Stock Market Defies Recession Fears: Investors See Continued Growth

Table of Contents

Strong Corporate Earnings Fuel Market Growth

Strong corporate earnings are a primary driver of the current stock market growth, defying recessionary expectations. This robust performance stems from several key factors:

Resilient Consumer Spending

Despite inflation and economic uncertainty, consumer spending remains surprisingly robust, providing a significant boost to corporate profits.

- Strong employment numbers are supporting consumer confidence. Low unemployment rates provide a safety net for consumers, allowing them to maintain spending habits.

- Increased savings during the pandemic are still being utilized. Many households accumulated savings during lockdowns, providing a buffer against inflationary pressures and supporting continued consumption.

- Certain sectors, like travel and entertainment, are experiencing significant growth. Pent-up demand from the pandemic continues to drive strong performance in these sectors, contributing significantly to overall economic activity and corporate earnings. This robust spending is a clear indicator of a healthy consumer sector, crucial for overall stock market growth.

Technological Innovation Driving Growth

Advancements in artificial intelligence (AI) and other cutting-edge technologies are fueling growth in specific sectors, attracting significant investment and driving stock prices upward.

- The AI boom is attracting considerable investment and driving stock prices in related companies. The rapid development and adoption of AI across various industries are creating new opportunities and boosting investor confidence in tech stocks.

- Technological advancements are leading to increased productivity and efficiency across various industries. This increased efficiency translates into higher profits for companies, further supporting market growth.

- Innovative companies are attracting significant venture capital funding, bolstering market confidence. The influx of venture capital into promising tech startups demonstrates investor confidence in future growth potential, contributing to the overall positive market sentiment.

Inflation Cooling and Interest Rate Adjustments

The recent cooling of inflationary pressures and the Federal Reserve's strategic interest rate adjustments are also contributing to the stock market's resilience.

Easing Inflationary Pressures

Although inflation remains a concern, recent data suggests a cooling trend, easing investor anxieties.

- The Federal Reserve's interest rate hikes are starting to show impact on inflation. The Fed's monetary policy tightening is gradually bringing inflation down, reducing the risks of runaway price increases.

- Supply chain issues are gradually easing, reducing inflationary pressures. Improved supply chain efficiency is helping to lower the cost of goods and services, contributing to lower inflation rates.

- Government policies are playing a role in mitigating inflation. Fiscal policies aimed at addressing inflation are also playing a part in stabilizing the economy.

Strategic Interest Rate Adjustments

The Federal Reserve's measured approach to interest rate adjustments is bolstering investor confidence by avoiding drastic measures that could trigger a recession.

- The Fed's commitment to price stability is reassuring investors. The central bank's clear commitment to controlling inflation is a crucial factor in stabilizing market expectations.

- Gradual interest rate increases are preventing a sudden economic shock. A gradual approach helps to minimize the negative impact on economic growth.

- The central bank's communication strategy is helping to manage market expectations. Clear communication from the Fed helps to reduce uncertainty and maintain investor confidence.

Investor Sentiment and Market Psychology

A shift in investor sentiment from pessimism to cautious optimism is also contributing to the current market performance.

Shifting Investor Sentiment

Positive economic indicators and market performance are improving investor confidence.

- Positive economic indicators are improving investor confidence. Stronger-than-expected economic data is bolstering investor sentiment and encouraging investment activity.

- Some investors are seeing the current market as a buying opportunity. The resilience of the market despite recession fears is leading some to view it as a favorable time to invest.

- Long-term investment strategies are gaining popularity. Investors are increasingly focusing on long-term growth potential rather than short-term market fluctuations.

Understanding Market Volatility

While the market is showing growth, volatility remains a factor that investors must consider.

- Geopolitical events continue to impact market sentiment. Global events and uncertainties can create market fluctuations.

- Unexpected economic shifts can still cause market fluctuations. Economic data and unexpected events can lead to short-term market volatility.

- Risk management strategies remain crucial for investors. Diversification and a well-defined investment plan are crucial for navigating market uncertainty.

Conclusion

The resilience of the stock market in the face of recession fears is a surprising but potentially significant development. Factors like strong corporate earnings, easing inflation, and shifting investor sentiment all contribute to this unexpected growth. While uncertainty remains, understanding these trends is crucial for navigating the current market landscape. Investors should adopt a well-informed, adaptable approach, carefully considering their risk tolerance and diversifying their portfolios. Don't miss out on the opportunity to capitalize on the continued growth of the stock market. Learn more about effective investment strategies to maximize your returns and understand the factors influencing stock market growth during times of economic uncertainty.

Featured Posts

-

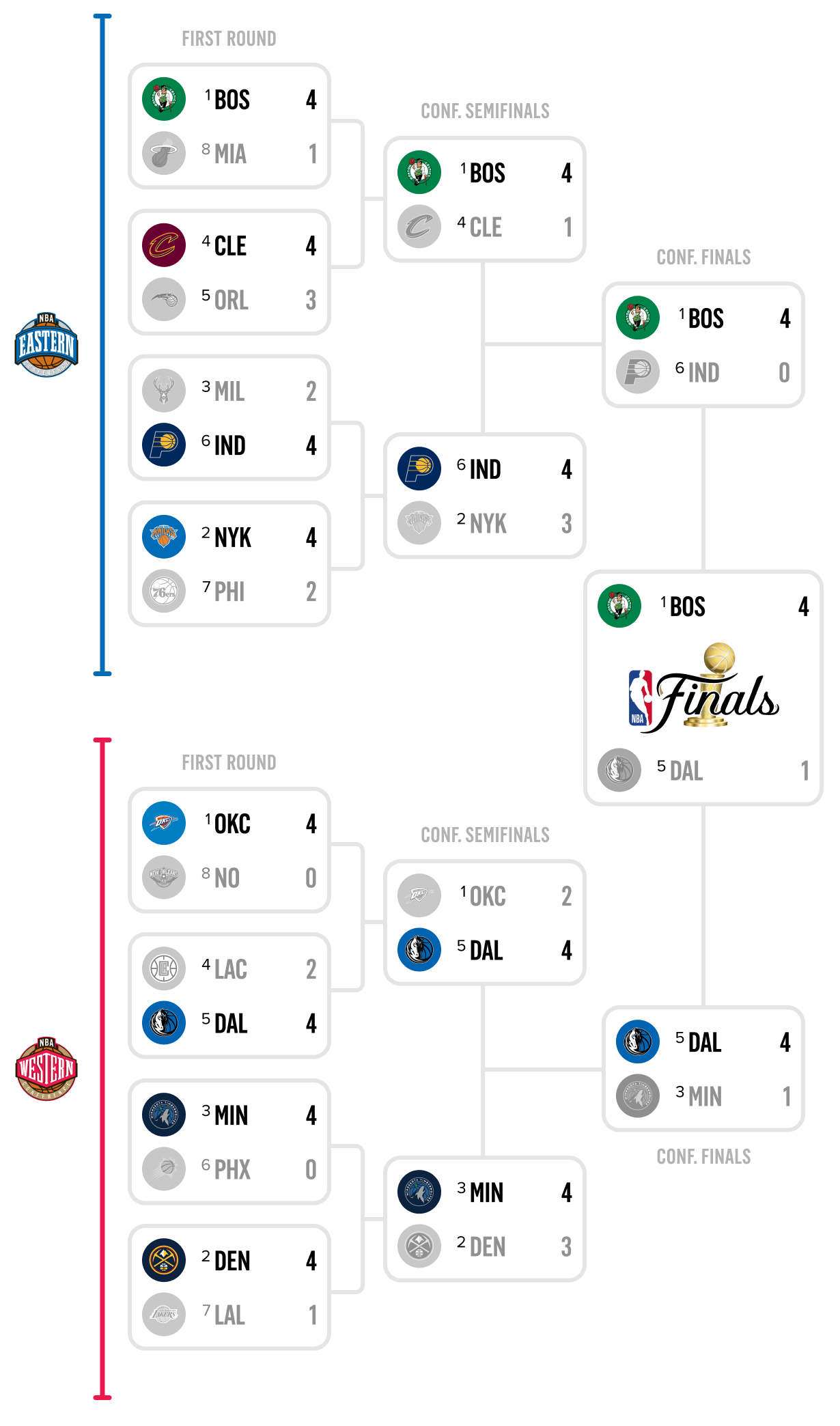

Nba Playoffs Bracket 2025 Round 1 Tv Schedule

May 06, 2025

Nba Playoffs Bracket 2025 Round 1 Tv Schedule

May 06, 2025 -

Analyzing The Effects Of Trumps Tariffs On Us Manufacturers

May 06, 2025

Analyzing The Effects Of Trumps Tariffs On Us Manufacturers

May 06, 2025 -

Jeff Goldblums Family Day Out Como 1907 Vs Torino Match

May 06, 2025

Jeff Goldblums Family Day Out Como 1907 Vs Torino Match

May 06, 2025 -

Mindy Kaling And B J Novak The Office Costars Relationship Through The Years

May 06, 2025

Mindy Kaling And B J Novak The Office Costars Relationship Through The Years

May 06, 2025 -

Gigabyte Aorus Master 16 Review Powerful Graphics Loud Fans A Detailed Look

May 06, 2025

Gigabyte Aorus Master 16 Review Powerful Graphics Loud Fans A Detailed Look

May 06, 2025

Latest Posts

-

Priyanka Chopras Nose Job Her Fathers Response

May 06, 2025

Priyanka Chopras Nose Job Her Fathers Response

May 06, 2025 -

Priyanka Chopra And Nick Jonas A Memorable Holi Celebration

May 06, 2025

Priyanka Chopra And Nick Jonas A Memorable Holi Celebration

May 06, 2025 -

2000

May 06, 2025

2000

May 06, 2025 -

Madhu Chopra Names Priyanka Chopras Unexpected First Mentor

May 06, 2025

Madhu Chopra Names Priyanka Chopras Unexpected First Mentor

May 06, 2025 -

Madhu Chopra Discusses Priyanka Chopras Experiences As A Bollywood Outsider

May 06, 2025

Madhu Chopra Discusses Priyanka Chopras Experiences As A Bollywood Outsider

May 06, 2025