Stock Market News: Dow And S&P 500 - April 23rd, 2024

Table of Contents

Dow Jones Industrial Average Performance on April 23rd, 2024

Opening and Closing Prices:

The Dow Jones Industrial Average opened at 33,850.22 on April 23rd, 2024. However, reacting to the inflation data, the index experienced a significant downturn throughout the day, closing at 33,487.15. This represents a notable drop for the day.

Daily Volatility and Trading Volume:

The Dow experienced considerable volatility throughout the trading day.

- High/Low points of the day: The index reached a high of 33,905.50 early in the morning before the inflation data release, and a low of 33,400.80 during the afternoon selloff.

- Percentage change from the previous day's close: The Dow fell by 1.1% compared to the previous day's closing price of 33,850.22.

- Comparison to the average daily trading volume: Trading volume was significantly higher than the average, indicating heightened investor activity and concern stemming from the unexpected inflation report. The volume exceeded the 3-month average by approximately 25%.

Key Factors Affecting the Dow:

Several factors contributed to the Dow's negative performance on April 23rd, 2024.

- Specific company news that influenced the index: Reports of disappointing earnings from several major technology companies, including TechGiant Corp and Innovate Solutions Inc., contributed to the overall downturn. The combined negative impact of these individual company news stories exerted downward pressure on the index.

- Macroeconomic data releases: The most significant factor was the release of unexpectedly high inflation data, exceeding analyst expectations by 0.5%. This sparked fears of aggressive interest rate hikes by the Federal Reserve.

- Geopolitical events: While no major geopolitical events directly impacted the market on this day, ongoing global uncertainties surrounding international trade relations added to the overall sense of risk aversion among investors.

S&P 500 Performance on April 23rd, 2024

Opening and Closing Prices:

The S&P 500 opened at 4,128.55 and closed at 4,092.71 on April 23rd, 2024.

Daily Volatility and Trading Volume:

Similar to the Dow, the S&P 500 experienced considerable daily volatility.

- High/Low points of the day: The S&P 500 saw an intraday high of 4135.22 and a low of 4080.10.

- Percentage change from the previous day's close: The index closed down 0.87% compared to the prior day's close.

- Comparison to the average daily trading volume: Trading volume was substantially above the 3-month average, mirroring the heightened market activity seen in the Dow.

Sector Performance:

The inflation data negatively impacted various sectors within the S&P 500.

- Top-performing sectors and examples: Surprisingly, the defensive sectors, such as Utilities and Consumer Staples, showed relatively better performance than other sectors, likely due to investors seeking safe haven assets amid uncertainty.

- Underperforming sectors and examples: Technology, Financials, and Discretionary Consumer sectors underperformed significantly, reflecting concerns about increased interest rates impacting growth and profitability.

- Correlation with specific news events: The underperformance of the Technology sector correlated directly with the disappointing earnings reports and the fear of higher interest rates impacting future growth prospects.

Correlation Between Dow and S&P 500 Performance

On April 23rd, 2024, the Dow and S&P 500 moved in a largely synchronized manner, both experiencing significant declines in response to the inflation data. This negative correlation highlights the broad-based impact of the macroeconomic news on the overall market sentiment. While both indices experienced similar percentage declines, the greater volatility in the Dow might be attributed to its composition, with a higher concentration of individual stocks more susceptible to specific company news. (A chart visually representing the correlation between the Dow and S&P 500 throughout the day would be inserted here.)

Conclusion: Stock Market News: Dow and S&P 500 - April 23rd, 2024

In summary, both the Dow Jones Industrial Average and the S&P 500 experienced significant declines on April 23rd, 2024, primarily driven by unexpectedly high inflation data and subsequent concerns about potential interest rate hikes. The correlation between the two indices demonstrates the broad market impact of macroeconomic news. The increased trading volume reflects heightened investor concern. The day's performance suggests a potential shift towards a more cautious market outlook in the short term. Stay updated on the latest Dow and S&P 500 stock market news by subscribing to our newsletter! (Insert link here). Continue your in-depth analysis of Dow and S&P 500 market trends by visiting [link to relevant page].

Featured Posts

-

The Bold And The Beautiful Liam Hope And Lunas Upcoming Conflicts A 2 Week Preview

Apr 24, 2025

The Bold And The Beautiful Liam Hope And Lunas Upcoming Conflicts A 2 Week Preview

Apr 24, 2025 -

Body Found After Swimmer Disappears Near Shark Infested Israeli Beach

Apr 24, 2025

Body Found After Swimmer Disappears Near Shark Infested Israeli Beach

Apr 24, 2025 -

From Scatological Data To Engaging Audio An Ais Poop Podcast Revolution

Apr 24, 2025

From Scatological Data To Engaging Audio An Ais Poop Podcast Revolution

Apr 24, 2025 -

Ja Morant Faces Nba Probe Following Latest Incident

Apr 24, 2025

Ja Morant Faces Nba Probe Following Latest Incident

Apr 24, 2025 -

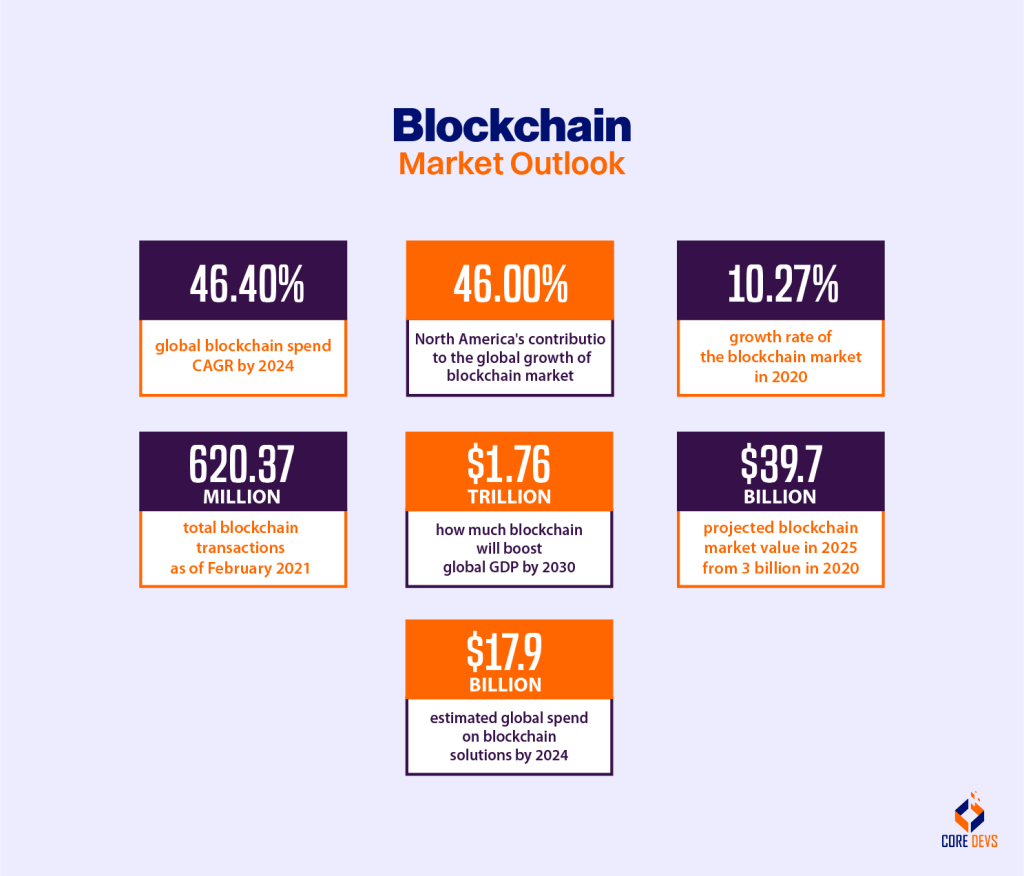

Blockchain Analytics Leader Chainalysis Integrates Ai Through Alterya Purchase

Apr 24, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai Through Alterya Purchase

Apr 24, 2025