Stock Market Prediction: Top 2 Stocks To Outperform Palantir Within 36 Months

Table of Contents

Understanding Palantir's Current Market Position and Limitations

Palantir, a prominent player in big data analytics and government contracting, has attracted significant attention. However, a comprehensive stock market prediction requires a nuanced understanding of its strengths and weaknesses.

Palantir's Strengths:

- Government Contracts and Data Analytics: Palantir's expertise lies in providing sophisticated data analytics solutions, particularly to government agencies. This sector offers substantial revenue streams and long-term contracts.

- Strong Technology and Sector Potential: Its cutting-edge technology provides a competitive edge in data integration and analysis. Growth potential exists within the expanding government and commercial sectors embracing advanced data analytics.

- Financial Data (Illustrative): While specific figures fluctuate, consider (hypothetical data for illustration): a market cap of $X billion, and a year-on-year revenue growth of Y%. (Note: Replace X and Y with actual, up-to-date figures at the time of publishing).

Palantir's Weaknesses:

- High Valuation and Growth Concerns: Palantir's stock price might be considered overvalued by some analysts, raising concerns about future growth meeting current expectations. Slower-than-projected growth could impact its stock performance.

- Competitive Threats and Market Risks: The data analytics market is competitive. New entrants and established players could erode Palantir’s market share. Economic downturns or shifts in government spending could also negatively impact its performance.

- Dependence on Government Contracts: A significant portion of Palantir's revenue comes from government contracts. This reliance creates vulnerability to changes in government policy and budgeting.

Why Look Beyond Palantir?

While Palantir presents a compelling narrative, other companies offer potentially higher growth with potentially lower risk within the tech stock market. This analysis focuses on two such companies: [Company Name 1] and [Company Name 2].

Stock #1: [Company Name 1] – A Deep Dive into Growth Potential (Replace "[Company Name 1]" with the actual company name)

Company Overview and Business Model: [Company Name 1] operates in the [Industry] sector, focusing on [briefly describe core business]. Their innovative [describe key technology/service] differentiates them from competitors.

Key Financial Indicators: [Insert charts and graphs illustrating strong revenue growth, profit margins, etc. Use concrete data and cite sources]. For example, a projected Compound Annual Growth Rate (CAGR) of Z% over the next 3 years. (Replace Z with the actual projected CAGR).

Competitive Advantages: [Company Name 1] benefits from [list key competitive advantages, e.g., strong intellectual property, first-mover advantage, superior technology, strong brand recognition]. These advantages solidify its position and forecast continued growth exceeding Palantir's projected trajectory.

Risk Assessment: Potential risks include [list potential risks, e.g., competition, regulatory changes, economic downturns]. However, these risks are mitigated by [describe risk mitigation strategies].

- Key Reasons to Invest:

- High growth potential in a rapidly expanding market.

- Strong competitive advantages.

- Proven track record of innovation.

- Solid financial performance.

Stock #2: [Company Name 2] – A Disruptive Force in [Industry] (Replace "[Company Name 2]" and "[Industry]" with the actual company name and industry)

Company Overview and Business Model: [Company Name 2] is a disruptive force in the [Industry] sector, leveraging [brief description of innovative business model].

Market Disruption Potential: [Company Name 2]'s innovative approach is transforming the [Industry] by [explain how it's disrupting the market and creating new opportunities].

Growth Catalysts: Key drivers for future growth include [list key growth catalysts, e.g., expanding market share, new product launches, strategic partnerships].

Risk Mitigation Strategies: The company actively manages risks through [explain risk mitigation strategies, e.g., diversification, robust financial management].

- Key Reasons to Invest:

- Disruptive innovation with significant market potential.

- Strong growth catalysts.

- Effective risk management strategies.

- First-mover advantage in a new market.

Comparative Analysis: [Company Name 1] vs. [Company Name 2] vs. Palantir

(Replace bracketed information with the actual company names.)

Growth Projections: [Insert charts comparing projected growth rates for all three companies over the next 36 months. Clearly label the axes and include a legend. Cite sources for your projections.]

Risk Profiles: [Compare risk levels associated with each investment, considering factors like market volatility, industry-specific risks, and financial stability. A simple risk rating system (e.g., low, medium, high) could be useful.]

Investment Strategy Recommendations: Based on risk tolerance, a diversified portfolio could include a combination of all three stocks, with a higher allocation towards [Company Name 1] and [Company Name 2] for potentially higher returns, balanced by the established presence of Palantir. This stock market prediction strategy prioritizes potential outperformance.

Conclusion:

This analysis suggests that [Company Name 1] and [Company Name 2] possess stronger growth potential than Palantir over the next 36 months, based on their innovative business models, compelling financial indicators, and robust growth catalysts. While Palantir has its merits, diversifying your portfolio with high-growth alternatives like the two companies highlighted above could significantly enhance your investment strategy. Conduct thorough due diligence before making any investment decisions, but consider including [Company Name 1] and [Company Name 2] in your stock market prediction strategy for potentially superior returns over the next 36 months. Start your research on these promising stocks today! Remember that this is a prediction, and past performance is not indicative of future results.

Featured Posts

-

Former Boris Becker Judge Heads Nottingham Attacks Inquiry

May 09, 2025

Former Boris Becker Judge Heads Nottingham Attacks Inquiry

May 09, 2025 -

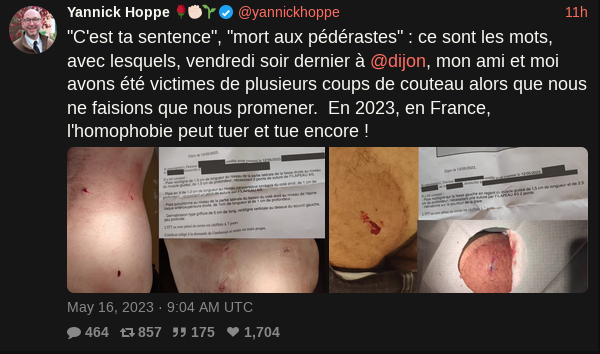

Dijon Violente Agression Au Lac Kir Trois Hommes Blesses

May 09, 2025

Dijon Violente Agression Au Lac Kir Trois Hommes Blesses

May 09, 2025 -

Understanding Your Nl Federal Candidates A Voters Guide

May 09, 2025

Understanding Your Nl Federal Candidates A Voters Guide

May 09, 2025 -

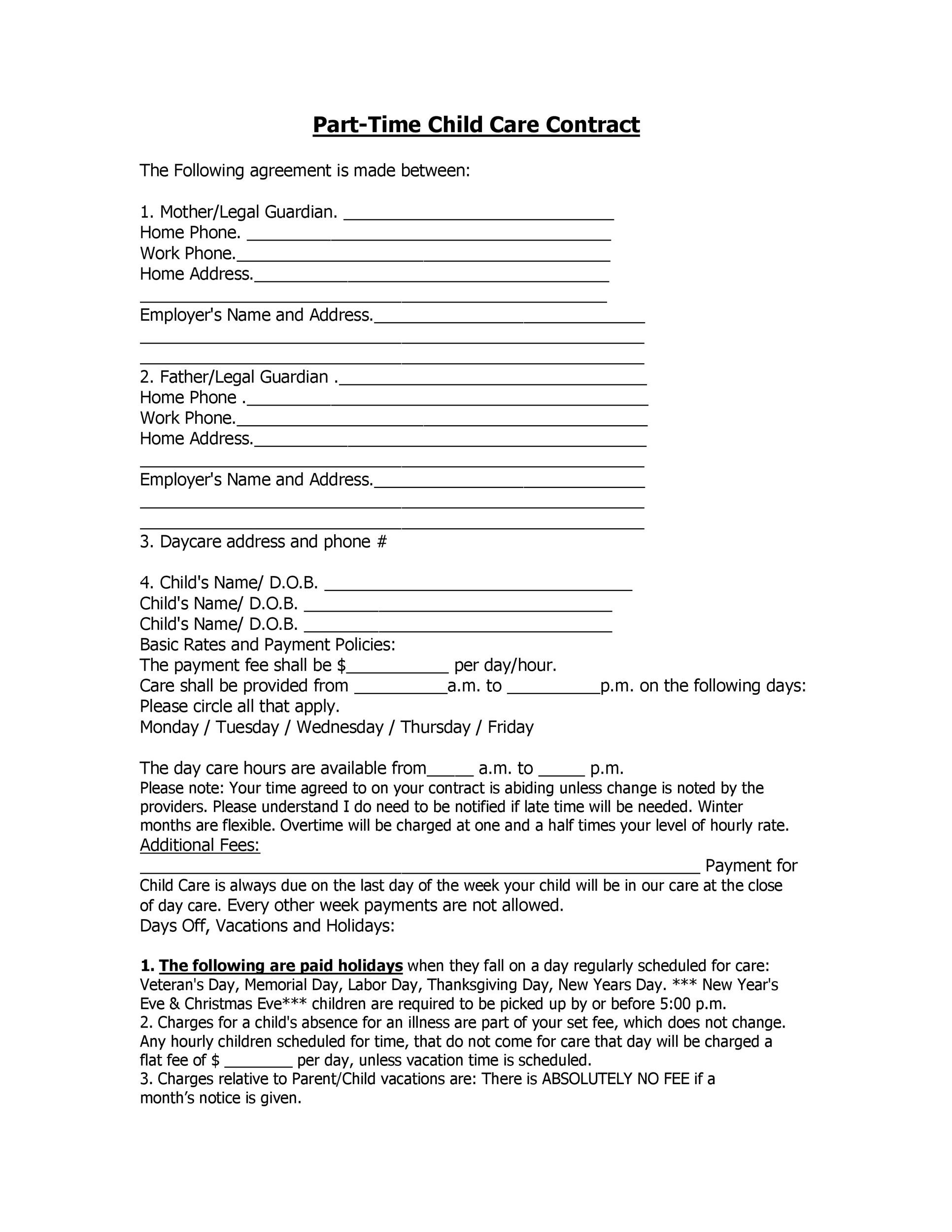

Nc Daycare Suspension What Parents Need To Know

May 09, 2025

Nc Daycare Suspension What Parents Need To Know

May 09, 2025 -

France Poland Friendship Treaty Macron Announces Signing Next Month

May 09, 2025

France Poland Friendship Treaty Macron Announces Signing Next Month

May 09, 2025