SpaceX's Booming Value: $43 Billion Ahead Of Musk's Tesla Shares

Table of Contents

Factors Contributing to SpaceX's Soaring Valuation

Several key factors have propelled SpaceX's valuation to unprecedented heights, positioning it as a dominant player in the private space industry.

Successful Starship Development & Testing

SpaceX's ambitious Starship program, aiming to create a fully reusable transportation system for both Earth and Mars, is a pivotal driver of its valuation. Recent, albeit sometimes explosive, test flights, while demonstrating significant challenges in development, showcase the company's commitment to pushing technological boundaries.

- Reusable Rockets: Starship's design prioritizes reusability, dramatically reducing the cost per launch compared to traditional expendable rockets. This cost reduction is a major selling point for both commercial and government clients.

- Super Heavy Booster: The sheer scale of the Super Heavy booster, designed to propel Starship into orbit, is unparalleled, highlighting SpaceX's ambition and engineering prowess.

- Revolutionizing Space Access: The potential for Starship to revolutionize space access, making it significantly cheaper and more frequent, is a key factor driving investor confidence in SpaceX's long-term growth. This includes the potential for point-to-point transport around the Earth.

Dominance in Satellite Internet

SpaceX's Starlink constellation is another significant contributor to its soaring valuation. This ambitious project aims to provide global broadband internet access via a vast network of low-Earth orbit satellites.

- Rapid Subscriber Growth: Starlink has experienced phenomenal subscriber growth since its launch, demonstrating a strong market demand for high-speed, low-latency internet access, even in remote areas.

- Impressive Revenue Projections: The substantial revenue projections for Starlink, fueled by its expanding user base and potential for future expansion, significantly bolster SpaceX's overall valuation.

- Market Leadership: While facing competition from other satellite internet providers, Starlink has established itself as a market leader, securing a substantial share of the burgeoning satellite internet industry.

Government and Commercial Contracts

Securing lucrative contracts with major players in the space industry is another cornerstone of SpaceX's financial success.

- NASA Contracts: SpaceX has secured significant contracts with NASA for crewed missions to the International Space Station (ISS), showcasing the agency's trust in SpaceX's capabilities and reliability.

- US Military Contracts: SpaceX also benefits from contracts with the US military, highlighting the strategic importance of its launch capabilities for national security.

- Commercial Space Launches: The company's commercial space launch business continues to thrive, attracting a diverse range of clients seeking reliable and cost-effective access to space.

Elon Musk's Vision and Leadership

Elon Musk's visionary leadership and unwavering commitment to pushing technological boundaries are undeniable factors influencing investor confidence in SpaceX.

- Brand Recognition: Musk's global brand recognition and reputation as a disruptive innovator attract both investors and clients, bolstering SpaceX's credibility and market position.

- Inspiring Vision: His ambitious long-term vision, encompassing ambitious goals like colonizing Mars, resonates deeply with investors who see significant potential for long-term returns.

- Proven Track Record: Musk's demonstrated track record of success with Tesla and other ventures further reinforces investor confidence in his ability to lead SpaceX to even greater heights.

SpaceX Valuation vs. Tesla Market Cap

Comparing SpaceX's private valuation to Tesla's public market capitalization reveals interesting insights into the dynamics of the financial markets.

Comparing Private vs. Public Company Valuations

A key difference lies in how valuations are determined. Tesla's market cap is publicly traded and reflects the collective assessment of its stock price by investors. SpaceX's valuation, being a private company, is based on more complex factors, including private investment rounds and estimates from financial analysts.

Analyzing the $43 Billion Discrepancy

The $43 billion difference reflects several factors including differing investor risk tolerance and future potential. While Tesla has proven profitability in its existing market, the space industry is inherently riskier, with SpaceX's future earnings dependent on the success of ambitious projects like Starship and Starlink. Market sentiment also plays a critical role.

Long-Term Growth Potential

Both SpaceX and Tesla possess substantial long-term growth potential, but in different sectors. Tesla's growth is tied to the expanding electric vehicle market and its potential for further diversification. SpaceX's future rests on its ability to revolutionize space travel and communication through Starship and Starlink, tapping into a potentially massive market.

Conclusion: The Future of SpaceX Valuation

SpaceX's remarkable valuation, exceeding Tesla's by $43 billion, is a testament to the company's groundbreaking technological advancements, lucrative contracts, and visionary leadership. The success of Starship, Starlink, and its government and commercial contracts are all pivotal in its current trajectory. The future of SpaceX's valuation will depend on continued innovation, successful execution of ambitious projects, and favorable market conditions. However, the company's current position suggests a bright future for this rapidly expanding space exploration powerhouse. Stay informed about the exciting developments at SpaceX and the evolving landscape of the private space industry. Learn more about SpaceX's valuation and its future prospects.

Featured Posts

-

Find The Best Live Music And Events In Lake Charles This Easter Weekend

May 10, 2025

Find The Best Live Music And Events In Lake Charles This Easter Weekend

May 10, 2025 -

Harry Styles Reacts To A Bad Snl Impression

May 10, 2025

Harry Styles Reacts To A Bad Snl Impression

May 10, 2025 -

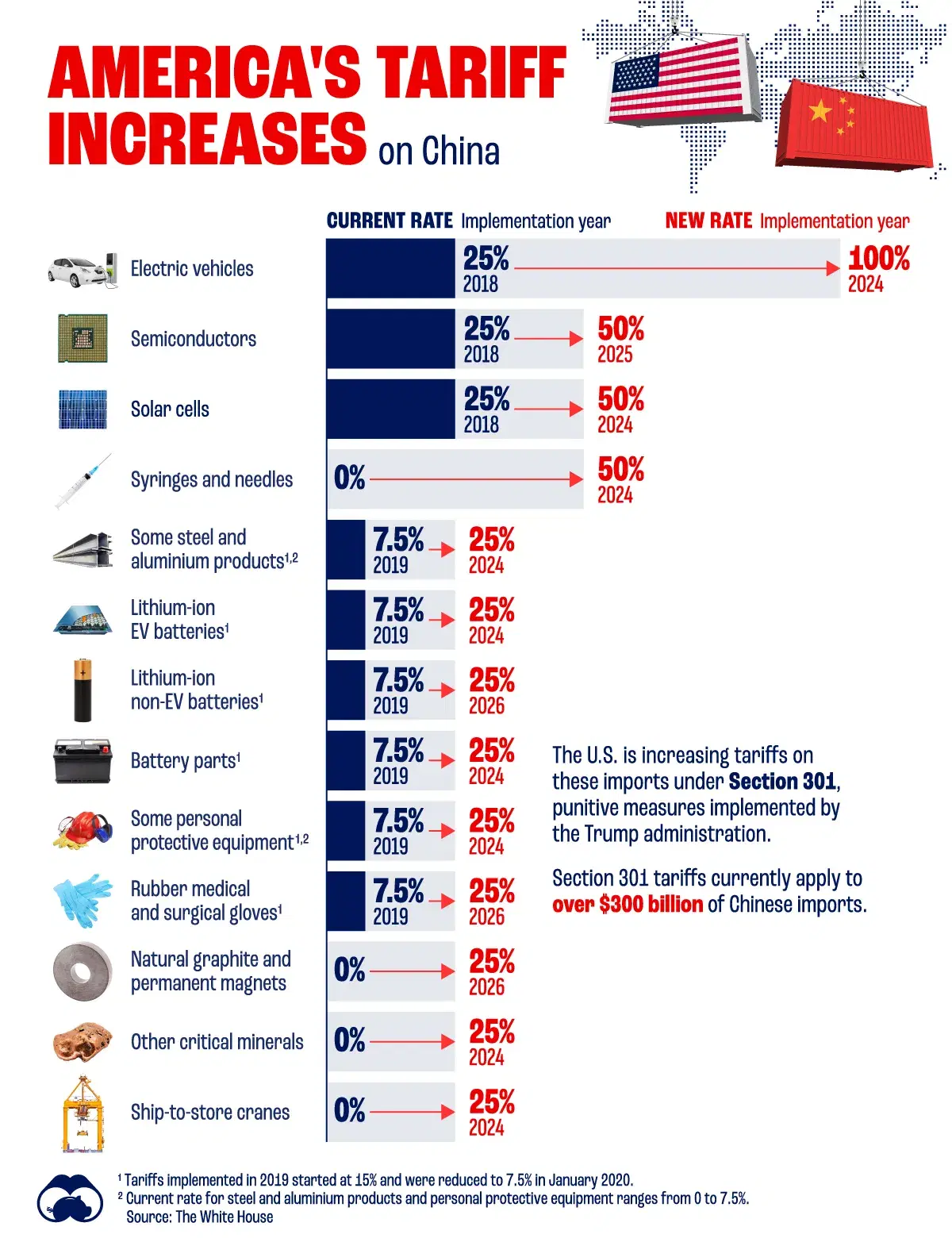

Us Uk Trade Deal Trumps Announcement And Its Implications

May 10, 2025

Us Uk Trade Deal Trumps Announcement And Its Implications

May 10, 2025 -

The Dangote Nnpc Factor How It Affects Petrol Prices In Nigeria

May 10, 2025

The Dangote Nnpc Factor How It Affects Petrol Prices In Nigeria

May 10, 2025 -

Iron Ore Price Decline Analysis Of Chinas Steel Output Reduction

May 10, 2025

Iron Ore Price Decline Analysis Of Chinas Steel Output Reduction

May 10, 2025