SSE Cuts £3 Billion Spending Plan: Slowing Growth Impacts Investment

Table of Contents

Reasons Behind SSE's Reduced Investment

Several interconnected factors have driven SSE's decision to slash its spending plan by £3 billion.

Economic Uncertainty and Inflation

The UK, like much of the world, is grappling with high inflation and significant economic uncertainty. This has profoundly impacted SSE's investment calculus.

- Increased Costs: The cost of materials, from steel to cabling, has skyrocketed, significantly increasing the capital expenditure for energy projects. Labor costs have also risen, adding further pressure to project budgets.

- Regulatory Hurdles: Navigating the regulatory environment for large-scale energy projects is complex and costly. Delays and uncertainties in obtaining necessary approvals add to the overall project expense.

- Rising Interest Rates: The Bank of England's efforts to curb inflation have led to higher interest rates, making borrowing significantly more expensive for large-scale investments like those undertaken by SSE. This increase in borrowing costs directly impacts the feasibility of many projects. The increased cost of capital makes previously viable projects less attractive.

Slowing Energy Demand Growth

Energy demand growth in the UK is slowing, partly due to improved energy efficiency measures in buildings and the increasing penetration of renewable energy sources. This dampens the projected returns on investment for traditional energy projects.

- Reduced ROI: Traditional energy projects rely on consistent and growing energy demand to generate sufficient returns. Slower growth necessitates a reevaluation of investment priorities.

- Renewable Energy Competition: The rapid growth of renewable energy sources like wind and solar power is creating competition for investment and market share. This competitive pressure influences SSE's investment decisions.

- Energy Efficiency Improvements: Government initiatives and consumer awareness are driving improvements in energy efficiency, reducing overall energy consumption and impacting demand projections. These improvements, while beneficial for the environment and consumers, directly impact the returns on investment for traditional energy companies.

Shifting Regulatory Landscape

Changes in government regulations and policies have also influenced SSE's decision.

- Net-Zero Targets: The UK's ambitious net-zero targets, while laudable, create uncertainty for traditional fossil fuel-based investments. Companies need to adapt and invest in low-carbon solutions.

- Renewable Energy Subsidies: Changes in government subsidies and support mechanisms for renewable energy projects can impact investment decisions, leading to a reassessment of project viability.

- Environmental Regulations: Stricter environmental regulations increase compliance costs, adding to the overall expense of energy projects and potentially reducing their attractiveness. These costs can be substantial, influencing investment choices.

Impact of the Spending Cut on SSE and the Energy Sector

The £3 billion spending cut will have significant repercussions for SSE and the UK energy market as a whole.

Consequences for SSE's Growth and Profitability

The reduction in investment will inevitably impact SSE's short-term and long-term growth and profitability.

- Shareholder Value: Reduced investment could lead to slower revenue growth and potentially lower returns for shareholders. Investor confidence may also be affected.

- Financial Performance: The short-term impact might be felt through decreased revenue, while the long-term impact could be a slower transition to new energy sources and reduced competitiveness.

- Delayed Projects: Crucial infrastructure projects might be delayed or canceled altogether, impacting future energy supply and potentially leading to job losses.

Wider Implications for the UK Energy Market

SSE's decision has far-reaching implications for the UK energy sector.

- Energy Security: Delays in crucial infrastructure projects could compromise the UK's energy security, particularly during periods of high demand.

- Job Losses: Reductions in investment could lead to job losses in the energy sector, impacting communities reliant on these industries.

- Renewable Energy Transition: While SSE's focus may shift toward renewable energy, the reduced overall investment could slow down the transition to a low-carbon energy system.

Competitor Responses and Market Dynamics

Other energy companies may respond to SSE's actions by reevaluating their investment strategies, potentially leading to a reshuffling of the market share and competitive dynamics within the UK energy sector. Some may seize opportunities arising from SSE's reduced activity, while others might adopt similar cautionary measures.

Future Outlook for SSE's Investment Strategy

While the £3 billion cut is significant, SSE's future investment strategy will be crucial.

Potential for Future Investment

While current investment is curtailed, SSE will likely refocus its spending on projects with higher returns and lower risk.

Focus on Renewable Energy

SSE is likely to prioritize investment in renewable energy sources, aligning with the UK's net-zero targets and taking advantage of the growing market for clean energy.

Strategies for Mitigating Financial Risks

SSE will likely implement stricter risk management strategies, including more thorough due diligence on projects, diversification of investments, and potentially hedging against market fluctuations to better manage financial risks in the future.

Conclusion: Analyzing SSE's £3 Billion Spending Cut and its Implications

SSE's £3 billion spending cut is a significant development, reflecting the challenges of economic uncertainty, slowing energy demand growth, and a shifting regulatory landscape. This decision will have consequences for SSE's financial performance, the UK energy sector, and the nation's energy security. The shift in investment strategy towards renewable energy is a likely outcome, but the overall impact will require close monitoring. Stay updated on the evolving situation with SSE's investment strategy and the impact of this significant £3 billion spending cut on the UK energy sector.

Featured Posts

-

Johnson Matthey Sells Unit To Honeywell Impact On Bt Profits

May 23, 2025

Johnson Matthey Sells Unit To Honeywell Impact On Bt Profits

May 23, 2025 -

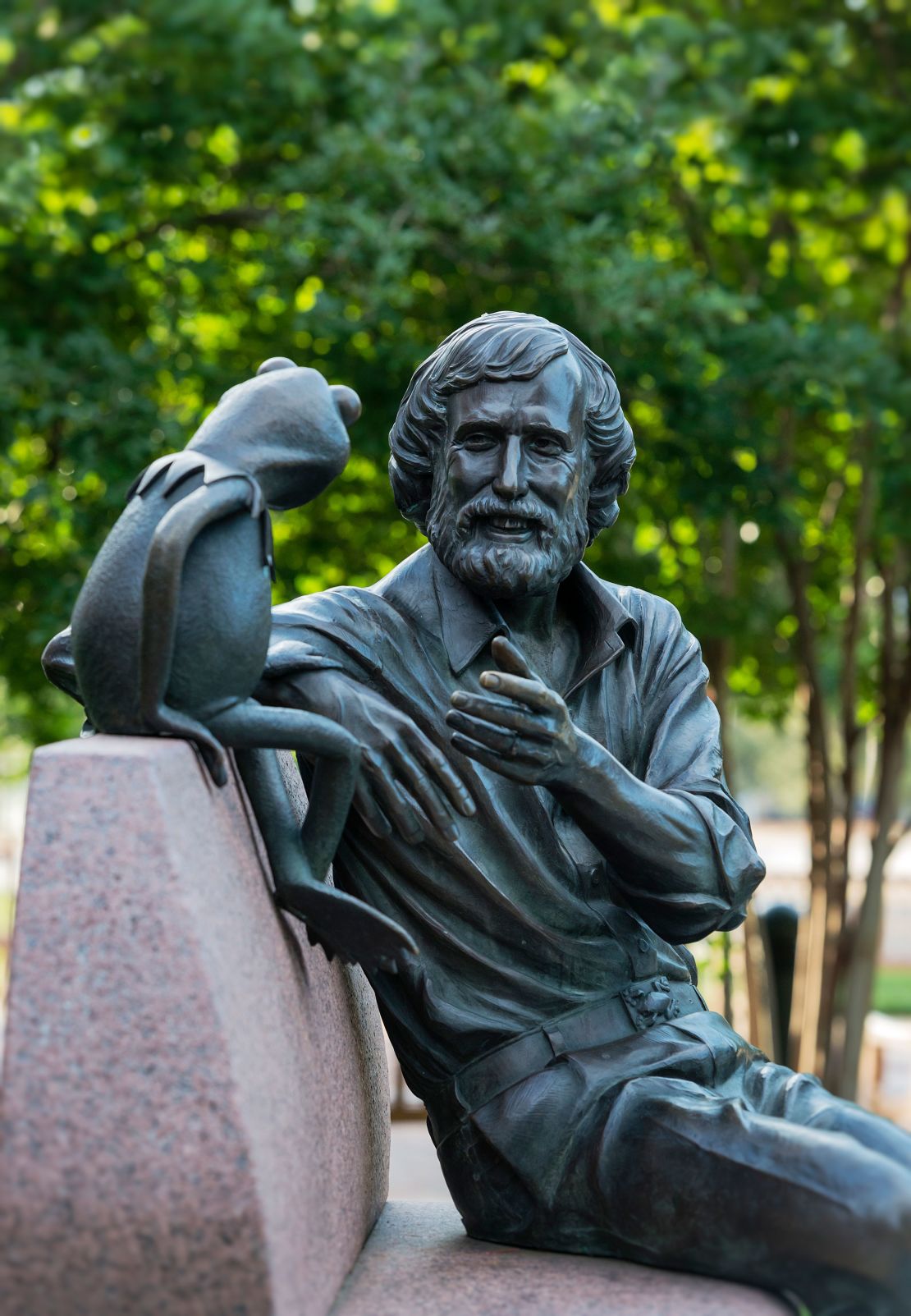

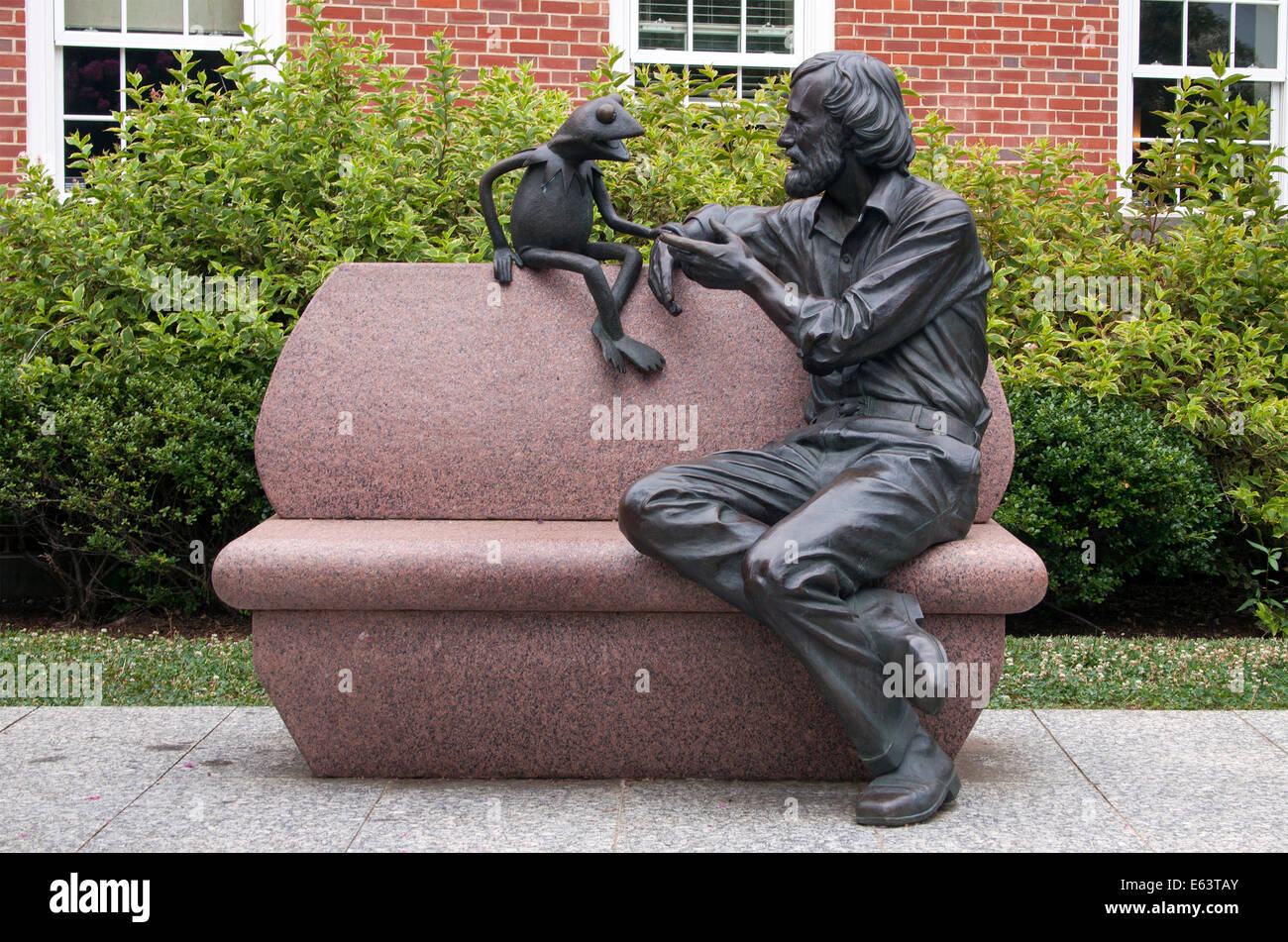

2025 Commencement Speaker Kermit The Frog At University Of Maryland

May 23, 2025

2025 Commencement Speaker Kermit The Frog At University Of Maryland

May 23, 2025 -

Cat Deeleys Phase Eight Midi Skirt A Style Hit On This Morning

May 23, 2025

Cat Deeleys Phase Eight Midi Skirt A Style Hit On This Morning

May 23, 2025 -

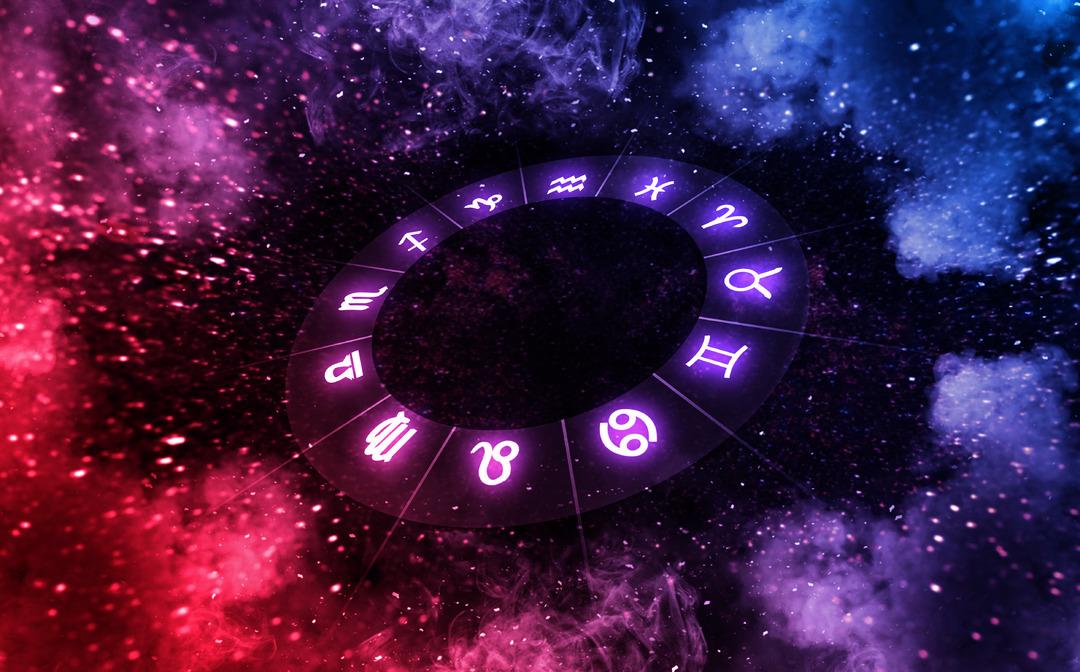

Hangi Burc 16 Mart Dogum Tarihlilerin Burc Oezellikleri

May 23, 2025

Hangi Burc 16 Mart Dogum Tarihlilerin Burc Oezellikleri

May 23, 2025 -

The Los Angeles Wildfires A New Frontier For Speculative Betting

May 23, 2025

The Los Angeles Wildfires A New Frontier For Speculative Betting

May 23, 2025

Latest Posts

-

University Of Maryland Commencement Speaker 2024 Kermit The Frog

May 23, 2025

University Of Maryland Commencement Speaker 2024 Kermit The Frog

May 23, 2025 -

Maryland University Selects Kermit The Frog For 2025 Commencement Ceremony

May 23, 2025

Maryland University Selects Kermit The Frog For 2025 Commencement Ceremony

May 23, 2025 -

Maryland University Selects Kermit The Frog For 2025 Graduation Ceremony

May 23, 2025

Maryland University Selects Kermit The Frog For 2025 Graduation Ceremony

May 23, 2025 -

2025 University Of Maryland Graduation Kermit The Frog To Speak

May 23, 2025

2025 University Of Maryland Graduation Kermit The Frog To Speak

May 23, 2025 -

Kermit The Frogs Commencement Speech A University Of Maryland First

May 23, 2025

Kermit The Frogs Commencement Speech A University Of Maryland First

May 23, 2025