Slight Decrease In Caesar's Las Vegas Strip Property Values Reported

Table of Contents

Factors Contributing to the Decrease in Caesar's Property Values

Several interconnected factors have contributed to the recent decline in Caesar's Las Vegas Strip property values. Understanding these factors is crucial for investors looking to navigate this dynamic market.

Impact of the Pandemic and Reduced Tourism

The COVID-19 pandemic significantly impacted the Las Vegas Strip, causing a dramatic drop in tourism. Travel restrictions, lockdowns, and public health concerns led to drastically reduced occupancy rates in hotels and casinos across the Strip, including Caesar's properties. This downturn had a cascading effect on revenue generation. The prolonged recovery has further influenced property valuations.

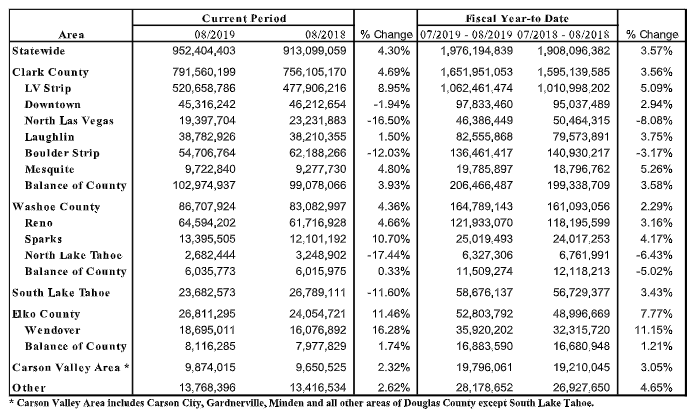

Statistics from the Las Vegas Convention and Visitors Authority show a significant decrease in visitor numbers during the peak pandemic period (2020-2021), impacting revenue streams for all businesses on the Strip. This decline directly affected the overall assessment of Caesar's Las Vegas Strip property values.

- Decreased gambling revenue: Reduced visitor numbers directly translated to lower revenue from gambling activities, a major revenue source for casinos.

- Lower hotel occupancy: Hotel occupancy rates plummeted, affecting revenue from room rentals and associated services.

- Reduced spending on non-gaming amenities: Visitors spent less on dining, entertainment, and shopping within Caesar's properties, impacting ancillary revenue streams.

Increased Competition on the Las Vegas Strip

The Las Vegas Strip is a fiercely competitive market. The emergence of new resorts with innovative amenities and attractions has intensified the competition, impacting the market share of established players like Caesar's. These newer properties often attract tourists with cutting-edge technology, unique experiences, and sophisticated marketing strategies.

- New resort openings and expansions: The continued development of new resorts and the expansion of existing ones have increased the overall supply of hotel rooms and entertainment options.

- Enhanced amenities and attractions offered by competitors: Competitors are constantly innovating, offering unique experiences that lure visitors away from established properties.

- Shifting consumer preferences towards newer properties: Tourists are increasingly drawn to newer resorts with modern amenities and cutting-edge technologies.

Economic Factors and Interest Rate Hikes

Broader economic factors, particularly rising interest rates, have also impacted Caesar's Las Vegas Strip property values. Increased interest rates make borrowing more expensive for real estate investments, affecting both development and operational costs.

- Increased borrowing costs for real estate development: Higher interest rates make it more expensive to finance new construction and renovations, impacting the ability to upgrade properties and compete effectively.

- Inflationary pressures on operational expenses: Rising inflation affects everything from staffing costs to the price of goods and services, increasing operational expenses for casino resorts.

- Potential for decreased investment in property upgrades: With higher borrowing costs, businesses might postpone renovations and upgrades, potentially making their properties less competitive in the long run.

Implications for Investors and the Future of Caesar's Properties

The decrease in Caesar's Las Vegas Strip property values presents both challenges and opportunities for investors.

Short-Term Market Outlook

The short-term outlook for Caesar's property values is characterized by uncertainty. The potential for further value decreases exists, depending on the pace of economic recovery and the competitive landscape. Strategic acquisitions or mergers could also influence the market.

- Potential for short-term market volatility: Investors should anticipate fluctuations in property values in the near term.

- Strategies for risk mitigation: Diversification and careful risk assessment are crucial for investors in this market.

- Impact on investor confidence: Short-term market fluctuations can impact investor confidence and investment decisions.

Long-Term Growth Potential

Despite the recent dip, the long-term growth potential of the Las Vegas Strip and Caesar's properties remains substantial. The Las Vegas market has historically shown resilience, bouncing back from previous economic downturns. Planned renovations, expansions, and the ongoing appeal of Las Vegas as a premier entertainment destination suggest a positive long-term outlook.

- Potential for long-term market recovery: Historically, the Las Vegas market has shown strong recovery from economic challenges.

- Future development plans and investments: Ongoing investments in new attractions and renovations will support the long-term growth of the Strip.

- Opportunities for increased profitability: Strategic investments and operational improvements can enhance the profitability of Caesar's properties in the future.

Conclusion

This report highlights the slight decrease in Caesar's Las Vegas Strip property values, attributed to various factors including the pandemic's lingering effects, increased competition, and broader economic conditions. While the short-term outlook may present challenges, the long-term potential for growth remains significant. Understanding the interplay of these factors is crucial for investors.

Call to Action: Stay informed about fluctuations in Caesar's Las Vegas Strip property values and other key market indicators to make well-informed investment decisions. Regularly monitor news and analysis on Caesar's Entertainment Corporation and the Las Vegas real estate market for a comprehensive understanding of this dynamic sector. Careful monitoring of Caesar's Las Vegas Strip property values is essential for savvy investors.

Featured Posts

-

Mit Disavows Students Ai Research Paper

May 18, 2025

Mit Disavows Students Ai Research Paper

May 18, 2025 -

This Weeks You Toon Caption Contest Winner Announced Booing Bears

May 18, 2025

This Weeks You Toon Caption Contest Winner Announced Booing Bears

May 18, 2025 -

Amanda Bynes Only Fans A Look At Her Recent Activities

May 18, 2025

Amanda Bynes Only Fans A Look At Her Recent Activities

May 18, 2025 -

Difficult Offseason Angels Stars Family Health Journey

May 18, 2025

Difficult Offseason Angels Stars Family Health Journey

May 18, 2025 -

Spring Breakout Rosters 2025 What To Expect

May 18, 2025

Spring Breakout Rosters 2025 What To Expect

May 18, 2025

Latest Posts

-

Check Daily Lotto Results For Wednesday 30th April 2025

May 18, 2025

Check Daily Lotto Results For Wednesday 30th April 2025

May 18, 2025 -

Find The Daily Lotto Results For Sunday April 27th 2025

May 18, 2025

Find The Daily Lotto Results For Sunday April 27th 2025

May 18, 2025 -

Daily Lotto Results Sunday 20th April 2025

May 18, 2025

Daily Lotto Results Sunday 20th April 2025

May 18, 2025 -

2025 Lotto Results Saturday April 12th Lotto Plus Draw

May 18, 2025

2025 Lotto Results Saturday April 12th Lotto Plus Draw

May 18, 2025 -

Find The Daily Lotto Results For Sunday April 20 2025

May 18, 2025

Find The Daily Lotto Results For Sunday April 20 2025

May 18, 2025