SSE's £3 Billion Spending Cut: Impact Of Economic Slowdown

Table of Contents

Reasons Behind SSE's Spending Reduction

Several interconnected factors have driven SSE's decision to slash its spending by £3 billion. Understanding these contributing factors is crucial to grasping the full scope of the implications.

Economic Slowdown and Inflation

The UK's current economic climate is characterized by high inflation and recessionary pressures, significantly impacting SSE's financial performance and investment appetite.

- Reduced consumer spending on energy: High energy prices, coupled with the cost-of-living crisis, have led to reduced consumer demand, squeezing SSE's profit margins.

- Increased borrowing costs: Rising interest rates make securing financing for large-scale projects more expensive, increasing the cost of capital for SSE.

- Pressure on profit margins: The combination of reduced demand and increased costs is directly impacting SSE's profitability, forcing the company to re-evaluate its investment strategy.

According to the Office for National Statistics, inflation reached a 40-year high in [Insert Month, Year], impacting household budgets and energy consumption. This, combined with [cite source for energy price changes], has created a challenging environment for energy providers. The impact extends to renewable energy projects and grid infrastructure investments, which are now facing increased scrutiny and potential delays.

Regulatory Uncertainty and Policy Changes

Government policies and regulatory frameworks play a significant role in shaping investment decisions in the energy sector. Uncertainty in these areas has contributed to SSE's spending cuts.

- Uncertainty surrounding future energy subsidies: Changes in government support for renewable energy projects create uncertainty for long-term investment planning.

- Changes in renewable energy incentives: Fluctuations in incentive schemes make it difficult for companies like SSE to accurately forecast returns on investment.

- Potential delays in planning permissions: Lengthy and complex planning processes can significantly delay project timelines and increase overall costs.

The recent changes to the [mention specific policy, e.g., Renewables Obligation] and the ongoing debate surrounding [mention another relevant policy] have introduced a degree of uncertainty that makes large-scale investment less attractive. These regulatory hurdles contribute directly to the caution exercised by SSE in its current spending plans.

Investor Sentiment and Market Conditions

Investor confidence and broader market conditions play a crucial role in influencing SSE's investment strategy.

- Reduced investor appetite for risk: In times of economic uncertainty, investors tend to favor less risky investments, making it harder for SSE to secure financing for large projects.

- Impact on share prices: The announcement of the spending cuts has likely affected SSE's share price, reflecting investor concerns about the company's future prospects. [Include data on share price performance if available].

- Difficulty in securing necessary financing: The combination of reduced investor appetite and increased borrowing costs makes securing the necessary funds for large-scale projects significantly more challenging.

Impact on SSE's Operations and Future Plans

The £3 billion spending cut will have significant implications for SSE's operations and long-term strategic goals.

Delayed or Cancelled Projects

Several projects are likely to be affected by the spending cuts.

- [Project Name 1]: [Brief description and estimated cost] – This project's delay could impact [mention consequences, e.g., renewable energy generation targets].

- [Project Name 2]: [Brief description and estimated cost] – Cancellation of this project could lead to [mention consequences, e.g., job losses in a specific region].

- [Project Name 3]: [Brief description and estimated cost] – Postponement of this project will hinder [mention consequences, e.g., grid modernization efforts].

These project delays or cancellations will undoubtedly impact job creation and regional economic development plans linked to these initiatives.

Changes in Workforce and Employment

The spending cuts could lead to:

- Hiring freezes: SSE might pause recruitment across various departments to manage costs.

- Potential job losses: While SSE hasn't announced widespread job cuts yet, it's a possibility as projects are delayed or cancelled. [Link to SSE's official statements if available].

The potential impact on employees and the wider community should be closely monitored.

Long-Term Strategic Implications

The spending cuts could significantly impact SSE's long-term strategic goals:

- Challenges in meeting climate targets: Delays in renewable energy projects could hinder the UK's progress towards its net-zero emissions goals.

- Maintaining market share: Reduced investment might affect SSE's ability to compete effectively in a rapidly evolving energy market.

- Securing future growth: The current strategic plan may require significant adjustments to accommodate the reduced investment capacity.

Wider Implications for the Energy Sector

SSE's decision has far-reaching consequences beyond the company itself.

Impact on Renewable Energy Development

The spending cuts send a worrying signal to the renewable energy sector:

- Reduced investment in renewable energy projects: This could slow down the UK's transition to cleaner energy sources.

- Potential consequences for achieving net-zero targets: Delays in renewable energy development might make it harder to meet ambitious climate targets.

The ripple effect could extend to investor confidence in the renewable energy sector as a whole.

Implications for Energy Prices and Consumers

Reduced investment in energy infrastructure might have several implications:

- Potential for increased energy prices: Lack of investment in grid upgrades could lead to higher costs for consumers.

- Reduced energy security: Delayed projects might compromise the reliability and resilience of the UK's energy supply.

Effects on other Energy Companies

SSE's actions could prompt similar moves from other energy companies.

- Potential for similar spending cuts: Other energy providers might follow suit, further impacting investment in the sector.

- Broader implications for the energy market: This could lead to a more cautious and less dynamic energy market.

Conclusion

SSE's £3 billion spending cut underscores the significant challenges facing the energy sector amidst economic slowdown and regulatory uncertainty. These SSE spending cuts have significant implications for the company's future, the UK's renewable energy ambitions, and energy prices for consumers. Further analysis is needed to fully understand the long-term consequences. Staying informed on the latest developments in SSE spending cuts and the wider energy market is crucial for stakeholders and consumers alike. Monitor news and official statements from SSE and relevant regulatory bodies for updates on the evolving situation.

Featured Posts

-

Mathieu Avanzi Et La Revitalisation De La Langue Francaise

May 25, 2025

Mathieu Avanzi Et La Revitalisation De La Langue Francaise

May 25, 2025 -

The Kyle And Teddi Dog Walking Incident A Heated Confrontation

May 25, 2025

The Kyle And Teddi Dog Walking Incident A Heated Confrontation

May 25, 2025 -

Krijgt De Snelle Marktdraai Van Europese Aandelen Een Vervolg

May 25, 2025

Krijgt De Snelle Marktdraai Van Europese Aandelen Een Vervolg

May 25, 2025 -

From Distant Shores To Dc A Love Story Cut Short

May 25, 2025

From Distant Shores To Dc A Love Story Cut Short

May 25, 2025 -

Gryozy Lyubvi Ili Ilicha V Trude Analiz Syuzheta I Personazhey

May 25, 2025

Gryozy Lyubvi Ili Ilicha V Trude Analiz Syuzheta I Personazhey

May 25, 2025

Latest Posts

-

Zheng Qinwens Historic Win Upsets Sabalenka At Italian Open

May 25, 2025

Zheng Qinwens Historic Win Upsets Sabalenka At Italian Open

May 25, 2025 -

I Mercedes Kai I Pithanotita Apoktisis Toy Ferstapen Mia Analysi

May 25, 2025

I Mercedes Kai I Pithanotita Apoktisis Toy Ferstapen Mia Analysi

May 25, 2025 -

I Mercedes Apomakrynetai Apo Ton Ferstapen

May 25, 2025

I Mercedes Apomakrynetai Apo Ton Ferstapen

May 25, 2025 -

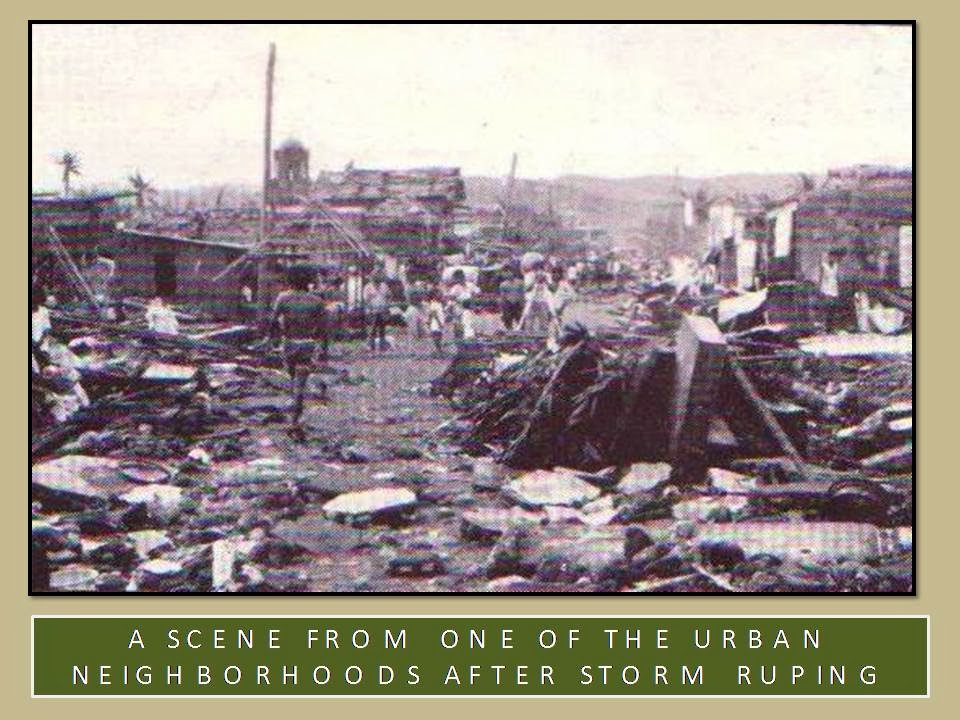

The Rise And Fall Or Continued Success Of Russell And The Typhoons

May 25, 2025

The Rise And Fall Or Continued Success Of Russell And The Typhoons

May 25, 2025 -

F1 Testing Lewis Hamiltons Classy Act With A Former Teammate

May 25, 2025

F1 Testing Lewis Hamiltons Classy Act With A Former Teammate

May 25, 2025