SMFG Eyes Minority Stake In India's Yes Bank

Table of Contents

SMFG's Strategic Rationale Behind the Investment

SMFG's interest in acquiring a minority stake in Yes Bank likely stems from a multi-faceted strategic vision. The move reflects a calculated expansion strategy targeting the burgeoning Indian banking market, characterized by its substantial growth potential and large, underserved population. Several key factors underpin SMFG's decision:

-

Access to the rapidly growing Indian banking market: India's robust economic growth and expanding middle class present immense opportunities for financial institutions. A stake in Yes Bank provides SMFG with immediate access to this lucrative market, bypassing the lengthy and complex process of establishing a new entity from scratch. This allows for quicker penetration and capitalizing on market share gains.

-

Diversification of investment portfolio: By investing in Yes Bank, SMFG diversifies its geographic and sectoral exposure, reducing overall portfolio risk. This move strategically reduces reliance on the Japanese market and mitigates potential economic downturns within Japan.

-

Potential for high returns on investment: Yes Bank, despite past challenges, possesses a substantial network and customer base. SMFG's investment could lead to significant returns as Yes Bank recovers and expands its operations, capitalizing on the growth opportunities within the Indian market.

-

Synergies with existing SMFG operations: SMFG’s existing global network and expertise in various financial services could create valuable synergies with Yes Bank's operations. This could include technology sharing, risk management strategies, and improved customer service offerings.

Implications for Yes Bank

The potential investment by SMFG carries profound implications for Yes Bank. The most immediate benefit is likely to be a significant capital infusion, bolstering the bank's financial stability and enabling it to further strengthen its balance sheet.

-

Capital injection and improved financial health: The infusion of capital from SMFG will inject much-needed liquidity into Yes Bank, helping to address past financial challenges and bolster its capital adequacy ratio.

-

Access to SMFG's expertise and resources: Beyond capital, SMFG brings a wealth of expertise in banking operations, risk management, and technological innovation. This access to resources will be invaluable in aiding Yes Bank's restructuring and growth plans.

-

Potential for accelerated growth and expansion: With strengthened financials and enhanced operational efficiency, Yes Bank can focus on expanding its reach and product offerings, targeting underserved segments of the Indian market.

-

Increased investor confidence: SMFG’s investment will likely signal to other investors a renewed confidence in Yes Bank's long-term viability, attracting further investment and stabilizing the bank's position in the market.

However, it's crucial to acknowledge potential challenges. The integration process between two distinct organizational cultures could present hurdles. Furthermore, the success of the partnership hinges upon effective implementation of SMFG's expertise and Yes Bank's ability to leverage it effectively.

The Indian Banking Sector's Perspective

SMFG's investment carries significant implications for the Indian banking sector as a whole. It highlights the attractiveness of the Indian market to foreign investors and signals the ongoing consolidation within the sector.

-

Increased competition within the sector: The entry of a major global player like SMFG intensifies competition among Indian banks, driving innovation and efficiency improvements.

-

Potential impact on other Indian banks: Other private and public sector banks will need to adapt and improve their offerings to remain competitive in the face of increased competition from a well-capitalized Yes Bank backed by SMFG.

-

Attracting further foreign investment into India’s financial sector: SMFG’s investment could set a precedent, attracting more foreign direct investment into India's financial sector, further boosting the country's economic growth.

-

The role of regulatory bodies in overseeing the acquisition: Regulatory bodies will play a crucial role in ensuring fair competition and protecting the interests of Indian consumers and the financial system's stability.

Market Reactions and Future Outlook

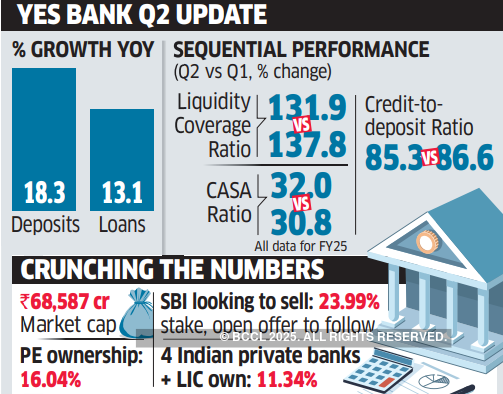

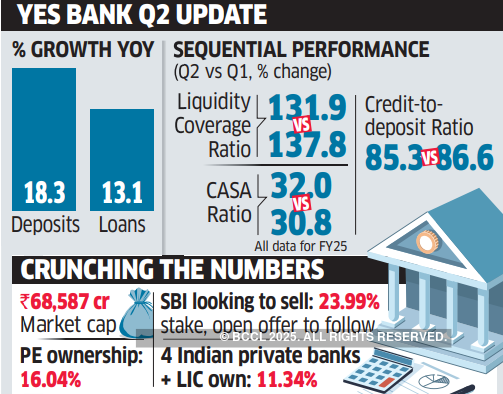

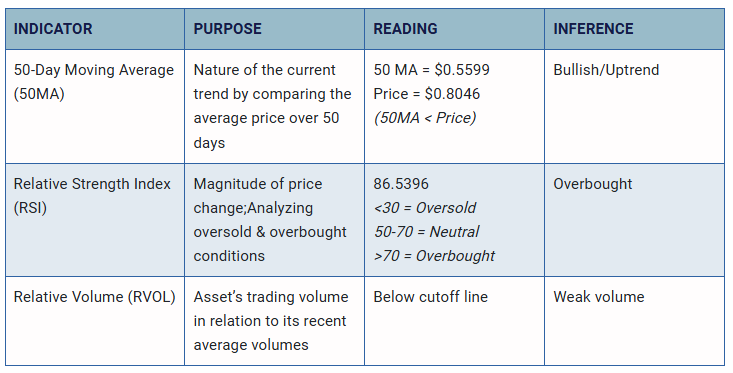

Market reactions to the news will be crucial in gauging the overall success of the potential deal. Stock prices for both SMFG and Yes Bank will likely fluctuate based on investor sentiment and further announcements regarding the investment.

Analysis of market reactions, along with the successful integration of operations and strategic decision-making, will be key determinants of this investment's long-term success. Predictions indicate that a successful partnership could lead to a significant increase in Yes Bank's market share and financial stability, while also strengthening SMFG's global presence. However, potential challenges, such as integration issues and regulatory hurdles, could impact the final outcome.

Conclusion

The potential acquisition of a minority stake in Yes Bank by SMFG represents a strategically significant move with substantial implications for both companies and the broader Indian banking sector. While the investment presents opportunities for growth, increased competition, and foreign investment into India, it also carries potential risks, such as integration challenges and regulatory hurdles. The successful outcome will depend on the effective execution of the strategic plan, market acceptance, and the ability to navigate potential challenges. Keep up-to-date on the latest developments regarding SMFG's potential minority stake in Yes Bank, and learn more about the strategic implications of this significant investment in the Indian banking sector.

Featured Posts

-

Mystery Solved Darius Kasparaitis Joins Alex Ovechkin For Florida Workouts

May 07, 2025

Mystery Solved Darius Kasparaitis Joins Alex Ovechkin For Florida Workouts

May 07, 2025 -

Stoerre Stjaernturnering I Nhl En Konfliktloesning

May 07, 2025

Stoerre Stjaernturnering I Nhl En Konfliktloesning

May 07, 2025 -

Xrp Price Derivatives Market Dampens Recovery Hopes

May 07, 2025

Xrp Price Derivatives Market Dampens Recovery Hopes

May 07, 2025 -

5 Xrp In 2025 Evaluating The Likelihood

May 07, 2025

5 Xrp In 2025 Evaluating The Likelihood

May 07, 2025 -

Cup Final Thriller De Busser Leads Go Ahead Eagles To Victory

May 07, 2025

Cup Final Thriller De Busser Leads Go Ahead Eagles To Victory

May 07, 2025

Latest Posts

-

The Long Walk Movie A Faithful Adaptation Of Stephen Kings Novel

May 08, 2025

The Long Walk Movie A Faithful Adaptation Of Stephen Kings Novel

May 08, 2025 -

Stephen Kings The Long Walk The Movie Is Real

May 08, 2025

Stephen Kings The Long Walk The Movie Is Real

May 08, 2025 -

Stephen Kings The Long Walk A Shockingly Faithful Adaptation

May 08, 2025

Stephen Kings The Long Walk A Shockingly Faithful Adaptation

May 08, 2025 -

The Long Walk Movie Adaptation Is It Finally Here

May 08, 2025

The Long Walk Movie Adaptation Is It Finally Here

May 08, 2025 -

Stephen Kings The Long Walk Movie A Terrific Adaptation

May 08, 2025

Stephen Kings The Long Walk Movie A Terrific Adaptation

May 08, 2025