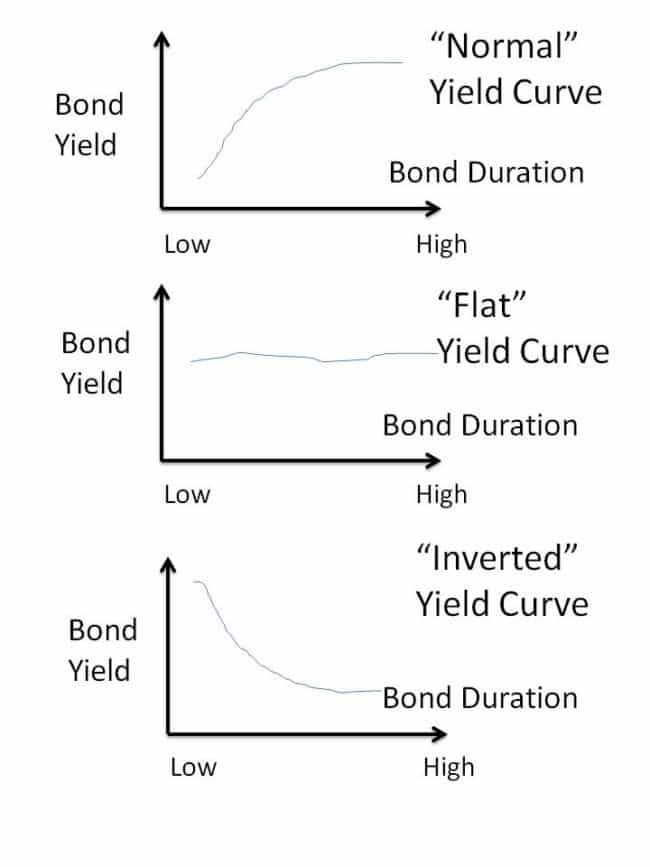

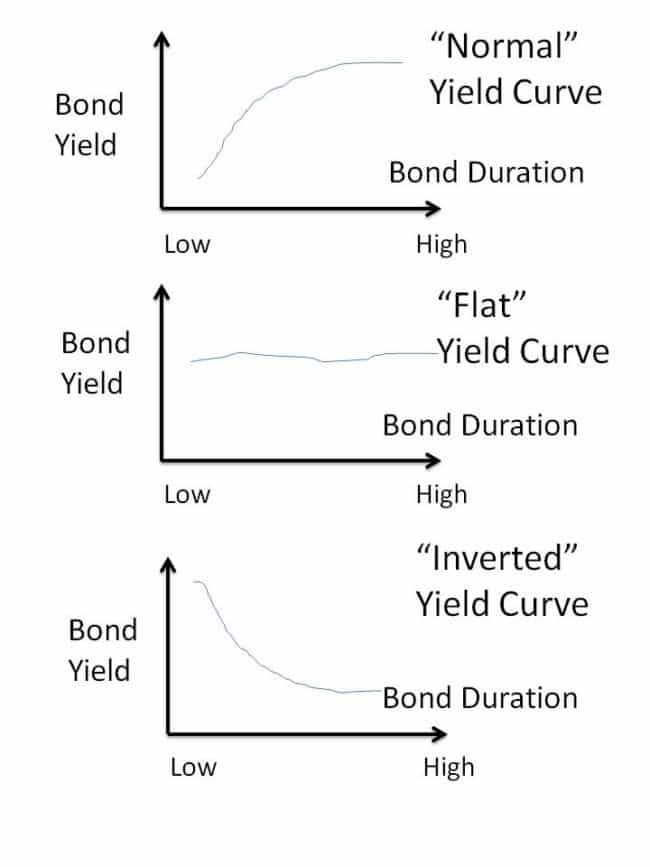

Steepening Japanese Government Bond Yield Curve: Investor Divisions And Economic Implications

Table of Contents

Factors Contributing to the Steepening JGB Yield Curve

The steepening of the JGB yield curve is a complex phenomenon resulting from several interconnected factors. Understanding these drivers is crucial for interpreting current market dynamics and anticipating future movements.

Bank of Japan (BOJ) Policy Shift

The Bank of Japan's (BOJ) gradual abandonment of its yield curve control (YCC) policy is the primary catalyst for the steepening curve. This shift, after years of ultra-loose monetary policy, has allowed longer-term JGB yields to rise more sharply than shorter-term yields.

- Increased Market Volatility: The policy adjustment has introduced increased volatility into the JGB market, making it more challenging for investors to predict future yield movements. This uncertainty is reflected in wider bid-ask spreads and increased trading activity.

- Potential for Further Adjustments: Markets remain highly sensitive to any further indications of potential adjustments to BOJ policy. Any hint of further tightening could lead to further steepening of the yield curve.

- Impact of Inflation: The BOJ's decision-making is increasingly influenced by persistent, albeit moderate, inflationary pressures within Japan. The balance between controlling inflation and maintaining economic growth is a key factor influencing the future trajectory of JGB yields.

Global Interest Rate Hikes

Rising global interest rates, especially in the United States, have made JGBs relatively less attractive to international investors compared to higher-yielding alternatives. This has contributed to capital outflows from Japan and upward pressure on JGB yields.

- JGB vs. US Treasury Yields: The yield differential between JGBs and US Treasuries is a key determinant of capital flows. A widening spread favors US Treasuries, leading to reduced demand for JGBs.

- Global Economic Uncertainty: Global economic uncertainty further reduces investor appetite for Japanese bonds, as investors seek safer haven assets.

- Capital Outflows: The combination of higher global yields and economic uncertainty has resulted in significant capital outflows from Japan, impacting the demand for JGBs and contributing to yield increases.

Increased Inflationary Pressures

While inflation in Japan remains relatively moderate compared to other developed economies, persistent inflationary pressures are forcing a re-evaluation of the BOJ's ultra-loose monetary policy, putting upward pressure on JGB yields.

- Japan's Inflation Rate: Analysis of Japan's current inflation rate and its projected trajectory is crucial for understanding the BOJ's future policy decisions and their impact on JGB yields.

- Rising Energy and Commodity Prices: Rising global energy and commodity prices are contributing to inflationary pressures in Japan, influencing investor expectations for future interest rate adjustments.

- Inflation and JGB Yields: The relationship between inflation and JGB yields is directly linked; higher inflation generally leads to higher yields as investors demand higher returns to compensate for inflation erosion.

Diverging Investor Strategies and Opinions

The steepening JGB yield curve has created a divergence in investor strategies and opinions, reflecting varying assessments of the risks and opportunities in the market.

Bullish on JGBs (Short-Term)

Some investors remain bullish on short-term JGBs, anticipating that the BOJ will continue to intervene to prevent excessive yield increases in the near term.

- Short-Term JGB Trading Strategies: These strategies focus on exploiting short-term fluctuations in JGB prices, taking advantage of anticipated BOJ intervention.

- Risk of BOJ Policy Shifts: A key risk for this strategy is the unpredictable nature of future BOJ policy; any unexpected policy shift could lead to significant losses.

Bearish on JGBs (Long-Term)

Other investors are bearish on long-term JGBs, expecting further yield increases driven by inflation and global market pressures, leading them to seek alternative investments.

- Hedging Strategies against Rising Yields: Bearish investors employ hedging strategies, such as selling JGB futures or buying inflation-linked bonds, to protect against potential capital losses.

- Potential for Capital Losses: The risk of capital losses on long-term JGB holdings is significant given the anticipated rise in yields.

Neutral/Hedging Strategies

Many investors are adopting neutral or hedging strategies to mitigate the risks associated with the uncertainty surrounding the JGB market.

- Hedging Strategies for Institutional Investors: Institutional investors employ sophisticated hedging strategies, such as interest rate swaps and options, to manage risk and protect against adverse yield movements.

- Effectiveness of Hedging Approaches: The effectiveness of various hedging approaches depends on the accuracy of yield forecasts and the timing of market interventions.

Economic Implications of a Steepening JGB Yield Curve

The steepening JGB yield curve has significant economic implications for Japan, potentially affecting government finances, corporate investment, and the value of the Japanese yen.

Impact on Government Borrowing Costs

A steeper yield curve increases the cost of government borrowing, potentially limiting the government's ability to fund fiscal spending and social programs.

- JGB Yields and Government Debt: Higher JGB yields directly translate into higher debt servicing costs for the Japanese government.

- Consequences for Government Budget Planning: Rising borrowing costs necessitate adjustments in government budget planning, potentially leading to cuts in spending or increased taxation.

Effects on Corporate Investment

Higher borrowing costs resulting from the steepening JGB curve could dampen corporate investment and slow economic growth.

- Impact on Corporate Borrowing and Investment: Increased interest rates make it more expensive for companies to borrow money for investment, leading to reduced capital expenditures.

- Consequences for Economic Growth and Job Creation: Lower corporate investment can negatively impact economic growth and job creation.

Impact on the Japanese Yen

Changes in JGB yields can affect the value of the Japanese yen, impacting trade and investment flows.

- JGB Yields and Yen Exchange Rate: Higher JGB yields can attract foreign investment, strengthening the yen. Conversely, lower yields can weaken the yen.

- Implications for Japan's Trade Balance and Competitiveness: Yen fluctuations impact Japan's trade balance and international competitiveness.

Conclusion: Navigating the Steepening Japanese Government Bond Yield Curve

The steepening Japanese Government Bond yield curve presents a complex and evolving situation with significant implications for the Japanese economy and global markets. Understanding the interplay between BOJ policy, global interest rate movements, inflation, and investor sentiment is crucial for navigating this dynamic market. Investors need to carefully analyze the risks and opportunities, adapting their strategies to manage potential volatility. Continuous monitoring of the steepening Japanese Government Bond yield curve and related macroeconomic factors is essential for informed decision-making and successful investment management. Stay informed to optimize your investment strategy in this ever-changing landscape.

Featured Posts

-

I Saoydiki Aravia Ypodexetai Ton Tramp Mia Megaloprepis Parelasi Me Xrysa Spathia Kai Maxitika Aeroskafi

May 17, 2025

I Saoydiki Aravia Ypodexetai Ton Tramp Mia Megaloprepis Parelasi Me Xrysa Spathia Kai Maxitika Aeroskafi

May 17, 2025 -

Waymo And Uber Comparing Robotaxi Services In Austin

May 17, 2025

Waymo And Uber Comparing Robotaxi Services In Austin

May 17, 2025 -

Jalen Brunson Injury Knicks Playoff Hopes Hinge On Point Guards Recovery

May 17, 2025

Jalen Brunson Injury Knicks Playoff Hopes Hinge On Point Guards Recovery

May 17, 2025 -

Microsoft Streamlines Surface Lineup Which Device Is Next

May 17, 2025

Microsoft Streamlines Surface Lineup Which Device Is Next

May 17, 2025 -

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Odds And Predictions

May 17, 2025

Bet365 Nypbet Bonus Code Your Guide To Knicks Vs Pistons Odds And Predictions

May 17, 2025