Stock Market Dip: Rising Unease Over US Finances

Table of Contents

The National Debt Ceiling Debate and its Market Impact

The ongoing debate surrounding the US national debt ceiling is a major contributor to the current stock market dip. The potential consequences of failing to raise the debt ceiling are severe and are weighing heavily on investor sentiment. A failure to reach an agreement could trigger a number of negative outcomes, significantly impacting market stability.

- Potential government shutdown: A failure to raise the debt ceiling could lead to a partial or complete government shutdown, disrupting essential government services and further eroding investor confidence.

- Risk of default on US Treasury bonds: The US government's inability to meet its debt obligations would be unprecedented, potentially leading to a default on US Treasury bonds – a cornerstone of the global financial system. This would severely damage the US's credit rating and trigger a global financial crisis.

- Impact on investor confidence and credit ratings: The uncertainty surrounding the debt ceiling debate is already eroding investor confidence. A failure to resolve the issue would likely lead to downgrades in US credit ratings, increasing borrowing costs for the government and businesses alike.

- Historical precedent of debt ceiling crises and market reactions: Past debt ceiling crises have resulted in significant market volatility and economic uncertainty. History serves as a cautionary tale, highlighting the potential for severe negative consequences if a resolution isn't reached promptly. Keywords: National debt ceiling, government shutdown, US Treasury bonds, investor confidence, credit rating, market reaction.

Inflation and its Persistent Pressure on the Stock Market

Persistent inflation continues to exert significant pressure on the stock market. Rising consumer prices are eating into consumer spending power, impacting corporate profits and subsequently stock valuations. The Federal Reserve's response to combat inflation adds another layer of complexity.

- Rising consumer prices and their impact on consumer spending: As the cost of essential goods and services continues to rise, consumers are forced to cut back on spending, leading to decreased demand and impacting business revenues.

- The Federal Reserve's response and potential interest rate hikes: To combat inflation, the Federal Reserve is likely to continue raising interest rates. Higher interest rates increase borrowing costs for businesses and consumers, potentially slowing economic growth and impacting corporate profits.

- Impact of inflation on corporate profits and stock valuations: Rising costs and reduced consumer demand squeeze corporate profit margins, leading to lower stock valuations and impacting investor returns. Keywords: Inflation, consumer prices, consumer spending, Federal Reserve, interest rate hikes, corporate profits, stock valuations.

Geopolitical Uncertainty and its Contribution to Market Volatility

Geopolitical instability adds further fuel to the fire of market volatility. Ongoing conflicts and global uncertainties contribute to a climate of fear and uncertainty amongst investors.

- Ongoing conflicts and their economic repercussions: Global conflicts disrupt supply chains, increase energy prices, and create overall economic uncertainty, leading to investor caution and market corrections.

- Supply chain disruptions and their impact on businesses: Disruptions to global supply chains increase production costs and limit the availability of goods, directly impacting businesses and ultimately affecting market performance.

- Uncertainties related to global trade and sanctions: The ongoing tensions between nations and the imposition of sanctions create uncertainty in international trade, further contributing to market instability. Keywords: Geopolitical uncertainty, global conflicts, supply chain disruptions, global trade, sanctions, market volatility.

Strategies for Navigating a Stock Market Dip

While a stock market dip is undeniably concerning, it presents opportunities for strategic investors. Adopting a proactive approach is key to mitigating risk and potentially profiting from market downturns.

- Diversification of investment portfolios: Diversifying across different asset classes (stocks, bonds, real estate, etc.) reduces the overall risk of your portfolio. This strategy helps cushion the blow of losses in any single sector.

- Long-term investment strategies versus short-term trading: A long-term investment strategy focused on steady growth is generally more resilient to market fluctuations than short-term trading, which is heavily influenced by daily market swings.

- Importance of risk assessment and tolerance: Understanding your own risk tolerance is crucial. Investors with a higher risk tolerance may be more comfortable with potentially higher-risk investments, while those with lower risk tolerance should focus on more conservative strategies.

- Seeking professional financial advice: Consulting a qualified financial advisor can provide valuable guidance tailored to your specific financial situation and investment goals. Keywords: Diversification, investment portfolio, long-term investment, short-term trading, risk assessment, risk tolerance, financial advisor.

Conclusion

The recent stock market dip is a multifaceted issue stemming from the interwoven threads of the national debt ceiling debate, persistent inflation, and significant geopolitical uncertainty. These factors have created a climate of volatility and investor anxiety. However, by understanding these underlying issues and implementing sound investment strategies, investors can mitigate risk and navigate these challenging times successfully. Diversification, long-term investment strategies, and a thorough risk assessment are crucial tools in weathering market fluctuations. Remember, informed decision-making is paramount.

Call to Action: Stay informed about the latest developments in the US financial landscape and the ongoing stock market dip. Continuously reassess your investment strategy, and don't hesitate to seek expert financial advice to effectively manage your portfolio during these periods of market volatility. Don’t let the current stock market dip deter you from long-term financial planning; carefully analyze your options and create a robust strategy for long-term success. Keywords: Stock market dip, US financial landscape, investment strategy, market volatility, financial advice.

Featured Posts

-

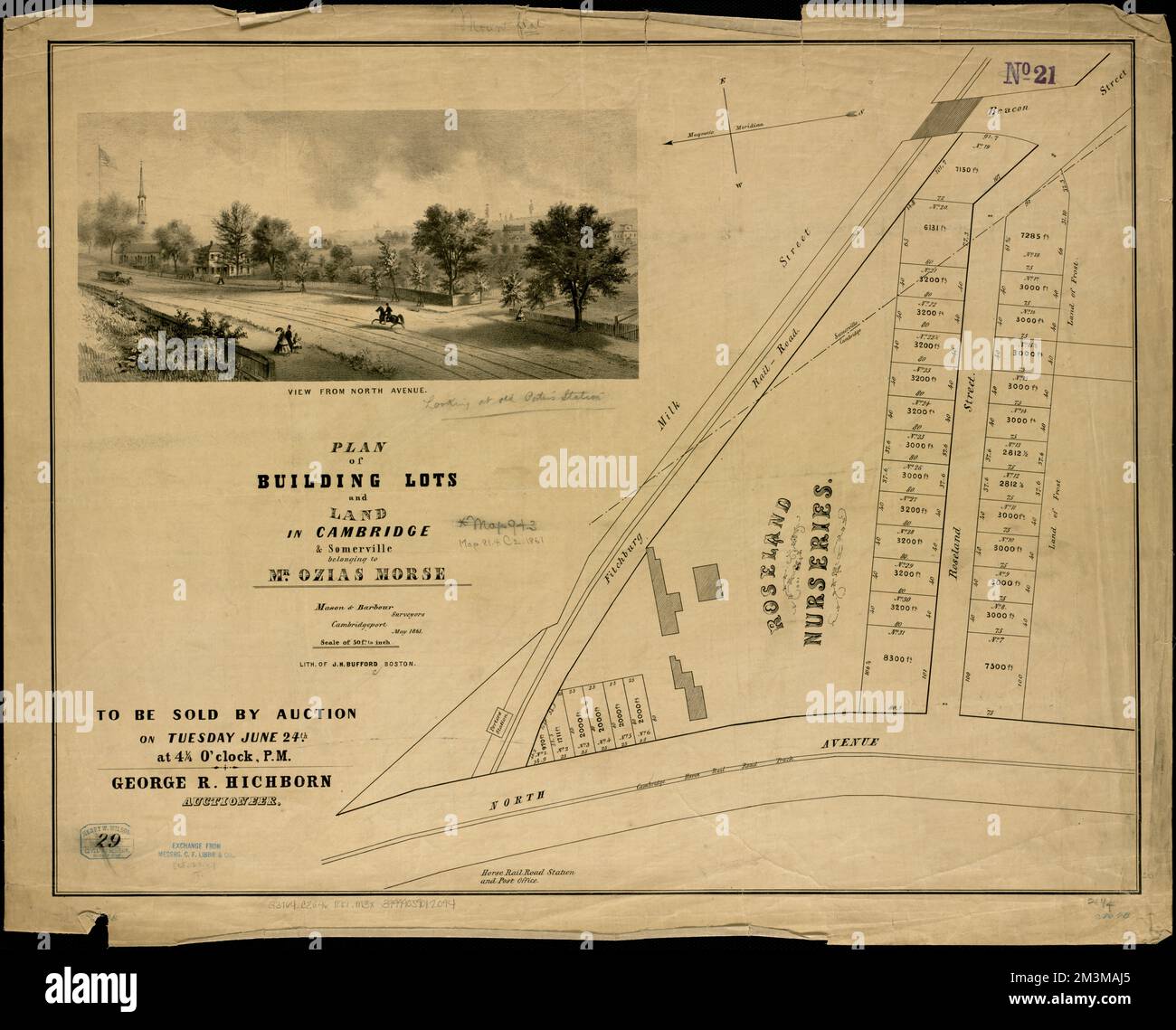

Plan Your Week Cambridge And Somerville Events Viva Central Hot Sauce Festival And Open Studios

May 23, 2025

Plan Your Week Cambridge And Somerville Events Viva Central Hot Sauce Festival And Open Studios

May 23, 2025 -

Zimbabwes First Away Test Win In Two Years The Sylhet Thriller

May 23, 2025

Zimbabwes First Away Test Win In Two Years The Sylhet Thriller

May 23, 2025 -

Phase Eight Midi Skirt This Mornings Must Have Fashion Item

May 23, 2025

Phase Eight Midi Skirt This Mornings Must Have Fashion Item

May 23, 2025 -

Grand Ole Opry Goes Global First Ever International Broadcast From Londons Royal Albert Hall

May 23, 2025

Grand Ole Opry Goes Global First Ever International Broadcast From Londons Royal Albert Hall

May 23, 2025 -

Upcoming French Cinema Festival A 2025 Rendez Vous Preview

May 23, 2025

Upcoming French Cinema Festival A 2025 Rendez Vous Preview

May 23, 2025

Latest Posts

-

Eric Andre Reveals Why Kieran Culkin Wasnt In A Real Pain

May 23, 2025

Eric Andre Reveals Why Kieran Culkin Wasnt In A Real Pain

May 23, 2025 -

Eric Andre Rejected Kieran Culkin For A Real Pain Role The Story Behind The Casting Choice

May 23, 2025

Eric Andre Rejected Kieran Culkin For A Real Pain Role The Story Behind The Casting Choice

May 23, 2025 -

This Hollywood Legends Debut And Oscar Win Are Streaming Now On Disney

May 23, 2025

This Hollywood Legends Debut And Oscar Win Are Streaming Now On Disney

May 23, 2025 -

Experience A Hollywood Legends Career Debut Film And Oscar Winning Role On Disney

May 23, 2025

Experience A Hollywood Legends Career Debut Film And Oscar Winning Role On Disney

May 23, 2025 -

Brotherly Love Macaulay And Rory Culkins Wwe Raw Appearance Causes A Stir

May 23, 2025

Brotherly Love Macaulay And Rory Culkins Wwe Raw Appearance Causes A Stir

May 23, 2025