SSE Announces £3 Billion Spending Cut Due To Growth Slowdown

Table of Contents

Reasons Behind SSE's Reduced Capital Expenditure

The £3 billion reduction in SSE's capital expenditure stems from a confluence of factors impacting the company's financial outlook and investment priorities. These include:

-

Economic Headwinds: Soaring inflation, rapidly rising interest rates, and the looming threat of a recession have significantly increased the cost of borrowing and reduced investor confidence. This makes large-scale energy projects more financially risky. The Bank of England's recent interest rate hikes, for example, have directly impacted the cost of financing for such projects.

-

Regulatory Uncertainty: Changes in government policy regarding energy production and distribution, coupled with the inherent volatility of the energy market, create uncertainty for long-term investment planning. The fluctuating price of gas and electricity adds further complexity to accurately predicting future returns.

-

Reduced Profitability: Lower-than-anticipated returns on previous investments have forced SSE to re-evaluate its spending strategy. Some projects may not have yielded the expected profits due to unforeseen circumstances, such as supply chain disruptions or permitting delays. This necessitates a more cautious approach to future expenditures.

-

Shifting Investment Priorities: SSE is refocusing its investment strategy, prioritizing renewable energy sources and crucial network upgrades. This shift means diverting funds away from less profitable or less strategically important areas. The company's commitment to decarbonization remains strong, but achieving it within a tighter budget requires careful resource allocation.

Impact of the Spending Cut on SSE's Projects and Future Plans

The £3 billion cutback will undoubtedly impact SSE's ongoing and planned projects. Specific consequences could include:

-

Delayed Rollout of New Wind Farms: Several planned wind farm developments may experience delays or even cancellations, impacting the UK's renewable energy targets.

-

Reduced Investment in Grid Infrastructure Upgrades: Essential upgrades to the national grid, crucial for integrating renewable energy sources, may be scaled back, potentially hindering the UK's energy transition.

-

Potential Scaling Back of Research and Development Projects: Investment in innovative energy technologies and research and development could be curtailed, slowing down technological advancements within the sector.

These reductions could have a ripple effect, potentially leading to job losses within SSE and impacting the broader UK economy. Furthermore, reduced investment could translate to higher energy prices for consumers in the long run.

Wider Implications for the UK Energy Sector

SSE's decision has significant implications for the entire UK energy sector. It signals a potential trend of reduced investment across the board, leading to:

-

Reduced Competition in the Energy Market: Less investment could consolidate the market, reducing competition and potentially impacting consumer choice and pricing.

-

Potential Delays in the UK's Energy Transition: Delays in renewable energy projects and grid upgrades will hamper the UK's ambitious decarbonization goals and its journey towards energy independence.

-

Impact on the Attractiveness of the UK for Foreign Energy Investment: The decreased investment confidence within the UK energy sector may deter foreign investors, impacting the overall growth of the industry.

Analyst Reactions and Market Response to SSE's Announcement

The market reacted negatively to SSE's announcement, with the company's share price experiencing a decline. Analysts have expressed concerns about the potential long-term consequences of the spending cuts, particularly regarding the UK's energy security and its climate change commitments.

-

Stock Market Reactions: Immediate downward pressure on SSE's share price reflected investor anxieties.

-

Analyst Ratings and Forecasts: Several financial analysts have downgraded their ratings for SSE, citing concerns about future growth prospects.

-

Comments from Industry Leaders: Industry experts have voiced concerns about the potential domino effect of SSE's decision on other energy companies and the wider UK energy sector.

Conclusion: Understanding the Significance of SSE's £3 Billion Spending Cut

SSE's £3 billion spending cut reflects a complex interplay of economic headwinds, regulatory uncertainty, and shifting investment priorities. The short-term impact includes project delays and potential job losses, while the long-term consequences could affect the UK's energy transition and its overall energy security. This decision highlights the challenges facing the energy sector and underscores the need for a stable and supportive policy environment to encourage sustainable investment in renewable energy. Stay informed about the evolving landscape of SSE investment and the implications of this £3 billion spending cut by subscribing to our newsletter.

Featured Posts

-

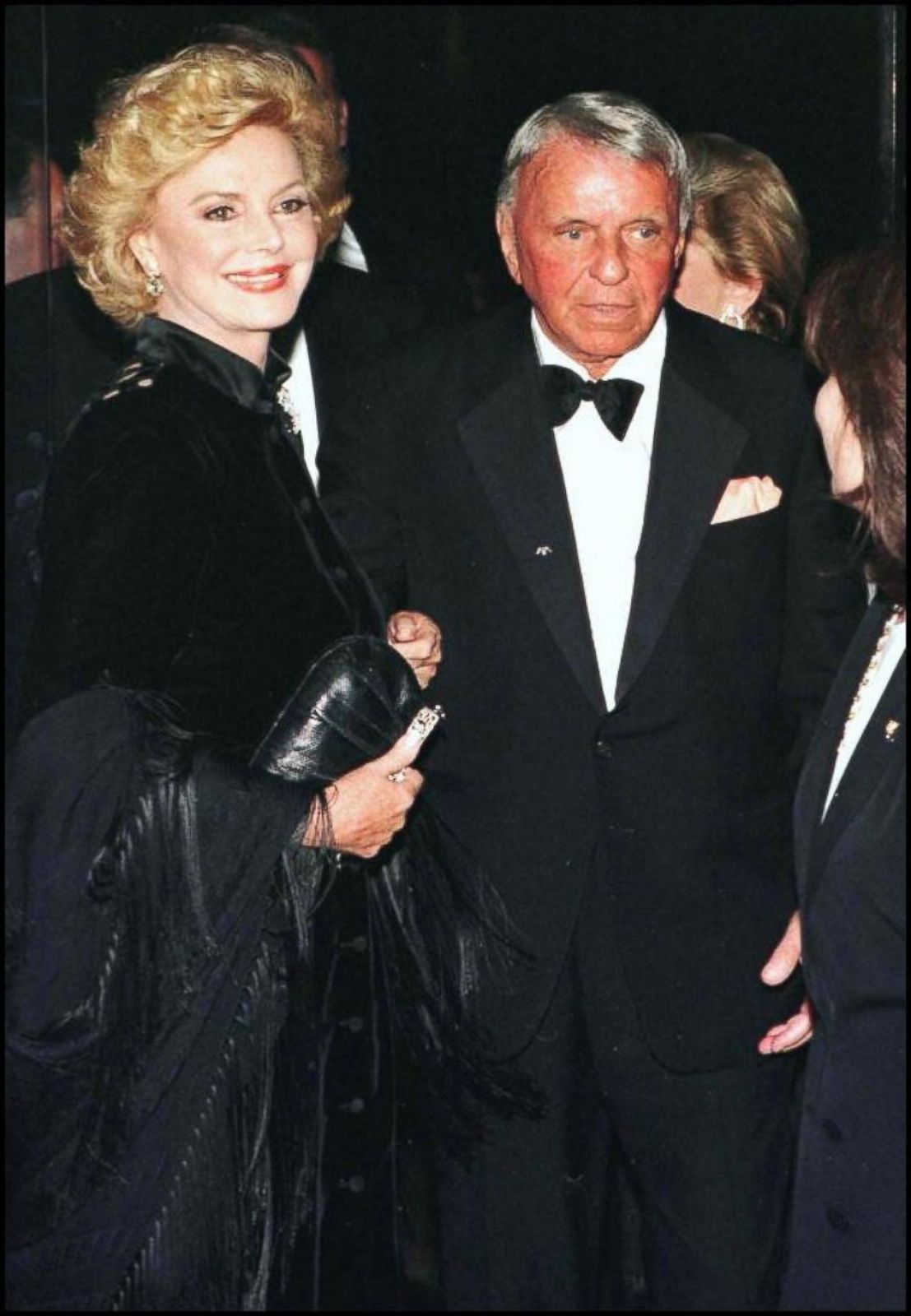

Frank Sinatra And His Four Wives Exploring His Love Life

May 24, 2025

Frank Sinatra And His Four Wives Exploring His Love Life

May 24, 2025 -

The Demna Gvasalia Era What To Expect From Gucci

May 24, 2025

The Demna Gvasalia Era What To Expect From Gucci

May 24, 2025 -

She Still Waiting By The Phone A Study In Patience And Perseverance

May 24, 2025

She Still Waiting By The Phone A Study In Patience And Perseverance

May 24, 2025 -

Exploring The Dc Legends Of Tomorrow Universe History Villains And More

May 24, 2025

Exploring The Dc Legends Of Tomorrow Universe History Villains And More

May 24, 2025 -

Rehabilitation Of Dreyfus French Parliament Debates 130th Anniversary

May 24, 2025

Rehabilitation Of Dreyfus French Parliament Debates 130th Anniversary

May 24, 2025

Latest Posts

-

Sylvester Stallones Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025

Sylvester Stallones Tulsa King Season 2 Blu Ray Sneak Peek

May 24, 2025 -

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025

The Last Rodeo Highlighting Neal Mc Donoughs Acting

May 24, 2025 -

Experience Free Films And Meet Stars At The Dallas Usa Film Festival

May 24, 2025

Experience Free Films And Meet Stars At The Dallas Usa Film Festival

May 24, 2025 -

Free Movie Screenings And Celebrity Appearances At The Usa Film Festival In Dallas

May 24, 2025

Free Movie Screenings And Celebrity Appearances At The Usa Film Festival In Dallas

May 24, 2025 -

The Last Rodeo Neal Mc Donoughs Leading Man Performance

May 24, 2025

The Last Rodeo Neal Mc Donoughs Leading Man Performance

May 24, 2025