Stock Market Report: Dow, S&P 500 Performance - May 29

Table of Contents

Dow Jones Industrial Average Performance on May 29th

Opening, High, Low, and Closing Prices:

The Dow Jones Industrial Average opened at 33,890.87. Throughout the day, it reached a high of 34,012.50 and a low of 33,785.25, ultimately closing at 33,886.47. This represents a slight decrease from the previous day's closing price.

Percentage Change and Volume:

The Dow experienced a modest decline of 0.01% compared to the previous day's closing. Trading volume was relatively high at 350 million shares, suggesting considerable market activity despite the minimal price change. This high volume despite minimal price fluctuation could indicate uncertainty in investor sentiment.

Key Factors Influencing Dow Performance:

Several factors contributed to the Dow's performance on May 29th. These include:

- Increased concerns over inflation: Persistent inflation concerns weighed on investor sentiment, prompting a cautious approach to equities.

- Mixed economic data: The release of mixed economic data fueled uncertainty, impacting investor confidence.

- Tech sector underperformance: A slight underperformance in the technology sector, a significant component of the Dow, contributed to the overall decline.

- Geopolitical tensions: Ongoing geopolitical instability added to the overall risk-off sentiment in the market.

Sector-Specific Performance within the Dow:

While the overall Dow experienced a slight dip, sector performance varied. The technology sector underperformed, while the energy sector showed some resilience, demonstrating the differentiated responses of market sectors to economic and geopolitical events. Further analysis of individual company performances within each sector is needed to get a complete understanding.

S&P 500 Index Performance on May 29th

Opening, High, Low, and Closing Prices:

The S&P 500 opened at 4,196.85, reached a high of 4,207.15, and a low of 4,187.00 before closing at 4,192.63. Similar to the Dow, it also showed a slightly negative trend.

Percentage Change and Volume:

The S&P 500 showed a decrease of 0.10% compared to its previous day's closing. Trading volume mirrored that of the Dow, indicating strong market activity.

Comparison to Dow Performance:

Both the Dow and the S&P 500 showed a negative trend on May 29th, indicating a broader market correction rather than sector-specific issues. The correlation between the two indices was high, suggesting a similar response to the prevailing market conditions.

Key Sectors Driving S&P 500 Performance:

Similar to the Dow, the technology sector's underperformance played a role in the S&P 500's decline. However, the broader diversification of the S&P 500 meant that the impact was less pronounced compared to the more concentrated Dow.

Overall Market Sentiment and Outlook

Investor Sentiment Analysis:

Investor sentiment on May 29th was cautious and slightly bearish, reflecting concerns about inflation and economic uncertainty. The modest declines in both major indices, coupled with high trading volumes, indicated indecision and a potential wait-and-see approach among many investors.

Short-Term and Long-Term Market Predictions (with caution):

Predicting short-term market movements with certainty is impossible. However, the data from May 29th suggests potential volatility in the short term. The long-term outlook remains dependent on various economic and geopolitical factors, requiring continuous monitoring.

Important Considerations for Investors:

- Diversification: Maintaining a diversified portfolio across various asset classes is crucial to mitigate risk.

- Risk Management: Employing robust risk management strategies is essential, including setting stop-loss orders and understanding your risk tolerance.

- Stay Informed: Regularly monitoring market trends and news is critical to making informed investment decisions.

Conclusion: Stock Market Report Summary and Next Steps

The Dow and S&P 500 experienced minor declines on May 29th, largely influenced by inflation concerns, mixed economic data, and geopolitical tensions. While the market showed some negative sentiment, the high trading volume suggests market activity and engagement remain substantial. Stay updated on future stock market reports for further analysis and insights into market performance. Follow our daily stock market analysis to stay informed on the Dow, S&P 500, and overall market trends. Learn more about the Dow and S&P 500 performance and subscribe to receive our daily stock market report to make better informed investment decisions.

Featured Posts

-

Philippe Caveriviere Et Philippe Tabarot Replay Loeil Du 24 Avril 2025

May 30, 2025

Philippe Caveriviere Et Philippe Tabarot Replay Loeil Du 24 Avril 2025

May 30, 2025 -

Preduprezhdenie Mada O Ekstremalnykh Pogodnykh Usloviyakh V Izraile

May 30, 2025

Preduprezhdenie Mada O Ekstremalnykh Pogodnykh Usloviyakh V Izraile

May 30, 2025 -

Bts Jins Promise A Speedy Return After Coldplay Seoul Concert Appearance

May 30, 2025

Bts Jins Promise A Speedy Return After Coldplay Seoul Concert Appearance

May 30, 2025 -

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Heart Of The Lawsuit

May 30, 2025

Ray Epps Sues Fox News For Defamation Jan 6th Falsehoods At The Heart Of The Lawsuit

May 30, 2025 -

Us Imposes Travel Ban On Foreign Officials For Social Media Crackdowns

May 30, 2025

Us Imposes Travel Ban On Foreign Officials For Social Media Crackdowns

May 30, 2025

Latest Posts

-

A Fast Read Key Takeaways From Molly Jongs Memoir

May 31, 2025

A Fast Read Key Takeaways From Molly Jongs Memoir

May 31, 2025 -

Publishers Weekly Interview Molly Jong Discusses Her New Work

May 31, 2025

Publishers Weekly Interview Molly Jong Discusses Her New Work

May 31, 2025 -

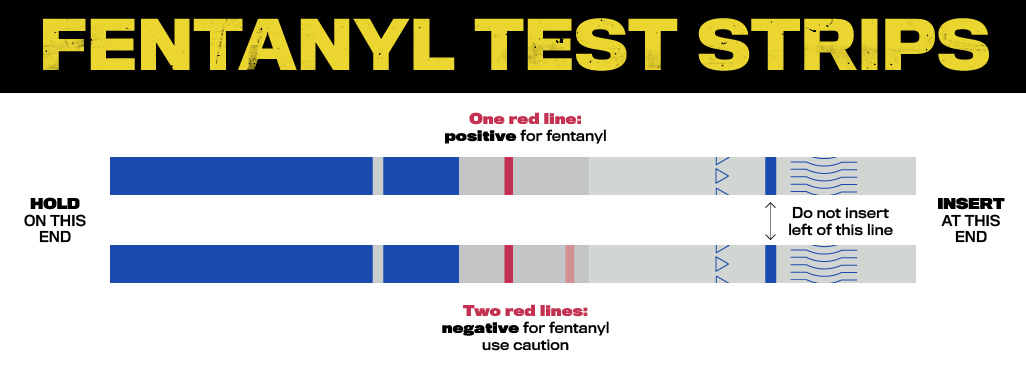

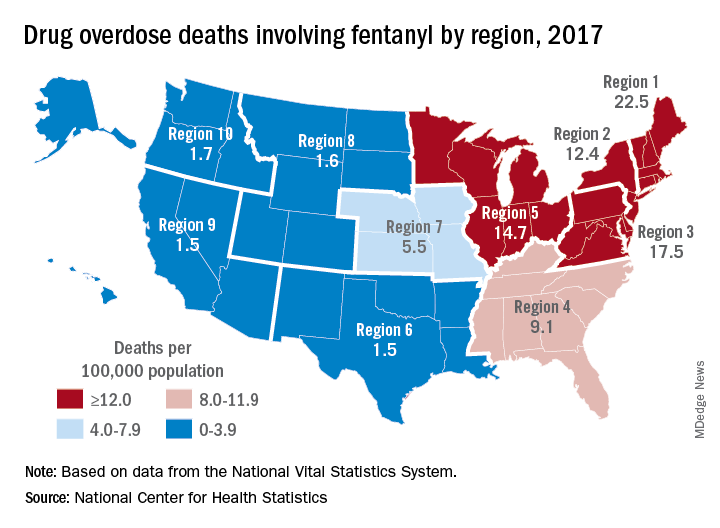

Fentanyl Levels In Princes Autopsy A Look Back At March 26th

May 31, 2025

Fentanyl Levels In Princes Autopsy A Look Back At March 26th

May 31, 2025 -

March 26th In History Princes Overdose And The Fentanyl Report

May 31, 2025

March 26th In History Princes Overdose And The Fentanyl Report

May 31, 2025 -

How To Lose Your Mother A Daughters Memoir In Short

May 31, 2025

How To Lose Your Mother A Daughters Memoir In Short

May 31, 2025