Stock Market Today: Bonds Tumble, Dow Futures Uncertain, Bitcoin Surges

Table of Contents

Bond Market Decline: Understanding the Tumble

The bond market is experiencing a significant decline, with yields falling sharply. This unexpected tumble raises several important questions about the current economic climate and investor sentiment.

Rising Inflation Concerns

The primary driver behind the falling bond prices appears to be renewed concerns about inflation.

- CPI and PPI Indicators: Recent data releases, particularly the Consumer Price Index (CPI) and Producer Price Index (PPI), have shown persistent inflationary pressures, exceeding expectations in several key areas. This fuels anxieties about the Federal Reserve's ability to control inflation without triggering a recession.

- Federal Reserve Policy: The Federal Reserve's ongoing efforts to combat inflation, including potential interest rate hikes, are influencing investor decisions. Uncertainty surrounding the effectiveness of these measures is contributing to the volatility.

- Economic Forecasts: Pessimistic economic forecasts, predicting slower growth or even a potential recession, are further contributing to the decline in bond prices. Investors are seeking safety in other assets, causing a sell-off in bonds.

For example, the 10-year Treasury yield dropped by 1.5% yesterday, reflecting a significant shift in investor confidence and expectations regarding future interest rates.

Flight to Safety?

The bond market decline could partly be attributed to investors seeking "safer" assets amidst economic uncertainty.

- Alternative Investment Options: Investors might be shifting their portfolios towards assets perceived as less risky, such as gold or other precious metals. The performance of these assets should be considered in tandem with the bond market’s decline.

- Correlation with Other Market Indicators: A negative correlation between bond yields and stock market performance is often observed. The current decline in bond prices might signal a cautious outlook for the stock market.

Dow Futures: A Picture of Uncertainty

Pre-market trading indicates a mixed outlook for the Dow Jones Industrial Average. The uncertainty stems from a confluence of factors, making predicting the opening bell a challenging task.

Pre-Market Indicators

Dow futures are showing a relatively flat performance, indicating indecision among investors.

- Geopolitical Events: Ongoing geopolitical instability, particularly the ongoing conflict in Ukraine and its global implications, continues to contribute to investor anxiety.

- Corporate Earnings Reports: Upcoming corporate earnings reports from key companies will play a crucial role in shaping market sentiment. Positive or negative surprises could significantly impact the Dow's performance.

- Investor Sentiment: Overall investor sentiment appears cautious, with a mix of optimism and pessimism, reflecting the complex economic backdrop.

Potential Market Open Scenarios

Based on current pre-market activity and overall market conditions, several opening scenarios are possible for the Dow.

- Gap Up Opening: Positive news or a surge in investor confidence could lead to a gap up, where the Dow opens significantly higher than the previous day's closing price.

- Gap Down Opening: Negative news or a deepening of investor pessimism could result in a gap down opening, with a sharp decline at the start of trading.

- Flat or Slightly Volatile Open: The most likely scenario could be a flat or slightly volatile opening, reflecting the current uncertainty in the market. The Dow’s reaction to incoming news will be key.

Bitcoin's Unexpected Surge: Crypto Market Volatility

In stark contrast to the bond market's decline and the Dow's uncertainty, Bitcoin has experienced a surprising surge, highlighting the volatile nature of the cryptocurrency market.

Factors Driving Bitcoin's Rise

Several factors may contribute to this unexpected increase in Bitcoin's price:

- Institutional Investment: Increased institutional adoption of Bitcoin as an asset class continues to play a significant role in its price movements.

- Regulatory Developments: Positive regulatory developments or statements from key governments could boost investor confidence and drive demand.

- Market Sentiment: Overall positive sentiment in the broader financial markets, despite the turmoil in other sectors, could spill over into the cryptocurrency market. Bitcoin is sometimes considered a hedge against traditional market downturns.

Crypto Market Outlook

Bitcoin's performance may influence the outlook for the broader cryptocurrency market.

- Impact on Other Cryptocurrencies: A positive trend in Bitcoin often leads to increased activity and price appreciation in other cryptocurrencies.

- Potential Risks and Opportunities: Despite the current surge, the cryptocurrency market remains volatile and investors should remain aware of potential risks. However, the increasing mainstream adoption of Bitcoin and other cryptocurrencies presents significant long-term opportunities.

Conclusion

Today's Stock Market Today reveals a complex picture: a falling bond market reflecting inflation concerns, uncertainty surrounding Dow futures, and a surprising surge in Bitcoin. These interconnected events highlight the challenges and opportunities present in today's dynamic financial landscape. The implications for investors are significant, necessitating careful portfolio management and a close watch on upcoming economic data and market developments.

Key Takeaways: Inflation fears are impacting bond prices, Dow futures remain uncertain due to geopolitical tensions and earnings reports, and Bitcoin's surge reflects the volatile nature of the cryptocurrency market.

Call to Action: Stay updated on the ever-changing Stock Market Today by subscribing to our newsletter! For comprehensive daily stock market updates, check back tomorrow for more insightful analysis on Stock Market Today.

Featured Posts

-

Allegations Of Financial Hardship For Macaulay And Kieran Culkins Mother

May 23, 2025

Allegations Of Financial Hardship For Macaulay And Kieran Culkins Mother

May 23, 2025 -

Horoscopo De La Semana Del 1 Al 7 De Abril De 2025 Todos Los Signos Zodiacales

May 23, 2025

Horoscopo De La Semana Del 1 Al 7 De Abril De 2025 Todos Los Signos Zodiacales

May 23, 2025 -

Englands Team Selection One Off Test Against Zimbabwe Revealed

May 23, 2025

Englands Team Selection One Off Test Against Zimbabwe Revealed

May 23, 2025 -

16 Mart Burcu Nedir Oezellikleri Nelerdir

May 23, 2025

16 Mart Burcu Nedir Oezellikleri Nelerdir

May 23, 2025 -

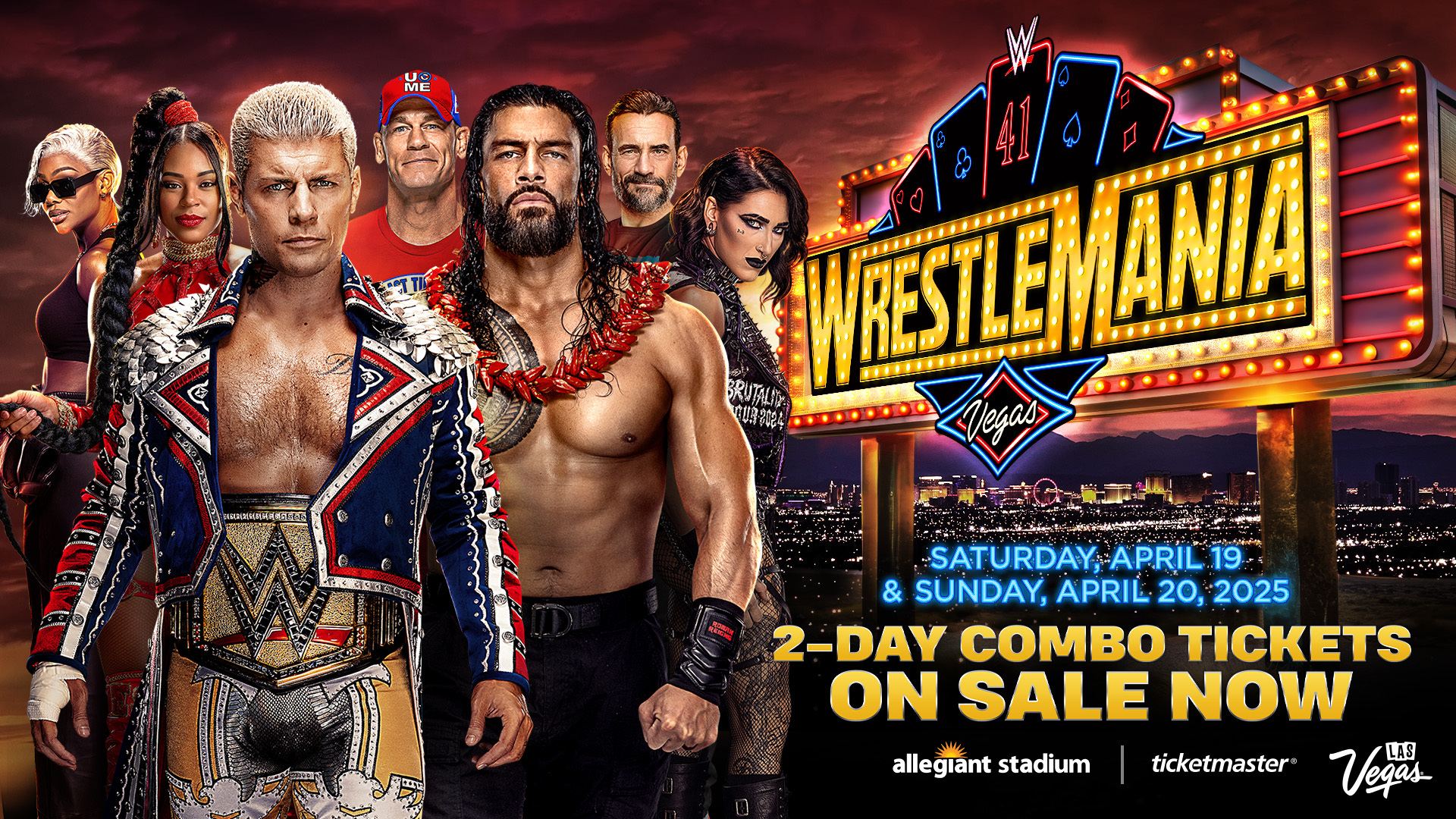

Wwe Wrestle Mania 41 Golden Belts And Memorial Day Weekend Ticket Sales

May 23, 2025

Wwe Wrestle Mania 41 Golden Belts And Memorial Day Weekend Ticket Sales

May 23, 2025

Latest Posts

-

The Best Response How Joe Jonas Handled A Couples Fight

May 23, 2025

The Best Response How Joe Jonas Handled A Couples Fight

May 23, 2025 -

Joe Jonas The Unexpected Response To A Marital Dispute

May 23, 2025

Joe Jonas The Unexpected Response To A Marital Dispute

May 23, 2025 -

Joe Jonas Stuns Fort Worth Stockyards With Impromptu Concert

May 23, 2025

Joe Jonas Stuns Fort Worth Stockyards With Impromptu Concert

May 23, 2025 -

Fort Worth Stockyards Joe Jonas Unexpected Performance

May 23, 2025

Fort Worth Stockyards Joe Jonas Unexpected Performance

May 23, 2025 -

The Last Rodeo Highlighting Neal Mc Donoughs Character

May 23, 2025

The Last Rodeo Highlighting Neal Mc Donoughs Character

May 23, 2025