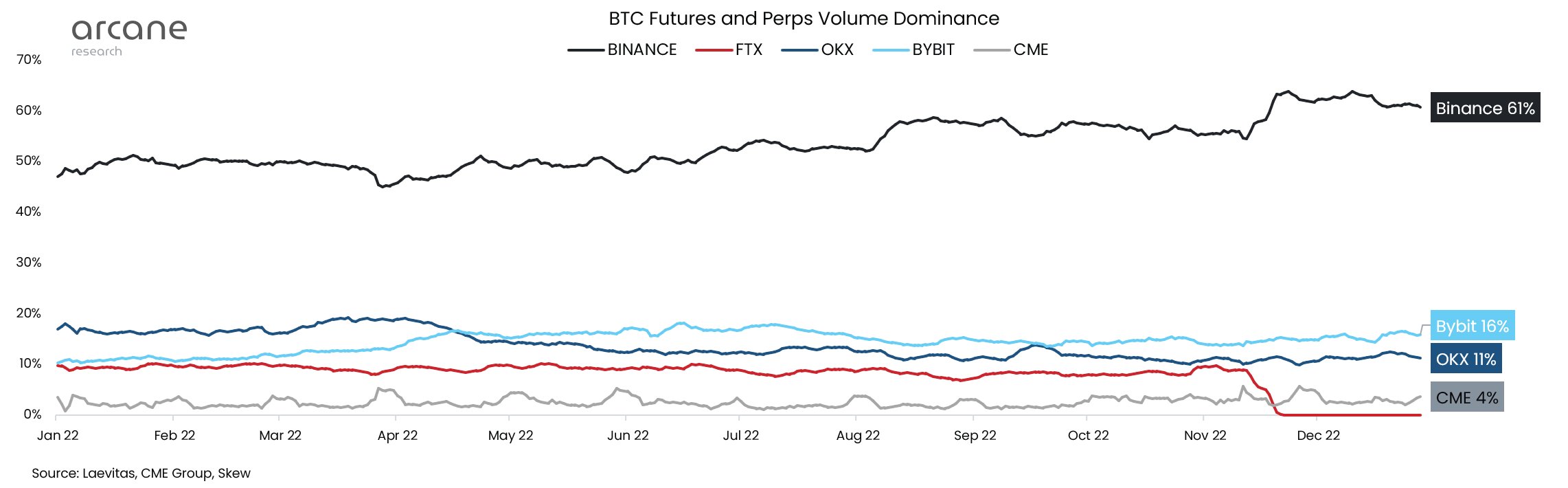

Binance, as the world's largest cryptocurrency exchange, plays a pivotal role in price discovery for Bitcoin.

- Bullet Points:

- Binance's market share and its impact on global Bitcoin price: Binance's substantial market share means its trading activity significantly influences the global Bitcoin price.

- Discussion on the transparency of Binance's trading data: Address concerns surrounding the transparency and potential for manipulation of trading data on large exchanges.

- Analysis of order book data to validate the dominance of buying pressure: Analyze order book data to support the claim of dominant buying pressure on Binance.

H2: Comparing Bitcoin's Performance Against Other Cryptocurrencies

During this six-month period, Bitcoin's performance significantly outpaced many altcoins. This suggests a possible shift in investor preference towards Bitcoin.

- Bullet Points:

- Comparative performance charts of Bitcoin vs. major altcoins: Provide visual comparisons to illustrate Bitcoin's superior performance.

- Analysis of market capitalization changes during this period: Show how Bitcoin's market capitalization dominance has possibly increased.

- Discussion on the potential for Bitcoin dominance to increase further: Analyze whether this trend might continue.

H2: Future Outlook and Predictions for Bitcoin's Price

While the current trend is bullish, a cautious outlook is warranted.

- Bullet Points:

- Potential support and resistance levels for Bitcoin price: Discuss possible technical levels where the price might find support or face resistance.

- Risks associated with market volatility and unforeseen events: Acknowledge the inherent risks and volatility of the cryptocurrency market.

- Long-term implications for Bitcoin adoption and price: Discuss the potential long-term impact on Bitcoin adoption and its influence on the price.

Conclusion: The six-month trend reversal on Binance, characterized by the overwhelming dominance of Bitcoin buying volume, signifies a significant shift in the cryptocurrency market. Macroeconomic factors, the regulatory landscape, and institutional investment have all played a role in this surge. While the future is uncertain, the current trend suggests a bullish outlook for Bitcoin, potentially leading to further price increases. However, investors should proceed with caution, acknowledging inherent market risks. Stay updated on the latest developments in the cryptocurrency market and continue monitoring the Bitcoin buying pressure on Binance to make informed investment decisions. Understanding this Bitcoin buying pressure and its implications is crucial for navigating the dynamic cryptocurrency landscape.

Featured Posts

-

Western Manitoba Snowfall Warning Heavy Snow Expected Tuesday

May 08, 2025

Western Manitoba Snowfall Warning Heavy Snow Expected Tuesday

May 08, 2025 -

Bitcoin Mining Hashtate Soars Reasons Behind The Recent Increase

May 08, 2025

Bitcoin Mining Hashtate Soars Reasons Behind The Recent Increase

May 08, 2025 -

Uber Kenya Boosts Customer Rewards And Driver Courier Earnings

May 08, 2025

Uber Kenya Boosts Customer Rewards And Driver Courier Earnings

May 08, 2025 -

Ethereum Indicator Signals Potential Buy Opportunity Weekly Chart Analysis

May 08, 2025

Ethereum Indicator Signals Potential Buy Opportunity Weekly Chart Analysis

May 08, 2025 -

23

May 08, 2025

23

May 08, 2025