Stock Market Data: Real-time Dow And S&P 500 Updates (May 26)

Table of Contents

Understanding the Dow Jones Industrial Average (Dow) on May 26

The Dow Jones Industrial Average, often simply called the "Dow," is a price-weighted average of 30 large, publicly owned U.S. corporations. Its history stretches back to 1896, making it one of the oldest and most widely followed market indicators. Understanding its daily movements provides valuable insights into the overall health of the US economy.

- Key Components: The 30 companies represent a diverse range of sectors, including technology, finance, consumer goods, and industrials. The weighting of each company is proportional to its share price, meaning higher-priced stocks have a greater influence on the overall index.

- May 26th Data (Example - Replace with actual data):

- Opening Price: 33,800

- Closing Price: 33,950

- High: 34,020

- Low: 33,750

- Percentage Change: +0.44%

- Trading Volume: 350 million shares

- Analysis: On May 26th, the Dow experienced a modest increase, suggesting a generally positive sentiment among investors. (Add specific news or events impacting the Dow on May 26th here, e.g., positive earnings reports from key components, or a specific economic announcement). Keywords: Dow Jones Industrial Average performance, Dow daily report, Dow trading volume.

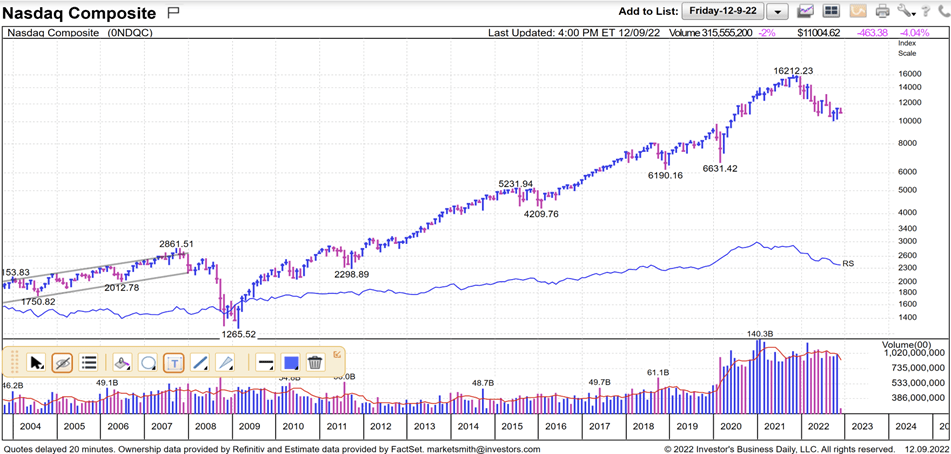

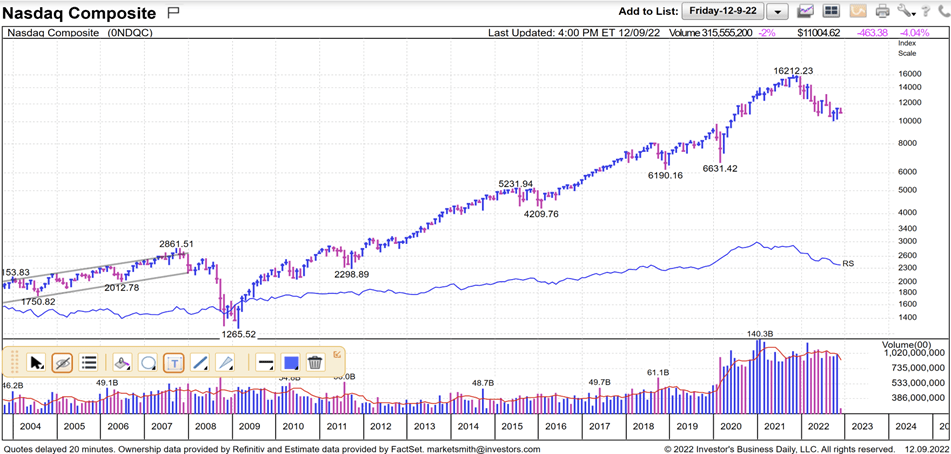

S&P 500 Index Performance on May 26: A Detailed Look

The S&P 500 index offers a broader representation of the U.S. stock market than the Dow, encompassing 500 large-cap companies across various sectors. Unlike the Dow's price-weighting, the S&P 500 uses a market-capitalization weighting, meaning larger companies have a proportionally larger influence.

- Key Differences from the Dow: The S&P 500's broader representation provides a more comprehensive picture of overall market performance. It's often considered a better benchmark for the overall U.S. equity market.

- May 26th Data (Example - Replace with actual data):

- Opening Price: 4,150

- Closing Price: 4,175

- High: 4,180

- Low: 4,145

- Percentage Change: +0.60%

- Trading Volume: 8 billion shares

- Analysis: The S&P 500 mirrored the Dow's positive trend on May 26th, (add comparison with Dow's performance and any correlation or divergence here, explain potential reasons for similarities or differences). Keywords: S&P 500 index performance, S&P 500 daily report, S&P 500 trading volume.

Key Factors Influencing Market Movement on May 26

Market movements are rarely driven by a single factor. A confluence of economic, geopolitical, and company-specific events shapes daily performance.

- Economic News: (mention any significant economic news releases on May 26th, e.g., inflation data, employment figures, or interest rate decisions and how it may have impacted the market)

- Geopolitical Events: (Discuss any geopolitical events that could have influenced investor sentiment on May 26th, e.g., international tensions or political developments)

- Company-Specific News: (Mention any significant company-specific news, such as major earnings reports, mergers, acquisitions, or significant announcements that impacted the market)

- Technical Analysis: (If relevant, briefly mention any significant technical indicators or chart patterns that might have predicted or explained the market movement on May 26th.) Keywords: market volatility, economic indicators, geopolitical risk.

Resources for Real-time Stock Market Data

Accessing reliable real-time stock market data is crucial for informed decision-making. Several reputable sources provide this information:

- Financial News Websites: (List reputable financial news websites with links, e.g., Yahoo Finance, Google Finance, Bloomberg)

- Brokerage Platforms: (Mention popular brokerage platforms that provide real-time quotes, and include links if possible)

- Financial APIs: (Mention APIs for developers to access real-time data)

Using reliable sources is paramount. Unreliable sources can lead to inaccurate investment decisions. Keywords: reliable data sources, real-time stock quotes.

Conclusion: Stay Informed with Continuous Stock Market Data

The Dow and S&P 500 showed modest gains on May 26th, influenced by a combination of factors. Monitoring real-time stock market data is essential for navigating the complexities of the financial markets and making informed investment decisions. To stay ahead of the curve and gain a deeper understanding of daily market fluctuations, regularly check back for updated real-time Dow and S&P 500 updates. Consider subscribing to our newsletter or following us on social media for timely market insights and analysis. We provide continuous stock market data to help you make better investment decisions. Remember to utilize reliable sources for your real-time Dow and S&P 500 information.

Featured Posts

-

Dubbo Championship Wrestling Musical See Whos Starring In The Readings

May 27, 2025

Dubbo Championship Wrestling Musical See Whos Starring In The Readings

May 27, 2025 -

Cast Revealed New Musical Readings Of Dubbo Championship Wrestling

May 27, 2025

Cast Revealed New Musical Readings Of Dubbo Championship Wrestling

May 27, 2025 -

Is Tracker Season 2 Episode 18 Streaming Tonight

May 27, 2025

Is Tracker Season 2 Episode 18 Streaming Tonight

May 27, 2025 -

Tacles Interposes Faure Et Bouamrane Illustrent La Durete De La Course Au Ps

May 27, 2025

Tacles Interposes Faure Et Bouamrane Illustrent La Durete De La Course Au Ps

May 27, 2025 -

Gilts Spring Flash Sale Designer Gucci Up To 70 Off Handbags Sneakers And More

May 27, 2025

Gilts Spring Flash Sale Designer Gucci Up To 70 Off Handbags Sneakers And More

May 27, 2025

Latest Posts

-

Dominant Nuggets Win Jokics One Handed Flick A Game Highlight

May 31, 2025

Dominant Nuggets Win Jokics One Handed Flick A Game Highlight

May 31, 2025 -

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025

Supercross Returns To Salt Lake City Dates Tickets And What To Expect

May 31, 2025 -

2025 Fox Raceway National Comprehensive Results And Race Recap

May 31, 2025

2025 Fox Raceway National Comprehensive Results And Race Recap

May 31, 2025 -

Pro Motocross 2025 Round 1 At Fox Raceway Winners And Standings

May 31, 2025

Pro Motocross 2025 Round 1 At Fox Raceway Winners And Standings

May 31, 2025 -

Nuggets Rout Jazz Jokics One Handed Highlight Steals The Show

May 31, 2025

Nuggets Rout Jazz Jokics One Handed Highlight Steals The Show

May 31, 2025