SSE Cuts £3 Billion Spending Plan: Slowing Growth Forces Budget Review

Table of Contents

Reasons Behind SSE's £3 Billion Spending Reduction

Several interconnected factors have contributed to SSE's decision to slash its spending plan by £3 billion. Understanding these underlying causes is crucial to grasping the full implications of this significant move.

Impact of Inflation and Rising Interest Rates

The current economic climate is characterized by high inflation and rising interest rates. This has profoundly impacted SSE's investment capabilities.

- Increased Cost of Borrowing: Higher interest rates make borrowing money more expensive, increasing the cost of financing large-scale energy projects. This directly impacts the profitability of investments.

- Soaring Construction Material Costs: Inflation has driven up the price of construction materials, significantly increasing the overall cost of projects. This makes previously viable projects economically unfeasible.

- Data Point: The UK inflation rate reached X% in [Month, Year], while interest rates have increased by Y% since [Date]. These figures demonstrate the substantial financial pressures facing SSE and the wider energy sector.

Decreased Energy Demand and Price Volatility

Fluctuations in energy demand and prices have further complicated SSE's investment decisions.

- Reduced Energy Consumption: Factors such as energy efficiency improvements and economic slowdown have led to decreased energy demand, affecting the projected returns on investments in new generation capacity.

- Energy Price Volatility: The volatile nature of energy markets makes long-term investment planning extremely challenging. Price swings make accurate projections difficult, increasing investment risk.

- Statistical Insight: Energy consumption in the UK fell by Z% in [Year], while wholesale energy prices experienced significant fluctuations, with peaks of [Price] and troughs of [Price] during [Period].

Regulatory Uncertainty and Policy Changes

Government policies and regulatory changes also play a significant role in shaping SSE's investment strategy.

- Changing Regulatory Landscape: Frequent alterations in government regulations and policies create uncertainty, making long-term investment planning risky.

- Impact of Specific Policies: [Mention specific policies, e.g., changes to renewable energy subsidies or carbon emission targets, and their impact on SSE's investment decisions].

- Risk Mitigation: Navigating this regulatory uncertainty requires careful risk assessment and potentially a shift in investment priorities.

Impact of the SSE Spending Cuts on the UK Energy Sector

The £3 billion reduction in SSE's spending plan will have far-reaching consequences across the UK energy sector.

Job Security and Employment

- Potential Job Losses: The spending cuts could lead to job losses within SSE and potentially across the wider supply chain.

- Mitigation Strategies: SSE is likely to implement measures to mitigate job losses, such as voluntary redundancy schemes or redeployment opportunities. However, some job losses are inevitable.

- Wider Sector Impact: The ripple effect could impact employment levels in related industries, such as construction and engineering.

Investment in Renewable Energy Projects

- Delayed Projects: The cuts could result in delays or cancellations of renewable energy projects, hindering the UK's progress towards its carbon reduction targets.

- Impact on Renewable Energy Growth: Reduced investment in renewable energy could slow down the transition to a low-carbon energy system.

- Long-Term Implications: This could negatively affect the UK's energy security and its commitment to combating climate change.

Future Energy Prices and Consumer Impact

- Potential Price Increases: The reduced investment in new generation capacity could potentially lead to higher energy prices for consumers in the long term.

- Energy Security Concerns: A slowdown in renewable energy development may compromise the UK's energy security and its ability to meet future energy demands.

- Government Response: The government may need to intervene to address the potential negative impacts on consumers and energy security.

SSE's Future Strategy and Outlook Following the Spending Cuts

SSE is likely to undertake significant changes to its strategy in response to the economic pressures.

Restructuring and Efficiency Measures

- Internal Restructuring: SSE will likely restructure its operations to improve efficiency and reduce costs.

- Cost-Cutting Measures: This may involve streamlining processes, reducing overheads, and exploring opportunities for synergy and consolidation.

- Operational Changes: The company will likely focus on optimizing its existing assets and improving operational efficiency.

Revised Investment Priorities and Focus Areas

- Shifting Investment Focus: SSE may prioritize investments in projects with quicker returns and lower risk.

- Strategic Partnerships: Collaboration and strategic partnerships could become crucial to managing risk and accessing capital.

- Strategic Acquisitions: The company might pursue strategic acquisitions to gain access to new technologies or markets.

Financial Implications and Long-Term Sustainability

- Impact on Shareholder Value: The spending cuts will likely impact SSE's short-term financial performance and potentially its shareholder value.

- Credit Rating Implications: The reduced investment capacity could affect SSE's credit rating.

- Long-Term Sustainability: The long-term sustainability of SSE will depend on its ability to adapt to the changing economic landscape and implement a successful long-term strategy.

Conclusion: Analyzing the Significance of SSE's Spending Cuts and Looking Ahead

SSE's £3 billion spending cut reflects the significant challenges facing the UK energy sector. Factors such as inflation, rising interest rates, decreased energy demand, and regulatory uncertainty have forced the company to reassess its investment strategy. The impact of these cuts will be far-reaching, affecting employment, renewable energy development, and ultimately, energy prices for consumers. SSE's revised strategy will focus on efficiency, cost reduction, and a recalibration of investment priorities. To learn more about the impact of SSE spending cuts on the UK energy landscape, explore our related articles and stay informed about further developments.

Featured Posts

-

Demnas Vision Reshaping Guccis Identity

May 25, 2025

Demnas Vision Reshaping Guccis Identity

May 25, 2025 -

The Philips Future Health Index 2025 How Ai Will Reshape Global Healthcare

May 25, 2025

The Philips Future Health Index 2025 How Ai Will Reshape Global Healthcare

May 25, 2025 -

Naomi Kampel Stis Maldives Apolaystikes Diakopes Me Mpikini Sta 54

May 25, 2025

Naomi Kampel Stis Maldives Apolaystikes Diakopes Me Mpikini Sta 54

May 25, 2025 -

F1 Testing Lewis Hamiltons Unexpected Gesture To Ex Teammate Revealed

May 25, 2025

F1 Testing Lewis Hamiltons Unexpected Gesture To Ex Teammate Revealed

May 25, 2025 -

New Orleans Jailbreak Inmates Allegedly Use Hair Trimmers In Escape Attempt

May 25, 2025

New Orleans Jailbreak Inmates Allegedly Use Hair Trimmers In Escape Attempt

May 25, 2025

Latest Posts

-

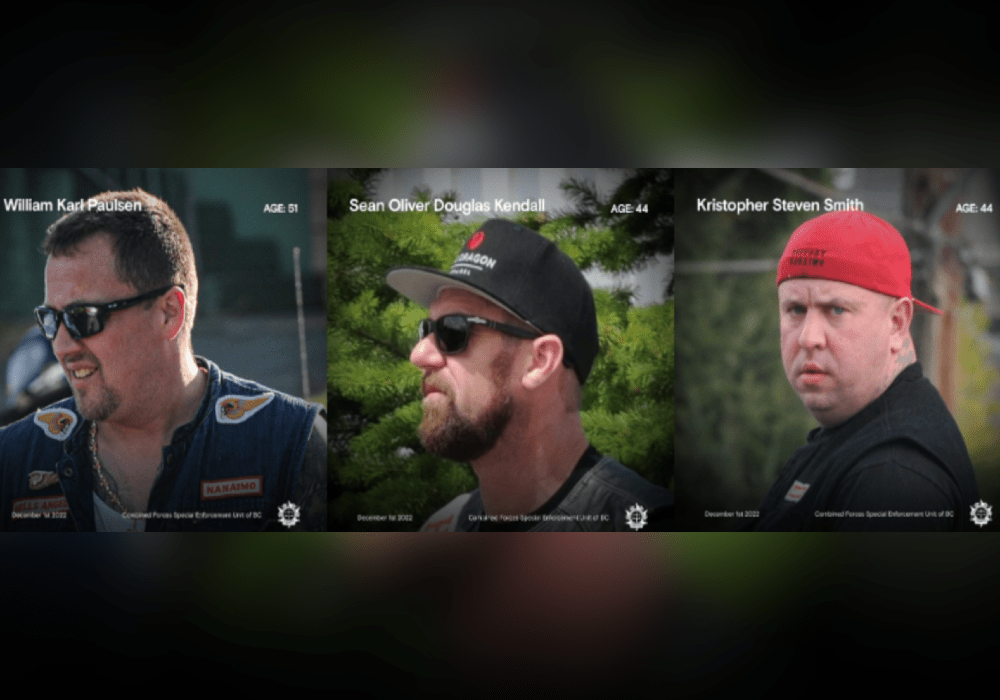

Hells Angels An Analysis Of Their Global Presence And Influence

May 25, 2025

Hells Angels An Analysis Of Their Global Presence And Influence

May 25, 2025 -

Remembering Craig Mc Ilquham A Hells Angels Memorial Service Sunday

May 25, 2025

Remembering Craig Mc Ilquham A Hells Angels Memorial Service Sunday

May 25, 2025 -

The Hells Angels And The Law Criminal Activities And Legal Battles

May 25, 2025

The Hells Angels And The Law Criminal Activities And Legal Battles

May 25, 2025 -

Sunday Memorial Service Honors Deceased Hells Angels Member Craig Mc Ilquham

May 25, 2025

Sunday Memorial Service Honors Deceased Hells Angels Member Craig Mc Ilquham

May 25, 2025 -

Exploring The Hells Angels Membership And Hierarchy

May 25, 2025

Exploring The Hells Angels Membership And Hierarchy

May 25, 2025